Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

USD/RUB Breaks Key Resistance At 76.00

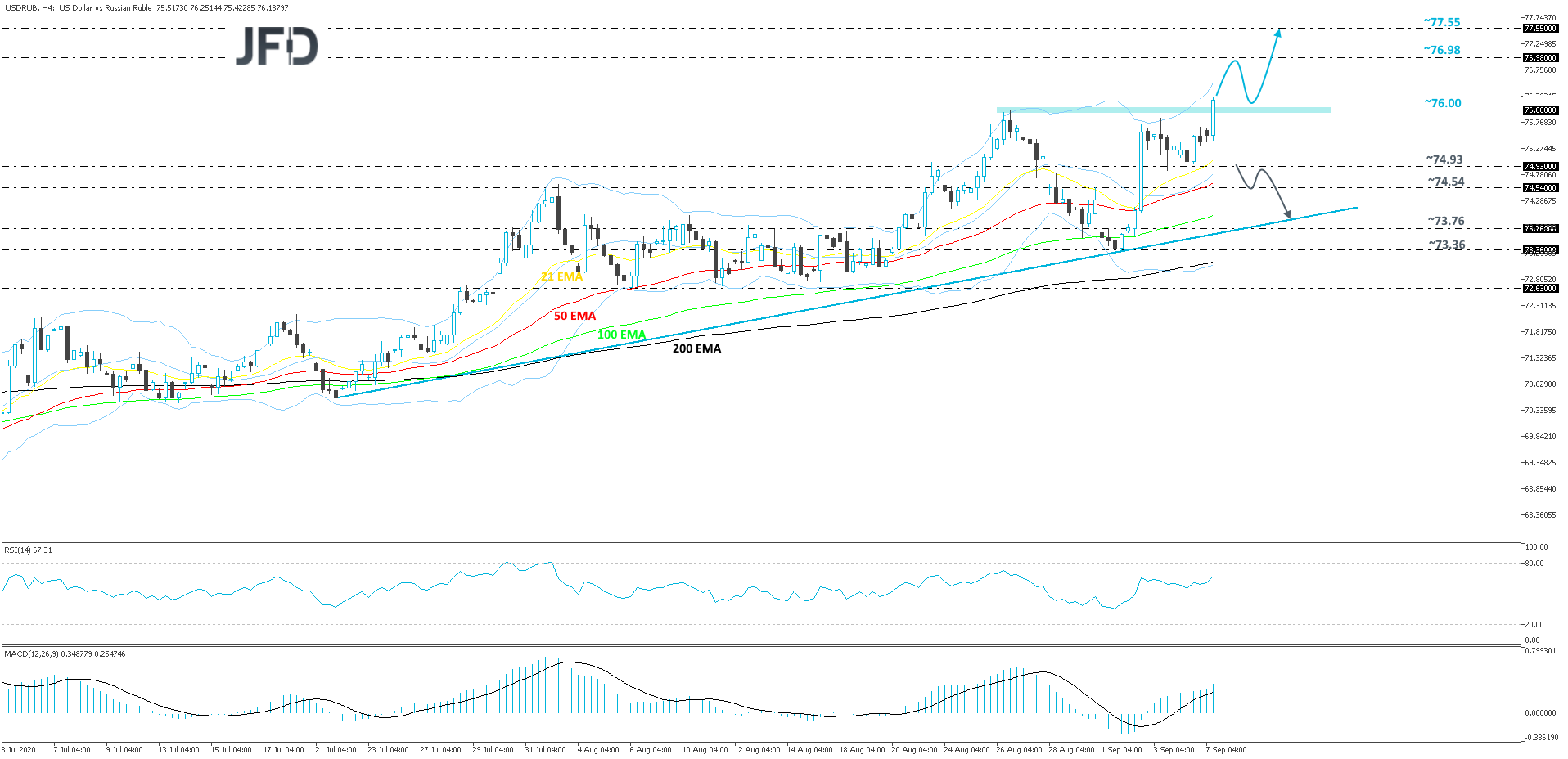

Given that oil has fallen under some selling interest lately, some oil-exporting countries have been under pressure too, together with their national currencies. One of those countries is Russia and its Ruble, which continues to weaken against its US counterpart. From the beginning of this summer, USD/RUB has been drifting north, recovering slightly more than half of the losses made in the period between mid-March and the beginning of June. Also, to add a bit more to the current positive move, today the pair has broken one of its key resistance barriers, at 76.00, which is the highest point of August. For now, we will take a bullish approach, especially if the rate stays above that 76.00 hurdle.

A further move north, away from the above-discussed 76.00 barrier, might end up pushing the pair to the 76.98 area, marked by an intraday swing low of April 22nd, where USD/RUB may stall temporarily. It could even correct slightly lower, but if the rate remains above the 76.00 territory, a reversal back to the upside might be possible, as some buyers may see this as a good opportunity to step in. The bulls could drive the pair to the 76.98 hurdle again, a break of which may open the way to the highest point of April, at 77.55.

Looking at the RSI and the MACD on our 4-hour chart, we can see that both indicators are currently pointing higher. In addition to that, the RSI is above 50 and the MACD is above zero and its trigger line. The oscillators show a rising upside price momentum, which supports the idea for a move towards some higher levels in the near term.

Alternatively, if the rate falls back below the previously-mentioned 76.00 zone and also continues to slide below the 74.93 area, marked by the low of September 4th, that may temporarily spook the bulls from the field. That might force the rate to drop to the 74.54 hurdle, a break of which may send USD/RUB towards a short-term tentative upside support line drawn from the low of July 21st.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research