Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Sep 21 – Sep 25: RBNZ, Riksbank, Norges Bank, and SNB Decisions

Although we don’t have much data on the agenda for this week, we do have four central banks deciding on their respective monetary policy. Those Banks are the RBNZ, the Riksbank, the Norges Bank and the SNB. No Bank is expected to proceed with any changes on monetary policy and thus, all the attention may fall on clues and hints with regards to their future plans. With regards to the data, the most important may be the preliminary PMIs for September.

On Monday, there are no major economic indicators or releases on the economic agenda.

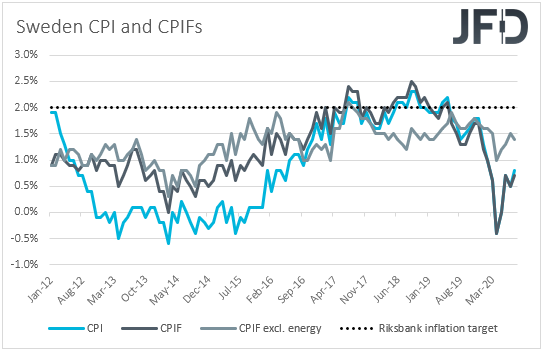

On Tuesday, during the early European session, we have a Riksbank monetary policy decision. At its latest gathering, the Riksbank decided to extend its framework for its asset purchases from SEK 300bn to SEK 500bn, up to the end of June 2021, while it announced that in September, it will start purchasing corporate bonds. The Board also decided to cut interest rates and extend maturities on lending to banks, despite keeping the repo rate unchanged at 0.0%.

Latest inflation data showed that both the CPI and CPIF rates increased, even though by less than anticipated, but the core CPIF metric, which excludes the volatile items of energy, has slowed to +1.4% yoy from +1.5%. In any case, we believe that after acting at the previous gathering, a tick down in the core CPIF rate is unlikely to urge Riksbank policymakers to proceed with any policy changes at this meeting.

Later in the day, the US existing home sales for August are coming out and the forecast points to a slowdown to +2.4% mom from +24.7%.

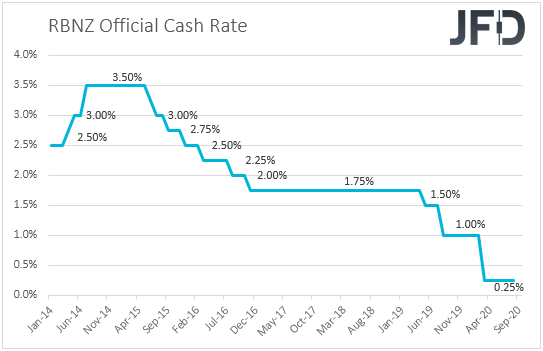

On Wednesday, during the Asian morning, it’s the turn of the RBNZ to decide on monetary policy. At its latest gathering, the Bank decided to keep its Official Cash Rate (OCR) unchanged at 0.25%, but expanded its Large-Scale Asset Purchase (LSAP) program, adding that a package of additional monetary instruments must remain in active preparation, including a negative OCR and purchases of foreign assets.

Since then, the only top tier economic data we received was New Zealand’s GDP for Q2, the qoq rate of which slid to -12.2% from -1.4%. That said, although a 12.2% qoq contraction is a severe one, it is still better than the Bank’s own forecast of -14.3% qoq. Therefore, combined with the fact that the Bank has expanded its stimulus efforts just at the prior gathering, this is likely to keep officials’ fingers off the easing button at this gathering. They may prefer to wait for more data before they reach at safe conclusions as to whether more stimulus is needed or not.

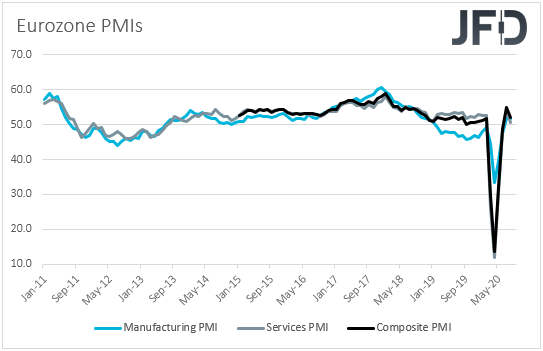

During the EU trading, we have the preliminary manufacturing and services PMIs for September from several Euro-area nations and the bloc as a whole. Eurozone’s manufacturing PMI is forecast to have risen somewhat, to 51.9 from 51.7, while the services index is anticipated to have held steady at 50.5. Strangely, this is expected to drag the composite index slightly lower, to 51.7 from 51.9.

