Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Microsoft Stock Traders Await Earnings Results

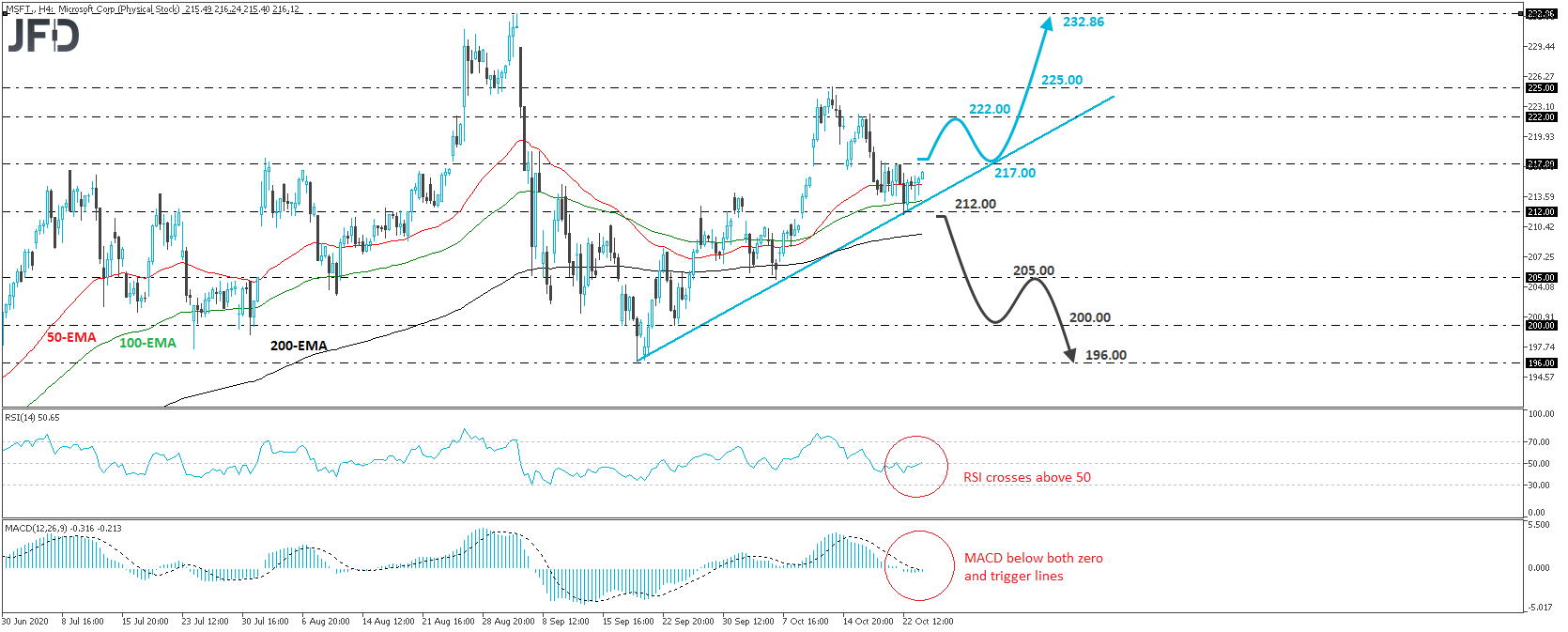

Microsoft Corp. (NYSE: MSFT) traded higher on Friday, after hitting support near 212.00 on Thursday. Overall, the stock is trading above a short-term tentative upside support line drawn from the low of September 18th, and thus, we would consider the near-term outlook to be positive at the moment. However, given that, tomorrow, the company announces its earnings results, we prefer to hold a cautious stance ahead of the release.

If the results come out better than expected, the stock may rise above the 217.00 barrier, a move that may be a trend-continuation signal. Investors may then decide to push the price towards the 222.00 level, or even the 225.00 barrier, marked by the peak of October 13th. Another break, above 225.00, would confirm a forthcoming higher high and may carry larger bullish implications, perhaps paving the way towards the stock’s all-time high, at 232.86, hit on September 2nd.

Looking at our short-term oscillators on the 4-hour chart, we see that the RSI has just poked its nose above the 50 level, while the MACD, although slightly below both its zero and trigger lines, shows signs of bottoming. Both indicators suggest that the stock may start gathering upside speed again soon, which corroborates the case for some further near-term advances.

Now, in case earnings surprise to the downside, the share price may slide below 212.00, thereby confirming a forthcoming lower low. It will also be below the aforementioned upside line, and thus, investors may allow declines towards the 205.00 zone, near the low of October 6th. If that zone is not able to halt the slide, the next support may be the psychological round figure of 200.00, which prevented the stock from falling lower on September 23rd and 24th. In case that level is also broken, we may see the slide extending towards the low of September 18th, at around 196.00.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research