Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

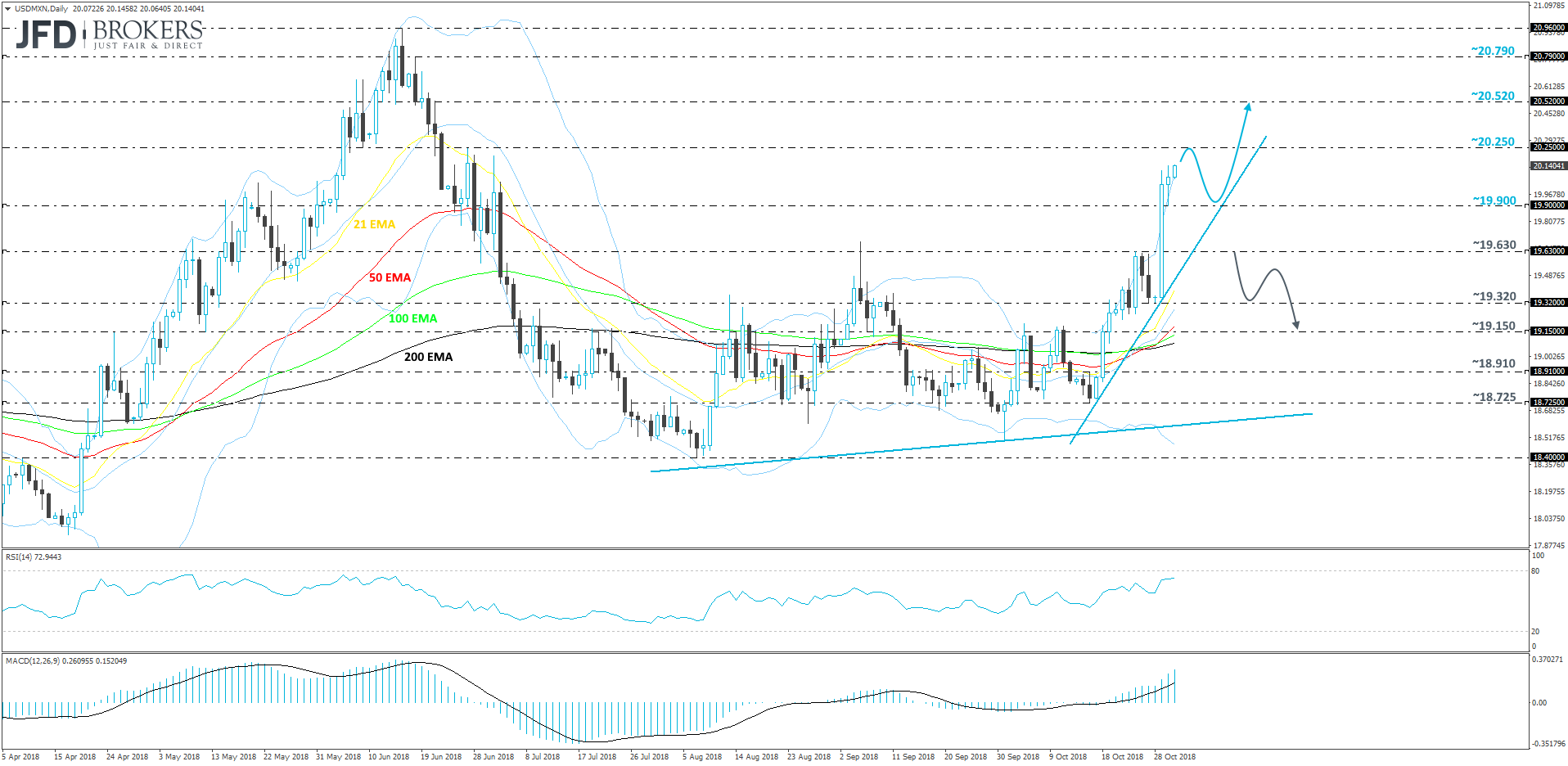

USD/MXN Reacts to Mexico City Airport Project Shutdown

On Monday, the Mexican peso took a strong hit and depreciated heavily against its neighbouring US dollar. That day, the Mexican president came out saying that he will respect the results of Sunday’s referendum, in which people voted against the further construction of the new airport. The market took the news as a negative, because this could mean that any future business developments and projects could be overturned either by the government or by the people. This gave a strong boost to USD/MXN, which broke the psychological 20.000 barrier and continues to aim higher.

Before USD/MXN could continue pushing higher, it could retrace back down to either test the psychological 20.000 barrier, or the 19.900 level, marked by yesterday’s low. If USD/MXN fails to break below the 19.900 area, then this could be a good opportunity for the bulls to step in again and take charge of the 20.250 obstacle, which is near the high of the 27th of June. A break above that level could open the way towards the next potential resistance at 20.520. This hurdle was marked by the high of the 21st of June and is also near the inside swing low of the 14th of June.

Looking at our oscillators on the daily chart, we can see that the RSI and the MACD are both aiming higher. The RSI is currently trying to reach the 80 zone and the MACD is in the positive area and above its trigger line. Both indicators are supporting the upside scenario, for now.

Alternatively, if USD/MXN decides to move below the 19.900 level and eventually breaks the short-term upside support line drawn from the low of the 17th of October, this could be a good warning signal that the buying momentum is fading away. If the pair continues to slide and breaks below the 19.630 hurdle, this is where more bears could get comfortable in joining the party and driving USD/MXN lower. We could then target the 19.320 level, which was the low of the 28th of October. A further decline could open the way to the next potential support zone to keep an eye on is the 19.150 obstacle, a break of which could send the pair to test the 18.910 barrier, marked by the inside swing high of the 16th of October.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research