Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Nov 04 – Nov 08: RBA and BoE Decisions, NZ and Canada Job Reports

Following the FOMC, BoC and BoJ policy gatherings, last week, now the central bank torch is passed to the RBA and the BoE. Both Banks are expected to stand pat, so all the attention is likely to fall on hints and signals with regards to their future course of action. We also get employment data from New Zealand and Canada.

Monday appears to be a relatively light day with the only indicators worth mentioning being Eurozone’s final manufacturing PMI for October, which is expected to confirm its preliminary estimate of 45.7, and the UK construction PMI for the same month, which is forecast to have risen to 44.0 from 43.3. The case for a slight improvement in this index is supported by the manufacturing PMI, released on Friday, which rose to 49.6 from 48.3.

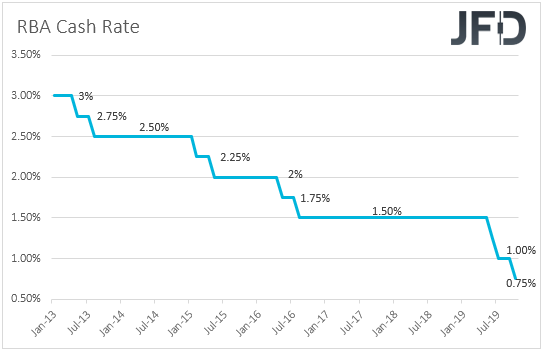

On Tuesday, during the Asian morning, the RBA will decide on monetary policy. At its October gathering, the Bank decided to cut interest rates by 25bps, to a new record low of +0.75%, and reiterated that they will continue to monitor developments, including in the labor market, and ease policy further if needed.

Since then, the employment report for September showed that the unemployment rate ticked down to +5.2% from +5.3%, which is certainly a move in the desired direction, but still distant from the 4.5% mark which the RBA believes it may start generating inflationary pressures. The CPIs for Q3 showed that the headline rate ticked up to +1.7% yoy from +1.6%, while the trimmed mean rate held steady at +1.6% yoy. With both rates below the lower end of the Bank’s inflation target range of 2-3%, and the unemployment rate still well above 4.5%, investors kept some bets with regards to further easing on the table. However, according to the ASX 30-day interbank cash rate futures implied yield curve, they don’t fully price in another 25bps reduction for this year and the next. That said, there is a 90% chance for a quarter-point cut in June. Thus, although no action is expected at this gathering, we will dig into the statement for clues as to whether the Bank remains willing to act again if needed, and if so, whether its signals would suggest that this could come earlier (or later) than most investors are currently expecting.

As for Tuesday’s data, during the European day, the UK services PMI is expected to have increased somewhat, to 49.8 from 49.5, while later in the day, the US ISM non-manufacturing index is forecast to have risen to 53.2 from 52.6.From the US, we also get the final services and composite PMIs for October, but as it is always the case, they are expected to confirm their preliminary estimates.

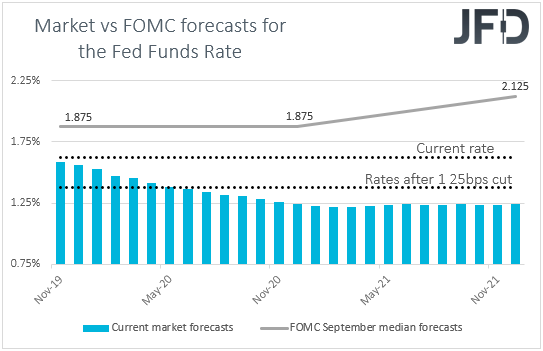

Last week, the FOMC decided to cut rates by another 25bps, but signaled that it is planning to stay sidelined for now, unless things fall out of orbit. That said, investors remained largely unconvinced that the Fed has stopped cutting rates. Even after Friday’s better than expected employment report, they are still pricing in another cut to be delivered in June next year. Perhaps this was due to the ISM manufacturing PMI rising less than expected and staying in contractionary territory. In our view, a small rise in the non-manufacturing print is unlikely to vanish cut expectations, but it could allow market participants to push that timing back.

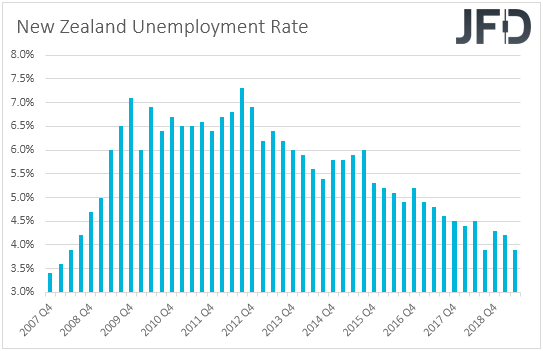

On Wednesday, early Asian trading, New Zealand’s employment report for Q3 is due to be released. The unemployment rate is expected to have edged up to 4.1% from 3.9%, while the employment change is anticipated to have slowed to +0.3% qoq from +0.8%. The Labor Costs index is also expected to have slowed, to +0.6% qoq form +0.8%.

