Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

US NFPs Enter the Spotlight Amid Omicron Concerns

The US dollar was found higher against most of the other major currencies this morning, while the equity world suggests that market sentiment improved somewhat during the US session. We stick to our guns that the coronavirus will stay the main focus for a while more, but today, investors may turn their gaze to economic data again for a while, and especially the US employment report for November.

The US dollar Gained, while Equities Rebounded Ahead of the US Jobs Data

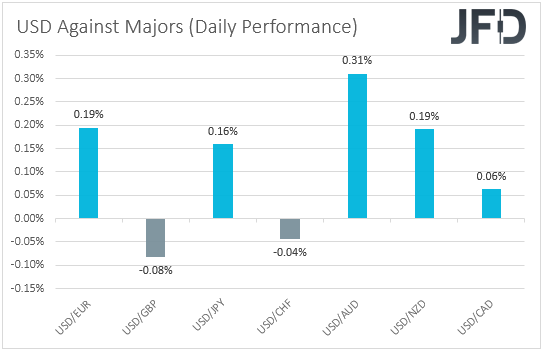

The US dollar traded higher against most of the other major currencies on Thursday and during the Asian session Friday. It lost some ground only versus GBP and CHF, while it gained the most against AUD, NZD, and EUR.

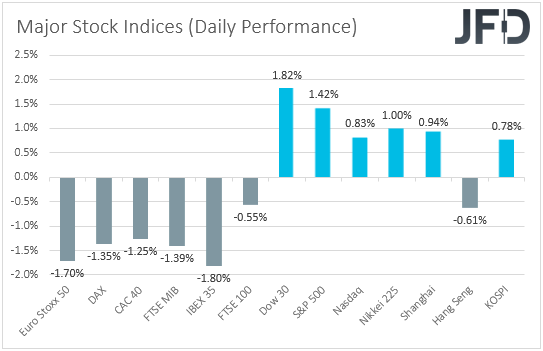

The strengthening of the US dollar and the weakening of the risk-linked Aussie and Kiwi suggests that markets traded in a risk-off fashion yesterday and today in Asia. However, the weakening of the yen and the strengthening of the pound points otherwise. Thus, in order to get a clearer picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world. There, major EU indices traded in the red, but later in the day, Wall Street rebounded, with the recovery in sentiment rolling somewhat into the Asian session today.

EU indices may have continued to be dragged down by the uncertainty surrounding the Omicron COVID variant and the potential implications new restrictive measures could have on the global economy. With no clear and strong catalyst to justify the rebound later in the day, we will class this one as a corrective bounce as well. Remember, yesterday, we said that the uncertainty surrounding the coronavirus by itself may be enough to prevent market participants from adding to their risk exposures.

Today, the spotlight is likely to turn to economic data for a while. The main release may be the US employment report for November. Nonfarm payrolls are expected to have accelerated to 550k from 531k in October, while the unemployment rate is anticipated to have ticked down to 4.5% from 4.6%. Average hourly earnings are forecast to have grown at the same monthly pace as in October, something that will take the yoy rate up to 5.0% from 4.9%.

Accelerating wages could translate into accelerating inflation in the months to come, and thus, this, combined with decent employment gains and a sliding unemployment rate, could add more credence to Fed Chair Powell’s view that the “transitory” wording may have to be dropped out of the Fed’s monetary policy statement, and that tapering should end sooner than previously thought. This could encourage more dollar buying, but how the equity market will react is not crystal clear. On the one hand, more investors may reduce their risk on expectations that higher rates sooner could hurt companies’ profitability, while on the other, equities may be bought as a strong report could underscore the strong performance of the US economy. Even if the second proves to be true, as investors may have digested somewhat the idea of higher rates sooner, we will still not call for a long-lasting recovery. We will treat it as an extension of the latest corrective bounce. We stick to our guns that the uncertainty surrounding the Omicron variant may result in another round of selling soon.

