Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Mar 02 – Mar 06: RBA and BoC Meet Amid Virus Fast Spreading, US Jobs Data Also on the Agenda

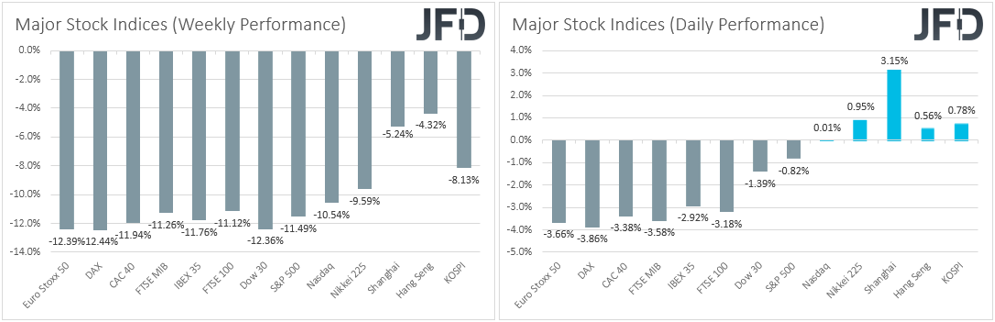

Last week was marked by a global selloff in equity markets, with major stock indices recording their worst week since the 2008 financial crisis. The culprit was no other than the coronavirus, with its fast spreading raising fears of another global recession. As for this week, apart from headlines concerning the virus, investors may pay close attention to the RBA and BoC policy meetings, as well as on the US and Canadian jobs reports for the month of February.

Following last week’s tumble, which wiped out around USD 5 trillion from the market, most major indices rebounded somewhat during the Asian morning today, perhaps on expectations that central banks will respond to safeguard their economies from the damaging impact from the coronavirus. The first signal was given by Fed Chair Jerome Powell on Friday, who said that he and his colleagues will use their tools and act as appropriate to support the economy. Then, early today, BoJ Governor Kuroda said that the BoJ will take necessary steps to stabilize markets jolted by the coronavirus, adding more fuel to speculation over a coordinated global monetary policy action.

As for this week’s data and events, Monday is PMI day. We get the final manufacturing PMIs for February from several Eurozone nations and the Eurozone as a whole. We get the final Markit PMIs from the UK and the US as well. The Eurozone and the US final prints are expected to confirm their preliminary estimates, while in the UK expectations are for a small downside revision, to 51.8 from 51.9.

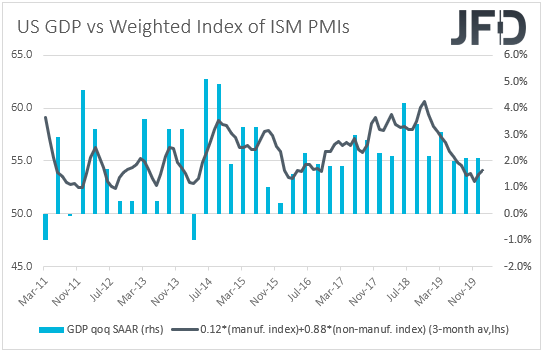

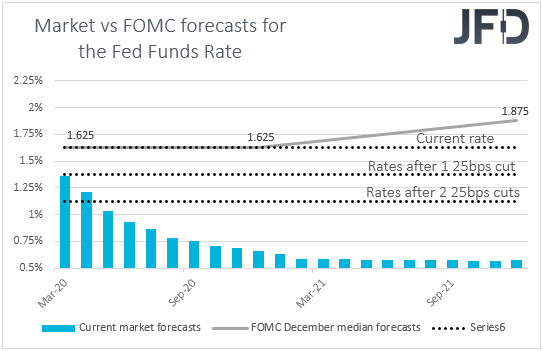

Barring any major deviations from the forecasts, investors may decide to pay more attention to the US ISM print, which is expected to have declined to 50.4 from 50.9. Taking into account that February was marked by the effects of the fast spreading coronavirus, such a slide may not be that bad. However, a negative surprise, below the boom-or-bust zone of 50, may raise concerns over the performance of the US economy during the month and may prompt investors to add to their already elevated bets with regards to further easing by the Fed. We will talk more on that front when we will discuss Friday’s employment report for the month.

