Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: May 03 – May 07: RBA and BoE Meetings, US NFPs in Focus

Following last week’s BoJ and Fed decisions, two more central banks take their turn this week: the RBA and the BoE. No policy action is expected by the RBA, but market chatter suggests that the BoE may scale back the pace of its bond purchases. We also get employment data from the US and Canada, with the US report expected to be strong, but the Canadian one to be on the weak side.

Monday appears to be a quiet day, with the releases worth mentioning being the final manufacturing PMIs for April from the Eurozone and the US, which are expected to confirm their preliminary estimates, as well as the ISM manufacturing PMI for the month, which is forecast to have risen somewhat, to 65.0 from 64.7. This will add to evidence that the world’s largest economy is recovering from the coronavirus-related damages at a fast pace. We will also get to hear from Fed Chair Powell, but bearing in mind, that we’ve already heard from him last week, after the FOMC monetary policy decision, we don’t expect any surprises.

On Tuesday, during the Asian session, the RBA decides on monetary policy. At its April meeting, the Bank decided to keep its interest rate and the target of its 3-year government bond yields unchanged at 0.10%. They also kept the parameters of the Term Funding Facility and the government purchase program untouched. In the accompanying statement, officials repeated that the economic recovery in Australia is well underway and that it is stronger than had been expected. However, they added again that wage and price pressures are subdued and are expected to remain so for some years, which means that they are unlikely to start thinking normalization any time soon.

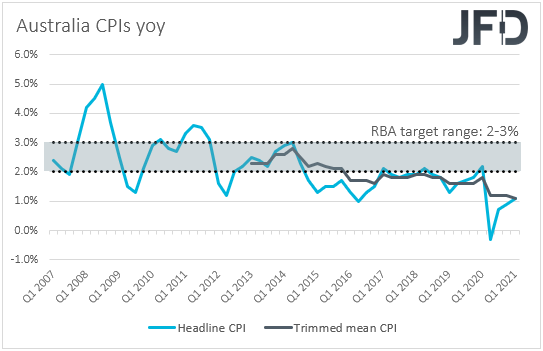

Last week, Australia’s CPIs disappointed, with the headline rate rising to +1.1% yoy from +0.9%, missing the forecast of +1.2%, and the trimmed mean rate ticking down to +1.1% yoy from +1.2%. The forecast for the trimmed mean rate was for an unchanged print of +1.2%. This adds credence to the Bank’s view with regards to subdued price pressures and confirms that officials are likely to keep their monetary policy settings unchanged at this meeting. That said, it would be interesting to see whether they will repeat that the economic recovery in Australia continues to be stronger than previously assumed. If so, the Australian dollar may receive an instant boost, but overall, we expect the faith of the currency to depend on developments surrounding the broader market sentiment.

Later in the day, we have the final UK manufacturing PMI for April, which is expected to confirm its initial estimate, as well as the US and Canadian trade balances for March. The US deficit is forecast to have widened somewhat, while Canada’s surplus is anticipated to have decreased.

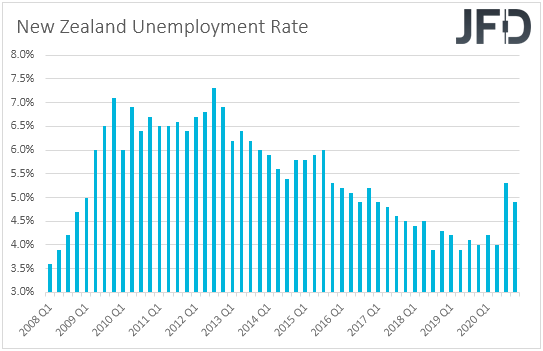

On Wednesday, Asian time, New Zealand’s employment report for Q1 is due to be released. The unemployment rate is forecast to have held steady at 4.9%, while the net change in employment is expected to have slowed to +0.2% qoq from +0.6%. The labor costs index is anticipated to have stayed unchanged at +1.5% yoy.

At its prior gathering, the RBNZ kept its policy untouched, staying prepared to lower the OCR further if required and adding that a prolonged period of time is most likely to pass before their objectives are met. Although the CPIs for Q1 surprised to the upside, the yoy rate remained below the midpoint of the Bank’s target range of 1-3%, and thus, in our view, a slowdown in jobs growth will allow officials to remain ready to cut interest rates if deemed necessary.

During the European session, the final services and composite PMIs for April from the Eurozone and the US are due to be released, but as it is always the case, they are expected to confirm their preliminary estimates. The ISM non-manufacturing index and the ADP employment report for the month are coming out as well. The ISM index is expected to have risen to 64.3 from 63.7, while the ADP report is forecast to show that the private sector has gained 815k jobs after adding 517k in March.

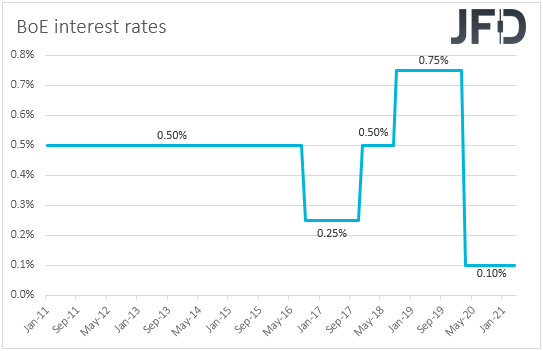

On Thursday, the main event is likely to be the BoE interest rate decision. Back in March, British policymakers kept their policy unchanged and noted that the recent plans for easing of covid-related restrictions may be consistent with a slightly stronger outlook for consumption growth. However, they repeated that the outlook for the economy remains unusually uncertain and that if the inflation outlook weakens, they stand ready to take the necessary action.

Since then, the UK economy has been recovering from the coronavirus recession faster than expected as the vaccine rollout continues, and market chatter suggests that officials are likely to scale back the pace of their bond purchases at this gathering. If so, the pound could gain on such a decision, but pound traders are likely to quickly turn their attention to the new economic projections, where upside revisions are likely to encourage them to add to their long positions.

As for Thursday’s data, China’s Caixin services PMI for April and Eurozone’s retail sales for March are due out. No forecast is available for the Caixin index, while Eurozone’s retail sales are expected to have slowed to +1.4% mom from +3.0%.

Finally, on Friday, investors may lock their gaze on the US employment report for April. Nonfarm payrolls are expected to have accelerated to 978k from 916k in March, while the unemployment rate is anticipated to have declined to 5.7% from 6.0%. In our view, this is likely to add more credence to the view that the US economy is recovering from the coronavirus-related damages at a fast pace, and although last week the Fed maintained its dovish stance, it may tempt some participants to start thinking as to whether the Fed should consider normalizing its policy earlier. This could take the US dollar slightly higher and equities lower, but we don’t expect it to prove a game changer. We would consider such a counter reaction as a corrective move. We stick to our guns that with the Fed prepared to keep its policy extra loose for long and President Biden willing to pass more supportive bills, the broader market sentiment is very likely to stay supported.

We get jobs data for April from Canada as well. The unemployment rate is expected to have risen to 7.8% from 7.5%, while the net change in employment is forecast to show that the economy has lost 187.5k jobs after gaining 303.1k in March. A soft employment report could raise questions over whether the BoC acted correct and scaled back its bond purchases at the prior gathering, and may force the Loonie to correct lower.

As for the rest of Friday’s releases, China’s and Germany’s trade balances are coming out. No forecast is available for the Chinese figure, while the German surplus is forecast to have held largely unchanged.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.07% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research