Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

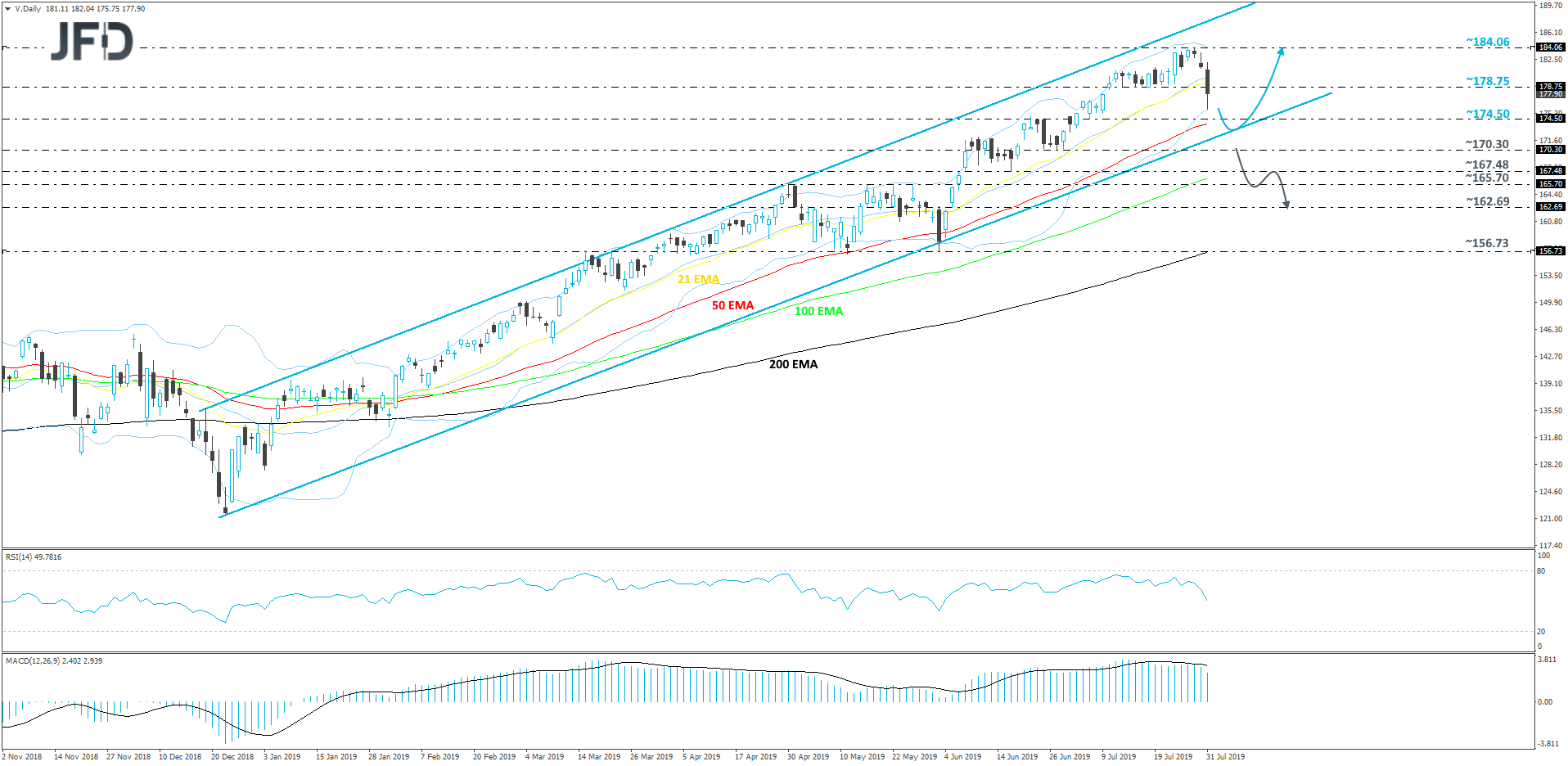

Visa Stock Is Still Within the Rising Channel

After hitting an all-time high at 184.06 on July 29th, the Visa Inc stock (NYSE: V) started shifting back down a bit. Yesterday, the share price even broke below one of its key support levels, at 178.75, which held it from falling between July 12th and 24th. But the current slide might be short-lived as the stock remains within a rising channel formation, which is running from the end of December 2018. For now, we will take a cautiously-bullish approach, as we aim for the lower side of the channel first. But if it stays intact, we will switch and aim higher.

As mentioned above, a small decrease in price could bring V to the 174.50 zone, marked by the high of June 25th and the low of July 5th, or even to the lower side of the rising channel. If it holds, potential buyers may see it as a good opportunity to step in and drive the price back up again, initially aiming for the 178.75 hurdle, but this time from underneath. If there is still a lot of buying interest from investors, a break of that hurdle may lift the share price to the all-time high level, at 184.06. If at that price, there are still new buyers showing up, Visa Inc stock may end up creating a new all-time high, potentially moving towards the upper bound of the rising channel.

Our oscillators, the RSI and the MACD, suggest that the price is slowly losing speed. The RSI has slightly fallen below 50 and still points lower. The MACD, after topping in the end of July, started shifting lower and sits below its trigger line. That said, the indicator is still well in the positive territory. The message that we are getting from both indicators right now is somewhat in support of the above discussed scenario.

Alternatively, if the lower bound of the rising channel gets broken and if the price falls below the 170.30 hurdle, marked near the lows of June 27th and 28th, this my spook potential new buyers and some current investors might liquidate on their positions. We will then examine a possible slide to the 167.48 area, or even to the 165.70 zone, which acted as good resistance between April 30th and June 5th. If this time that obstacle can play the role of a good support, we may see V rebounding slightly. But if the price is not able to move back inside the channel, this could lead to another slide, possibly overshooting the 165.70 zone and targeting the 162.69 level, which is the high of June 3rd and the low of June 5th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research