Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Apr 05 – Apr 09: RBA Decision, FOMC and ECB Minutes

Central banks return to the spotlight this week with the RBA monetary policy decision getting the ball rolling on Tuesday. We don’t expect any policy action, and we see the case for officials to repeat that they will maintain highly supporting monetary conditions. Then, on Wednesday and Thursday, we get the minutes from the latest FOMC and ECB meetings, respectively. We expect the Fed ones to confirm officials’ dovish stance, while with regards to the ECB, it would be interesting to see whether they are willing to ease more in order to prevent further “unwarranted” increases in Eurozone bond yields.

Monday is Easter Monday in most nations under our radar and thus, the respective markets will stay closed. We only get some US data, with the most important ones being the final Markit services PMI for March and the ISM non-manufacturing index for the same month. The final Markit PMI is expected to be revised up to 60.0 from 59.8, while the ISM index is forecast to have risen to 58.5 from 55.3, underscoring the fast pace of the recovery in the world’s largest economy.

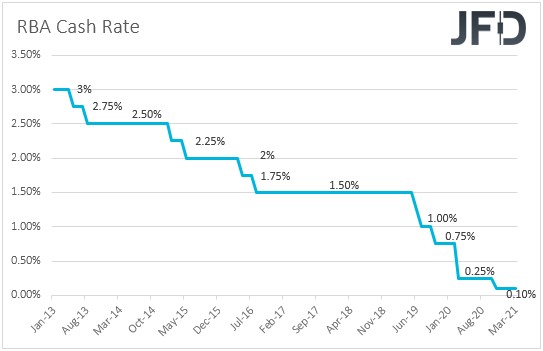

On Tuesday, during the Asian morning, the RBA decides on monetary policy. At their previous meeting, RBA officials kept their monetary policy unchanged and noted that the economic recovery is well under way and has been stronger than earlier expected. However, they also put at ease concerns over high inflation, noting that wage and price pressures are subdued and are expected to remain so for some years.

In our view, this means that the Bank is unlikely to start considering scaling back QE or rising interest rates any time soon. What adds more credence to our view are comments by former RBA board member John Edwards, who, on Friday, noted that the Bank will need to maintain its QE program for an extended period to prevent the Aussie from rising to high levels and thereby damage the economic recovery. The Aussie has surged more than 30% following its covid-related slump, to hit 0.8000 against its US counterpart in February. Thereafter it started to retreat. Remember that in November, the RBA started to buy long-dated bonds in order to narrow the yield deferential with the US, which could keep a lid on the local currency. With AUD/USD now trading at higher levels than in November, we see it very unlikely for policymakers to even start thinking about normalization. We expect them to repeat that they will maintain highly supporting monetary conditions until their goals are achieved, something they don’t expect to happen until 2024 the earliest.

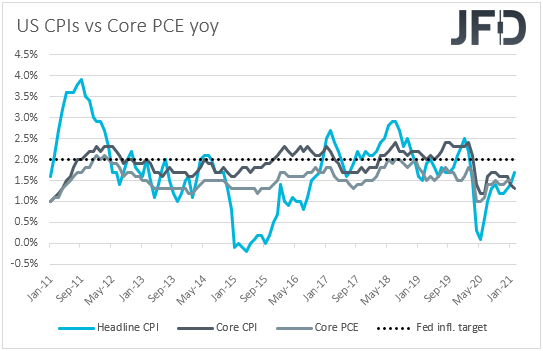

On Wednesday, the main event on the agenda may be the minutes from the latest FOMC gathering. At that meeting, policymakers decided to keep all their policy settings unchanged via a unanimous vote, noting that bond purchases will continue until substantial further progress has been made towards their maximum employment and price stability goals. As far as the new dot plot is concerned, 4 members voted for hikes in 2022, while 7 members saw rates higher in 2023, but the median dots suggested that interest rates are likely to stay at present levels even in 2023. Even though officials upgraded their economic and inflation forecasts – inflation is seen at 2.4% this year –, Fed Chair Powell clearly said that this will be temporary and would not meet their standards. He also stuck to his guns that it is too early to discuss tapering QE.

