Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Jun 01 – June 05: RBA, BoC and ECB Meetings; US and Canada Jobs Data

There are three central bank meetings on this week’s agenda. On Tuesday we have the RBA, on Wednesday the BoC, and on Thursday the ECB. We don’t expect any action from the RBA and the BoC, but we do expect the ECB to expand its QE purchases in its effort to support the Euro-area economy from the damages of the coronavirus pandemic. As for the data, on Friday, we get the employment reports for May from the US and Canada.

On Monday, markets in Germany, Switzerland and Norway will be closed due to the Whit Monday and Pentecost. As for the data, during the European morning, we get the final manufacturing PMIs for May from the Eurozone and the UK and expectations are for a confirmation of the initial estimates. Later in the day, we get the final Markit manufacturing PMI for the month from the US, which is also expected to match its preliminary print, as well as the ISM manufacturing PMI, which is anticipated to have rebounded to 43.0 from 41.5.

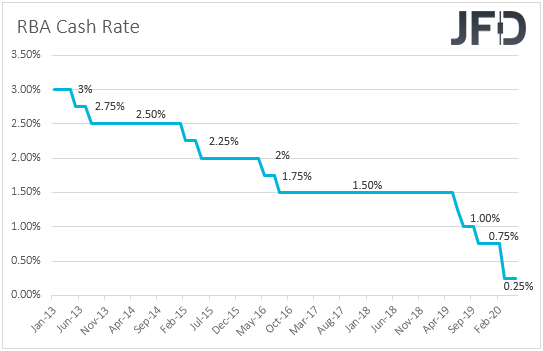

On Tuesday, the RBA decides on monetary policy. At its latest meeting, the Bank kept its cash rate and the target of its 3-year government bond yields at +0.25%, with officials noting that they have scaled back the size and frequency of their bond purchases. However, they added that they are prepared to scale-up these purchases again if deemed necessary.

The only top-tier data set we got since then was the employment report for April. The unemployment rate rose to 6.2% from 5.2%, instead of surging to 8.3% as the forecast suggested. However, looking at the slide of the participation rate, the not-that-big increase in the unemployment rate may be due to many people losing their jobs and refraining from registering for unemployment benefits. Indeed, the employment change revealed that the economy lost 594.3k jobs, which is the biggest plunge on record.

This may have raised speculation that policymakers could stop scaling back their QE, and perhaps start increasing their purchases again. That said, our own view is that officials are aware that data for March and April may come on the soft side. If the spreading of the coronavirus continues to level off and, at the same time, governments around the globe continue easing their restrictions, we think that the prospect of better days may allow RBA officials to continue reducing their bond purchases. What adds more credence to our view is that on Thursday, RBA Governor Philip Lowe said that the economic downturn due to the coronavirus will likely not be as severe as earlier thought and that the current stimulus program is working “as expected”.

With regards to Tuesday’s data, we only get Australia’s current account balance for Q1 during the Asian morning, with the nation’s surplus expected to have increased to AUD 6.3bn from 1.0bn.

On the political front, another round of Brexit talks is set to begin. This would be the final round ahead of the June 18th and 19th EU summit, by which the UK has to decide whether to ask for an extension to the transition period, or not. With PM Johnsons insisting over a December 31st deadline, a failure to find common ground is likely to increase fears over a disorderly exit in the end of the year, which combined with the prospect of negative interest rates by the BoE, may keep the pound pressured.

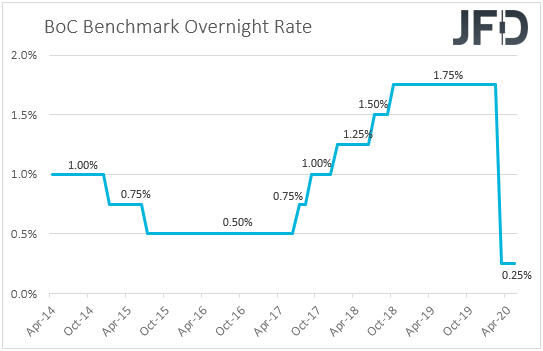

On Wednesday, the central bank torch will be passed to the BoC. When they last met, policymakers of this Bank kept interest rates unchanged at 0.25%, and announced an expansion of their QE purchases. A couple of weeks ago, inflation numbers for April missed estimates, with the headline rate falling to -0.2% yoy, while last week, GDP data showed that the economy contracted 8.2% qoq (annualized rate).

