Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

US Senate Passes Stimulus Bill, BoE and US Jobless Claims in Focus

The dollar continued to slide against most of the other G10s, while most EU and US indices closed positive on expectations that the US Senate was getting closer to pass a USD 2 trillion stimulus package. Indeed, the bill was approved later in the day, but Asian indices finished today’s trading mixed. As for today, apart from headlines surrounding the coronavirus, investors may pay some attention to the BoE decision and the US initial jobless claims for last week.

Markets Trade Risk on Ahead of BoE and US Jobless Claims

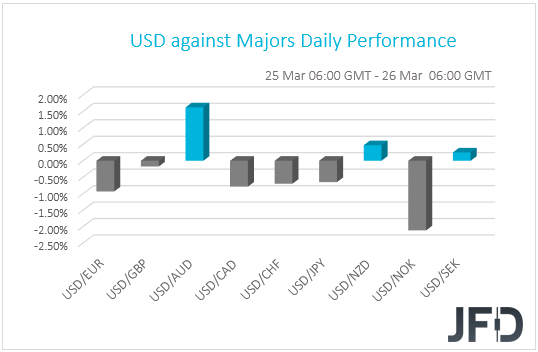

The dollar continued trading lower against most of the other G10 currencies on Wednesday and during the Asian morning Thursday. It gained only against AUD, NZD, and slightly versus SEK, while it underperformed the most against NOK, EUR, and CAD in that order. The greenback was down against CHF and JPY as well.

The relative strength of the safe havens yen and franc, combined with the weakness of the risk-linked Aussie and Kiwi, suggests a risk-off trading environment. However, the slide of the US dollar and the strengthening of the oil-related Loonie and Krone point otherwise. Thus, with the FX performance painting a blurry picture with regards to the broader market sentiment, we will turn our gaze to the equity world.

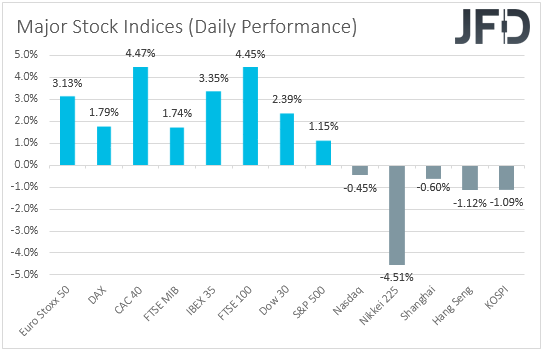

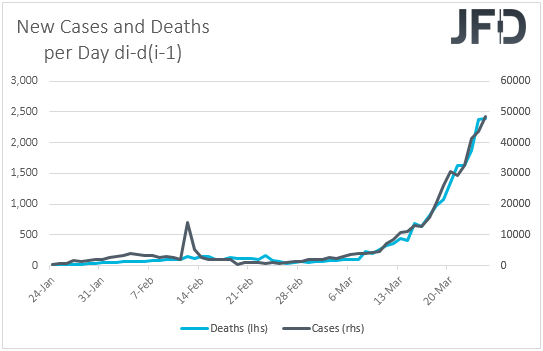

There, major EU and US indices traded in the green, with Nasdaq being the only exception, closing 0.45% down. What may have allowed most indices to record their second straight day of gains may have been expectations that the US Senate was getting closer to a USD 2 trillion stimulus package to support businesses and households hit by the coronavirus spreading. European bourses may have received and extra boost by Germany’s decision to suspend its debt brake for the first time in its history in order to finance a large aid package. In the US, although both the S&P and Dow finished in green territory, they came off their peaks following reports which raised doubts on how quickly the US bill may pass. In any case, during the Asian session, the US Senate passed it unanimously, sending it to the House of Representatives, which is expected to vote today or tomorrow. Asian indices finished mixed, with Japan’s Nikkei and China’s Shanghai Composite sliding 4.51% and 0.60% respectively. It may have been a “sell the fact” response after the bill’s approval, or it could have been a “reality check” as new infected cases and deaths from the virus hit new daily records.

As for today, market participants may pay extra attention to the US initial jobless claims for last week, which are expected to have surged to 1.0mn from 281k, due to companies announcing layoffs and state lockdowns forcing stores to close. This would be higher than the peaks seen during the 1982 and 2009 recessions. That said, with investors already anticipating a very bad number, we don’t expect a major market reaction if the forecast is met. Even if we get a higher number, the market reaction may not be huge, as the estimates range from a minimum of 250k to a maximum of 4mn, which means that some investors may have been already positioned for a worse-than-expected outcome.

