Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

RBA Surprises Markets With a 50bps Rate Hike

The Australian dollar was the main gainer among the majors on Monday and during the Asian session Tuesday, rallying after the RBA surprised the markets with a 50bps hike, at a time when the consensus was for a 25bps increase, and the most optimistic speculation was for a 40bps hike. What’s more, the Bank remained willing to continue lifting interest rates, adding credence to the overly hawkish expectations around its future course of action.

Aussie Gains After RBA Hikes by 50bs and Maintains a Hawkish Stance

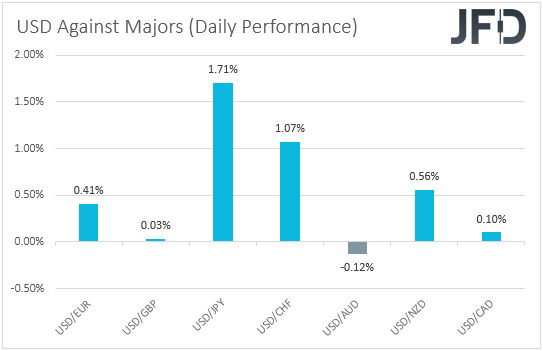

The US dollar traded higher against most of the other major currencies on Monday and during the Asian session Tuesday. It gained the most versus JPY, CHF, and NZD, while it lost ground only versus AUD. The greenback was found virtually unchanged against GBP.

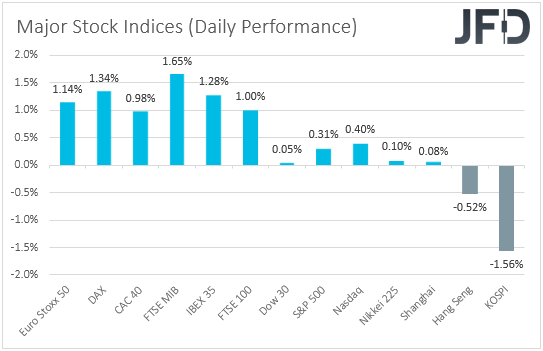

The strengthening for the Aussie and the weakening of the yen suggest that the financial markets may have traded in a risk-on fashion yesterday and today in Asia. However, the weakening of the Kiwi and the strengthening of the dollar point otherwise. Thus, in order to clear things up, we prefer to turn our gaze to the equity world. There, we see that major European indices traded in the green, helped by banks and commodity-linked stocks, with the positive appetite, though softer, rolling into the US session. Some help to that may have been the 2% gains in Amazon after it split its shares 20 for 1, and the 0.5% rise in Apple after the tech giant announced it would more deeply integrate its software into the core driving systems of cars. In Asia today, sentiment softened even more, with Hong Kong’s Hang Seng and South Korea’s KOSPI trading in the red.

For now, it is too early to arrive to safe conclusions with regards to the forthcoming short-term direction in the broader sentiment as we have a very important ECB meeting scheduled for Thursday and the US inflation numbers on Friday. The ECB is not expected to take any action, but with increasing bets that officials should hike more aggressively than previously thought, due to high inflation, it will be interesting to see what signals we will get. As for the US inflation numbers, they could attract special attention, especially following the recent chatter around a pause in interest rate hikes by the Fed after summer.

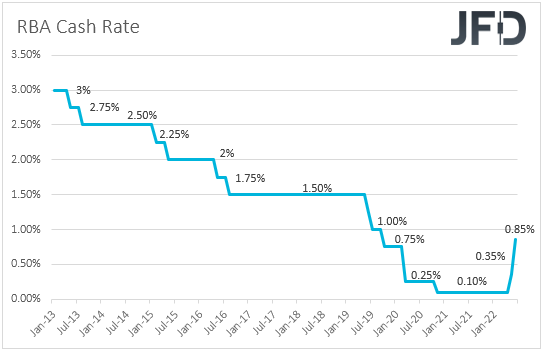

Having said all that, we already had a major central bank deciding on interest rate today, during the Asian morning, and this was the RBA. Against the consensus of a 25bps hike and some expectations over 40bps, this Bank decided to lift interest rates by 50bps, to 0.85%, noting that inflation is expected to increase further and that they will take further steps in normalizing monetary conditions. This was pleasant news for Aussie traders, as it added credence to the overly hawkish expectations around this Bank’s future course of action. Remember that, ahead of the meeting, according to the ASX 30-day interbank cash rate futures yield curve, market participants were pricing in 9 quarter-point hikes by the end of the year.

