Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

PayPal Stock Could Be Setting A New Short-term Trend

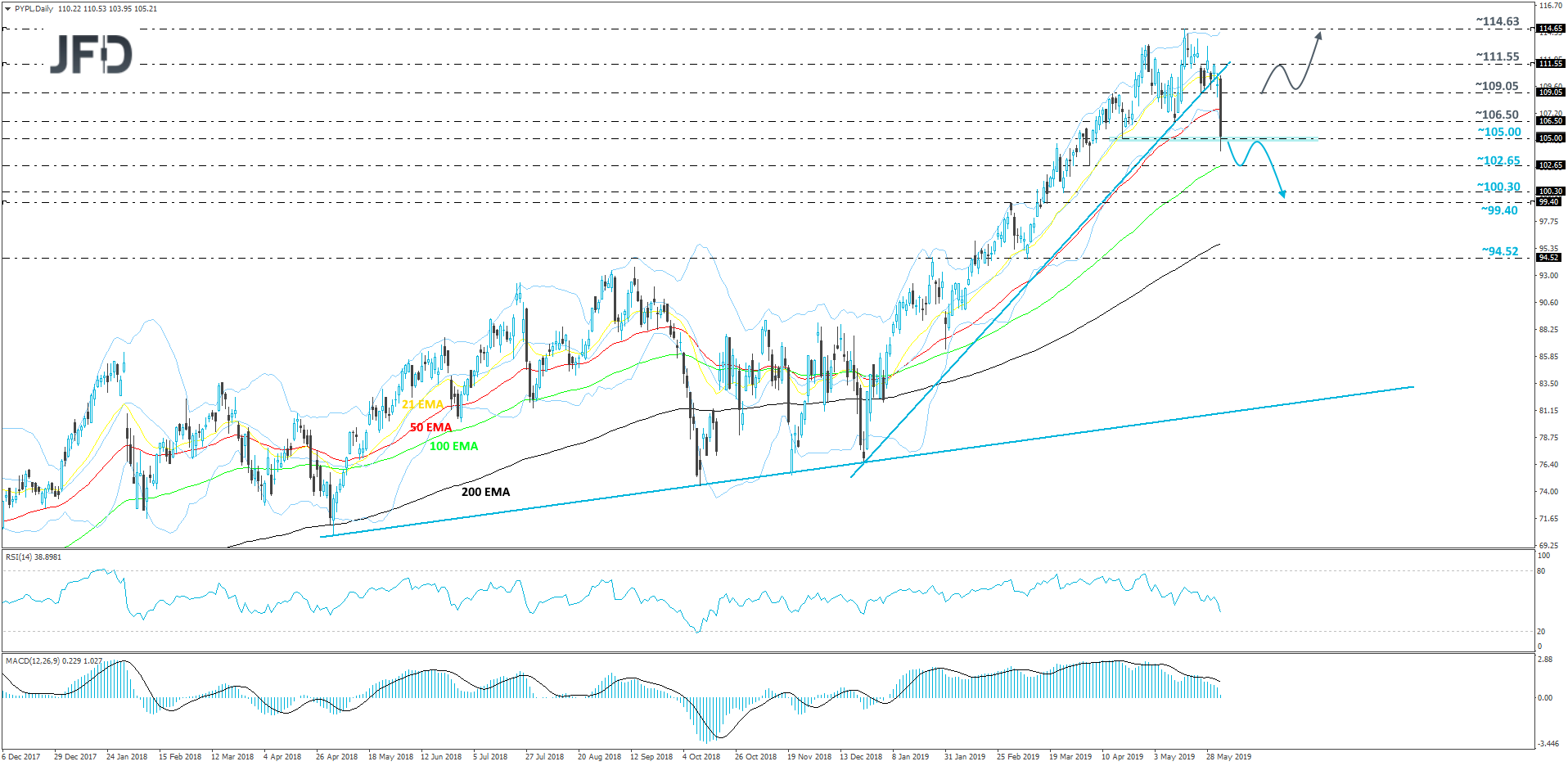

From the beginning of 2017, the PayPal stock (NASDAQ: PYPL) had been on a steep uprise, setting a new all-time high on May 16th and hitting the 114.63 level. But after touching that area, the price started depreciating slowly and ended up testing the medium-term steep upside line drawn from the low of December 24th. However, on Friday last week we saw a break and a close below that line, followed by a sharp sell-off on Monday. The stock, initially broke below the 105.00 level, but wasn’t able to close the day below it, this way making that area an important one to watch. From the short-term perspective, we could see the price sliding further, but from the longer-term perspective, the stock is still on an uptrend. This is why the possible move lower could be interpreted as a more extended correction to the downside.

If PYPL makes another dive below the 105.00 hurdle and this time manages to close the day below it, this could make investors worry, as the stock could clear the path for itself towards lower areas. This is when we will target the 102.65 obstacle, a break of which may lead the share price to the support zone between the 100.30 and 99.40 levels. Those levels mark the low of March 25th and the high of March 1st respectively.

Our oscillators, the RSI and the MACD, are very much in support of the above-discussed scenario. The RSI is below 50 and points to the downside. The MACD, although is still fractionally above zero, continues to drift lower by running below its trigger line.

Alternatively, if PYPL reverses back up and climbs above the 109.05 barrier again, marked by the low of May 23rd, this could attract more buyers into the field. Such a move may open the door for a potential move to the 111.55 hurdle, a break of which might lift the share price to test the all-time high again, at 114.63.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research