Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

USD Slightly Up on Fed Minutes, Focus Turns to ECB Minutes and EZ PMIs

Yesterday, the Fed minutes revealed that officials want to announce soon a plan to stop their balance-sheet reduction later this year, while with regards to interest rates, the views were split, which keeps some hike chances on the table. As for today, focus turns to the US-China trade sequel, where high-level talks are set to begin, as well as the ECB meeting minutes and Eurozone’s PMIs for February.

Fed Minutes Keep Some Hike Chances on the Table

The dollar ended the day within a ±0.10% range against most of the other G10 currencies. It gained more only against NZD and NOK, while it underperformed only against CAD, which may have stood tall due to yesterday’s rise in oil prices.

Yesterday, the main event for USD-traders was the minutes from the latest FOMC gathering. The minutes revealed that “almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve’s asset holdings later this year”, confirming market expectations on that front. That said, with regards to future interest rate moves, several members suggested that a hike would be necessary only if inflation accelerates higher than their baseline outlook, while several others argued that they see the case of raising rates later this year as appropriate, even if the economy evolves as expected.

The outcome comes more or less in line with our expectations. Yesterday, we noted that we don’t expect any signals that the Committee is done hiking and the split views keep some hike chances on the table. With market participants pricing in only 1% chance of a hike by year end ahead of the minutes, this helped the dollar to strengthen somewhat at the time of the release, while the probability for a hike by December moved slightly higher, to 5%. According to the Fed funds futures, investors remain nearly 90% confident that officials will not push the hiking button this year, but the probability for a cut fell to 5% from 12%.

Focus now turns back to the US-China sequel, where two-day high-level talks as set to begin, led by US Trade Representative Robert Lighthizer and China’s Vice Premier Liu He. As we repeatedly noted this week, another round of upbeat remarks may allow risk assets, like equities, to regain upside momentum, but once again, we believe that a final deal is unlikely to be reached. We stick to our guns and we believe that something like that is likely to happen at a meeting between US President Trump and his Chinese counterpart Xi Jinping.

With regards to the other currencies, the Australian dollar was found virtually unchanged against its US counterpart this morning, but the ride was not as quiet as it seems. The Aussie strengthened following Australia’s better than expected employment data but was quick to give back those gains in the following minutes. This confirms our view that better numbers were unlikely to alter market expectations with regards to the RBA’s future plans. After all the Bank has put the prospect of a rate cut on the table, already acknowledging the strength of the labor market. At the time of writing, the Aussie took another hit following reports that China’s northern Dalian port banned coal imports from Australia indefinitely.

Moving to the pound and the Brexit saga, the British currency slid somewhat yesterday after three Conservative MPs resigned, citing as a reason the government’s “disastrous handling of Brexit”. This makes PM May’s ability to get any accord approved by UK lawmakers an even-harder task and that’s why the pound may have come under some selling interest. Yesterday, PM Theresa May met with EU Commission President Junker and, according to their joint statement, the talks were “constructive”, and they will “explore the options in a positive spirit”. They also plan to meet again next week ahead of the new challenge in the US parliament. The big question remains whether May can secure any legally-binding changes to the Irish backstop by next week, and if so, whether the Parliament will accept any new deal. Otherwise, as May herself promised, lawmakers will have the opportunity to vote on proposed amendments on February 27th.

