Les sites Web frauduleux se présentent souvent comme ayant un lien avec JFD

Veuillez être conscient des sites Web frauduleux se présentant comme des affiliés et / ou des contreparties de JFD. Pour plus d'informations, veuillez consulter la liste des sites Web prétendant avoir une connexion avec JFD.

Weekly Outlook: Oct 04 – Oct 08: RBA and RBNZ Decisions, US NFPs and OPEC+ Meeting

We have an interesting week ahead of us, with two central bank decisions on the agenda: the RBA and the RBNZ. No action is anticipated by the RBA, but the RBNZ is expected to lift rates for the first time since the coronavirus pandemic outbreak. Ahead of those decisions, on Monday, the OPEC+ group meets to decide on oil output, while on Friday, we get the US employment report for September.

On Monday, Chinese and South Korean Markets stayed closed due to holidays, while no major indicators are scheduled on the calendar for the rest of the day. Therefore, at first glance, it appears to be a quiet day for the markets. However, we do have a meeting between OPEC and its allies to debate whether and how much more oil may be needed to be released into the market.

In July, the OPEC+ group agreed to increase production by 400k barrels per day every month at least until April 2022, in a process to phase out 5.8mn bpd of existing cuts. Lately, prices of the black liquid soared to a three-year high, driven by supply disruptions and recovering demand from the coronavirus pandemic, as well as due to gas supply shortages. Last week, four sources told Reuters that the group was considering adding more, but there were no details on how much more, or when any supply increases could take place.

Therefore, with that in mind, although October’s volumes are already decided, any decision pointing to more increases in the next few months may result in a decent downside correction in oil prices. On the other hand, maintaining the existing deal and providing no clues as to whether a decision to increase output could be looming at one of the upcoming meetings, could add further fuel to the fuel’s latest uptrend.

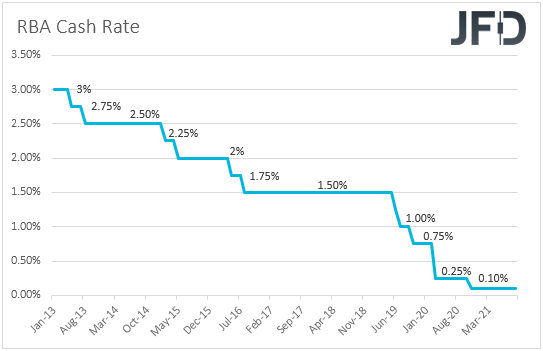

On Tuesday, during the Asian session, the RBA meets to decide on interest rates. At its September gathering, the Bank indeed proceeded with the planned tapering from AUD 5bn to AUD 4bn per week, but it delayed the date for a new review from November 2021 to February 2022, due to a delay in the economic recovery and increased uncertainty associated with the outbreak of the Delta coronavirus variant. As for interest rates, officials stuck to their guns that they are likely to keep them at present levels at least until 2024.

So, taking the prior decision into account, we don’t expect any policy changes this week. However, with daily covid infections staying near records and having also in mind the worsening economic slowdown in China, we will monitor the accompanying statement to see whether it will be written in a more dovish language. Any fresh concerns over the nation’s economic recovery could raise speculation that, at some point soon, the Bank may delay even further the timing of its next tapering, thereby adding pressure to the Australian dollar. Conditional upon expectations of a November tapering move by the Fed increasing, the Aussie could resume its recent downtrend against its US counterpart.

Elsewhere in Asia, Chinese markets will stay closed until Thursday in celebration of the National Day. From New Zealand, we get the NZIER business confidence index for Q3, while from Japan, we have the Tokyo CPIs for September. Australia’s trade balance for August is also coming out.

Later in the day, we have the final composite and services PMIs from the Eurozone, the UK, and the US, but as it is always the case, they are expected to confirm their preliminary estimates. The ISM non-manufacturing index for the month is also due to be released and it is expected to have declined to 60.0 from 61.7. From Canada, we have the nation’s trade balance for August.

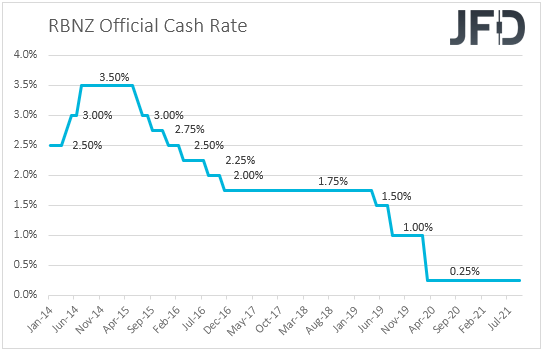

On Wednesday, the central bank torch will be passed to the RBNZ. When they last met, officials of this Bank delayed raising interest rates, at a time when the financial community was more than certain over a hike. Policymakers changed their minds after the nation entered a lockdown due to new coronavirus cases, however, they signaled that they still expect to push the hike button before year end.