In our view, the dollar may slide somewhat in case the forecast is exceeded, but we don’t expect the retreat to last for long. After all, a very bad figure may result in a risk-off trading in the aftermath, and paradoxically, may once again prove supportive for the dollar. In a dollar-denominated world, investors scaling back their risk exposure may prefer to hold cash in order to be able to cover loses and margin calls elsewhere. History has shown that in extremely turbulent conditions, the greenback may outperform even the traditional safe havens, like the yen and the franc. In any case, we prefer to exploit any potential dollar gains against the Aussie or the Kiwi, currencies which come under selling interest when investors’ morale deteriorates.

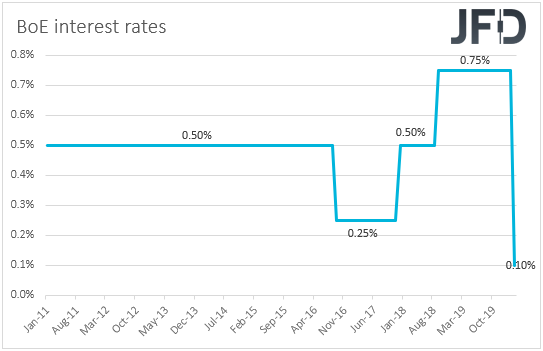

Apart from the US initial jobless claims, we also have a BoE decision today. Some investors may be eager to see whether the Bank will decide to cut rates to zero. However, with officials already cutting rates twice this month, bringing them to 0.1%, and also signaling a restart of their QE purchases, we don’t expect them to push the cut button today. We believe that they will stand ready to do so if needed, but with little ammunition left, they may be careful with regards to the timing of further easing. Another reason why we expect policymakers to wait for a while before, and if, they decide to act again is the Chancellor’s announcement over a large fiscal spending package. It would be interesting though to see whether there will be any changes in language, given that this will be the first gathering headed by the new Governor Andrew Bailey.

GBP-traders may keep most of their attention to headlines surrounding the spreading of the coronavirus in the UK. With the number of infected cases in the Kingdom rising to 9529 on Wednesday from 8077 the day before, further acceleration may result in some pound-selling. Despite the currency’s latest recovery, at least against the US dollar, we believe that the last thing investors and traders would like to do is holding assets with extra risk, and the extra risk related to the pound is Brexit and the transition-period negotiations. If indeed the broader trading environment switches back to risk-off, we would expect the pound to lose the most ground against the dollar, as well as the safe-havens yen and franc. It could underperform the euro as well, which appeared to have attracted some haven flows as well in late February – early March. It could wear its safe-haven suit again, even if a broader USD strength drags EUR/USD lower.

