Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Higher Inflation Concerns In The West, But BoJ Aims For A Lower One

Yesterday, during the US session, we received the country’s weekly crude oil inventories number, which showed a huge increase from the previous reading. the main event on the economic calendar yesterday was the Bank of Canada interest rate decision and the accompanying overall monetary policy report, followed by a press conference. During the early hours of the Asian morning today, the Bank of Japan delivered its monetary policy report. Another big economic event, which will take centre stage later on in the day, will be the ECB interest rate decision, together with the monetary policy statement.

Crude Oil Price Moves Lower

Yesterday, during the US session, we received the country’s weekly crude oil inventories number, which showed a huge increase from the previous -0.431 mln showing up at +4.267 mln. The rise in inventories forced oil-bulls to step back for a bit and allow the bears to take control, resulting in a decline in price of oil. The higher indicator number shows that there is slightly lower demand for oil products, but oil production remains at the same level overall. The slight lack of demand might partially be caused by already higher prices, which consumers have to pay at the petrol stations. Also, rising inflation, because of global supply disruptions, is making other goods and services more expensive, forcing consumers to re-think their spending. Although we are currently seeing a slight decline in oil prices, this may be a temporary effect, as it could be classed as a temporary correction, before another possible leg of buying.

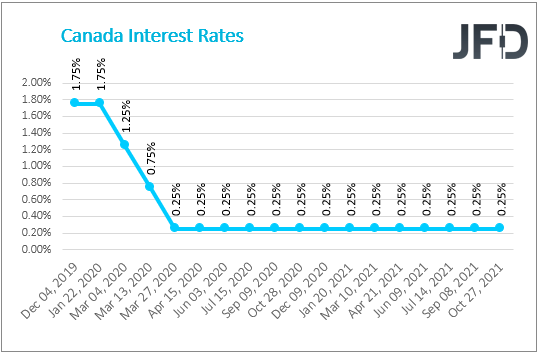

Bank Of Canada

However, the main event on the economic calendar yesterday was the Bank of Canada interest rate decision and the accompanying monetary policy report, followed by a press conference. In the monetary policy report, the BoC stated that they have decided to end their quantitative easing programme and switch to the reinvestment stage, because “the Canadian economy is once again growing robustly”. The Bank kept its overnight rate the same as previous, at +0.25%. Also, the Committee expressed their concerns about rising inflation, which is caused by global supply chain disruptions, and believes that higher prices might remain elevated for a while. This means that the CPI figures may stay slightly above the Bank’s target range, which is between +1% and +3%. However, the Committee is expecting inflation to ease off by late 2022. In regards to the Canadian dollar, it may stay on the stronger side, if oil prices continue their journey north.

