Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Jan 18 – Jan 22: ECB, BoC and BoJ Decisions; Biden’s Inauguration

This week is likely to be a busy one as there are three central banks on the schedule, as well as several important data releases. The Banks are the ECB, the BoC, and the BoJ, while on the data front, we get Australia’s employment report, the UK, New Zealand’s and Canadian CPIs, as well as the preliminary PMIs from the Eurozone, the UK and the US. With regards to politics, on Wednesday, Joe Biden will officially become the 46th US President.

On Monday, we already got China’s GDP for Q4, as well as the fixed asset investment, industrial production, and retail sales, all for the month of December. On a qoq basis, the GDP slowed to 2.6% from 3.0%, but this drove the yoy rate up to 6.5% from 4.9%. Fixed asset investment and industrial production also accelerated on a yoy basis, while retail sales slowed.

The rest of the day appears relatively quiet, with the only release worth mentioning being Canada’s housing starts for December, which are expected to have slowed to 225k from 246k.

On Tuesday, during the Asian morning, we have New Zealand’s NZIER business confidence index for Q4 and the nation’s electronic card retail sales for December, but no forecast is available for neither release.

During the European session, the final German CPIs for December, the nation’s ZEW survey for January, and Eurozone’s current account balance for November are due to be released. As it is always the case, the final German CPIs are forecast to confirm their preliminary estimates, while, with regards to the ZEW survey, the current conditions index is anticipated to have declined to -68.0 from -66.5, but the economic sentiment one is expected to have risen to 60.0 from 55.0. There is no forecast for Eurozone’s current account balance.

On Wednesday, all eyes will be in the US, as Joe Biden will be inaugurated as the 46th US President. Usually, such events pass unnoticed by the markets, but this time it will be interesting to see whether Trump’s supporters will proceed with more violent protests, as they still refuse to accept that the outcome of the elections was fair and clear. If this is the case, markets may trade on a risk-off fashion, but we stick to our guns that the path of least resistance for risk-linked assets remains to the upside. We repeat that the vaccinations, the US spending package, the monetary-policy support around the globe, and a softer stance on global trade by Biden, are a cocktail of developments that may keep the broader appetite supported in the first months of 2021.

Apart from Biden’s inauguration, we also have a BoC meeting on Wednesday’s agenda. After scaling back its QE purchases in October, the BoC decided to keep its policy unchanged in December, noting that the rebound in the global and Canadian economies has unfolded largely as the Bank anticipated in its October Monetary Policy Report. Officials acknowledged that the positive vaccine news is providing some reassurance but added that the pace and breadth of the global rollout of vaccinations remain uncertain. Overall, the language was on the neutral side.

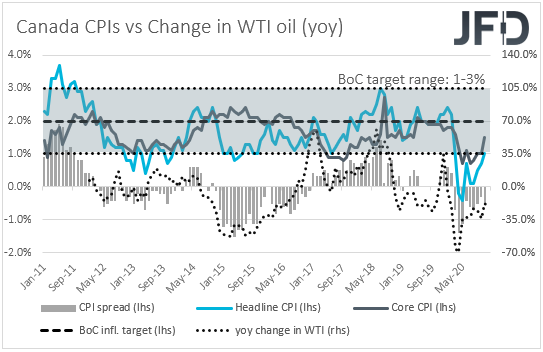

However, with inflation still well below the Bank’s objective of 2%, and the latest employment report revealing that the Canadian economy has lost 62.6k jobs, we see a decent likelihood for the Bank to re-increase its QE purchases at this gathering, something that could hurt the Canadian dollar. That said, we don’t expect this to last for long. We still believe that the overall path of this commodity currency will depend on developments surrounding the broader sentiment. As we already noted, we see risk appetite improving in 2021, at least in the first months, something that could prove supportive for oil prices and thereby for the Canadian dollar. For the Loonie to tumble and stay under selling interest for a while, BoC policymakers may have to surprise the markets with a rate cut. Nonetheless, we believe that the chances for something like that are minimal as officials themselves have said that 0.25% is the lower effective bound.