Market participants are betting that such a move could indeed take place at this gathering, but they only anticipate a 25bps rate increase. Any expectations over a double hike may have diminished recently as covid infections have spiked again, suggesting that a full economic reopening is still away. Therefore, with a quarter-point hike fully priced in, we don’t expect any Kiwi reaction on that. We believe that any move is likely to be triggered by the language in the accompanying statement. Anything suggesting a more cautious hike path could push the Kiwi lower. For the currency to strengthen, we need to see optimistic remarks pointing to faster hikes, a case we see as unlikely for now. Therefore, with all that in mind, we would consider the risks surrounding the Kiwi’s reaction to the meeting as tilted to the downside.

Later in the day, we have Eurozone’s retail sales for August and the US ADP report for September. Eurozone’s retail sales are expected to have rebounded 0.8% mom after sliding 2.3%, while in the US, the ADP report is expected to show that the private sector has gained 430k jobs, less than August’s 374k. Although the ADP is far from a reliable predictor of the NFPs, it is the only major gauge we have for the official statistic, and thus, it could raise some speculation that the NFPs could also come in slightly better than in August.

Thursday is a quiet day in terms of economic releases and data, with the only event worth mentioning being the minutes from the latest ECB monetary policy meeting. At that meeting, the Bank announced a “moderately lower pace” of PEPP purchases for the following quarter, but President Lagarde made it clear that this was not a tapering move, and that when PEPP is over, they have all other tools available. In our view, this may be a hint that when PEPP is over, conditional upon the economic outlook, they could compensate by buying more through other schemes, like the Asset Purchase Program (APP). So, with that in mind, we will scan the minutes to see whether this is the case. Clearer hints that the Bank stands ready to offset the end of the PEPP by buying more through other programs could encourage more euro selling.

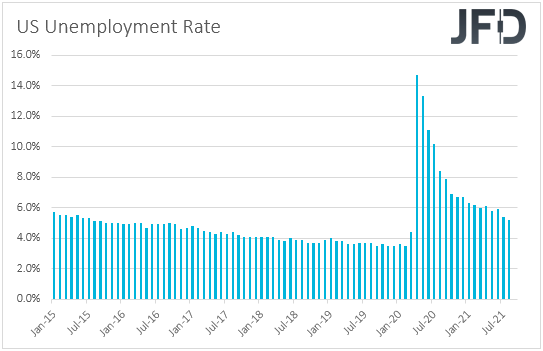

Finally, on Friday, the main item on the agenda may be the official US employment report for September. Nonfarm payrolls are expected to have accelerated to 470k from 243k, while the unemployment rate is expected to have ticked down to 5.1% from 5.2%. Average hourly earnings are forecast to have slowed to +0.4% mom from +0.6%, but barring any deviations to the prior monthly prints, this is anticipated to take the yoy rate up to +4.6% from +4.3%.

Overall, all this points to a more decent report than the one we got for August, which, combined with Powell’s recent remarks that inflation remains elevated for longer than they have estimated, may encourage market participants to add to bets over a November QE tapering by the Fed, and perhaps even bring forth their expectations over when the first interest rate hike could take place. Something like that could be translated into further strength in the US dollar, and a deeper correction in equities. The opposite could be true if we get a disappointing set of numbers.

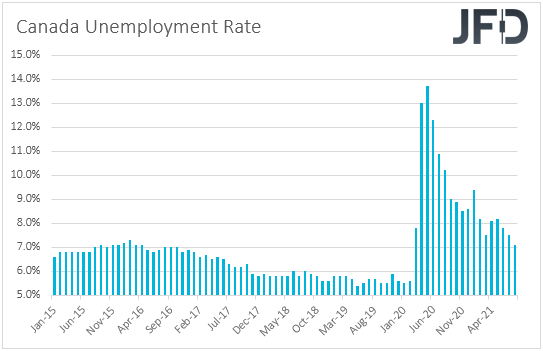

At the same time with the US employment report, we get jobs data for September from Canada as well. The unemployment rate is expected to have slid to 6.9% from 7.1%, while the net change in employment is forecast to show that the economy has added 60.0k jobs during the month, after adding 90.2k the month before.

At its prior gathering, the BoC kept its policy untouched, and maintained the guidance that the economic slack would be absorbed sometime in H2, 2022, which means this is when they expect to start raising interest rates. Following the economic contraction in Q2, many participants may have been expecting the Bank to announce a delay in its tapering plans. However, that was not the case. Even Governor Tiff Macklem said that he and his colleagues are moving closer to a time when continuing to add stimulus through QE won’t be necessary. Therefore, another round of decent employment numbers could add to the case of an October tapering and could support somewhat the Loonie. However, the currency could also be well affected by today’s decision on oil output by OPEC its allies.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.90% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

JFD Research

JFD Research

Marcus Klebe

Marcus Klebe