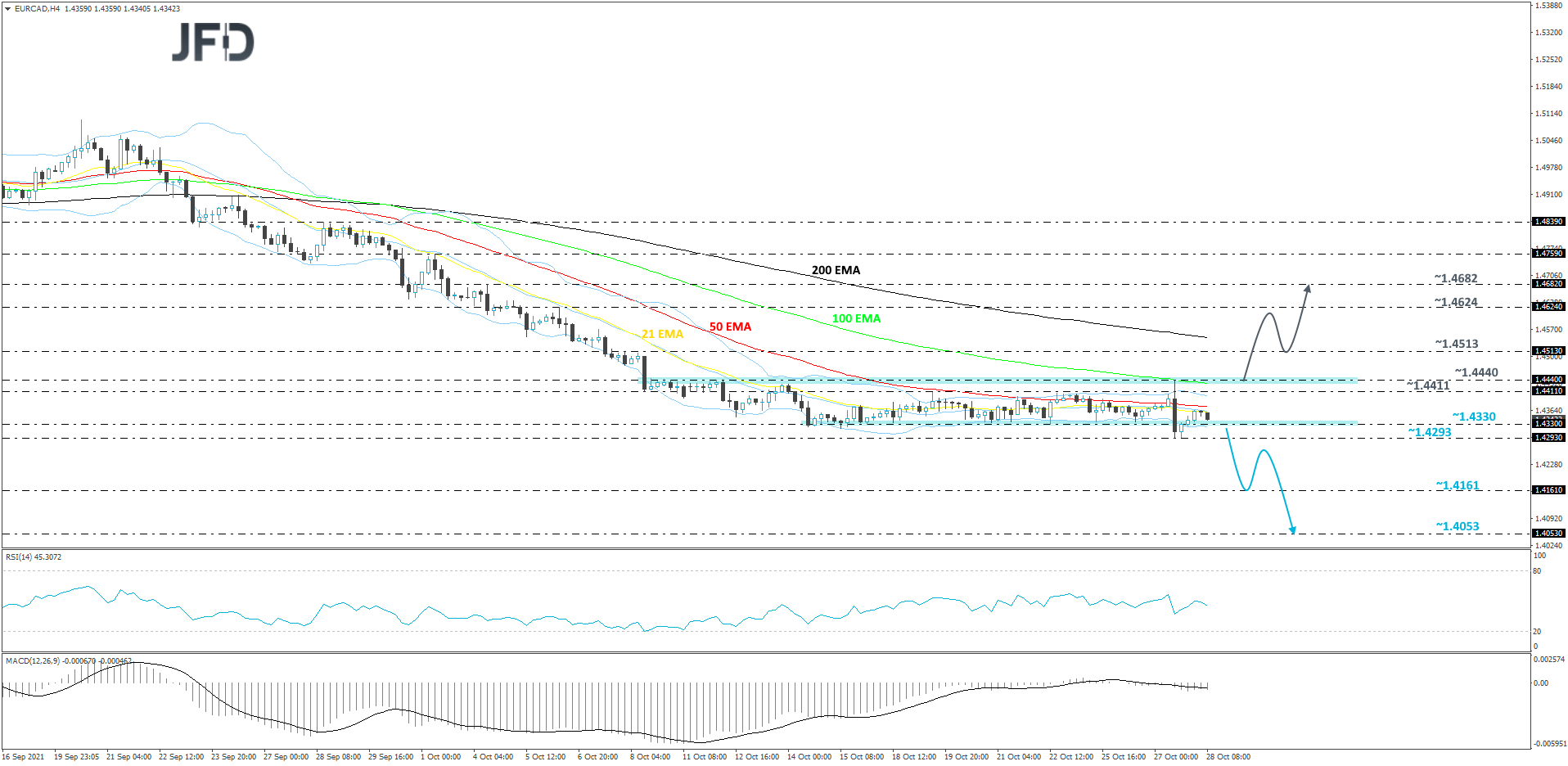

EUR/CAD – Technical Outlook

From around the end of September, EUR/CAD was seen sliding lower, but around mid-October the pair paused its decline and entered consolidation. Now we are seeing the rate stuck in tight range, roughly between the 1.4330 and 1.4440 levels. Although the prevailing trend was to the downside, we would prefer to wait for a violation of the lower bound of that range first, before examining a possible continuation move lower. Until then, we will take a neutral stance.

A break of the lower side of the aforementioned range and a drop below the 1.4293 hurdle, marked by yesterday’s low, may invite a few more sellers into the game, as a forthcoming lower low would be confirmed. That’s when we will aim for the 1.4161 obstacle, a break of which could set the stage for a move to the 1.4053 level, marked by the lowest point of April 2017.

On the upside, a break of the upper side of the previously mentioned range could spark interest in the eyes of a few more bulls. EUR/CAD might then travel to the 1.451 zone, marked by the high of October 8th, where a temporary hold-up may occur. That said, if the buyers remain strong, they could push the rate towards the 1.4624 obstacle, or to the 1.4682 level, marked by the high of October 4th.

BoJ Aims For Lower Inflation

During the early hours of the Asian morning today, the Bank of Japan delivered its monetary policy report, which was also followed by a press conference. The Bank kept the same policy in place for now and said that it is aiming for inflation to remain below 2%, at least for two years more. The BoJ Committee also downgraded their growth outlook for the remaining of this year, blaming lower consumption and production disruptions.

