Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

US NFP In The Spotlight, RBA MPC Statement, Trump Threats

Yesterday, the US released their initial and continuing jobless claims, where both numbers come out on the better side. This morning we have received the monetary policy statement (MPS) from the Reserve Bank of Australia, which delivered its interest rate decision on Tuesday. Today, market participants will get the long-awaited job numbers from the US.

US Initial and Continuing Jobless Claims

Yesterday, the US released their initial and continuing jobless claims, where both numbers come out on the better side. The initial jobless claims had a decent decline, showing up at 1186k, beating not only the previous 1435k reading, but also the forecasted 1415k number. The continuing jobless claims also showed a good result, coming out at 16107k, when the forecast was at 16702k. This means that not only that there were much less of new people filing for unemployment benefits, but also there was a reduction in the number of people who continue to claim the unemployment benefits.

RBA’s MPC Statement

This morning we have received the monetary policy statement (MPS) from the Reserve Bank of Australia, which delivered its interest rate decision on Tuesday. Then the Bank kept its cash rate unchanged, at +0.25%. In the MPS statement released this morning, the RBA outlined that they will not increase the cash rate until progress will be made towards full employment and reaching the inflation target, which is between 2%-3%. The board also expects unemployment for December to be around 10%, then around 8.5% for December 2021 and around 7% for December 2022. Also, the RBA sounded a bit more pessimistic about Australia’s YoY GDP for 2020, as the Bank believes it may contract 6%. The AUD is seen to be on the weaker side against its major counterparts. But that may also be due to Asian markets reversing south today, as the risk-on mood has been shaken a bit.

