Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Snap Inc Stock Attracts More Buying-Interest

Snap Inc (NYSE: SNAP) has been appearing in the news recently, as the company’s main product, Snapchat, became a new popular app on the Android phones. The company finally managed to offer Android phone users its social network platform, as previously it was only available to iOS users. Last week, the company reported its earnings and stated that it now has more people using Snapchat on an Android, than on iOS. Snap is slowly starting to offer more functionality on its application, which could eventually increase the user base even more, this way attracting more investors later on.

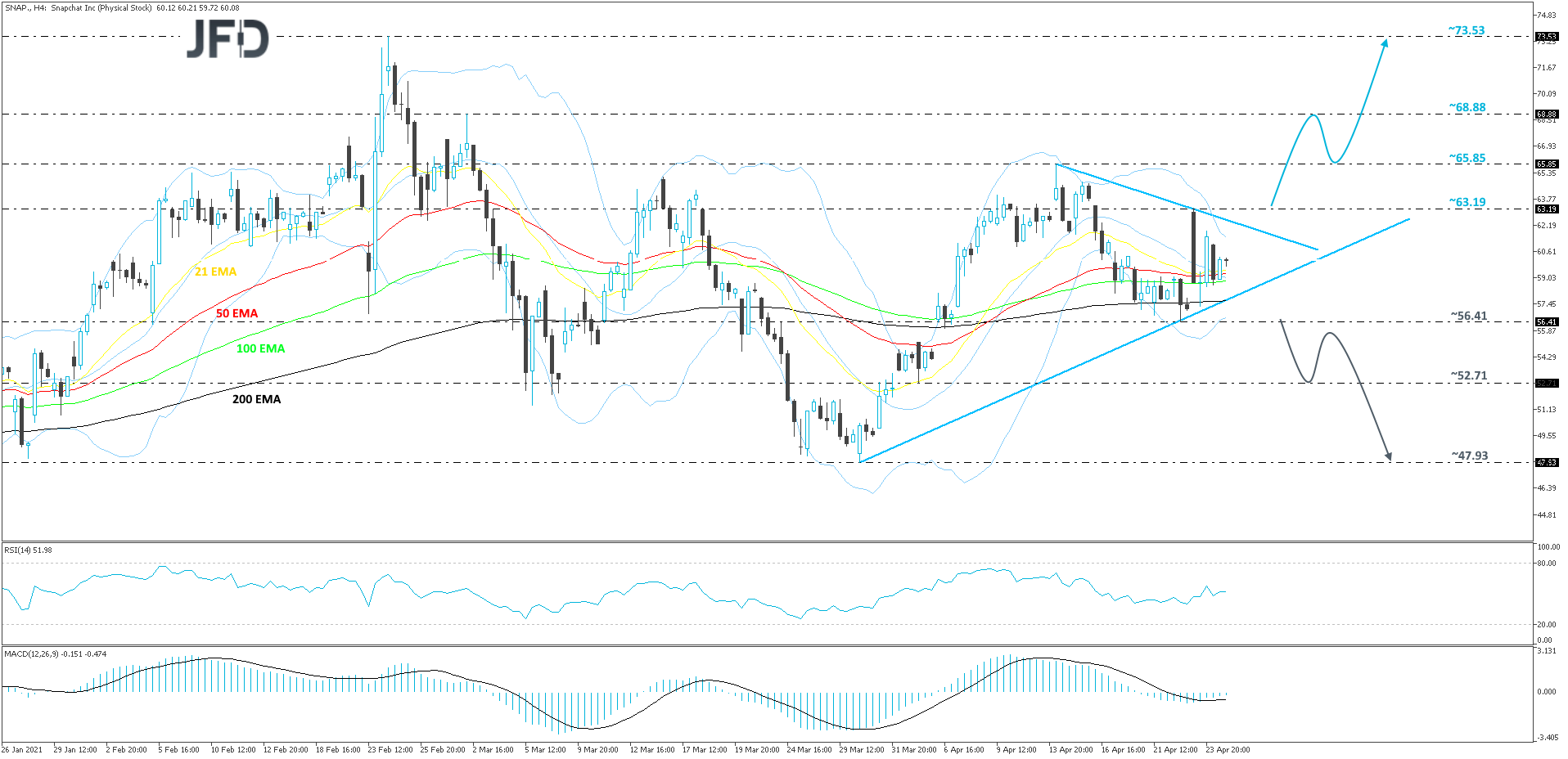

The technical picture of SNAP on our 4-hour chart shows that it is currently stuck between two short-term tentative lines, an upside one taken from the low of March 30th and the downside one drawn from the high of April 14th. As long as the price trades between those two lines, we will remain on the neutral side.

If the stock continues its journey in the direction of the prevailing uptrend and breaks the aforementioned downside line, this may attract more buyers, especially if the share price rises above last week’s high, at 63.19. This could open the gates for further advances, where we may start aiming for the 65.85 obstacle, marked by the current highest point of April, or for the 68.88 zone, which is the highest point of March. The uprise might slow down a bit near that zone, however, if there are still enough new buyers, they could continue applying pressure, potentially dragging SNAP to the 73.53 level, marked by the highest point of February.

The RSI and the MACD are both on the flat side. The RSI is currently slightly above 50, which could be inline with above-discussed idea. The MACD is just fractionally below zero, but continues to sit above its trigger line. The overall picture supports the idea of waiting for a better price-move.

Alternatively, if the share price breaks the previously-discussed upside line and then drops below the 56.41 hurdle, marked by last week’s low, that would confirm a forthcoming lower low, potentially spooking new buyers from the arena for a bit. SNAP may then travel to the current lowest point of April, at 52.71, a break of which might could clear the way to the 47.93 level, marked by the lowest point of March.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research