All this suggests that the Aussie could continue to gain, even against the US dollar, at least until we get the US inflation data on Friday, as the outcome officially places the RBA next to the Fed and the BoC in terms of hawkishness. We expect the US dollar to trade more cautiously until the US inflation data is out. However, we would prefer to exploit further Aussie gains against the Japanese yen. After all, the BoJ is the most dovish major central bank, with Governor Kuroda saying this morning that the Bank’s top priority is to support the economy.

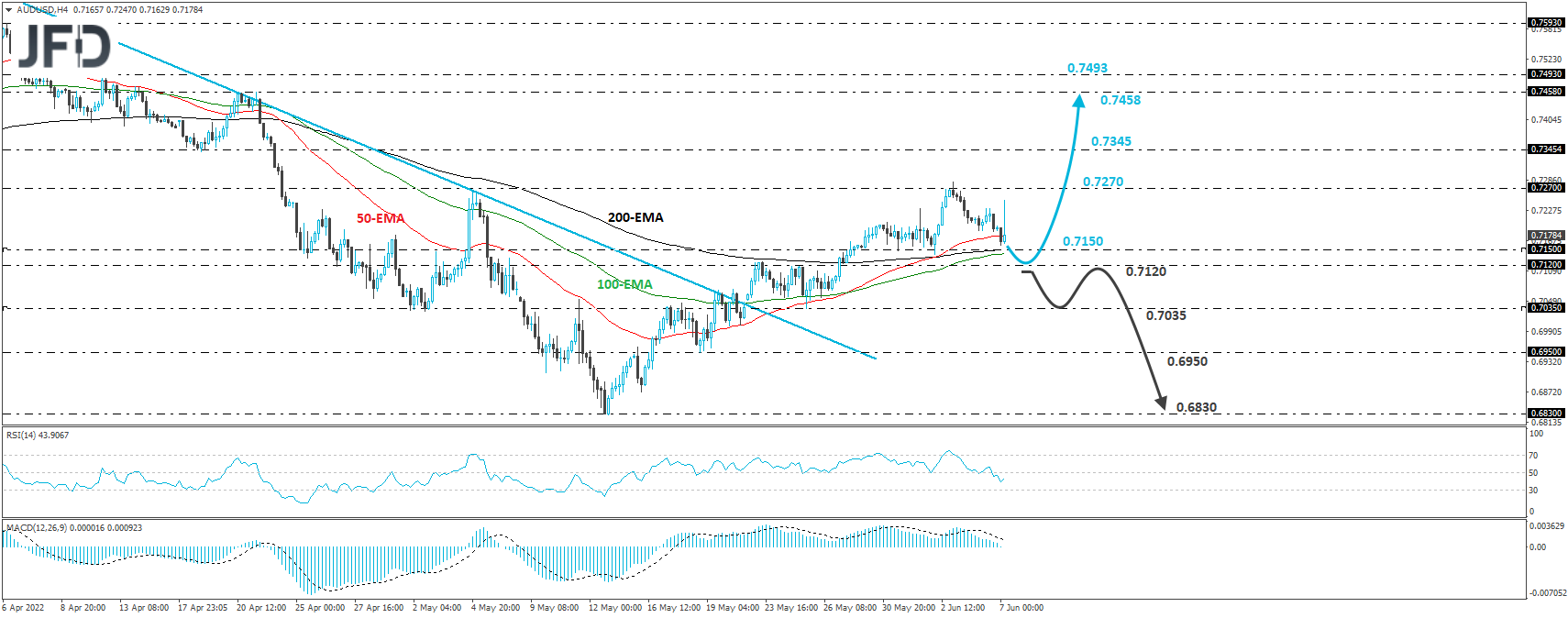

AUD/USD – Technical Outlook

AUD/USD spiked higher after the RBA decision, but it was quick to give back some of those gains. That said, the pair has been printing higher highs and higher lows since May 12th, and as long as it stays above the 0.7120/50 zone, we see decent chances for a rebound.

If the bulls are willing to recharge from near that zone, we would expect them to challenge again the 0.7270 territory, marked by the high of May 4th. That zone also stopped the rate from moving higher on Friday. If that area is broken, a forthcoming higher high would be confirmed and we could see advances towards the inside swing low of April 18th, at 0.7345. Another break, above 0.7345, could carry larger bullish implications, perhaps setting the stage for advances towards the high of April 21st, at around 0.7458, or the high of April 12th, near 0.7493.

