Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

ZAR Strengthened Slightly Against JPY

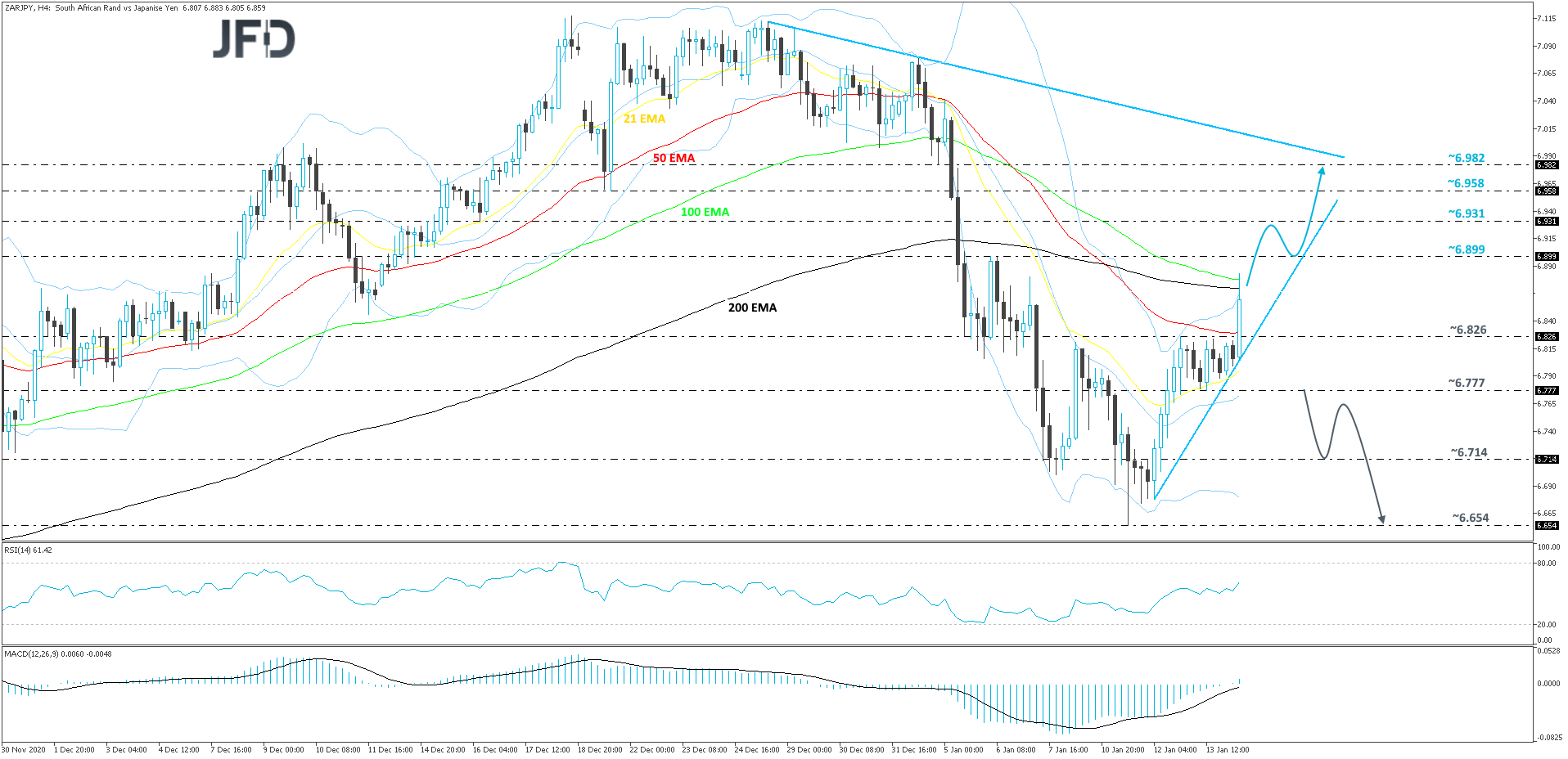

Looking at the technical picture of ZAR/JPY on our 4-hour chart, we can see that, from the beginning of this week, the South African rand has been strengthening against its Japanese counterpart, the yen. Today, the pair went for another higher high, overcoming Tuesday’s and Wednesday’s highs. At the same time, the rate is trading above a short-term tentative upside support line taken from the low of January 12th. From the very short-term perspective, we will continue aiming higher, but let’s not forget that this move higher might still be seen as a temporary correction, because the pair continues to move below a short-term tentative downside line drawn from the high of December 28th.

If ZAR/JPY goes ahead and once again pushes above all of its EMAs, that may set the stage for a test of the high of the January 6th, at 6.899, or even of the 6.931 zone, marked by the low of December 16th. Even if the rate retraces back down from there, as long as it remains above the aforementioned upside line, we will stay positive in the near term. ZAR/JPY could get picked up by the buyers again and travel to the 6.958 hurdle, or the 6.982 level, marked by the low of January 4th.

The RSI and the MACD continue to point higher. In addition to that, the RSI is above 50 and the MACD is now above zero, while still balancing above its trigger line. The two oscillators indicate increasing upside speed, at least for now.

Alternatively, if the previously discussed upside line gets broken and then the pair falls below the 6.777 zone, marked by yesterday’s low, that could spook the remaining bulls from the field. More bears could start joining in and pushing ZAR/JPY further south. That’s when we will target the 6.714 obstacle, or even the 6.654 level, marked by the current lowest point of January.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research