Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Stimulus Hopes Lift Equities, RBA Delivers the First Virus-related Cut

Most global indices rebounded on Monday, perhaps due to expectations over a coordinated easing by major central banks in order to defend the global economy from the effects of the fast-spreading coronavirus. The first to open the stimulus trunk was the RBA, cutting its interest rates by 25bps to a new record low of +0.5%, and signaling readiness to drive it lower if needed.

Equities Rebound on Hopes of Coordinated Policy Action, RBA the First to Cut

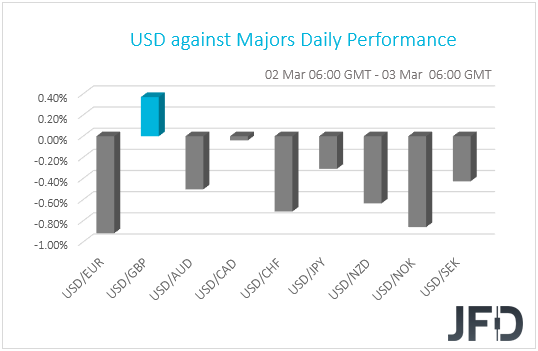

The dollar traded lower against all but two of the other G10 currencies on Monday and during the Asian morning Tuesday. It lost the most ground against EUR, NOK, and CHF in that order, while it gained only against GBP. The greenback was found virtually unchanged versus CAD.

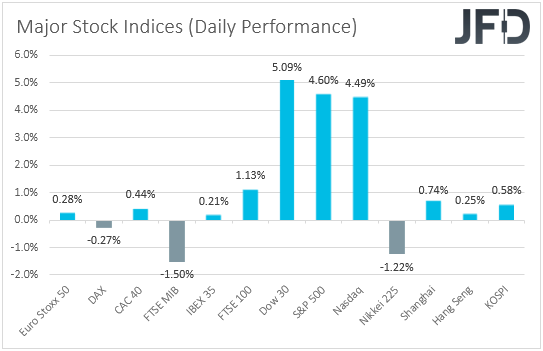

Although the Swiss franc was among the gainers, the dollar was among the second loser in line, while the yen took the last place among the currencies that gained against their US counterpart. What’s more, the commodity linked currencies also outperformed the greenback. This makes it hard to arrive to safe conclusions with regards to the broader market sentiment and thus, we will turn our gaze to the equity world. Doing so we clearly see that market participants decided to add to their risk exposure. Most major EU and US indices traded in green territory. The only exceptions were the German DAX, which slid 0.27%, and Italy’s FTSE MIB, which fell 1.50%, despite reports that the Italian government will introduce measures to soften the effects from the coronavirus. Just for the record, Italy is the European country hit the most, with the death toll surging to 52 from 34 within a day. The positive investor morale rolled over somewhat during the Asian morning today. Although Japan’s Nikkei 225 slid 1.22%, China’s Shanghai Composite, Hong Kong’s Hang Seng and South Korea’s KOSPI gained 0.74%, 0.25% and 0.58% respectively.

Following their worst week since the 2008 financial crisis, which wiped out around USD 5 trillion from the market, most indices may have rebounded on expectations that central banks will respond to safeguard their economies from the damaging impact of the coronavirus. The first signal came from Fed Chair Jerome Powell, who released a statement on Friday, saying that, although the fundamentals of the US economy remain strong, the coronavirus poses evolving risks and that the Committee will use its tools and act as appropriate to support the economy. Early yesterday, it was the turn of BoJ Governor Kuroda who said that his Bank will take the necessary steps to stabilize markets jolted by the coronavirus. The ECB followed suit later in the day, also signaling readiness to act. On top of that, reports suggested that Finance ministers from the G7 group will hold a conference call today, in order to discuss how to fight the effects of the outbreak.