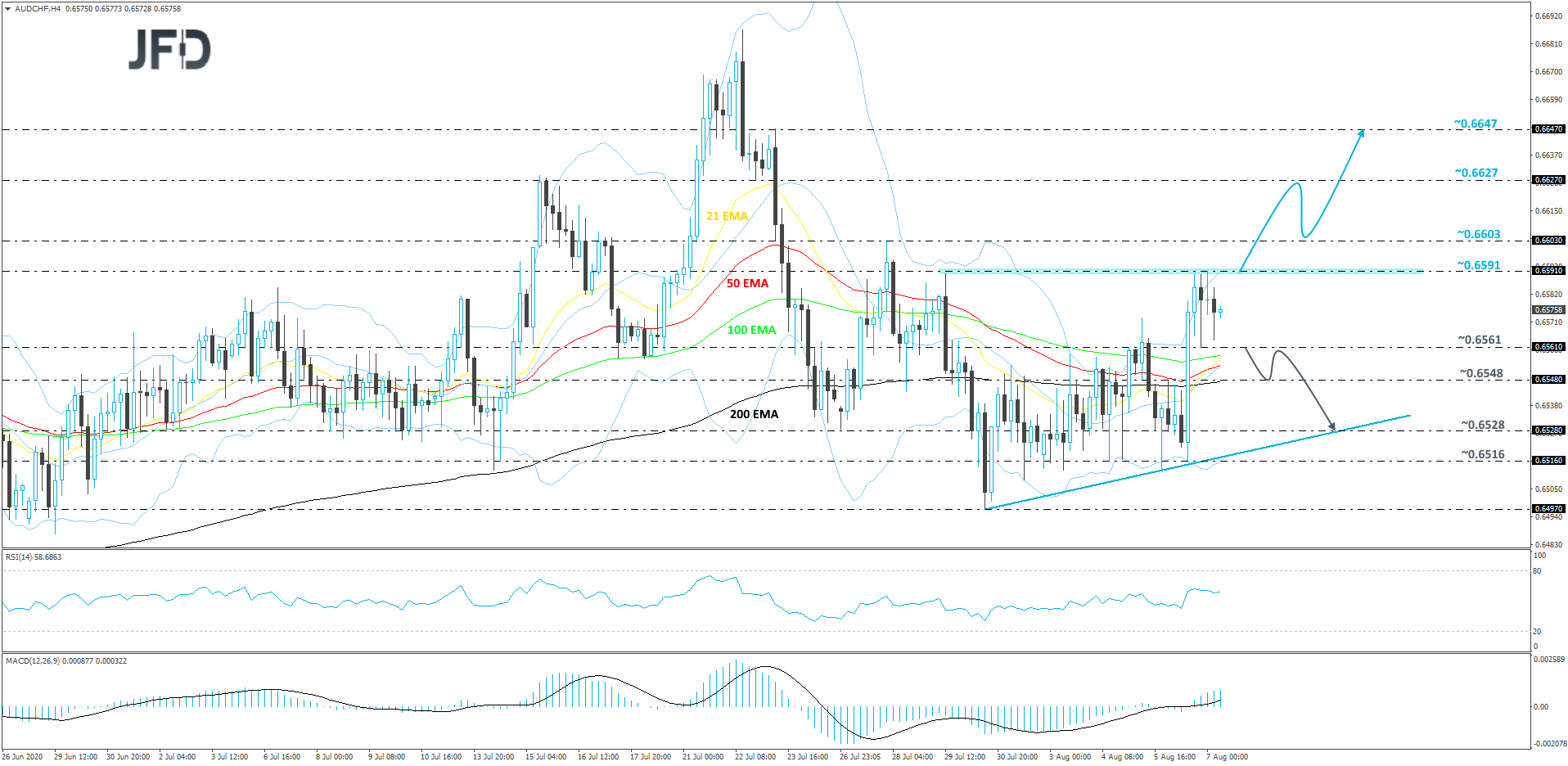

AUD/CHF – Technical Outlook

AUD/CHF came under buying interest yesterday, which game the pair a good boost. The rate rebounded from a short-term tentative upside support line and tested one of its key resistance areas, at 0.6591, marked near the high of July 29th. This morning, we are seeing a small correction to the downside, however if the pair reverses up again and overcomes that 0.6591 barrier, this could open the door to some higher areas. For now, we will take a cautiously-bullish approach.

If, eventually, we do see a strong upmove and a break above the 0.6591 zone, that would confirm a forthcoming higher high and may clear the path for a further acceleration. AUD/CHF could then travel to the 0.6603 territory, a break of which might set the stage for a push to the 0.6627 hurdle, marked by the low of July 22nd, where the price may stall for a bit. The rate could go for a bit of retracement back down from there, that said, if the buyers are still feeling a bit more comfortable, they might jump back into the game and lift the pair above the0.6627 obstacle. The next potential resistance may be seen near the 0.6647 level, which is the high of July 23rd.

Alternatively, if the pair falls back below the 0.6561 hurdle, marked by an intraday swing low from yesterday, that may spook the buyers from the arena temporarily. AUD/CHF might then drift to the 0.6548 obstacle, a break of which could clear the way to the 0.6528 level, marked by the low of July 26th and by an intraday swing low of May 5th.

Trump Gives a 45-day Notice To Some Chinese Tech Companies

The shakeup was mainly due to Trump’s decision yesterday to impose a ban on a few major Chinese tech giants, which have a large exposure in the US. Stating that such companies like Tik Tok and WeChat are a threat to national security. The expected ban should take into effect in 45 days from yesterday. However, as we know, there are talks going between Tik Tok’s Chinese owner ByteDance and Microsoft on potentially acquiring the North American operational part of Tik Tok. However, there are rumours that the consideration of a buyout of the whole Tik Tok by Microsoft might be a realistic one. We can view Trump’s 45-day term before the ban goes into effect, as a given period for the two major tech players (ByteDance and Microsoft) to come up with a deal.

