Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

TRY Drops in Value Against Its Major Counterparts

During the early hours of the Monday morning, the Turkish lira fell sharply against all of its major counterparts, such as EUR, USD, GBP and JPY. This move was caused by the Turkish President Tayyip Erdogan, who, during the weekend, fired the governor of the Turkish Central Bank, Naci Agbal. Mr Aqbal was the one, who came in in November last year and managed to stabilise the weakened lira, by raising interest rates. Something the Turkish President was always opposed to. The new appointee, Sahap Kavcioglu, is seen as pro-low-rate supporter, who’s views come in line with Erdogan’s wishes. However, so far, any attempts to stabilise the Turkish currency, without raising interest rates, have proven to be unsuccessful.

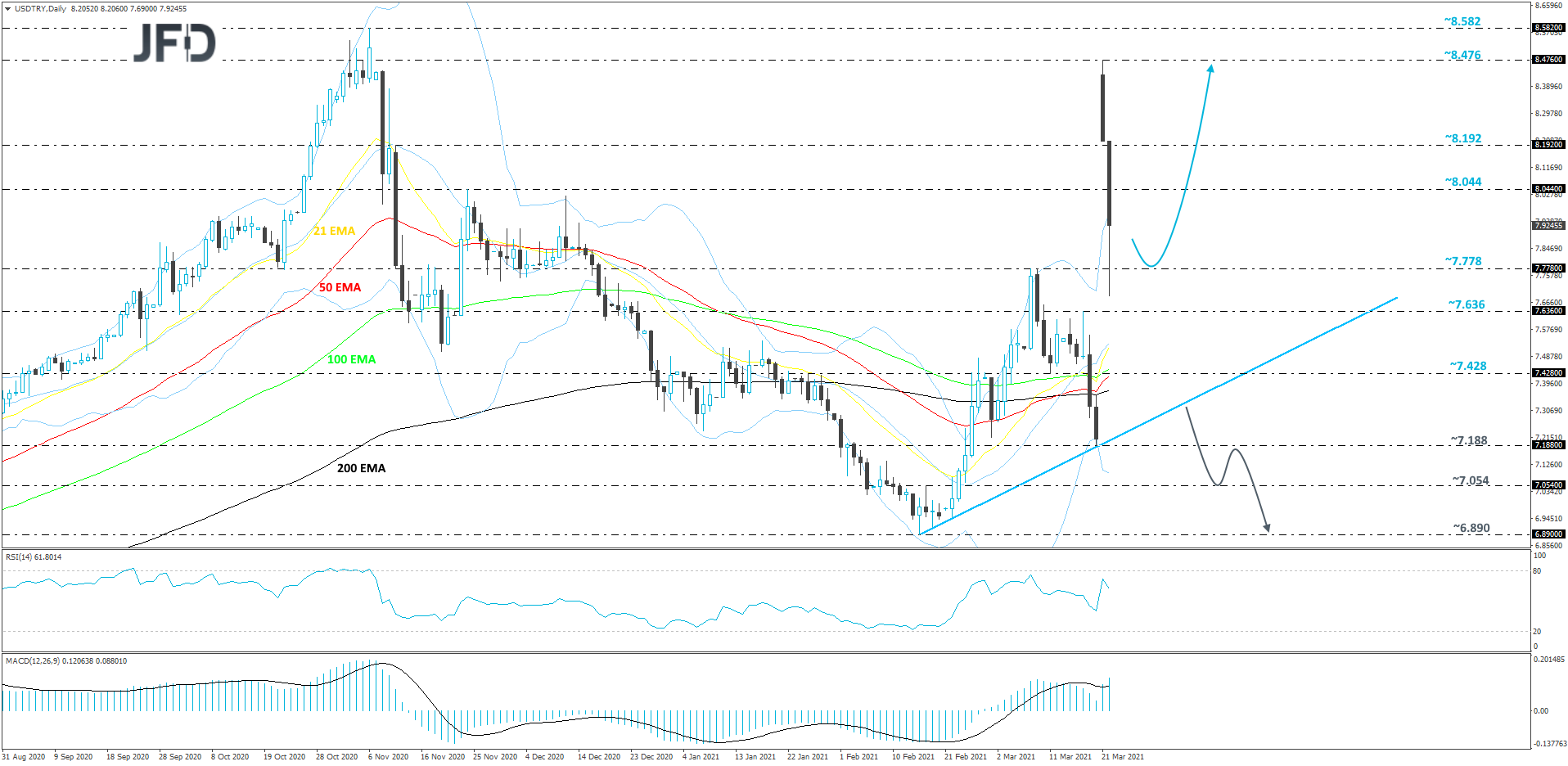

The technical picture of USD/TRY on our daily chart shows that, after an “explosion” this morning, the rate managed to retrace back down. However, the risk of seeing another wave moving back to the upside remains high, due to the uncertainty surrounding further steps of the TCB, under new leadership. For now, we will take a somewhat bullish approach over USD/TRY’s near-term outlook.

If the pair continues to balance above the highs of March 8th and 9th, at 7.778, this may attract the buyers back into the game, possibly sending the rate north again. USD/TRY could drift to the 8.044 obstacle, or to the 8.192 hurdle, marked by the high of November 11th, 2020. If the TRY devaluation doesn’t stop there, the next potential target might be the current high of today, at 8.476.

The RSI is currently pointing lower, but remains well above 50. The MACD is still pointing higher, as it continues to float above zero and its trigger line. The two oscillators still show positive price momentum, which supports the above-discussed scenario.

Alternatively, in order to shift our attention to some lower areas, a break of a short-term tentative upside support line, drawn from the low of February 16th, would be needed. If that happens and USD/TRY goes ahead and breaks the 7.188 hurdle as well, which is marked by the current lowest point of March, that could strengthen the downside scenario. The pair may drift to the 7.054 obstacle, a break of which might open the door for a test of the 6.890 level, marked by the lowest point of February.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.07% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research