Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Banco Comercial Portuguese Stock Still Looks Attractive

Banco Comercial Portuguese SA (ELI: BCP) belongs to the top three banks in Portugal, with more than 4mln clients in their business folder across the globe. In 2019, the financial institution received an award for the “Best Foreign Exchange” bank, issued by Global Finance. The bank’s market cap is around 2bln USD, however at the end of 2019, it was just slightly above 3bln USD. The decline has been linked to the pandemic, but as economies are slowly emerging from that, the financial industry is also picking up the pace.

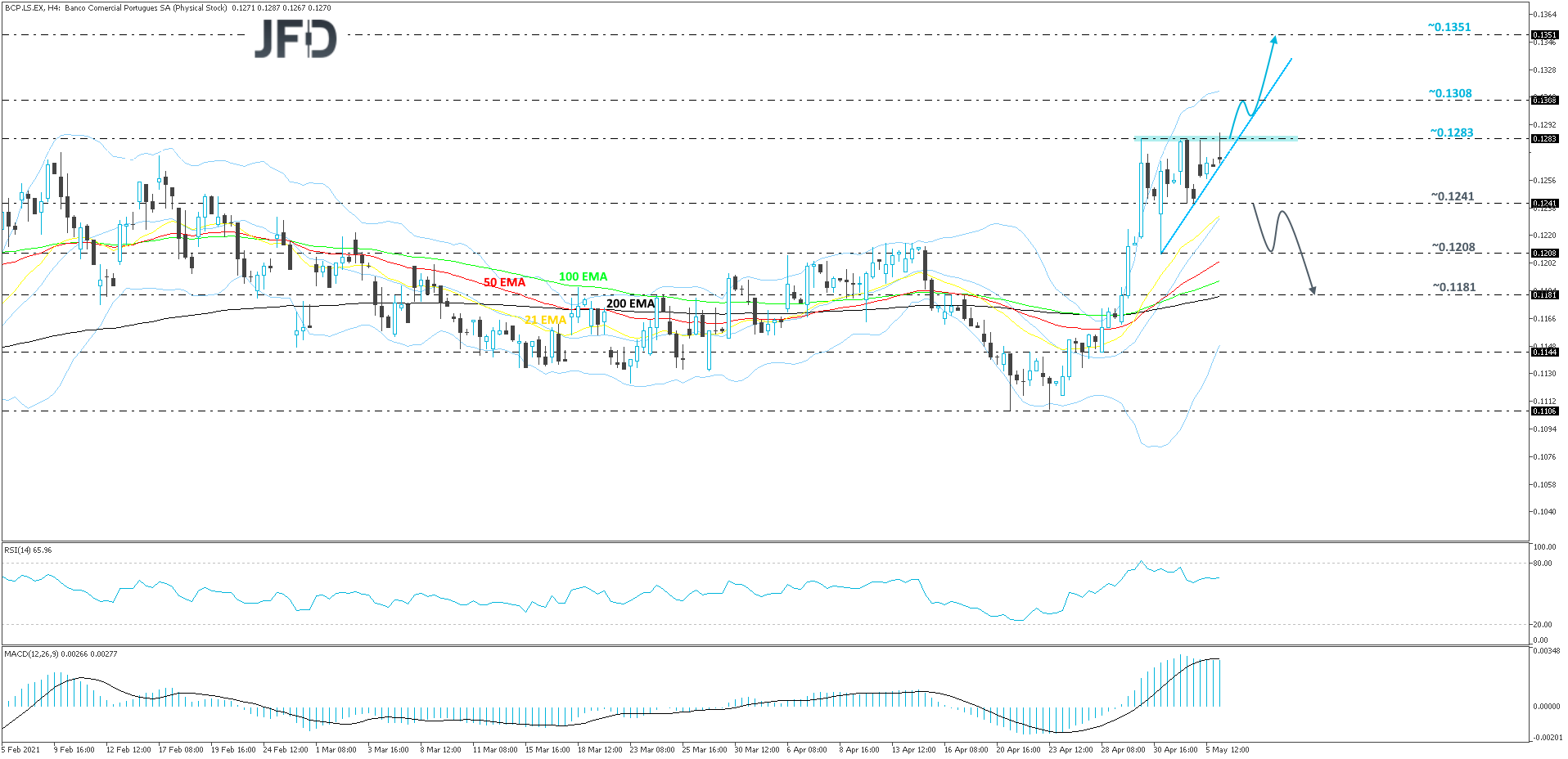

Looking at the technical picture of the BCP stock on our 4-hour chart, we can see that the share price moved strongly to the upside in the past two weeks and is now forming somewhat of a possible ascending triangle pattern, which tends to be a bullish indication. Nevertheless, we would prefer to wait for a push above the upper side of that formation first, before examining higher areas.

If the 0.1283 barrier, which is the upper side of the aforementioned ascending triangle, gets broken, more buyers might join in, potentially opening the door towards higher areas, possibly aiming for the 0.1308 hurdle, marked by the high of January 19th. A slight hold-up may occur around there, but if the bulls are still feeling comfortable, they could easily send the share price towards the 0.1351 level, marked by the high of January 14th.

The RSI and the MACD are currently flat. That said, the RSI is still above 50 and the MACD, although fractionally below its trigger line, remains well above zero. The two oscillators seem to be in support of the upside, but to wait for a break above the 0.1283 barrier first.

Alternatively, if the stock pushes through the lower side of the ascending triangle and breaks below the 0.1241 zone, marked by the low of May 4th, this may open the door for further declines. BCP may then drift to the 0.1208 obstacle, a break of which could set the stage for a move to the 0.1181 level. That level marks the high of April 16th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research