The RBNZ’s latest meeting was held on the September 25th. Back then, officials decided to keep interest rates unchanged at +1.00%, maintained their easing bias, but did not provide hints that a November cut is a done deal, despite elevated expectations by the market. The Committee agreed that new information since August did not warrant a significant change in the policy outlook and added that there is still scope for more fiscal and monetary stimulus “if necessary”. The latest CPI data showed that the yoy rate slowed to +1.5% yoy from +1.7%, but still above the RBNZ’s latest projection for the quarter, which is at +1.3%. Yet, market participants remained more convinced than not that the Bank will cut rates at its upcoming meeting, assigning a 52% chance for such an action. Thus, a weak employment report is likely to drive that percentage higher.

Later in the day, we get Eurozone’s final services and composite PMIs for October, as well as the bloc’s retail sales for September. As usual, the PMIs are forecast to confirm their preliminary numbers, while retail sales are expected to have slowed to +0.1% mom from +0.3%.

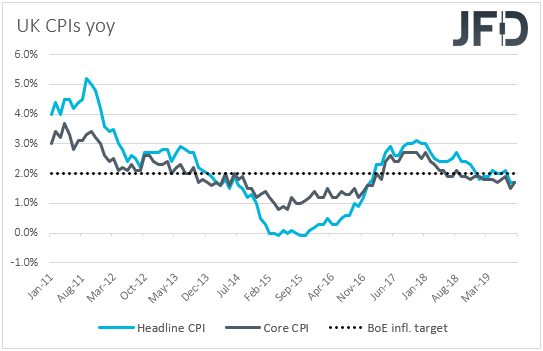

On Thursday, another central bank takes its turn in deciding on monetary policy and this is the BoE. The latest meeting passed largely unnoticed, with the Bank keeping its policy unchanged as was widely anticipated, and maintaining the forward guidance that conditional upon a smooth Brexit, increases in interest rates at a gradual pace and to a limited extent would be appropriate to return inflation sustainably to the 2% target.

Since then, the manufacturing PMIs showed that the economy stayed in contraction territory in both September and October, while both the headline and core CPI rates stood at +1.7% yoy, which is below the Bank’s objective of 2%. What’s more, the employment report for the three months to August showed that the unemployment rate ticked up to 3.9%, with the economy losing 56k jobs. With the Brexit riddle still unresolved, and the uncertainty postponed for perhaps another three months, it would be interesting to see whether the Bank will maintain its hiking bias or choose a more dovish path, even amid higher expectations that the new UK elections could eventually result in a break of the Brexit impasse.

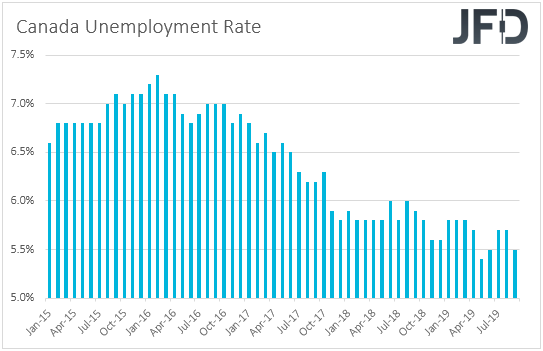

On Friday, Canada’s employment report for October is due to be released. The unemployment rate is forecast to have remained unchanged at 5.5%, while the net change in employment is anticipated to show that jobs growth slowed to 20k from 53.7k in September. At its latest meeting, the BoC kept interest rates unchanged at +1.75%, but the statement accompanying the decision had a more dovish flavor than previously, with BoC Governor Poloz saying that they discussed whether the downside risks were significant enough for an insurance cut, but the decided that they were not. Thus, a disappointing employment report is likely to increase speculation with regards to an easing action by this Bank soon.

Canada’s housing starts for October and building permits for September are also coming out, while from the US, we get the preliminary UoM consumer sentiment index for November, which is expected to have increased to 96.0 from 95.5.

Finally, on Saturday, early Asian time, we have China’s CPI and PPI for October. The CPI rate is expected to have risen to +3.2% yoy from +3.0%, but the PPI one is forecast to have declined to -1.5% yoy from -1.2%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

78% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research