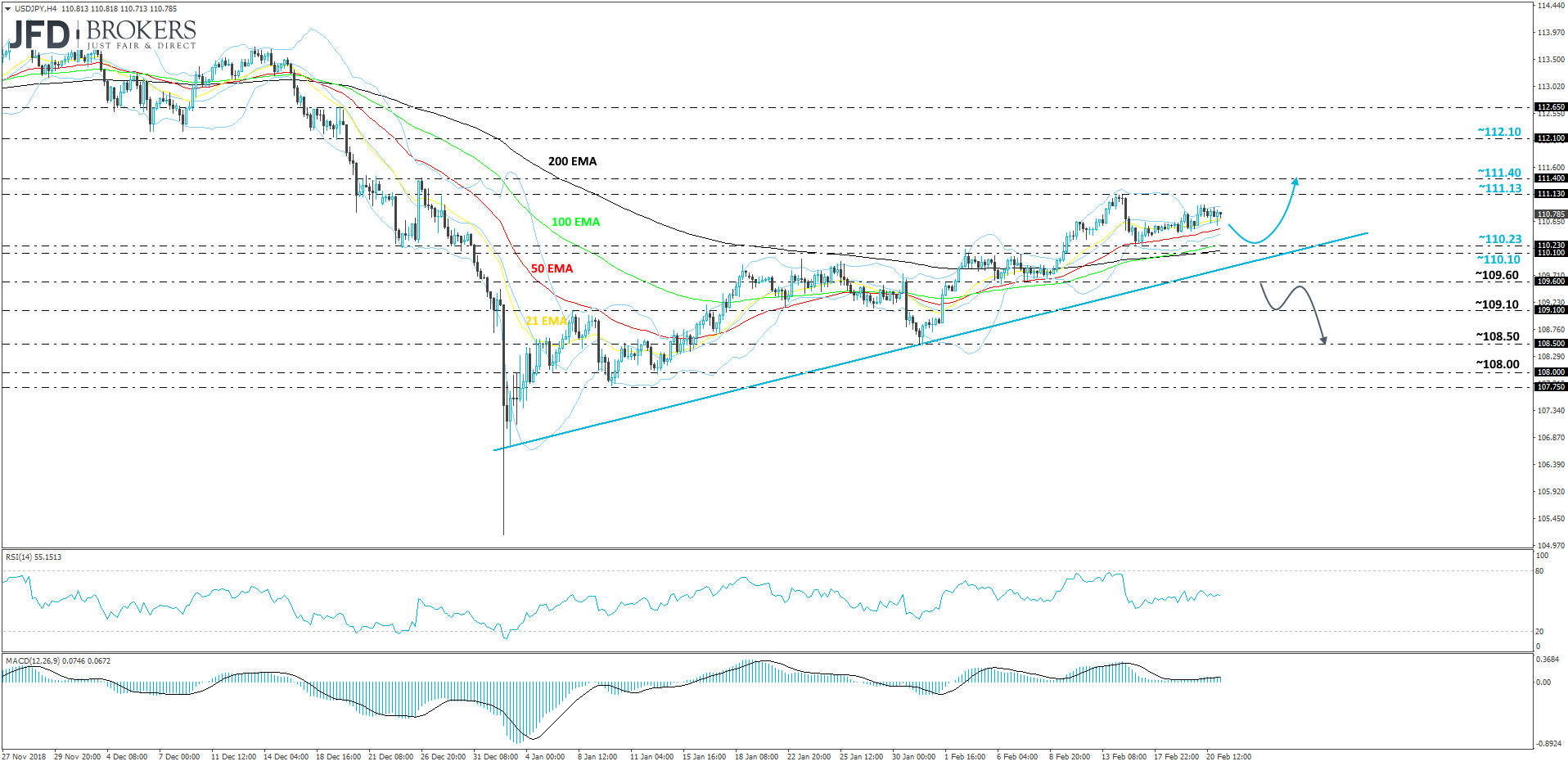

USD/JPY – Technical Outlook

Overall, USD/JPY continues to trade above its upside support line taken from the low of January 3rd. But from the short-term perspective, the pair is struggling to keep up the pace of moving higher. That said, even though we may see the rate shifting lower, as long as it remains above the above-mentioned upside line, we will continue aiming higher.

If USD/JPY moves lower but stays above its key support area at 110.10, marked by the highs of February 4th and 7th, we will once again aim for the recent highs, around the 111.13 level. But if we finally see a break above that level, this is when more bulls may start joining, as this move would confirm a forthcoming higher high and could lift the rate to its next possible resistance zone at 111.40, which is the high of December 26th. A break of that zone could clear the path towards the 112.10 area, marked by the low of December 19th.

Alternatively, in order to get comfortable with the downside from the short-term perspective, we would like to see a break of the aforementioned upside support line and a rate-drop below the 109.60 hurdle, which is the low of February 7th. Such a move might remove the bulls from the arena, at least for a while, and USD/JPY could set sail south, aiming for the 109.10 obstacle, marked by the lows of January 22nd and 29th. If the sellers continue dictating the rules, a further slide may drag the rate towards the important 108.50 level, which is the low of January 31st.

ECB Minutes and Eurozone PMIs in Focus

Apart from the US-China trade talks, today investors may also keep an eye on the minutes of the latest ECB policy gathering. At that meeting, policymakers kept all three interest rates unchanged, and made no changes to the accompanying statement, reiterating that interest rates are likely to remain unchanged “at least through the summer of 2019”. That said, at the conference following the decision, ECB President Mario Draghi noted that the risks surrounding the bloc’s economic outlook have now “moved to the downside”.