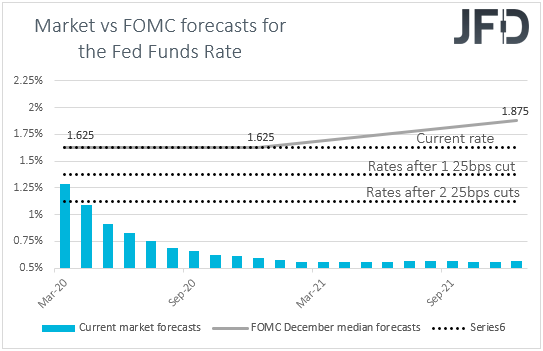

Elevated expectations over further easing by the Fed may have also been the catalyst behind the dollar’s slide. According to the Fed funds futures, market participants are pricing in a rate cut to be delivered at the Fed’s upcoming gathering. The more interesting point is the size of the expected cut. Investors are really confident that the Fed will cut by 50bps, considering such an action to be a done deal. Apart from Powell’s remarks, what may have bolstered further expectations over a bold action by the Fed, and thereby added more pressure on the greenback, could have been the negative surprise in the ISM manufacturing PMI for February. Expectations were for a slide to 50.5 from 50.9, but the index fell to 50.1, just a tick above the boom-or-bust zone of 50.

The euro continued marching higher, despite expectations that the ECB will cut its main refinancing rate by 10bps at next week’s gathering. In our view, investors may have maintained long positions on the euro, as the ECB is expected to cut by the smallest percentage, and perhaps due to recent reports that Germany’s finance ministry is seriously considering to boost fiscal spending, due to growing pressure to support the nation’s sluggish economy, something that will lessen the need for aggressive easing by the ECB.

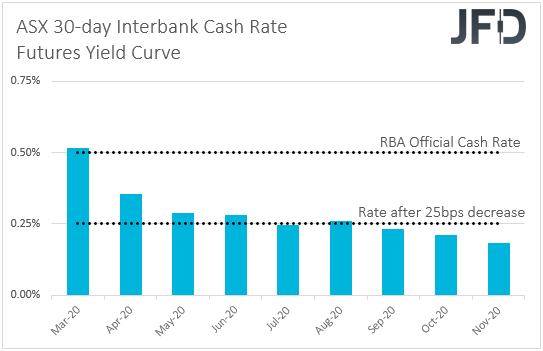

The stimulus trunk was opened by the RBA during the Asian morning today. Australian officials decided to cut interest rates by 25bps, to a new record low of 0.5%, with Governor Philip Lowe saying in the post-meeting statement that the coronavirus was having a “significant” impact on the domestic economy and that it’s hard to assess how large the effects will be. In the statement, it was also repeated that officials “remain prepared to ease monetary policy further to support the Australian economy”. According to the ASX 30-day interbank cash rate futures yield curve, there is an 86% chance for officials to push the cut button again in May.

The Australian dollar traded somewhat lower at the time of the release, but bearing in mind that this was largely priced in following the initial signals over a coordinated policy action by major central banks, the slide was short-lived. The Aussie was found higher against the US dollar, perhaps aided by the broader upbeat sentiment. Paradoxically, despite the RBA cutting rates and expected to cut more, the Aussie may now enjoy some gains for a while on expectations that other Banks will follow suit in order to prevent a global recession.

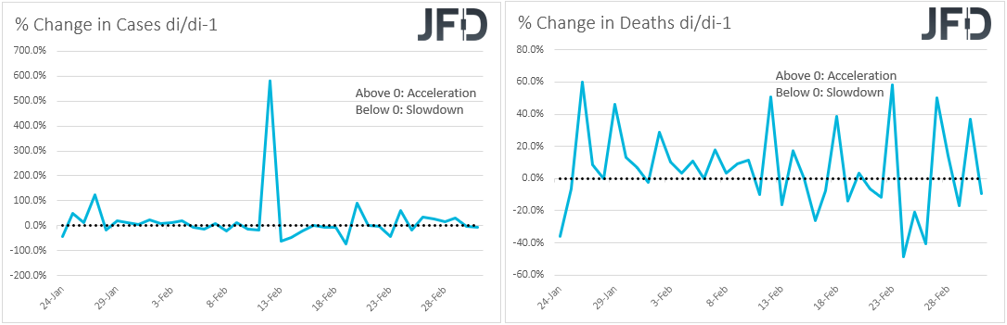

Having said all that though, it may be naïve to assume that rate cuts will be enough to revive the global economy from the impact of the coronavirus. Although infected cases and deaths entered a slowdown mode on Monday, Sunday was marked by acceleration, which suggests that the worst is not behind us yet. With the virus now spreading much faster outside China than within, and with no vaccine on the horizon, predicting when it will be contained, and how large the effects will be, appears to be a hard task. If this coordinated easing effort fails to stimulate decently the global economy, panic may return into the financial world, leading to another slide in equities and other risk-linked assets as investors could start seeking shelter in safe havens again.