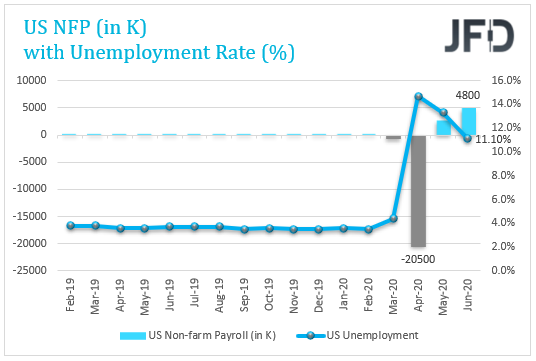

US NFP Day

Today, market participants will get the long-awaited job numbers from the US. The non-farm payroll figure will be released, together with the unemployment rate. Average hourly earnings and the participation rate will also be on the agenda. Currently, the non-farm payroll reading is expected to come out at 1600k, which is already well below the previous 4800k. Some investors and traders like to look at the ADP number, in order to manage their expectations in relation to the NFP figure, which is released usually on Wednesday’s of the same week. However, as we mentioned before, one should not solely rely on the ADP reading, as sometimes the two data sets come out on different ends of the spectrum. If the actual number comes out even lower than the forecast, this may weigh in on equities in the negative way, as it would mean that the economy is struggling to create jobs, while the coronavirus continues to destabilise the country. Also, as it is known, President Trump is planning to sign an order to extend the program of enhanced unemployment benefits. This might be interpreted by some that the expected NFP number today might actually come out on a much lower end. This could mean that Mr Trump is trying to be one step ahead, so that the possible weaker job number wouldn’t look too bad on him and his presidential run.

However, the US unemployment rate is believed to have improved, going from 11.1% to 10.5%. So far, from April, the actual figure kept on beating the forecasts and coming out lower. Also, from April, every single forecast for the NFP was on the higher side and the actual reading was beating the expectations. This time we will be a bit careful, because the NFP reading is believed to have declined. It will be interesting to see if this positive correlation, which we saw over the past three months will continue.

The US MoM average hourly earnings are believed to have improved from -1.2% to -0.5%, where the YoY figure is expected to have moved a bit lower, from +5.0% to +4.2%. In regards to the participation rate, no forecast is available at the moment. All we know is that the figure is rising again, after reversing back up in May.