With this Bank saying that interest rates have reached their effective lower bound, no further cuts are expected, but the disappointing data may have increased chances for policymakers to expand even further their QE purchases. The willingness for more stimulus if required was highlighted by Governor Poloz last week, at his testimony before the Senate National Finance Committee, where he noted that “if further monetary stimulus is required to meet our inflation targets, the Bank has tools available to deliver that stimulus.”

However, at this point, we need to note that this will be the first meeting headed by a new Governor, Tiff Macklem, and although recent data and talks may have increased the chances for additional stimulus, officials may not proceed with any action at this meeting, as the new Governor may want to wait for a while more before he starts considering hitting the easing button. He may prefer to wait for upcoming data to reveal whether there has been any improvement following the peak of the coronavirus, or whether there is a risk for the downturn to worsen.

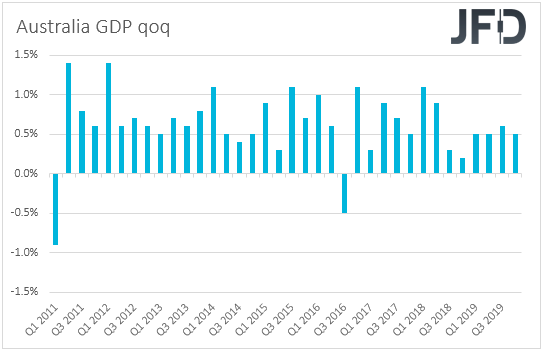

With regards to Wednesday’s economic releases, during the Asian morning, we get Australia’s GDP for Q1. Expectations are for the economy to have contracted 0.3% qoq after expanding 0.5% in Q4, which will drive the yoy rate down to +1.4% from +2.2%. Compared to the contraction rates in other major economies, this maybe among the softer ones and would confirm RBA Governor Lowe’s remarks that the economic downturn in Australia may not have been as severe as initially thought. In other words, such a print is unlikely to tempt RBA policymakers to start thinking about expanding their stimulus program. China’s Caixin services PMI for May is also coming out, but no forecast is currently available. That said, bearing in mind the official non-manufacturing index rose to 53.6 from 53.2, we would see decent chances for the Caixin index to have moved in a similar fashion.

During the European day, we get Switzerland’s GDP for Q1 and the final services and composite PMIs from the UK, the Eurozone and the US. Switzerland’s economy is expected to have contracted 2.0% qoq after expanding 0.3% Q4, while all the Markit PMIs are forecast to confirm their preliminary estimates.

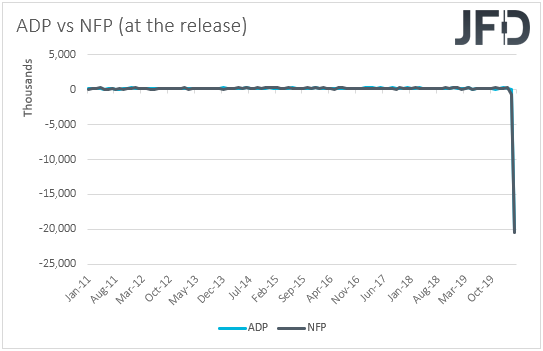

From the US, we also get the ADP employment report for May and the ISM non-manufacturing PMI for the month. After losing 20.24mn jobs in April, the private sector is now expected to lose another 9mn, which could raise speculation that the NFP number, due to be released on Friday, may also come near that figure. Indeed, the forecast for the NFP currently stands at 8.25mn. As for the ISM index, the forecast points to an increase to 44.0 from 41.8.

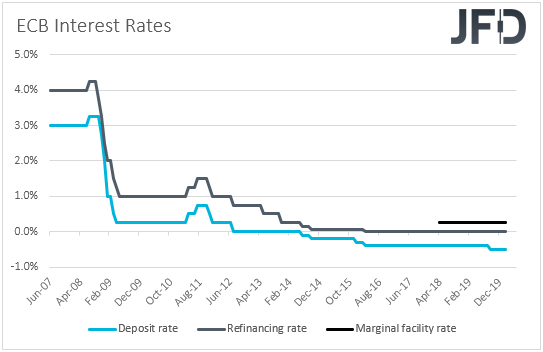

On Thursday, we have another central bank deciding on interest rates and this is the ECB. At the prior meeting, policymakers of this Bank kept interest rates unchanged, but eased the conditions of their TLTROs and introduced a new series of non-targeted pandemic emergency long-term refinancing operations (PELTROs). They also noted that they stay ready to adjust all of their instruments, as appropriate, to ensure that inflation moves towards their aim in a sustained manner.