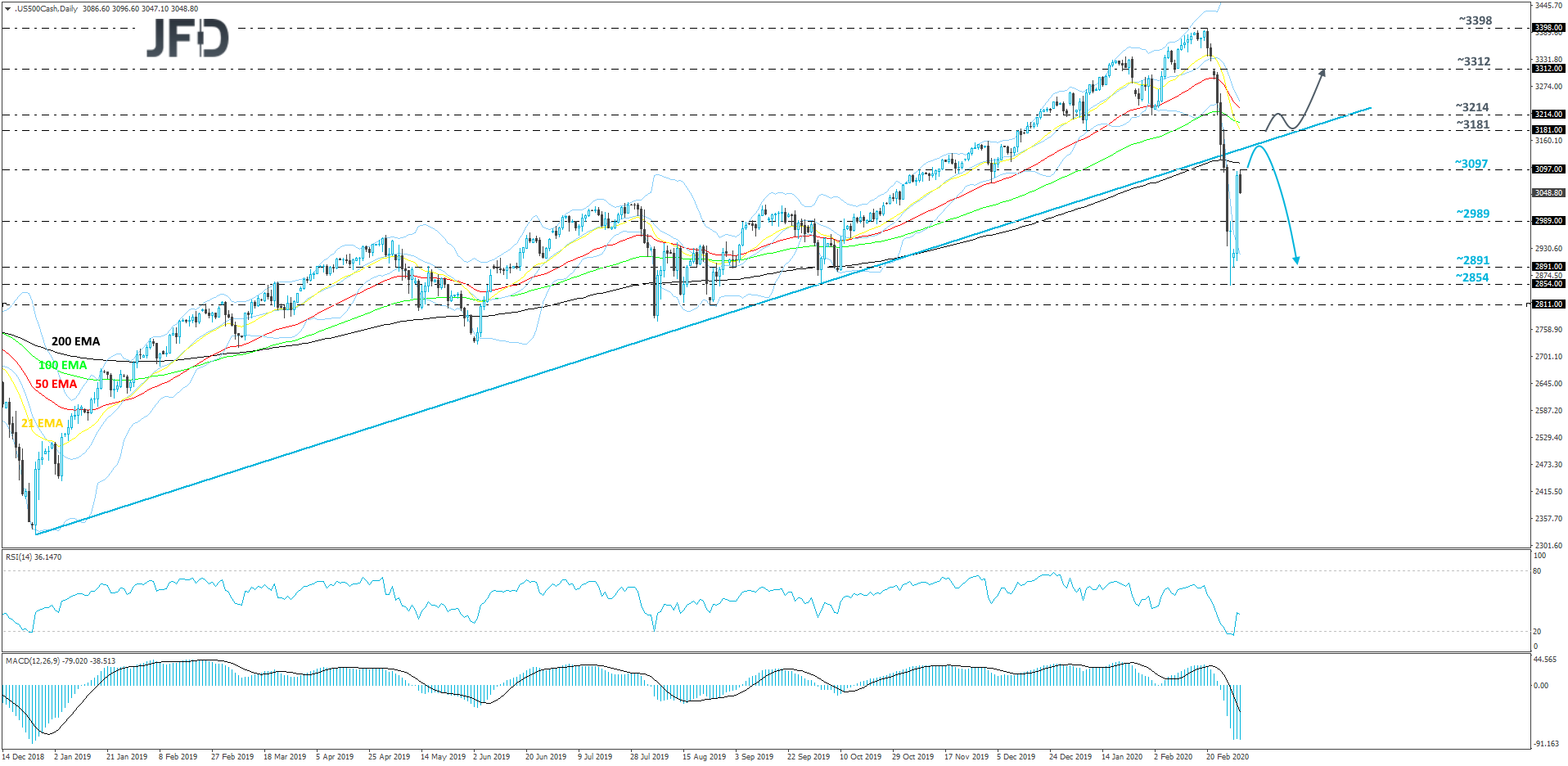

S&P 500 – Technical Outlook

Yesterday, the S&P 500 index had a decent recovery to the upside, after sliding heavily last week. This morning, the cash index came close to its 200-day EMA, but got held near the 3097 barrier. Overall, the price continues to balance below its long-term tentative upside support line drawn from the low of December 26th, 2018. Although we may see the S&P 500 retracing a bit more to the upside, if it stays below that line, we will aim for the downside again.

