Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

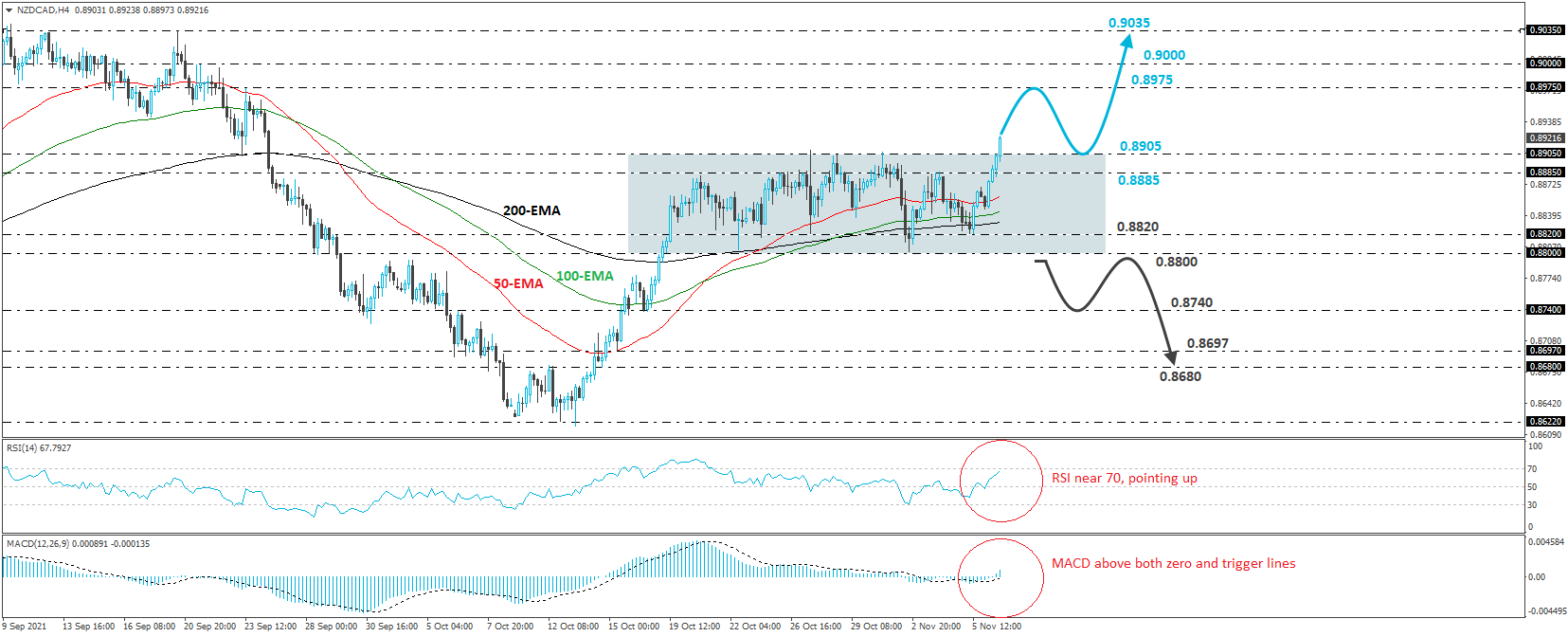

NZD/CAD Exits a Short-term Range to the Upside

NZD/CAD climbed higher today, breaking above the 0.8905 territory, which acted as a temporary ceiling for the rate between October 27th and November 1st. This is also the upper bound of the range that contained the price action from October 19th until today, and thus, its break may have turned the short-term outlook back to positive.

We believe that the break above 0.8905 may have opened the way towards the peak of September 23rd, at 0.8975, but if the bulls get there and show no willingness to give up, a break higher may allow a test at the round figure of 0.9000, or even at the peak of September 20th, at 0.9035.

Shifting attention to our short-term oscillators, we see that the RSI is climbing higher and is now slightly below its 70 line, still pointing up, while the MACD lies above both its zero and trigger lines, pointing up as well. Both indicators detect upside speed and corroborate our view for further advances in this exchange rate.

In order to start examining the bearish case, we would like to see the rate falling all the way back below the lower end of the aforementioned range, at 0.8800. This will confirm a forthcoming lower low on the 4-hour chart and may trigger declines towards the low of October 18th, at 0.8740. If the bears are not willing to stop there, then a break lower could target the 0.8690, or 0.8680 barriers, marked by the low of October 15th and the inside swing high of October 12th, respectively.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.90% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research