As for Wednesday’s data releases, we get the UK CPIs, the final Eurozone CPIs, and the Canadian CPIs, all for the month of December.

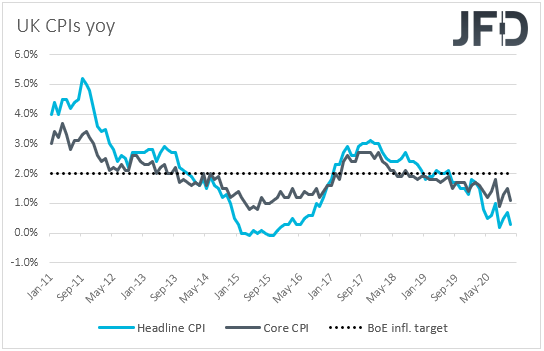

In the UK, both the headline and core rates are expected to have risen to +0.5% yoy and +1.3% yoy from +0.3% and +1.1% respectively. Although this is a move in the desired direction, both rates are still decently below the BoE’s target of 2%, and thus, the prospect of the Bank increasing the pace of its QE purchases at some point soon is not off the table. In any case, this is something the Bank already noted that it stands ready to do. Thus, it will not come as a major surprise if it happens. Overall, with the Brexit saga now taking the back seat, and BoE Governor playing down the prospect of negative interest rates, the pound has the potential to perform relatively well, at least against the safe havens, like the dollar and the yen, which we expect to stay under selling interest due to a supported overall market sentiment. We understand that talks between the EU and the UK are far from over, as there is still the issue of the UK’s access to the EU’s financial world. However, we will start worrying again as soon as headlines on that front start entering the spotlight.

As for Eurozone’s prints, they are expected to confirm their preliminary estimates. In Canada, the headline CPI rate is forecast to have held steady at +1.0%, while no forecast is available for the core one. In any case, we don’t expect Loonie traders to pay much attention to the inflation data as their gaze may be locked on the BoC decision, due later in the day.

On Thursday, the central bank torch will be passed to the BoJ and the ECB. Kicking off with the BoJ, when it last met, it announced no changes to its major monetary policy settings, but extended its funding support program to firms, that was introduced earlier this year in response to the coronavirus pandemic. The only factor we see as tempting Japanese officials to hit the easing button is the weakening of the US dollar against the Japanese yen. However, the recent rebound in USD/JPY may have provided some comfort. With the BoJ’s policy already being extremely loose, we believe that policymakers may wait for things to worsen much more before they decide to ease further.

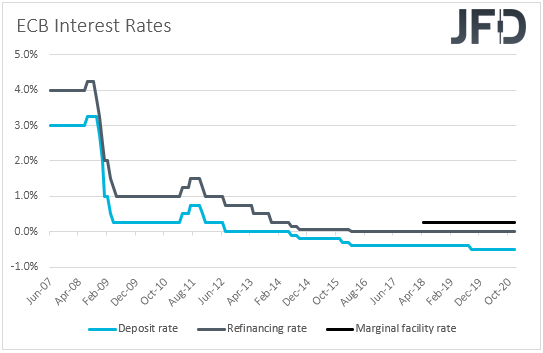

Now, passing the ball to the ECB, at its last meeting for 2020, this Bank decided to expand its Pandemic Emergency Purchase Programme (PEPP) by EUR 500bn and extended the scheme by nine months to March 2022. That said, the euro gained on the decision, as, due to the currency’s prior appreciation, many may have expected the Bank to deliver more. Currently the EUR/USD exchange rate is trading at about the same levels as back then, having even hit much higher levels earlier in January, which is a negative for consumer prices. After all, President Lagarde said at the press conference following the last decision that the appreciation of the euro exercises downward pressure on prices and that they will monitor it very carefully.