As mentioned above, a small push higher could send the price to test the aforementioned upside line from underneath and if the index struggles to make its way above that line, that’s when the bears might take control again. If so, the S&P 500 could slide to the 2989 hurdle, a break of which may clear the path to the 2891 level, marked by the current low of this week. Slightly below it lies another possible support area, at 2854, marked by the lowest point of February.

In order to consider a larger recovery to the upside, we would like to see the price moving back above the aforementioned upside line and a push above the 3181 barrier, marked by the low of January 8th. If so, the S&P 500 could drift to the 3214 hurdle, which may provide a bit of resistance, as previously it acted as a good support on January 31st and February 24th. If the buying doesn’t stop there, the index could get a boost to its next potential resistance mark, at 3312, which is the high of last week.

AUD/USD – Technical Outlook

After finding support last week near the 0.6434 hurdle, AUD/USD reversed to the upside and is now trying to make its way higher. However, the upside might get limited near a short-term downside resistance line drawn from the high of December 31st. For now, although the rate could travel a bit higher, overall, we will stay bearish.

A push higher could send the pair to the 0.6592 barrier, marked by the high of February 27th. Slightly above it runs the aforementioned downside line, which may provide additional resistance. If it stays intact, we could see the bears taking control again and driving AUD/USD back down, potentially targeting the 0.6510 territory, which is today’s low. A break of that area might put the pair under more pressure, and it may slide to the 0.6462 level, marked by the current low of this week.

Alternatively, if the previously-discussed downside line breaks and the rate rises above the 0.6639 barrier, which is the high of February 21st, this could be a sign of a change in the short-term trend. The pair might easily drift to the 0.6662 obstacle, a break of which may set the stage for a move to the 0.6707 zone, marked by the high of February 19th. AUD/USD might get a hold-up around there, or even correct lower. That said, if the rate stays above that downside line, we will stay positive, at least over the near term.

As for the Rest of Today’s Events

Following the RBA decision, during the European morning we got Switzerland’s GDP for Q4, which slowed by less than anticipated in qoq terms, something that pushed the yoy rate up to +1.5% from +1.1%.

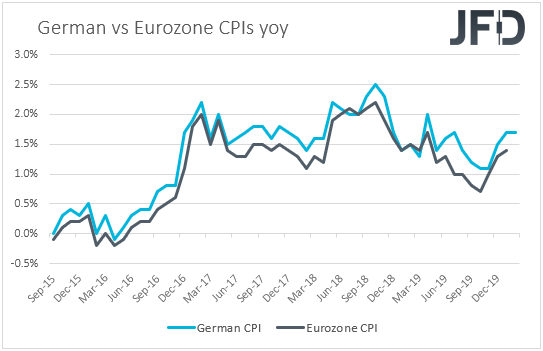

Later in the day, we get Eurozone’s preliminary inflation data for February. Expectations are for the headline rate to have declined to +1.2% yoy from +1.4%, while the core rate is anticipated to have held steady at +1.1% yoy. That said, with the German headline inflation rate staying unchanged at +1.7%, we see the risks surrounding Eurozone’s headline print as tilted to the upside.

Although both rates would still be below the ECB’s objective of “below but close to 2%”, a move in the desired direction, combined with recent reports that Germany’s finance ministry is seriously considering to boost fiscal spending, may lessen further the need for aggressive stimulus by the ECB and thereby support the euro slightly more.

With regards to the energy market, we get the API (American Petroleum Institute) weekly report on crude oil inventories, but as it is always the case, no forecast is available.

As for tonight, during the Asian morning Wednesday, Australia releases its GDP data for Q4, with the qoq rate expected to have held steady at +0.4%, something that could drive the yoy rate up to +2.0% yoy from +1.7% in Q3. This would be a somewhat pleasant development for RBA policymakers, but we doubt that it could materially affect expectations with regards to additional cuts. Investors may prefer to read into data concerning the first quarter of this year, as they try to assess whether and by how much did the coronavirus has affected the Australian economy, which is closely linked to the Chinese one.

We also have three speakers on the agenda: Today, we will get to hear from ECB Vice President Louis de Guindos and Cleveland Fed President Loretta Mester, while tonight, Chicago Fed President Charles Evans will speak.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research