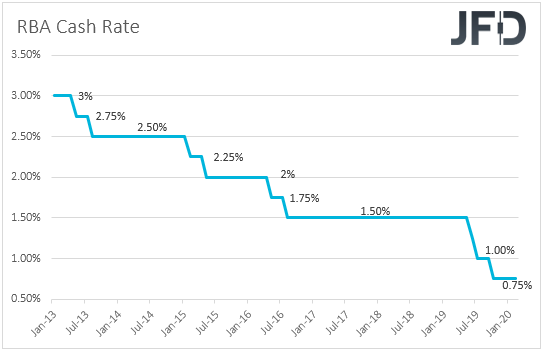

On Tuesday, during the Asian morning, the RBA decides on interest rates. At its latest meeting, the Bank decided to keep interest rates unchanged as was widely expected, and although officials remained prepared to ease further if needed, the overall tone of the statement was less dovish than anticipated. Officials noted that the bushfires and the coronavirus outbreak will weigh on domestic growth temporarily, and repeated that the long and variable lags in the transmission of monetary policy allowed them to hold interest rates unchanged. Having said all that though, the minutes of that meeting had a more dovish flavor, revealing that the board discussed the case of easing further even back then.

Since then, the virus continued spreading at a fast pace, especially outside China, raising fears that it could evolve into pandemic. As far as the domestic economic releases are concerned, last week, the Wage price index yoy rate for Q4 held steady at +2.2% yoy, which combined with an uptick in inflation for the quarter, resulted in a slowdown in real wages. What’s more, the unemployment rate rose to 5.3% from 5.2%, further distancing itself from the 4.5% threshold which the RBA believes it would start generating inflationary pressures.

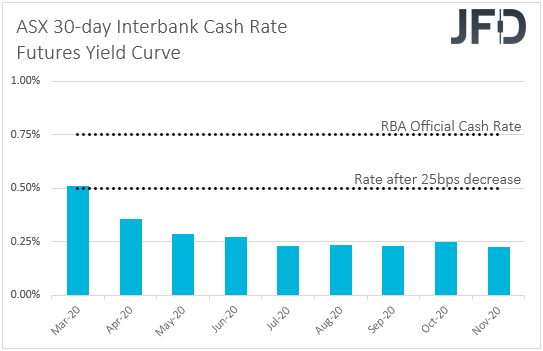

The cocktail of all those developments prompted market participants to bring forth their expectations with regards to a 25bps decrease, and they now believe that such an action will be delivered at this gathering. If the Bank indeed decides to act now in order to treat the wounds of its economy from the effects of the coronavirus, the Aussie may come under selling pressure, especially if the cut is accompanied by a more-dovish-than-previously language.

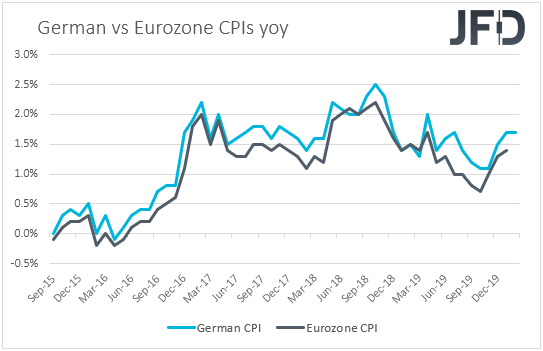

With regards to the data, during the European morning, we get Eurozone’s preliminary inflation data for February. Expectations are for the headline rate to have declined to +1.2% yoy from +1.4%, while the core rate is anticipated to have held steady at +1.1% yoy. That said, with the German headline inflation rate staying unchanged at +1.7%, we see the risks surrounding Eurozone’s headline print as tilted to the upside.

Although both rates would still be below the ECB’s objective of “below but close to 2%”, a move in the desired direction, combined with recent reports that Germany’s finance ministry is seriously considering to boost fiscal spending, due to growing pressure to support the nation’s sluggish economy, may lessen the need for further additional stimulus by the ECB and thereby support the euro further.

Remember that the euro surged last week, also aided by investors unwinding curry trades. In other words, the euro may have been a vehicle in carry trades, due to Eurozone’s negative interest rates. Namely, it may have been borrowed for buying other currencies, like the US dollar, in order to invest in risky assets, like US stocks. With investors now unwinding massively such trades, extra-low yielding currencies are getting benefitted.