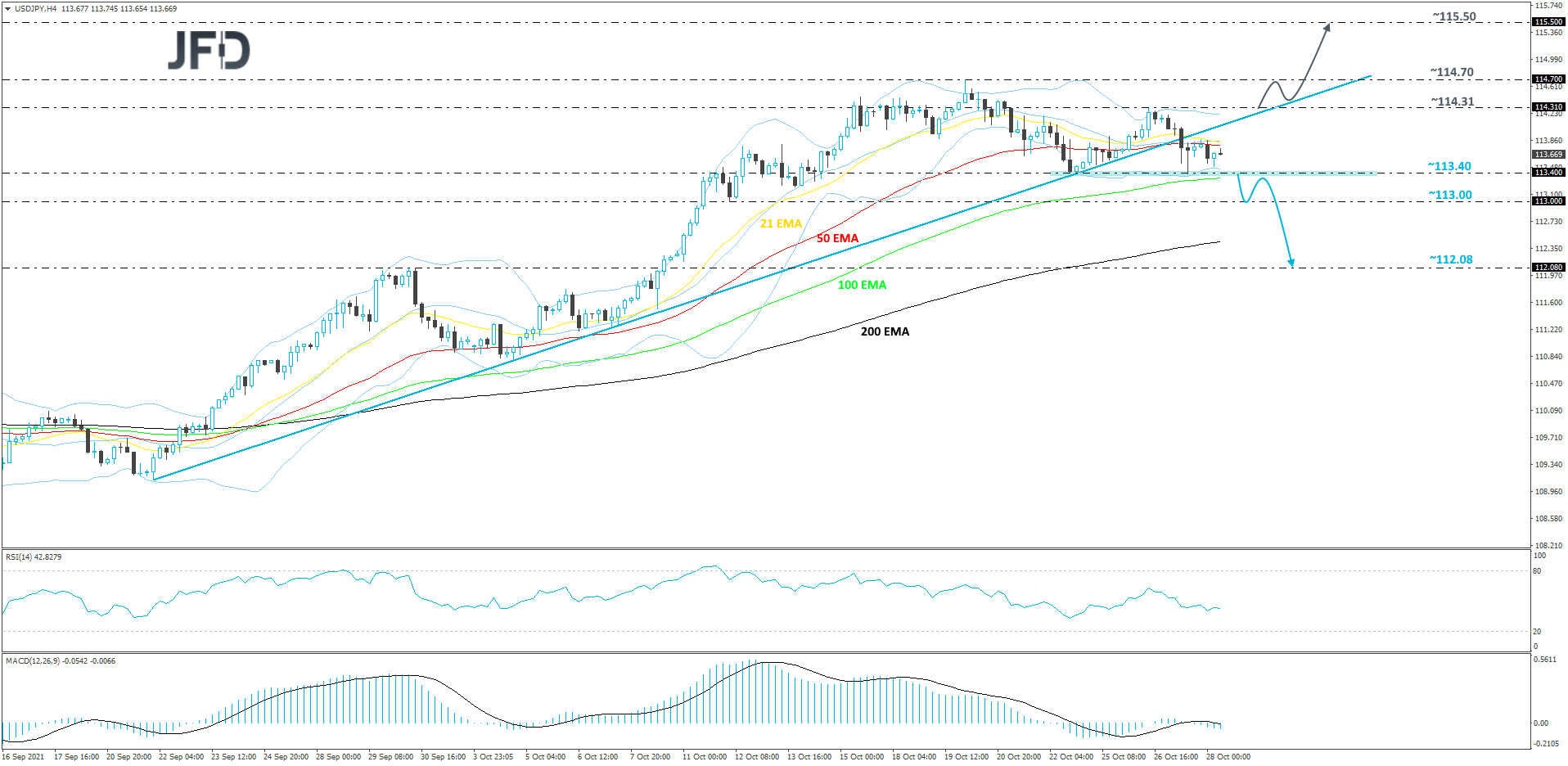

USD/JPY – Technical Outlook

The indecisive USD/JPY trading activity this weak is forcing the pair to move sideways. This led to a passive break of the short-term upside support line taken from the low of September 22nd. Although this might be a bearish indication, we would still prefer to wait for a rate-drop below the 113.40 hurdle, which is near the current lowest point of this week. For now, we will take a cautiously-bearish approach.

If, eventually, the slide happens and the rate falls below the 113.40 zone, that may attract a few more sellers into the game, possibly leading the pair towards the 113.00 area, marked by the low of October 12th. If the slide continues, the next potential support target might be near the 112.08 level, which is the highest point of September.

Alternatively, if USD/JPY makes its way back above the aforementioned upside line and then pops above the 114.31 barrier, marked by the high of October 26th, that could interest a few more buyers, as such a move could increase the pair’s chances of drifting further north. We will then aim for the current highest point of October, at 114.70, a break of which may lead to test of the 115.50 area, which is near the highest point of March 2017.

ECB Decision In Focus

Another big economic event, which will take centre stage later on in the day, will be the ECB interest rate decision, together with the monetary policy statement. 45 minutes later Christine Lagarde will hold the ECB press conference. For now, the interest rate might be kept the same as previous, at 0.0%. No changes in the Bank’s policies are expected, but rising inflation might be a concern for the Committee. The latest inflation reading in the eurozone showed another rise in the number, bringing it to +3.4%. This is above the ECB’s target of 2% over the medium term. The euro may not react much straight after the rate announcement, however we would keep a close eye on it during the Bank’s press conference. A negative tone could push the common currency further down against some of its major counterparts, like the commodity-linked currencies such as AUD, NZD and CAD.

As For The Rest Of Today’s Events

The United States will deliver its preliminary Q3 GDP figures. The current expectation is for a decent decline, going from +6.7% to the forecasted +2.7%. The US initial jobless claims will also be on the lookout, but no surprises are expected there, as the forecast sits at the same level as the previous, at 290k. US pending homes sales are believed to show on a much lower side, going from +8.1% to +0.5%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research