Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Equities Tumble as Inflation Fears Mound

Equity markets turned south yesterday, as investors became concerned again over surging inflation, with Target Corp announcing a 50% drop in quarterly profits and warning over a bigger margin hit later this year due to rising fuel and freight costs. In the FX world, the British pound was the main loser among the majors, despite data showing that inflation rallied to 9.0% yoy in April. We also got Canada’s CPIs yesterday, while tomorrow, during the Asian trading, it’s the turn of Japan to publish inflation numbers.

Investors Seek Shelter in Safe Havens After Retailers Worn Over High Inflation

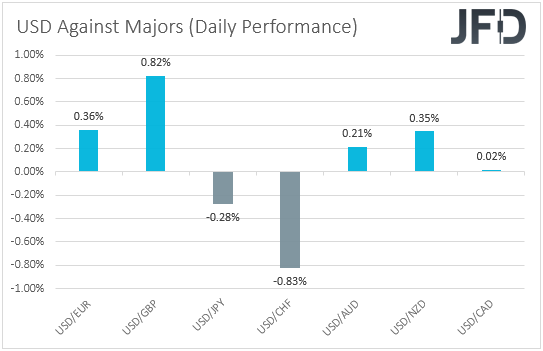

The US dollar traded mixed against the other major currencies on Wednesday and during the Asian session Thursday. It gained versus GBP, EUR, NZD, and AUD in that order, while it underperformed against CHF and JPY. The greenback was found virtually unchanged against CAD.

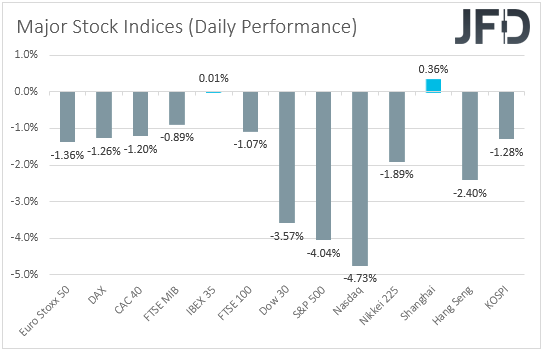

The strengthening of the safe-havens yen and franc, combined with some weakness in the commodity-linked Aussie and Kiwi, suggests that investors’ appetite deteriorated again at some point yesterday or today in Asia. Indeed, shifting our attention to the equity world, we see that major EU shares slipped, with the selling intensifying during the US session. All three of Wall Street’s main indices lost more than 3%, with Nasdaq falling 4.73%. Although somewhat softer, risk aversion rolled over into the Asian session today.

The sharp slide confirms the view we’ve been holding for the last few days, when the market was in a recovery mode. Remember we’ve been repeatedly noting that this may be a corrective rebound as the fundamental landscape of the markets has not change yet. But why the recovery was cut short so quickly, and why we saw so big declines?

It seems that inflation concerns returned to overshadow the relief from the declining covid cases in China and the prospect of removing related restrictions in the world’s second largest economy, and what added a lot of fuel to that may be Target Corp’s announcement that quarterly profits halved and that a bigger margin hit later this year is very likely due to rising fuel and freight costs. Following the relatively decent retail sales data on Tuesday, this comes to spark fresh concerns with regards to surging inflation affecting consumers in the US, and thus, it adds credence to the view that the Fed needs to continue hiking interest rates aggressively in order to bring inflation back down.

Remember that when speaking to The Wall Street Journal, Fed Chair Powell said that they are prepared to move more aggressively if needed. For now, market participants are trusting his previous remarks and are pricing in 50bps increment for the next couple of meetings. But we believe they will not hesitate to bring back bets of a 75bps liftoff in case double hikes are not as effective as initially thought. That’s why we will stick to our guns that the path of least resistance for the US dollar is to the upside, and for equities to the downside.

The British pound was the main loser despite UK inflation data revealing a surge to 9.0% yoy from 7.0%. In our view, the reason why the currency did not respond positively to the data is because the market was already anticipating a similar acceleration. The forecast was at 9.1%. Yes, this means that the BoE is very likely to continue lifting interest rates in order to bring that number back down to its 2% target, but due to recession fears, we believe, and it seems that so does the market, that the path will be slower than previously thought, and most likely slower than the Fed. Therefore, we still see the case for some further declines in GBP/USD.

Now, flying from the UK to Canada, the Loonie was the currency that neither gained nor lost to the greenback. It was found virtually unchanged this morning. In our view, this may have been due to two forces offsetting each other. On the one hand, we have deteriorating risk appetite, which is negative for the currency, while on the other hand, we have the Canadian CPIs coming in above estimates. This is positive, as it means the BoC could continue hiking interest rates at a fast pace, actually taking the second place among the majors, in terms of hawkishness, behind the Fed.

DJIA – Technical Outlook

The Down Jones Industrial Average fell sharply yesterday, after hitting resistance at the downside line taken from the high of April 21st, with the cash index hitting support at 31315 this morning. That barrier is slightly above the low of May 12th, and it is initially marked by the low of March 8th, 2021. With all that in mind, we will stick to our bearish view.

A clear break below 31315 could confirm a forthcoming lower low on the daily chart and may encourage the bears to dive towards the low of March 4th, 2021, at around 30535. If that zone is not able to stop the downtrend, then its break could carry extensions towards the 29660 zone, marked by the low of January 31st, 2021.

