Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

VISA Breaks the Downside Line

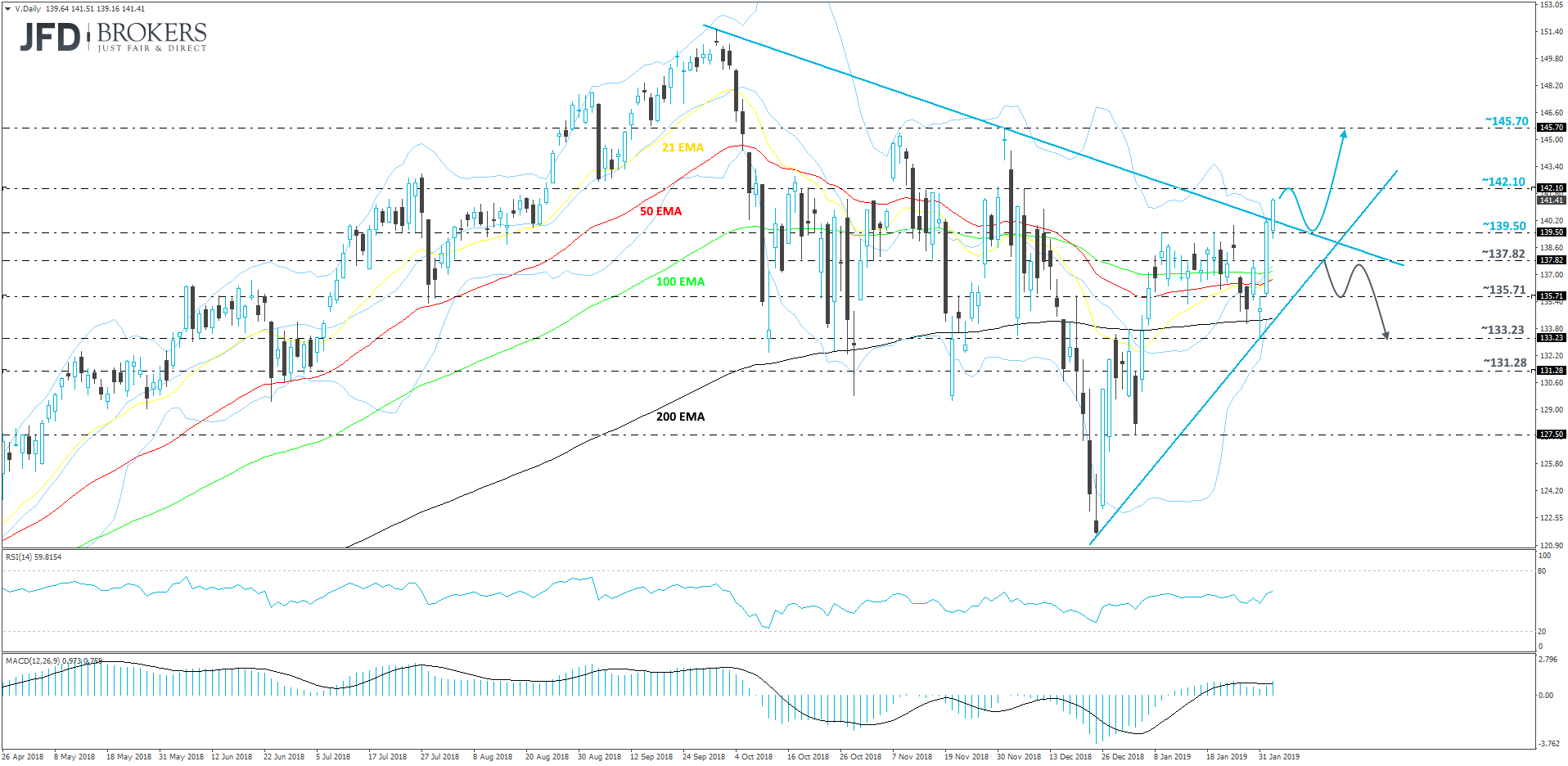

Even though Visa Inc. (NYSE: V) stock was also affected by the turmoil in the equity markets during the second half of 2018, the share price has managed to climb back and recover more than half of its losses made in that period. From the technical side, as of yesterday, V is trading above its medium-term downside resistance line, taken from the high of October 1st. At the same time the stock remains above its short-term upside support line drawn from the low of December 24th. For now, we will aim a bit higher, but with a possibility of seeing a small retracement back down before another potential leg of buying.

Visa Inc stock is now getting closer to its key resistance area at 142.10, marked by the highs of December 7th and November 30th. Because, historically, the level managed to hold the price down for some time, there is a possibility of seeing the share price getting held there for a bit, or even sliding slightly back down. But as long as the price remains above the two lines (the downside and the upside ones), we will continue looking north in the near term. The next potential area of resistance to watch out for could be at 145.70, which is the high of December 3rd.

Taking a quick glance at our oscillators, the RSI is above 50 and keeps pointing higher. The MACD continues to run above zero and from yesterday, it shifted above its trigger line and started pointing higher. Both indicators suggest that the momentum is picking up again and we may see some more upside in the stock’s trading.

Alternatively, in order to start considering much lower levels, we would like to see a drop below both the downside and the upside lines, in order to consider a further slide. This is when we may target the 135.71 hurdle, which is the low of February 1st. If, eventually, that hurdle fails to withhold the downwards-pressure, a break of it could set the stage for a re-test of the 133.23 support zone, marked by the low of January 31st.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research