With all that in mind, we don’t expect the minutes to paint a different picture. We believe that they will confirm that inflation is likely to rise and stay above 2% for some time in the years after 2023, and that it is too early to start discussing policy normalization. In our view, this is likely to ease further fears over high inflation in the months to come, and could also reduce speculation for higher interest rates sooner than previously anticipated. Equities are likely to continue their upside trajectory, while the US dollar and the safe-haven Japanese yen may come under selling interest.

As for Wednesday’s data, during the EU session, we get the final services and composite PMIs for March from the Eurozone and the UK. As it is always the case, they are expected to confirm their preliminary estimates. From Canada, we get the Ivey PMI for March and the trade balance for February. We get trade data from the US as well.

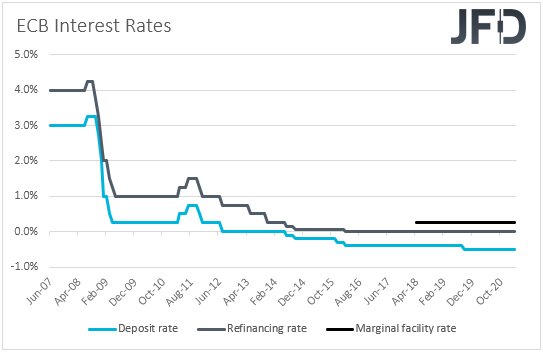

On Thursday, we get more meeting minutes, this time from the ECB. At its latest meeting, this Bank decided to accelerate its Pandemic Emergency Purchase Program in order to stop any unwarranted rise bond yields. Although other major central banks share the view that the latest rise in bond yields around the globe just represents a healthy economic recovery, that’s not the case for the ECB. Rising bond yields in Europe have partly spilled over from US markets reacting to President Biden’s massive fiscal stimulus. Therefore, with Eurozone’s economic recovery still being fragile, we will scan the minutes for hints and clues as to whether ECB officials stand ready to ease their monetary policy further if Eurozone bond yields remain elevated. Last week, President Lagarde noted that investors could test the Bank’s willingness to rein in rising borrowing costs “as much as they want”, and thus, we believe that the minutes will show that policymakers will not hesitate to do more if needed.

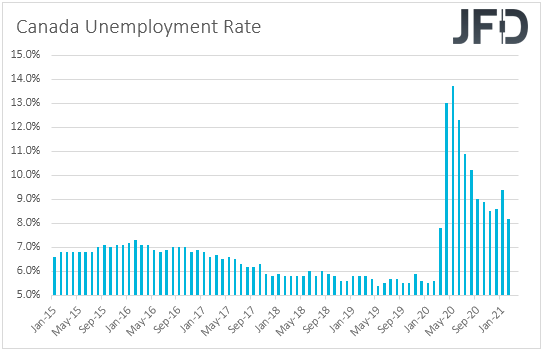

Finally, on Friday, the highlight on the schedule may be Canada’s employment report for March. The unemployment rate is expected to have declined to 8.0% from 8.2%, while the net change in employment is forecast to show that the economy has added 90k jobs, following a 259.2k gain in February. After such a strong jobs growth in February, a slowdown in March appears more than normal to us, and thus, we would consider this a decent report.

When they last met, BoC officials kept monetary policy unchanged and noted that the economic recovery continues to require extraordinary monetary policy support, until economic slack is absorbed so that the 2% inflation goal is sustainably achieved. According to the Bank’s January projections, this is not expected to happen until into 2023. However, they reiterated that as they continue “to gain confidence in the strength of the recovery, the pace of net purchases of Government of Canada bonds will be adjusted as required”, something that may have kept the door for a QE tapering open. With that in mind, a decent employment report may keep that option on the table and thereby support the Canadian dollar.

As for the rest of Friday’s data, during the Asian session, China’s CPI and PPI for March are due to be released. The CPI rate is expected to have rebounded to +0.2% yoy from -0.2% in February, while the PPI rate is anticipated to have risen to +3.5% yoy from +1.7%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.07% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research