Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

We Are Waiting For NZD/CAD To Move Out Of The Range

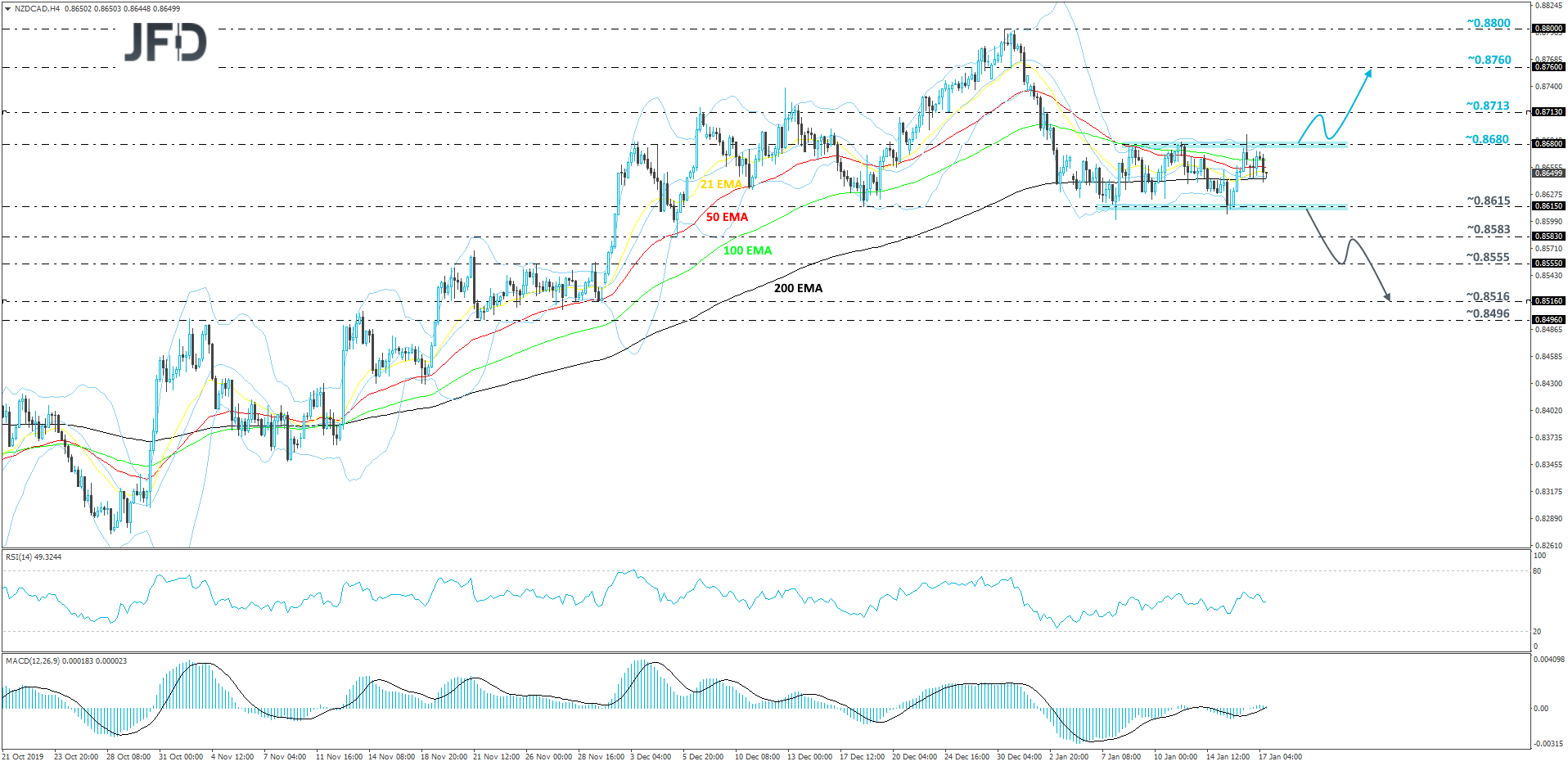

After topping in the end of December near the 0.8800 level, NZD/CAD drifted lower, but after the first week of January, the pair started moving sideways, forming a range. The range is roughly between the 0.8615 and 0.8680 levels. At the same time, the rate continues to move around its 200 EMA on the 4-hour chart. For now, we will take a neutral stance and wait until we see a break of one of the range’s sides, before examining a further directional move.

If the rate rebounds from the 200 EMA and breaks above the 0.8860 barrier, this might attract more buyers, as it could increase the pair’s chances of moving further north. This way, we will aim for the 0.8713 hurdle, marked by an intraday swing high of January 2nd, a break of which may lead NZD/CAD even higher. If so, we will then aim for the 0.8760 level, which marks the inside swing low of December 30th.

Our oscillators, the RSI and the MACD, are currently more on the flat side. The RSI keeps on balancing near 50 and the MACD cannot get away from the zero line. Such activity reflects the current neutrality in the pair.

Alternatively, if the pair breaks the lower bound of the aforementioned range, at 0.8615, this might clear the path for a further slide. We will then aim for the 0.8583 obstacle, which if broken might send the rate to the 0.8555 zone, marked near the highs of November 26th and 29th. NZD/CAD could initially stall around there, but if the selling continues, this may lead to a break of that zone and a drop to the 0.8516 level, marked near the lows of November 28th and 29th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research