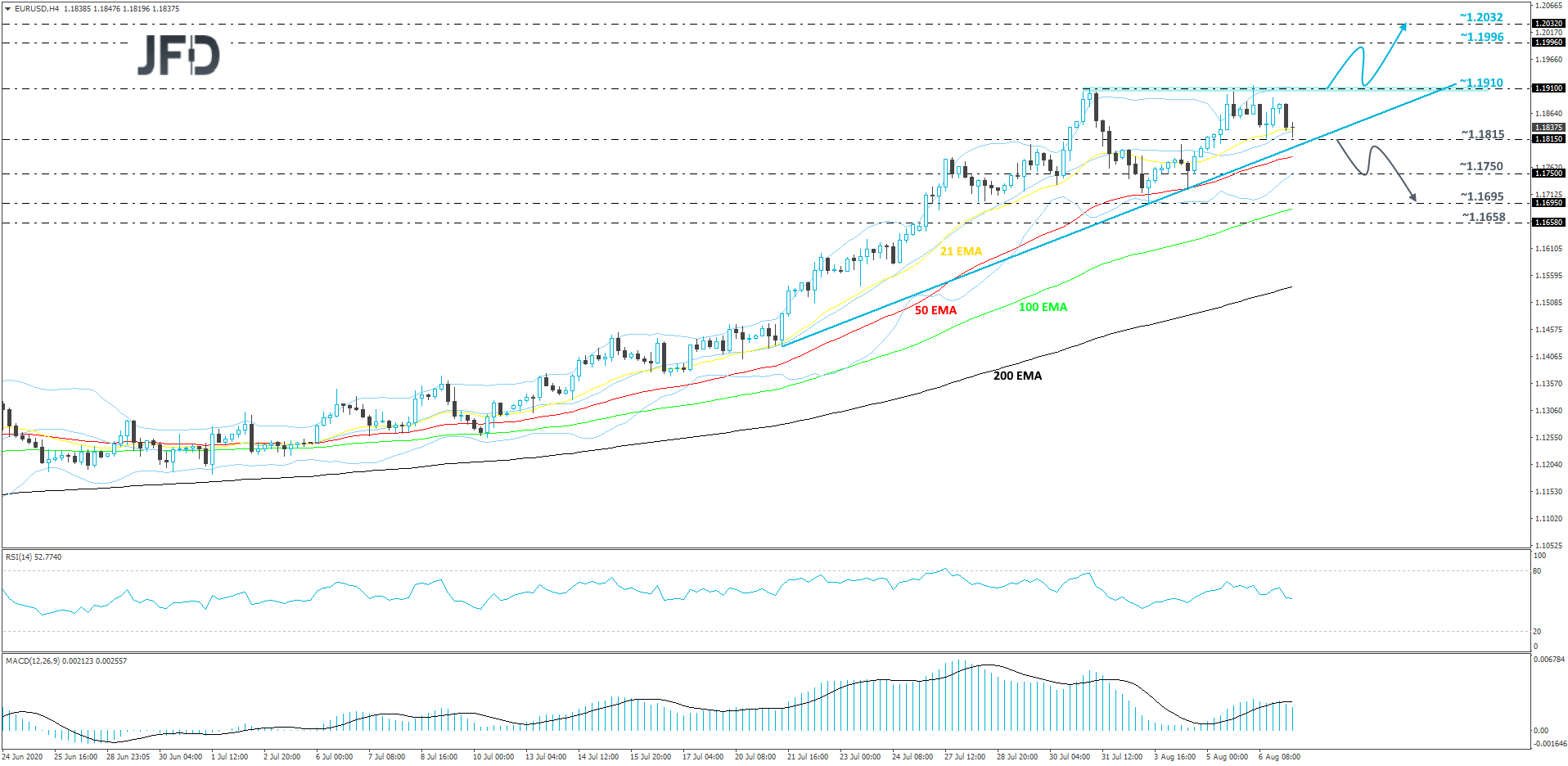

EUR/USD – Technical Outlook

EUR/USD had another good run to the upside this week, but once again it failed to stay above the highest point of July, at 1.1910. The pair is now seen moving lower, however, we may class this slide as a corrective one, as long as the rate remains above its short-term tentative upside support line taken from the low of July 21st. We will take a somewhat positive stance for now, however to get comfortable with the upside, we will wait for a push above the 1.1910 barrier first.

If EUR/USD gets another boost, which will be enough to lift it above the 1.1310 barrier, that would confirm a forthcoming higher high and could clear the way to some higher areas. The pair might then drift to the 1.1996 zone, marked by the high of May 14th of 2018, where it might stall temporarily. The rate may slide back down a bit, however, if it stays above the previously-mentioned 1.1910 area, the bulls may try their luck again to raise the pair higher. If they succeed in doing that and they overcome the 1.1996 obstacle, the next possible resistance level could be at 1.2032, which is the high of May 14th, 2018.

On the other hand, if the pair breaks below the 1.1815 hurdle, marked by yesterday’s low, and also falls below the aforementioned upside line, that may send EUR/USD further down. The rate might start sliding to the 1.1750 obstacle, a break of which could open the way to the 1.1695 level, marked by the current lowest point of August.

As for the rest of today’s events

Canada will also produce its jobs figures for the month of July. Unemployment is expected to have moved a bit lower, from 12.3% to 11.1%. The focus will also fall on Canada’s labour participation number. The previous number was 63.8%, but the actual figure is forecasted to have improved fractionally, going to 64%.

In addition to the jobs numbers, Canada will deliver its Ivey PMI for July, which is expected to have dropped slightly from the previous 58.2 to 57.5.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research