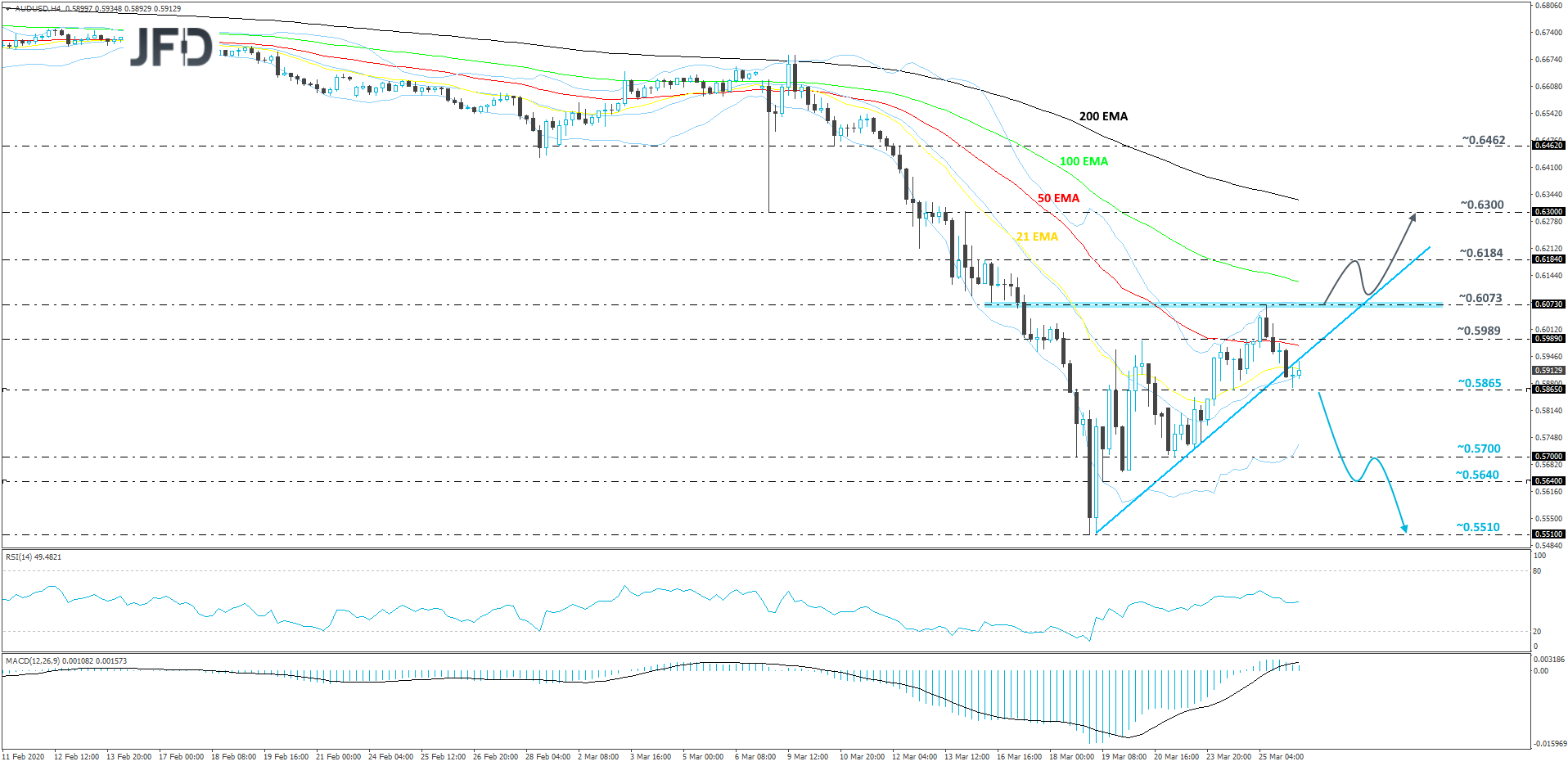

AUD/USD – Technical Outlook

After yesterday’s failed attempt to stay above the psychological 0.6000 hurdle, AUD/USD reversed back south and fell below its short-term upside support line drawn from the low of March 19th. If the pair continues to trade below that line, there is a chance to see a larger decline, especially if the rate slides below the 0.5865 hurdle, which is an intraday swing low of March 24th and lies near today’s current low. Until we see a drop below that hurdle, we will stay cautiously bearish.

As mentioned above, if AUD/USD stays below the aforementioned upside line and falls below the 0.5865 area, this would confirm a forthcoming lower low and more bulls might start abandoning the field. This is when we will aim for the 0.5700 territory, or even the 0.5640 hurdle, marked by the low of March 23rd and an intraday swing low of March 19th. The pair may temporarily get a hold-up around that area, from which it could even rebound slightly. However, if the bears are still feeling more confident, they might take back control and send AUD/USD down again. If the 0.5640 zone surrenders to the bears, this could lead to a test of the 0.5510 level, which is the current low of March.

Alternatively, if the rate climbs back above the aforementioned upside line and manages to overcome the 0.6073 barrier, marked by the current high of this week, this will confirm a forthcoming higher high and could open the door for a further extension north. We will then aim for the 0.6184 obstacle, a break of which may clear the path to the 0.6300 level, marked by the high of March 16th.