When asked about the timing of when the markets expect a hike, he replied that the markets place the first hike in 2020 and this shows that they understood the Bank's reaction function. With regards to whether they have started looking into a new round of TLTROs (Targeted Long-Term Refinancing Operations), which are cheap loans to banks, Draghi said that several policymakers raised the issue, but no decision was taken because there was no policy discussion this time. “We only focused on the assessment,” he added. Both Coeure and Praet discussed the possibility of new TLTROs in recent speeches. So, having all that in mind, we believe that investors will scan the minutes for clues on whether the Bank plans to change its interest-rate guidance at one of their upcoming meetings, and how likely the introduction of new TLTROs is.

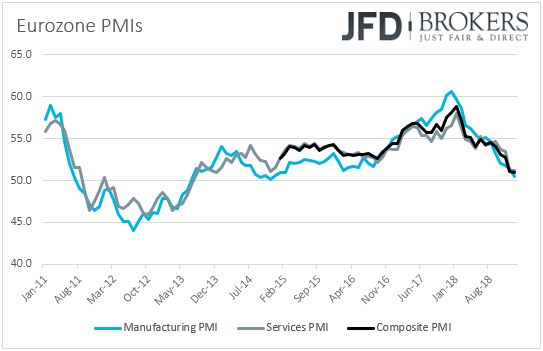

Ahead of the minutes though, investors will have access to more up-to-date information, which, combined with what the minutes show, could allow them to better assess what the ECB’s future steps may be. That information is the preliminary Eurozone PMIs for February. The manufacturing index is forecast to have declined to 50.3 from 50.5, while the services index is anticipated to have increased to 51.5 from 51.2, a combination that could drive the composite index fractionally higher, to 51.1 from 51.0. This would be the first tick up in the composite index after six consecutive slides, and apparently, it is far from suggesting a rebound in the bloc’s economic activity. Combined with another soft German ZEW survey on Tuesday, this set of PMIs may allow investors to keep on the table their bets with regards to no action by the ECB this year.

EUR/GBP – Technical Outlook

Last week, after finding good resistance near the 0.8830 barrier, EUR/GBP started moving south. This week, on Tuesday, the pair broke below its key support area at 0.8725, marked by the lows of February 1st, 4th and 7th, and continued drifting lower. The selling momentum had eased off for now, but our short-term outlook remains negative, as we may see another possible slide.

At the time of this analysis, EUR/GBP is stalling and moving sideways, between the 0.8672 and 0.8710 levels. If the bears take control again, the rate might travel to the 0.8672 hurdle, a break of which could open the door to some lower areas. This is when we will target the 0.8655 obstacle first, where another break may lead the pair for a re-test of January’s lowest point, at 0.8616.

On the other hand, if EUR/GBP had enough of the downside and the bulls are willing to step back into the game, the pair may rise back above, not only the 0.8710 hurdle, but also back above the 0.8725 barrier, which could attract even more buyers. Such a move might clear the path higher, where the next hold up for the pair may occur around the 0.8763 zone, marked by the high of February 19th. If there is still no sight of the bears near that level, we could see another rate-rise, which can lead EUR/GBP to the 0.8793 barrier, marked near the highs of December 12th and 13th.

As for the Rest of Today’s Events

During the European day, apart from the Euro-area PMIs, we also get the final German CPIs for January, but, as it is usually the case, expectations are for the final number to confirm the preliminary estate, namely that inflation in Eurozone’s growth engine slowed to +1.4% yoy from +1.7%.

Later in the day, we get PMIs from the US as well. Specifically, we get the preliminary Markit indices for February, with the forecasts suggesting that the manufacturing index remained unchanged at 54.9, and the services one rose fractionally, to 54.4 from 54.2. This is likely to drive the composite index higher, but as we noted several times in the past, the market tends to pay more attention to the ISM indices, due out on March 1st and 5th. Durable goods orders for December and existing home sales for January are also coming out.

As for tonight, during the Asian morning Friday, we have Japan’s National CPIs for January. The headline rate is expected to have declined further, to +0.2% yoy from +0.3%, while the core rate is anticipated to have ticked up to +0.8% from +0.7%. That said, bearing in mind that both the headline and core Tokyo rates rose somewhat, we see the risks surrounding the headline rate as tilted to the upside. However, even if both the national rates rise somewhat, they would still be well below the BoJ’s objective of 2%. Thus, with all the Japanese inflation metrics, especially the Bank’s own core CPI, still far from that target, we stick to our guns that BoJ policymakers have a long way to go before they start to consider altering their ultra-loose monetary policy.

As for the speakers, we have four on the agenda: Today, we will get to hear from the BoE and ECB chief economists, Andy Haldane and Peter Praet, as well as from the BoC Governor Stephen Poloz. Tonight, during the Asian morning Friday, RBA Governor Lowe will step up to the rostrum.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research