In order to start examining the bullish case, we would like to see a clear break above the high of May 17th, at 32755, the break of which would not only confirm a forthcoming higher high, but also the break above the aforementioned downside line taken from the high of April 21st. Market participants could then get encouraged to climb towards the 33350 zone, marked by the high of May 3rd, the break of which could carry extensions towards the 34120 territory, which acted as a key resistance between April 25th and May 5th.

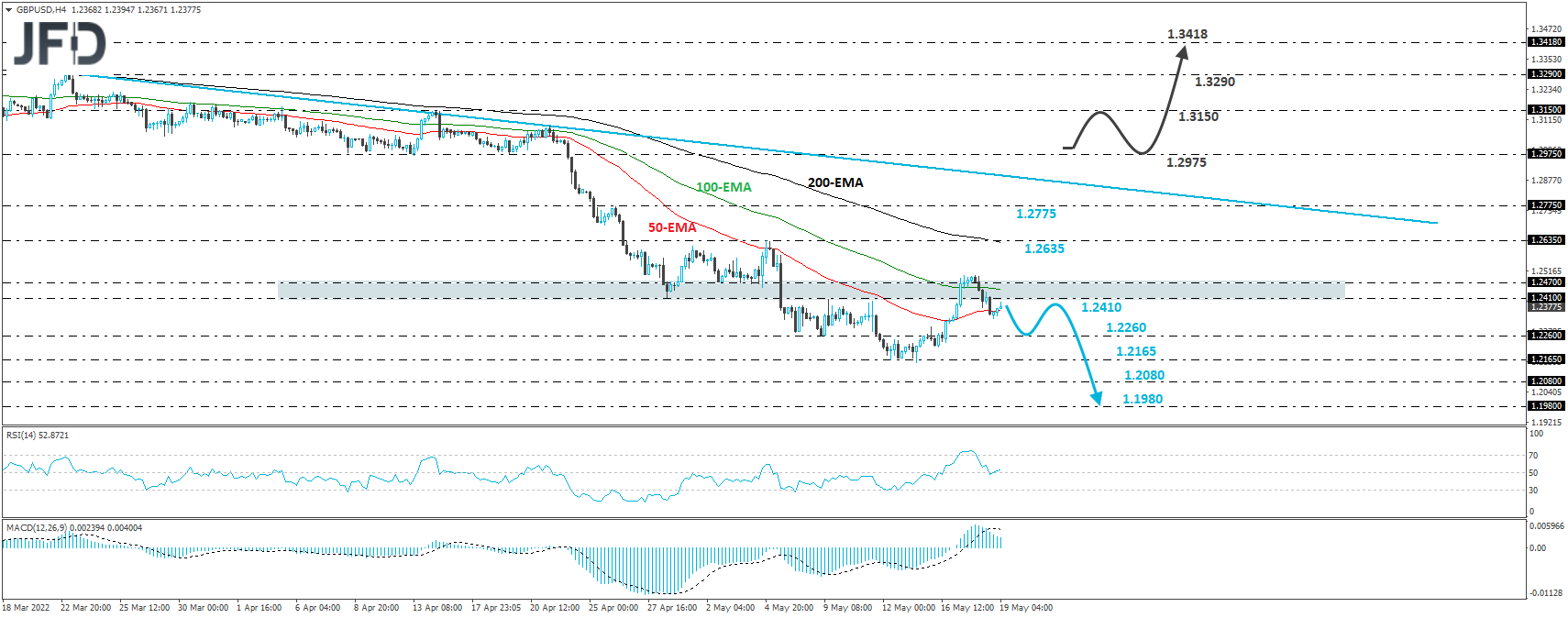

GBP/USD – Technical Outlook

GBP/USD traded lower yesterday, coming back below the key barrier of 1.2410, which acted as a key support on April 28th, and as a key resistance on May 9th and 11th. Overall, the pair is trading well below the downside resistance line taken from the high of March 23rd, which combined with the rate’s return below 1.2410 suggests a negative bias.

We believe that the dip back below 1.2410 has opened the path for another test near the 1.2165 zone, which provided support on May 12th and 13th, the break of which will confirm a forthcoming lower low on the daily chart and may target the 1.2080 level, marked by the low of May 18th, 2020. Another break, below 1.2080, could carry extensions towards the 1.1980 barrier, marked by the inside swing high of March 25th, 2020.

The outlook could turn overly bullish in our view, upon a break all the way above 1.2975. The rate will already be above the downside line taken from the high of March 23rd, and thus, we may see the bulls initially aiming for the high of April 14th, at 1.3150. A break higher could extend the advance towards the peak of March 23rd, at 1.3290, or even towards the high of March 3rd, at 1.3418.

As for Today’s Events

Today, during the Asian session, we already got Australia’s employment report for April, with the unemployment rate ticking down to 3.9% from 4.0% as expected, but the net change in employment revealing that the economy added only 4.0k jobs, a slowdown from March’s 17.9k, and a miss of the 30.0k consensus. The slide in the unemployment rate is a positive development, but the employment change figure is not that encouraging. Thus, we don’t believe that this report has affected much the expectations around the RBA’s future course of action.

There are no top tier indicators for the rest of the day, while tomorrow, during the Asian trading Friday, we get Japan’s National CPIs for April. However, we don’t expect yen traders to pay much attention. We believe that they will stay focused on developments pointing to how the global landscape is affected. After all, the yen is strengthening nowadays, while the BoJ is the most dovish major central bank.

Just for the record, there is no forecast for the headline rate, while the core one is expected to rise to +2.1% yoy from +0.8%. Though a decent jump to fractionally above the Bank’s target, it is still well below the high numbers in other major economies, and thus, we don’t expect BoJ policymakers to start thinking altering their monetary policy after that.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.99% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research