On May 21st, Eurozone’s preliminary PMIs for May rebounded by more than anticipated but stayed well below the boom-or-bust zone of 50. On top of that, on Friday, preliminary data showed that headline inflation in the Euro area slowed to +0.1% yoy from +0.3%, with the core rate staying unchanged at +0.9% yoy. This may have increased the chances for the ECB to adopt additional easing measures, and/or to expand the existing ones, perhaps as early as at this gathering.

Apart from the ECB gathering, we also have Switzerland’s CPIs for May, the UK construction PMI for the same month, Eurozone’s retail sales for April, as well as the US and Canadian trade data for April. Switzerland’s CPI is forecast to have declined further into the negative territory, to -1.3% yoy from -1.1%, while the UK construction PMI is expected to have rebounded to 30.0 from 8.2. Eurozone’s retail sales are forecast to have tumbled -15.0% mom after sliding 11.2% in March, something that will drive the yoy rate down to -22.9% from -9.2%. The US trade deficit is expected to have narrowed fractionally, to USD 44.30bn from 44.40bn, while the Canadian one is expected to have widened to CAD 2.31bn from 1.41bn.

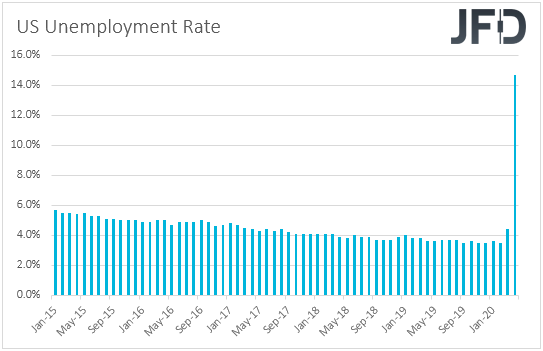

Finally, on Friday, the spotlight is likely to turn to the US employment report for May. Nonfarm Payrolls are expected to have fallen 8.25mn after tumbling 20.5mn in April, while the unemployment rate is forecast to have increased to 19.7% from 14.7%. Average hourly earnings are expected to have slowed to +1.0% mom from 4.7%, which, barring any deviations to the prior monthly prints, is still expected to drive the yoy rate higher, to 8.4% from 7.9%. This may be another worrisome report, but bearing in mind that investors may already be prepared for another bad data set, it may not have a huge negative impact on the market. On the other hand, better than expected numbers may raise hopes that the economic damages during May were not as serious as initially thought and could help equity indices to continue their recovery. Paradoxically, this may prove negative for the dollar, which has been acting as a safe haven recently.

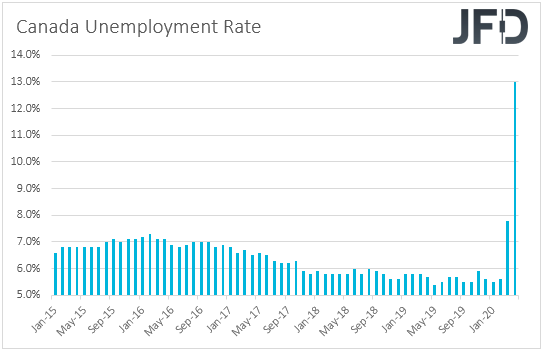

We get jobs data for May from Canada as well. The unemployment rate is forecast to have risen to 15.0% from 13.0%, with the net change in employment expected to show that the economy has lost 0.5mn jobs after losing nearly 2mn in April. Although this would be another set of bad data, taking into account that the BoC will already reconsider its monetary policy on Wednesday, we don’t expect this report to alter expectations around what officials could deliver next, as this may well be telegraphed by Wednesday’s statement.

As for Friday’s other releases, Germany’s factory orders for April and Canada’s Ivey PMI for May are due to come out. Germany’s factory orders are expected to have fallen 20.0% mom after sliding 15.6% in March, while no forecast is available for Canada’s PMI.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research