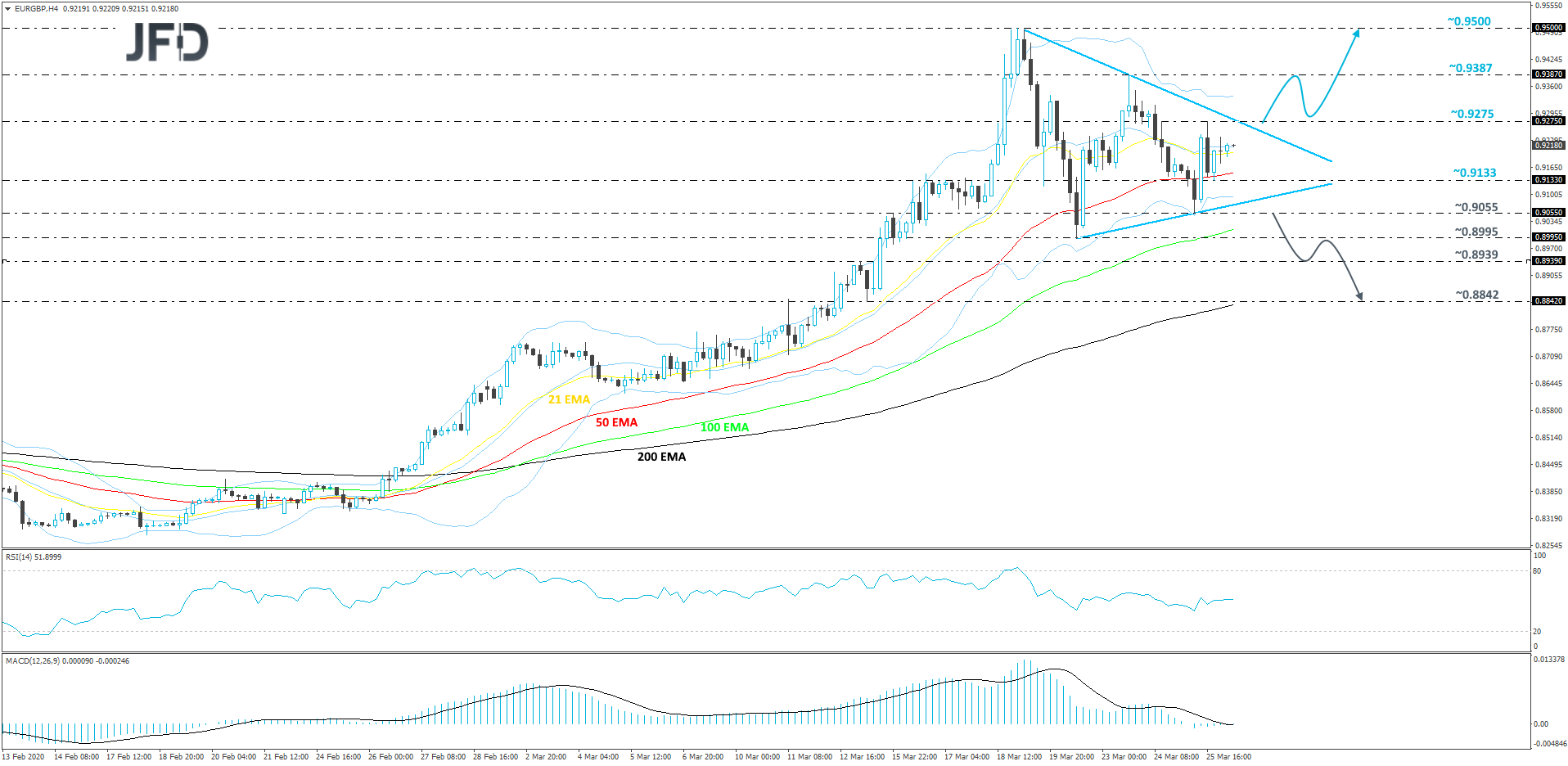

EUR/GBP – Technical Outlook

Looking at the technical picture of EUR/GBP on our 4-hour chart, we can see that the pair is currently coiling up, as it is stuck in a triangle pattern. For now, we will stay neutral and wait for a clear break of one of the sides of that formation.

If EUR/GBP makes a move higher, breaks the upper side of the aforementioned triangle and climbs above the current high of this week, at 0.9275, this would confirm a forthcoming higher high and might attract more buyers into the field. The pair could then drift to the 0.9387 hurdle, a break of which may set the stage for a test of the current highest point of March, near the 0.9500 level.

On the other hand, if the rate falls sharply, breaks the lower bound of the triangle and drops below the 0.9055 area, which is the current low of this week, that may spook the buyers from the field temporarily and allow the bears to take control for a while longer. That’s when we will aim for the 0.8995 zone, a break of which may send the pair to the 0.8939 area, marked by an intraday swing high of March 13th. Initially, EUR/GBP might stall around there, or even bounce back up a bit. However, if the rate finds to difficult to get back above the psychological 0.9000 area, this could lead to another slide. If the pair easily overcomes the 0.8939 hurdle, this will confirm another forthcoming lower low and may clear the way to the 0.8842 level, marked by the low of March 13th.

As for the Rest of Today’s Event

During the early European morning, we already got the UK retail sales for February. Headline sales slid 0.3% mom after rising 1.1% in January, missing the forecast of a slowdown to +0.2%. The core rate entered negative waters as well, sliding to -0.5% mom from +1.8%. The forecast was for the core rate to slide to -0.2%.

Later in the day, apart from the initial jobless claims, from the US we also get the final GDP for Q4. The final print is expected to confirm its second estimate, namely that the US economy grew 2.1% qoq SAAR during the last three months of 2019. In any case, barring any major deviations from the forecast, we expect this release to pass unnoticed. After all, we have models pointing to how the economy has been performing during the first quarter of this year, during which the outbreak of the coronavirus happened and thus, investors may be more interested on data concerning that period. Surprisingly, the Atlanta Fed GDPNow model points to a 3.1% qoq SAAR growth rate, but the New York Nowcast suggests a slowdown to 1.5% qoq SAAR. Having in mind how turbulent this quarter has been, we lean towards the New York model, but in any case, we will have to wait for the actual data to confirm whether and how much was the economy hurt.

As for tonight, during the Asian morning Friday, Japan releases the Tokyo CPIs for March. No forecast is currently available for the headline rate, but the core one is anticipated to have ticked down to +0.4% yoy from +0.5%.

With regards to the speakers, Fed Chair Jerome Powell will make a televised interview, where we may get more insights on the Fed’s latest actions to fight the coronavirus, and what the Committee’ s future plans may be.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research