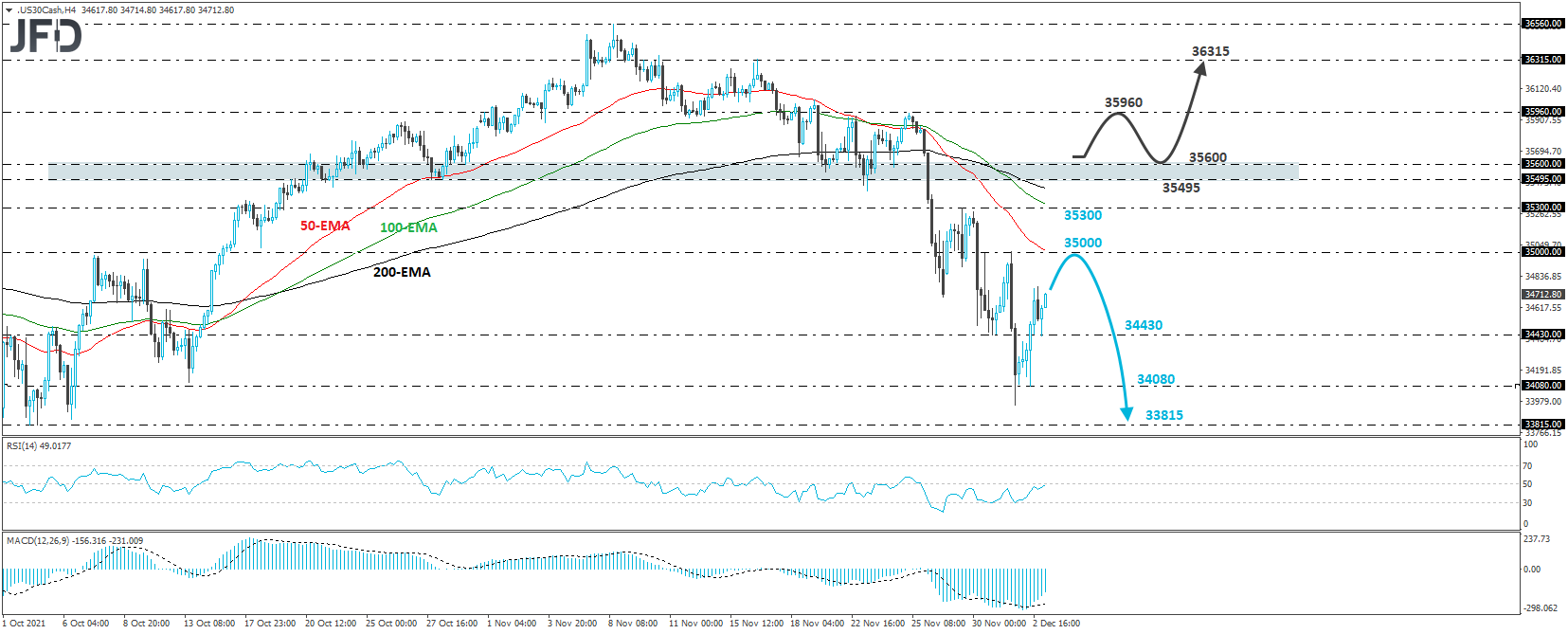

DJIA – Technical Outlook

The Dow Jones Industrial Average traded higher yesterday, after hitting support at 34080. However, the overall price structure remains of lower highs and lower lows, and thus, even if the recovery continues for a while more, we will class it as a correction before the next leg south.

As we noted, the recovery may continue for a while more, but the bears may take charge again from near the psychological number of 35000, as they did on Wednesday. They could initially challenge the 34430 zone, the break of which could result in another test near 34080. Another break, below 34080, could extend the fall towards the lows of October 4th and 5th, at around 33815.

On the upside, we would like to see the recovery extending above the 35495/35600 territory, which acted as a floor between October 20th and November 24th, before we start examining the bullish case again. Such a move may encourage advances towards the high of November 25th, at 35960, the break of which could extend the recovery towards the high of November 16th, at 36315.