Thus, with negative headline and very low core inflation rates, we see decent chances for the ECB to act again at some point soon. However, we don’t expect this to happen at this gathering. Officials have just expanded their stimulative efforts in December, and they may prefer to wait and see the effects of their decision before they decide to act again. If indeed the ECB stands pat, we will dig into the statement for clues as to whether indeed officials are considering more easing, and if so, when it could be served. The euro may slide a bit more if the Bank provides clear signals that it’s planning to expand its bond purchases in the months to come, while the opposite may be true if we don’t get such clues.

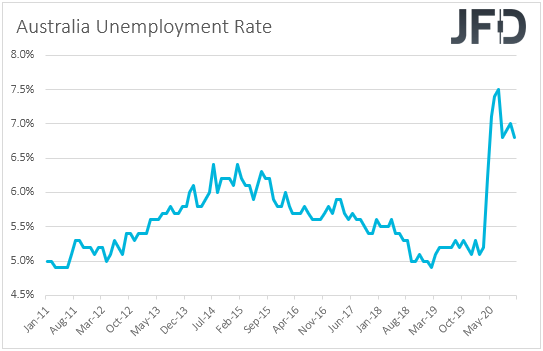

As for Thursday’s economic data, during the Asian session, we get Australia’s employment report for December. The unemployment rate is expected to have ticked down to 6.7% from 6.8%, while the net change in employment is forecast to show that the economy has gained 50k jobs after adding 90k in November. At its December meeting, the RBA stood pat repeating that they are prepared to do more if necessary. That said, with the Bank noting that the Australian economic recovery is underway, and that recent data have generally been better than expected, we don’t believe that a slowdown in jobs’ growth will be the trigger for more easing. A slowdown following the 178.8k and 90k job gains in October and November appears more than normal to us. Japan’s trade balance for December is also coming out and expectations are for the nation’s surplus to have increased to JPY 942.8bn from JPY 366.1bn.

Later in the day, the US building permits and housing starts, both for the month of December, are coming out. Building permits are forecast to have declined somewhat, to 1.604mn from 1.635mn, while housing starts are expected to have increased to 1.560mn from 1.547mn.

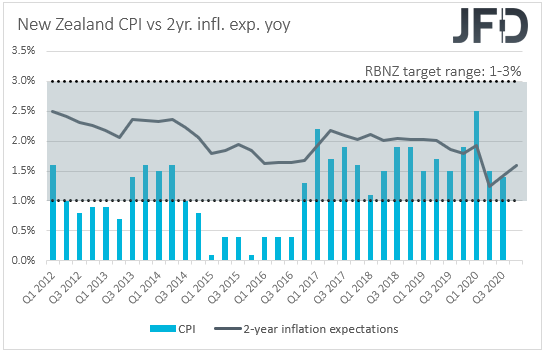

Finally, on Friday, during the Asian trading, New Zealand’s CPI is forecast to have accelerated to +0.9% qoq in Q4 from +0.7%, something that would drive the yoy rate up to 1.7% from 1.4%. Back in November, the RBNZ decided to keep its official cash rate and its Large-Scale Asset Purchase program unchanged, and although it noted that it will launch a funding for lending program in December, Governor Adrian Orr said that domestic activity since August has been more resilient than previously assumed. This combined with accelerating inflation is likely to diminish the chance for this Bank to adopt negative interest rates. Japan’s CPIs for December are also due to be released.

Later in the day, we get the preliminary PMIs for January from several European nations, the Eurozone as a whole, the UK, and the US. Both Eurozone’s manufacturing and services indices are expected to have declined, something that would take the composite index down to 47.9 from 49.1. In the UK, all indices are expected to have held steady, while in the US, both the manufacturing and services prints are forecast to have slid. The UK and Canadian retail sales for December and November respectively are also due to be released. Both the headline and core UK sales are forecast to have rebounded after tumbling in November, while Canada’s sales are forecast to have slowed.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.57% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research