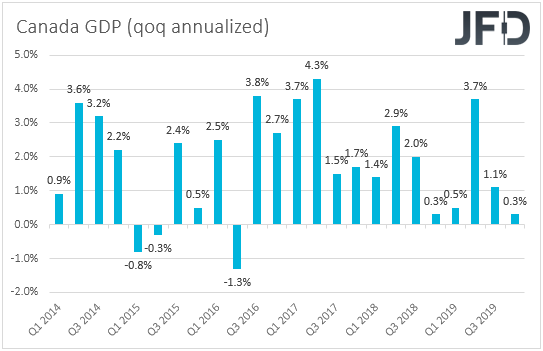

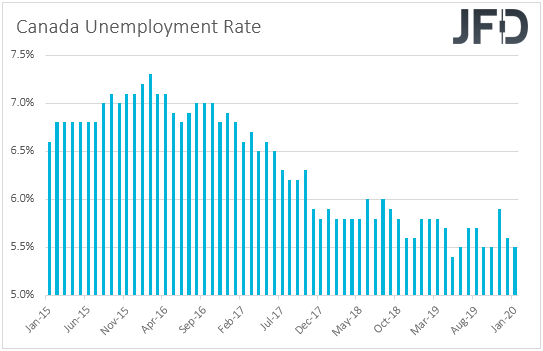

On Wednesday, the central bank torch will be passed to the BoC. At its latest gathering, the Bank kept interest rates unchanged, but the statement had a dovish flavor, suggesting that officials have opened the door to a rate cut. They removed the part saying that it is appropriate to maintain the current level of interest rates and instead noted that “In determining the future path for the Bank's policy interest rate, Governing Council will be watching closely to see if the recent slowdown in growth is more persistent than forecast”.

Since then, most data have been on the bright side, with the unemployment rate ticking down to 5.5% from 5.6%, and inflation accelerating by more than anticipated. That said, Friday’s GDP data showed that the economy slowed to an annualized rate of +0.3% qoq in Q4 from a downwardly revised +1.1% in Q3. Thus, although officials are not expected to push the cut button at this gathering, they may maintain their dovish stance and keep the door to a potential rate cut wide open, especially with the oil prices tumbling due to the coronavirus disruptions hitting global demand. At this point, we need to say that we agree with the market consensus of no cuts at this gathering. Officials might prefer to wait for data showing how the economy has been performing after the outbreak of the virus. In other words, they may wait for releases concerning the month of February in order to better assess the virus’s effects on the Canadian economy. The risk to our view is a preemptive cut at this gathering following last week’s panic and turbulence.

As for Wednesday’s indicators, during the Asian session, Australia releases its GDP data for Q4, with the qoq rate expected to have held steady at +0.4%, something that could drive the yoy rate up to +2.0% yoy from +1.7% in Q3. This would be a somewhat pleasant development for RBA policymakers, but we doubt that it could materially affect expectations with regards to their future course of action, especially if they decide to cut interest rates on Tuesday. Investors may prefer to read into data concerning the first quarter of this year, as they try to assess whether and by how much did the coronavirus has affected the Australian economy, which is closely linked to the Chinese one.

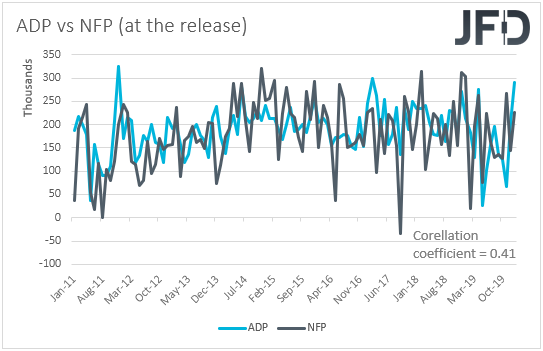

From the US, we get the ADP report for February. The forecast suggests that the private sector has gained 191k jobs, less than January’s 291k. Something like that may raise speculation that the NFPs, due out on Friday, may also come below their January print. Having said that though, we repeat for the umpteenth time that, although the ADP is the only major gauge we have for the NFPs, it is far from a reliable predictor. The correlation between the two time-series at the time of the release (no revisions are taken into account) has fallen in recent years. Taking data from back in January 2011, that correlation stands at 0.41.

As for the other data, the Eurozone, the UK and the US final Markit services and composite PMIs for February are expected to confirm their initial estimates. Again, market participants may pay more attention to the US ISM non-manufacturing PMI, which is expected to have declined to 54.9 from 55.5. Similar to the ISM manufacturing index, such a slide is unlikely to raise concerns with regards to the performance of the US economy, but a negative surprise below 50 could most probably do.

On Thursday, the spotlight is likely to turn to the energy market, as OPEC and major non-OPEC oil producing nations gather in Vienna for a two-day meeting, in order to discuss output. The so-called OPEC+ group has been already curbing output by 1.7mn barrels per day (bpd), a deal that expires in the end of this month. That said, lower demand due to the coronavirus has led a committee to recommend an extra output cut of 600.000 bpd. However, it seems that this number was not enough for market participants, who allowed crude prices to continue tumbling. According to reports, that number is now insufficient for some of the group’s members as well, one of which is Saudi Arabia. Sources said that those members are considering an output cut of 1mn bpd, a deal that should run throughout the second quarter.

