Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Risk Appetite Stays Relatively Supported as We End 2020

Major EU indices finished their session slightly lower yesterday, but risk appetite improved somewhat during the US session, and was boosted even further today in Asia. We believe that the broader market sentiment is likely to stay supported as we enter 2021, and we base our view on the coronavirus vaccinations, the US fiscal stimulus, the Brexit accord, and a Biden Presidency in the US.

USD Slides, US and Asian Equities Gain; Will this Roll Into 2021?

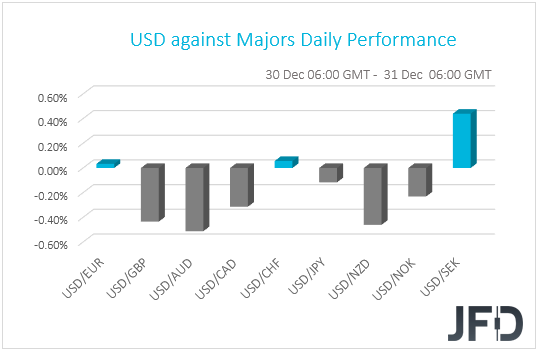

The US dollar continued trading south against the majority of the other G10 currencies on Wednesday and during the Asian session Thursday. It gained only versus SEK, while it was found virtually unchanged against EUR and CHF. The greenback underperformed the most versus AUD, NZD, and GBP.

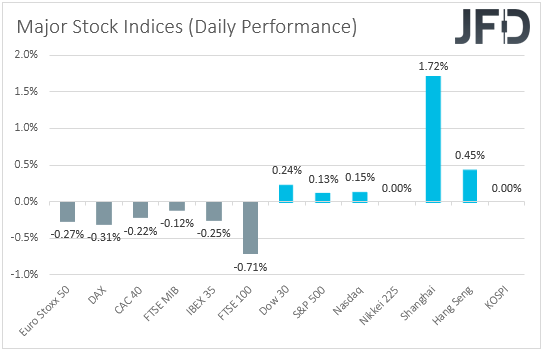

The weakening of the US dollar, combined with the strengthening of the risk-linked Aussie and Kiwi, suggests that financial markets continued trading in a risk-on fashion. However, turning our gaze to the equity world, we see that major EU indices finished their session slightly in the red. The only index that lost more than 0.35% was UK’s FTSE 100 (-0.71%), perhaps due to a strengthening pound after Britain approved the emergency use of the coronavirus vaccine developed by AstraZeneca and Oxford University, which will be rolled out on Monday. Remember that many companies of the FTSE generate profits in other currencies, so in a strengthening GBP environment, if those profits are converted into pounds, they worth less. In the US, Wall Street’s three main indices closed slightly positive, while during the Asian session today, the improved investor morale was more profound. Both China’s Shanghai Composite and Hong Kong’s Hang Seng gained 1.72% and 0.45% respectively. Japan’s Nikkei 225 and South Korea’s KOSPI remained closed.

The relatively muted trading activity during yesterday’s EU and US sessions confirms our view that markets are poised to end the year on a quiet note. However, the stronger performance during the Asian session gives flesh to the risk we have been mentioning, namely that, sometimes, thin liquidity results in some volatility. That said, remember that we also said that in such a case, we would see the risks as tilted to the upside, in line with our broader view. Speaking about our view, we stick to our guns that the vaccinations, the fiscal stimulus in the US, the Brexit accord, and a Biden presidency, may continue to provide support for risk-linked assets, while safe havens may stay under selling interest as we enter 2021. As for today though, most markets under our radar will be closed as it is New Year’s Eve, while others, like in the UK, will close early. Tomorrow is New Year’s Day and thus, all the markets we pay attention to will be closed. Therefore, we will get a clearer picture with regards to the broader market sentiment next week.

