Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

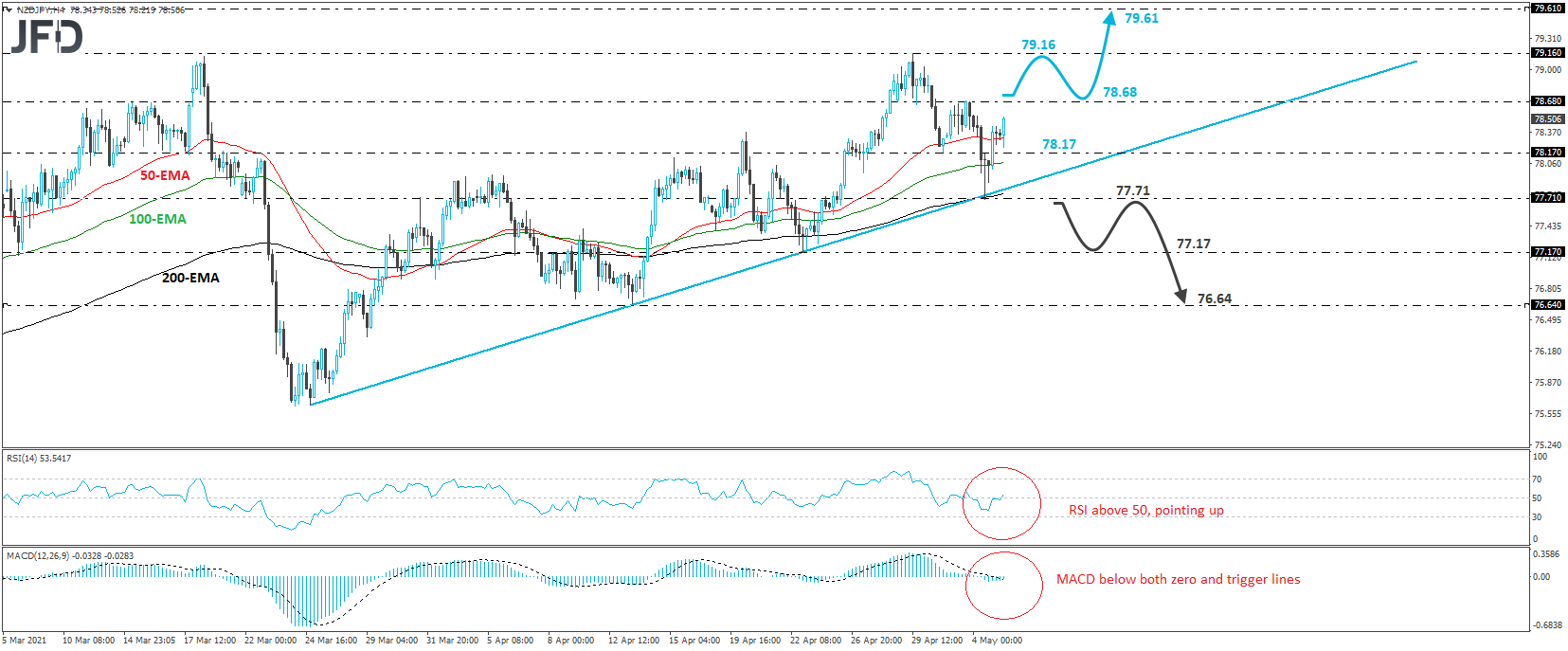

NZD/JPY Rebounds from an Upside Support Line

NZD/JPY has been in a recovery mode since yesterday, when it hit support at the crossroads of the 77.71 level and the upside support line drawn from the low of March 24th. As long as the pair continues to trade above that upside line, we would consider the short-term outlook to be positive.

At the time of writing, the rate is approaching the 76.68 resistance, marked by Monday’s high, the break of which could allow the bulls to target the key hurdle of 79.16, which rejected further advances on February 25th, March 18th, and last Thursday. If they manage to overcome it this time around, the rate would be placed into territories last tested back in April 2018, with the next possible resistance being the 79.61 barrier, marked by the peak of the 13th of that month.

Shifting attention to our short-term oscillators, we see that the RSI has just crossed above 50, while the MACD, although still slightly below both its zero and trigger lines, shows signs of bottoming as well. Both indicators suggest that the pair may start regaining upside speed soon, which supports the idea of a trend continuation.

On the downside, a dip below 77.71 would confirm a forthcoming lower low and perhaps signal a short-term bearish reversal. The bears may then get encouraged to drive the action down to the low of April 22nd, at 77.17, the break of which may set the stage for extensions towards the 76.64 area, defined as a support by the low of April 13th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.07% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research