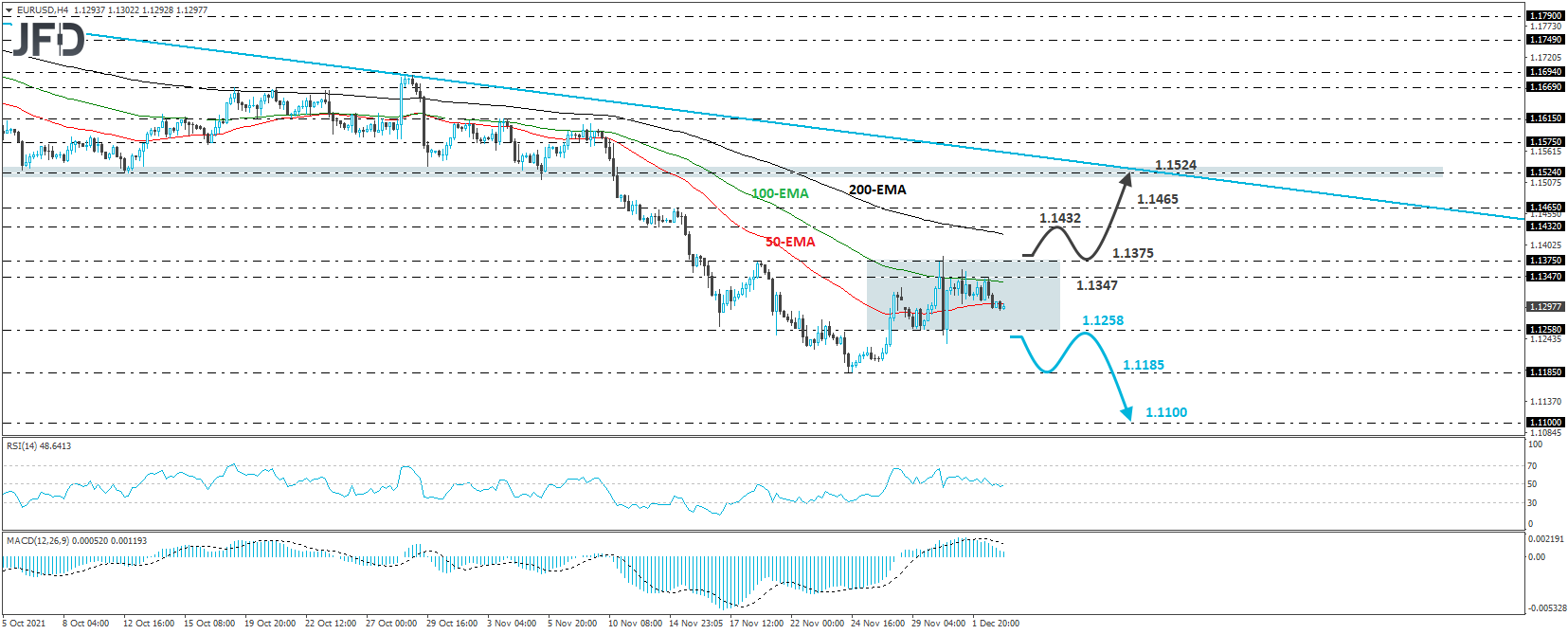

EUR/USD – Technical Outlook

EUR/USD traded slightly lower yesterday, after it hit resistance at 1.1347. Since November 26th, the pair has been trading in a sideways manner, between 1.1258 and 1.1375, and thus, we prefer to wait for exiting that short-term range before examining the next directional move. However, in the bigger picture, EUR/USD remains below the downtrend line taken from the high of May 25th, and thus, we will consider the overall outlook to be negative.

This, combined with decent expectations over the US employment report, make us believe that the downside exit out of the short-term range is more likely than the upside one. If this is indeed the case, the bears may then drive the action towards the 1.1185 barrier, marked by the low of November 24th, the break of which could extend the fall towards the 1.1100 zone, marked by the low of June 1st.

On the upside, a break above 1.1375 would not result in a trend reversal, but maybe a decent upside correction. The bulls could get exited temporarily and drive the action up, towards the 1.1432 or 1.1465 zones, the break of which could extend the recovery towards the key hurdle of 1.1524, or the aforementioned medium-term downside line.

As for the rest of Today’s Events

At the same time with the US employment report, we get jobs data for November from Canada as well. The unemployment rate is forecast to have slid to 6.6% from 6.7%, while the net change in employment is forecast to show that the economy has added 35.0k jobs after adding 31.2k in October. Following the stronger-than-expected rebound in economic activity during Q3, a decent jobs report could increase speculation for a rate hike by the BoC soon and thereby support somewhat the Loonie. Remember that at their latest gathering, Canadian policymakers unexpectedly ended their QE program, maintaining an optimistic stance. Having said all that though, it remains to be seen whether the Omicron variant will be a reason for changing plans. With that in mind and taking into account that the Loonie is a risk-linked currency, we will treat any rebound as a corrective bounce and we would expect it to come back under selling interest, in case the broader sentiment deteriorates again.

As for the rest of the releases, we get the final services and composite Markit PMIs for November from the Eurozone, the UK, and the US, and as with the manufacturing indices, they are mostly expected to confirm their preliminary estimates. The ISM non-manufacturing PMI for November is also coming out and the forecast points to a decline to 65.0 from 66.7.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68.02% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research