Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

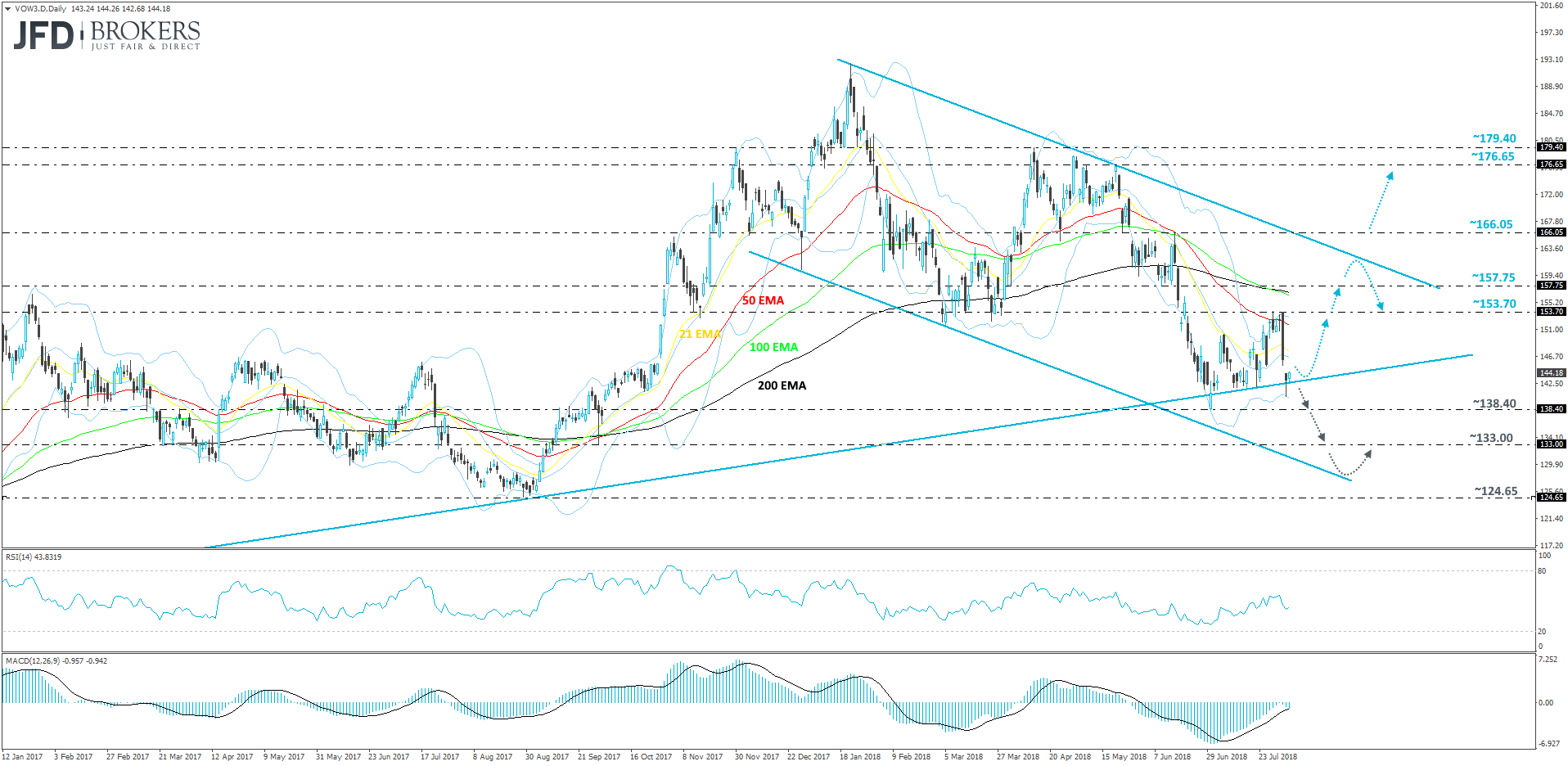

Volkswagen AG Preference Shares (ETR: VOW3) – Technical Outlook

Since the emission scandal in 2015, Volkswagen AG managed to climb back up a bit, but still wasn’t able to recover the losses made in that year. On the 1st of August this year the company reported stronger second quarter results, but investors decided to sell the shares, due to the tightening of the new EU regulations on emissions and fuel efficiency.

From the technical side, even though we saw a drop in the stock due to investor selling, still it found its strong support at the long-term upwards moving trendline, drawn from the lowest point of October 2015. This was the time, when the shares started moving back up again. The overall trend remains to the upside and as long as the aforementioned trendline remains intact, we will aim for higher levels.

A move back up to and a break of the 153.70 level could open the way for the bulls to drive the stock higher towards the next potential area of resistance at 157.75, marked by the inside swing low of the 11th of June. But if that area is not able to withhold the price down, a break of it could lead to a test of the upper bound of the short-term falling channel that the stock is still within. This is where the bulls and the bears could start battling it out over where it could go next. If the bulls remain in the driver’s seat, then the shares could continue their route towards the 166.05 hurdle, marked by the peak of the 15th of June. Further price increase could open the way to test 176.65 or 179.40, with the last being the high on the 13th of April.

All could change for Volkswagen if the share price drops and closes below the previously mentioned upwards moving trendline. This move could lead to further declines. The next potential areas of support to keep an eye on could be the 138.40 level, marked by the low of the 2nd of July, or even the 133.00 barrier, which held the price from dropping lower on the 29th of September last year. Slightly below lies the lower bound of the aforementioned falling channel, which could initially hold the price from dropping further.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research