At the prior ECB meeting, policymakers kept monetary policy untouched, reiterating that they stand ready to adjust all their instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner. That said, although President Lagarde said that the risks of the economic outlook remain to the downside, the Bank’s GDP projections were revised slightly higher. Thus, small movements in the Euro area PMIs are unlikely to raise speculations that further easing is on the cards for the upcoming ECB gathering, which means that the euro is unlikely to move much if the actual prints come close to their forecasts.

We get the preliminary PMIs for September from the UK and the US as well. No forecast is available for the UK data, while with regards to the US ones, the manufacturing index is forecast to have ticked up to 53.2 from 53.1, and the services one to have declined to 54.7 from 55.0.

On Thursday, the central bank torch will be passed to the SNB and the Norges Bank. Kicking off with the SNB, its latest meeting, in June, proved to be a non-event, as officials kept interest rates unchanged at -0.75% and repeated that they remain willing to intervene more strongly in the FX market. They also reiterated the notion that the Swiss franc remains highly valued, with President Jordan saying that they made substantial interventions since March, and that there is no specific limit to that. With the franc now trading at higher levels against the euro than back then, we expect Jordan and his colleagues to reiterate once again that the franc is highly valued and to continue signaling willingness to intervene when necessary.

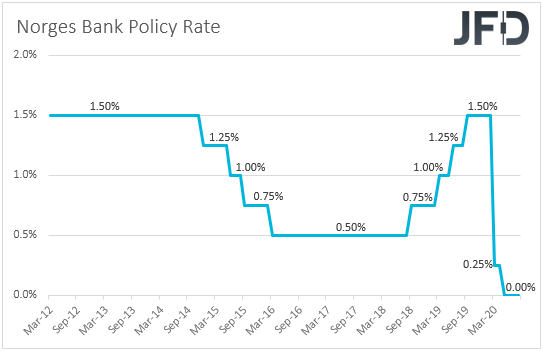

Now, passing the ball to the Norges Bank, at its latest meeting, this Bank decided to keep interest rates unchanged at 0.0%, repeating that the outlook and balance of risks suggest that they will most likely stay at that level for some time ahead. Officials acknowledged that the economy is in the midst of a deep downturn, and added that new information largely confirms the picture of developments presented in the June report. With GDP data showing that mainland Norway contracted 6.3% in Q2, very close to the Bank’s estimate, and the CPIs accelerating in August, Norges Bank officials are likely to continue sitting comfortably on the sidelines.

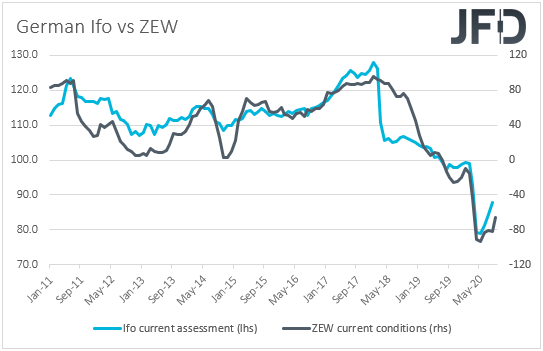

As for Thursday’s data, during the European session, Germany’s Ifo survey for September is due to be released. Both the current assessment and expectations indices are expected to have increased to 89.5 and 98.0 from 87.9 and 97.5 respectively. This would drive the business climate index up to 93.8 from 92.6. An improving Ifo survey is supported by the ZEW survey for the month, both indices of which rose by more than anticipated. The US new home sales for August are also coming out later in the day, with the forecast pointing to a 0.1% mom slide after a 13.9% rise in July.

Finally, on Friday, the only release worth mentioning is US durable goods orders for August. Both headline and core orders are forecast to have slowed to +1.5% mom and +1.3% mom from +11.4% and +2.6% respectively.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research