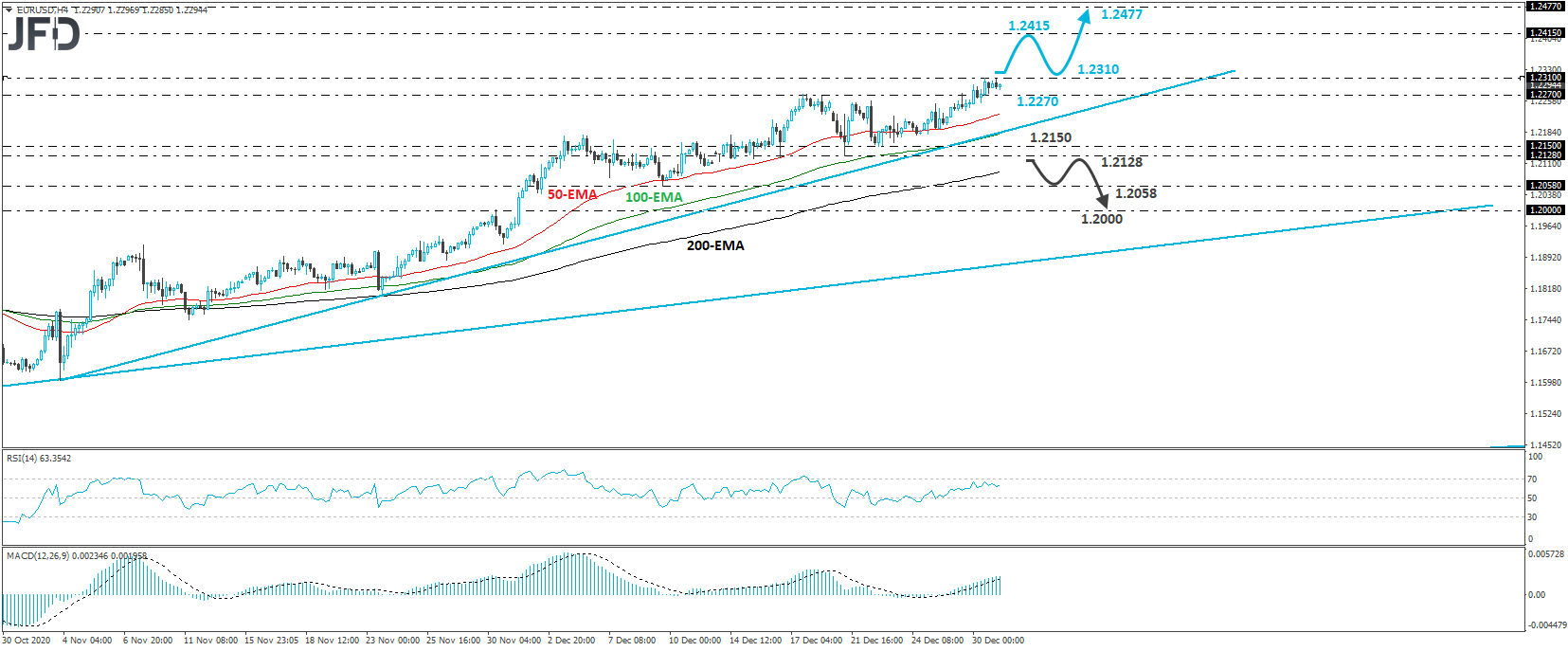

Back to the currencies, besides the improved markets appetite, another factor that may be behind the US dollar’s slide is the rapidly widening “twin deficit” in the US. The explosion in the budget and trade deficits means that more dollars are being printed and moved abroad. With President-elect Joe Biden pledged to provide more fiscal stimulus, meaning that the nation’s debt will increase, the dollar is likely to stay under selling interest in the first months of the new year. On the contrary, the EU runs a huge current account surplus, largely thanks to Germany, so there is a natural inflow of euros through trade. With both the Fed and the ECB stepping on the extra-loose pedal in terms of monetary policy, this makes us believe that the path of least resistance for EUR/USD is to the upside.

DJIA – Technical Outlook

The Dow Jones Industrial Average cash index traded slightly higher yesterday, but stayed below its record peak of 30597.50, hit on Tuesday. Today, during the Asian morning, the index retreated somewhat. Overall, the broader trend on the daily chart remains to the upside and thus, we would consider the near-term picture to be positive.

A clear and decisive break above the all-time high of 30597.50 would confirm a forthcoming higher high and would take the index into uncharted territory. With no prior highs and inside swing lows to mark new resistance barriers, the next level that may play that role ay be the round figure of 31000. However, before the next leg north, we see decent chances for a corrective setback, and this is due to the slowing upside speed detected by our short-term oscillators. A dip below 30275 may confirm the case and perhaps allow declines towards the low of December 23rd, from where the bulls may retake charge.

Now, in order to abandon the bullish case and start examining deeper declines in the short run, we would like to see a clear break below the 29420 territory, defined as a support by the low of December 21st. Such a move may initially open the path towards the low of November 22nd, at 29170, the break of which may extend the fall towards the 28855 zone, marked by the low of November 10th. Another dip, below 28855, could set the stage for the 28500 area, which is marked by the inside swing high of November 5th.

EUR/USD – Technical Outlook

EUR/USD edged north yesterday, breaking above the peaks of December 17th and 18th, at 1.2270, thereby confirming a forthcoming higher high. That said, the pair hit resistance at 1.2310, and today, it pulled back somewhat. Overall, EUR/USD continues to print higher highs and higher lows above the tentative upside support line taken from the low of November 4th, and thus, we would consider the near-term outlook to be positive.

If the bulls are willing to stay in the driver’s seat, we could soon see a break above 1.2310, something that may open the path towards the 1.2415 zone, which is marked as a resistance by the inside swing low of April 13th, 2018. If that zone is not able to halt the advance, the next area to consider as a potential resistance may be the 1.2477 one, marked by the high of April 17th, 2018.

On the downside, we would start examining whether the bears have stolen the bulls’ swords, at least in the short run, if we see a dip below the low December 21st, at 1.2128. This would not only take the rate below the aforementioned upside line, but it would also confirm a forthcoming lower low on the daily chart. The bears may then get encouraged to push the battle towards the 1.2058 level, marked by the low of December 9th, the break of which may extend the decline toward the psychological round figure of 1.2000, near the inside swing high of November 30th.

As for Today’s Events

The only item on the economic calendar worth mentioning is the US initial jobless claims for last week, which are expected to have increased to 833k from 803k the week before.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.57% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research