We will start examining the case of decent declines upon a break below 0.7120. This will confirm a forthcoming lower low on the 4-hour chart and may initially aim for the low of May 25th, at 0.7035. A break lower could target the low of May 18th, at around 0.6950, and if the bears are not willing to stop there, we may see them pushing towards the 0.6830 area, marked by the low of May 12th.

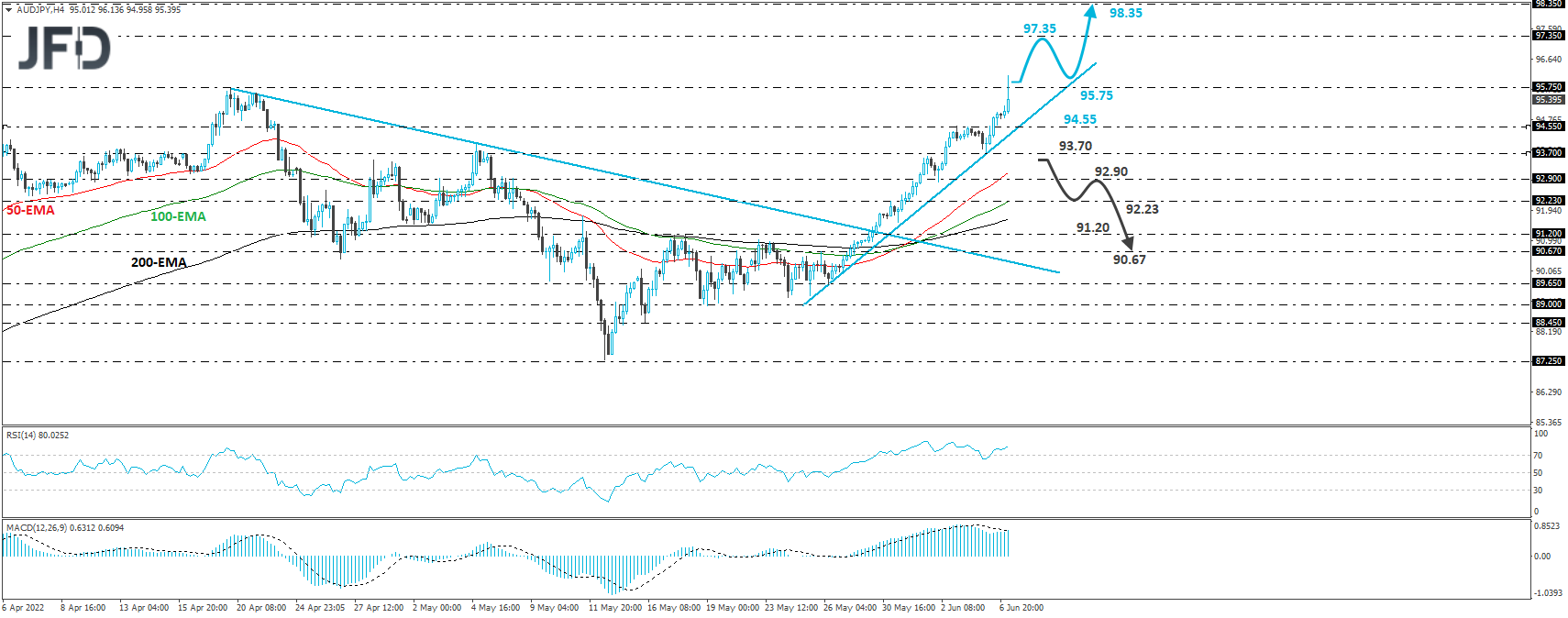

AUD/JPY – Technical Outlook

AUD/JPY continued climbing higher yesterday, and accelerated overnight after the RBA decision. The rate remains above an upside support line drawn from the low of May 26th, and thus, we would see decent chances for more advances.

Today, the rate briefly broke above the high of April 20th, at 95.75, but then, it came back below it. So, another, stronger attempt may be the actual break. This could pave the way towards the high of May 14th, 2015, at around 97.35, the break of which could extend the advance towards the peak of December 29th, 2014, at around 98.35.

We will start examining the bearish case, only if we see a dip below 93.70. This may not confirm only the break below the aforementioned upside line, but also a forthcoming lower low on the 4-hour chart. The next stop may be at 92.90, or even at 92.23, and if the bulls are not willing to enter there either, then we could see the slide extending towards the 91.20 barrier, marked by the inside swing high of May 18th, or the 90.67 territory, marked by the inside swing high of May 26th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.99% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research