As for our view, for oil prices to rebound, producers may need to deliver something above and beyond that. We base our view on the fact that oil prices ignored the aforementioned reports and continued to slide steadily. Thus, anything between 600k and 1mn bps is unlikely to alter that course. Now, in case the number is below 600k (or in the extreme case of no new cuts), oil prices are likely to tumble instantly, accelerating their prevailing downtrend.

Apart from the OPEC+ gathering, the only other worth mentioning release is Australia’s trade balance for January, which is due to be released during the Asian session. Expectations are for the nation’s surplus to have narrowed to AUD 4.800bn from AUD 5.223bn in December.

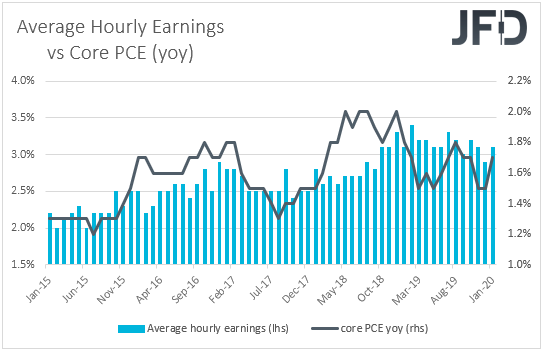

On Friday, the main event is likely to be the US employment report for February. Nonfarm payrolls are expected to have increased 178k, less than January’s 225k, while the unemployment rate is forecast to have ticked back down to its 50-year low of 3.5%. Average hourly earnings are expected to have accelerated to +0.3% mom from +0.2%, something that, barring any deviations to the prior monthly prints, will drive the yoy rate up to 3.2% yoy from 3.1%.

Overall, the forecast point to a decent report, consistent with further tightening in the US labor market. However, we don’t expect this report to eliminate expectations with regards to a rate cut by the Fed in the months to come. At its latest meeting, the Committee noted that it will not tolerate inflation persistently below the 2% target, but Fed Chief Powell, even when testifying before Congress, noted that the current level of interest rates remains appropriate. Under normal circumstances, accelerating wages would have raised speculation of higher inflation in the months to come, and thereby allow Fed officials to stay sidelined for more.

However, fears over the coronavirus’s effects on the US economy have prompted market participants to drastically increase bets with regards to a rate cut as soon as at the upcoming meeting. According to the Fed funds futures, they consider a 25bps cut to be a done deal. Even Fed Chair Powell released a statement on Friday, saying that, although the fundamentals of the US economy remain strong, the coronavirus poses evolving risks and that the Committee will use its tools and act as appropriate to support the economy. This increased cut-bets even further, with participants assigning 95% chance over a 50bps cut when the Fed gathers next. Therefore, this time around a strong employment report may not prove that determinant with regards to the Fed’s future course of action. It could just drive the percentage of a double cut slightly lower.

We get employment data from Canada as well. The unemployment rate is expected to have ticked back up to 5.6% from 5.5%, while the net change in employment is anticipated to show that the economy gained less jobs than it did in January. Specifically, it is expected to show an increase of 10k jobs, less than the prior print of 34.5k. Conditional upon BoC officials maintaining their dovish stance on Wednesday and not cutting rates, a soft employment report is likely to keep the chances of a rate cut in the not-too-distant future elevated.

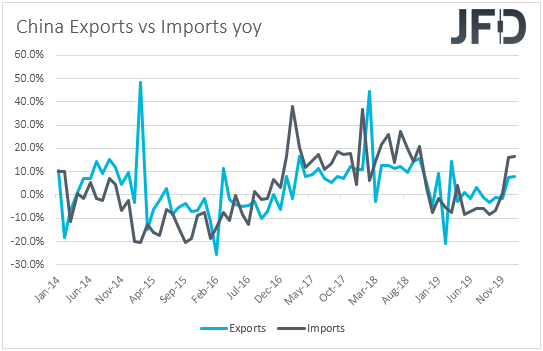

Finally, on Saturday, China’s trade balance for February is coming out. Both exports and imports are expected to have slumped 8.4% yoy and 9.0% yoy respectively, after rising 7.9% and 16.5% in January. This may result in a shrinking surplus of USD 12.75bn from USD 47.21bn. The outbreak of the coronavirus started in China, the authorities of which have adopted restrictive measures in their attempt to contain the virus, something that is expected to have hurt businesses, and thereby exports and imports. Even if we see larger slides, this will not come as a surprise to us. In any case, bigger declines may increase concerns that the virus’s economic effects are larger than previously anticipated and may result in another round of risk aversion next week.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research