Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Silver Still Has Potential To Move Higher

Silver Still Has Potential To Move Higher | Technical Analysis

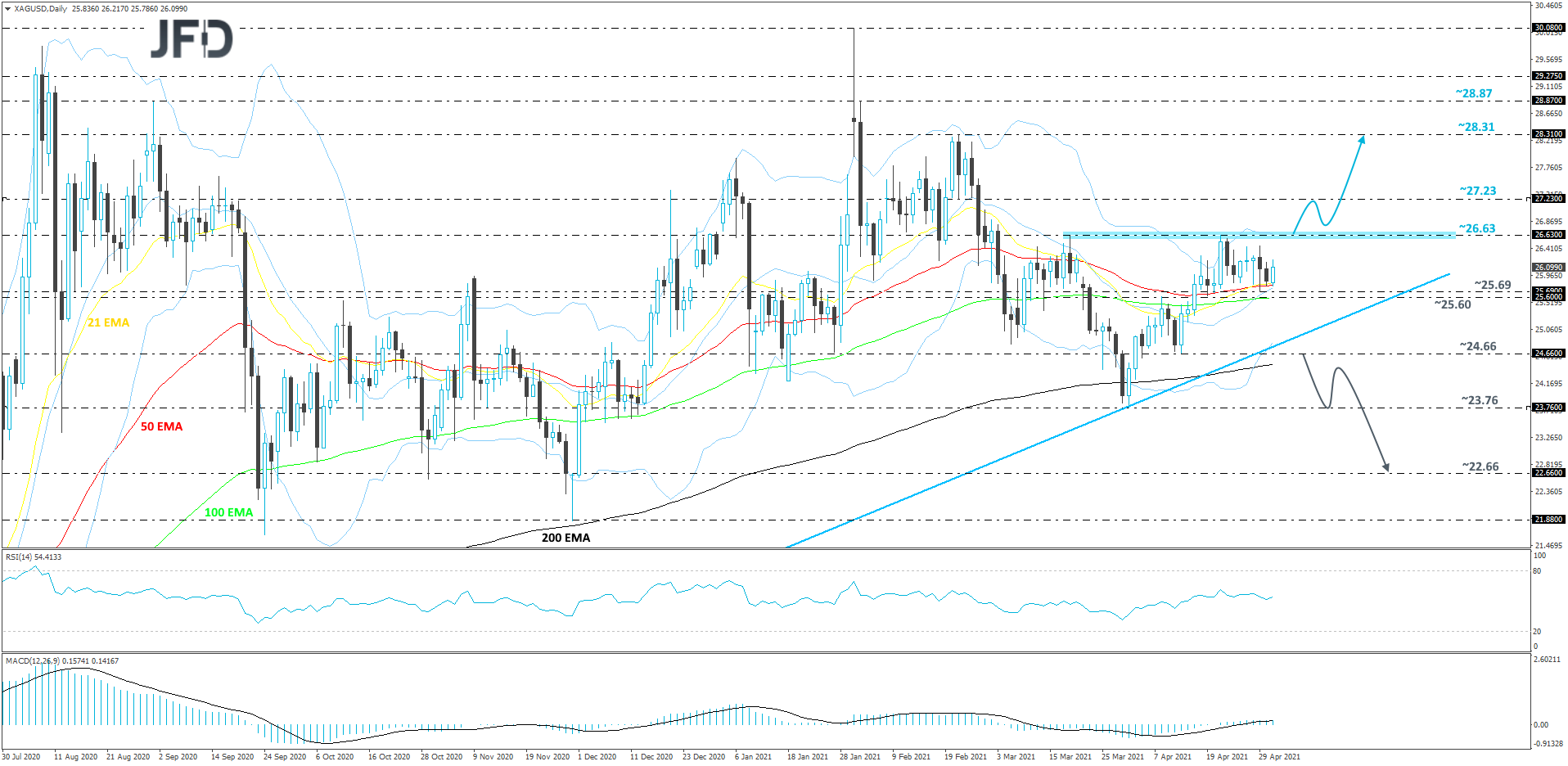

The bulls continue to keep silver above all of its EMAs on our daily chart. At the same time, the commodity remains above a short-term tentative upside support line taken from the low of March 18th. Although there are indications for a possible move further north, we would still prefer to wait for a push above the 26.63 barrier, before examining higher areas. Until then, we will take a cautiously-bullish approach.

If, eventually, the “white metal” pushes through that barrier, at 26.63, and stays above it, this will confirm a forthcoming higher high, possibly opening the door to some higher areas. The commodity might then drift to the 27.23, marked by an inside swing low of February 23rd. If the buying continues, the next potential target could be at 28.31, which is the high of February 23rd.

The RSI is currently above 50 and points higher. The MACD, although slightly on the flat side, is sitting above zero and just fractionally above its trigger line. The two oscillators seem t be in support of the upside idea, at least for now.

Alternatively, if the price breaks the aforementioned upside line and then falls below the 24.66 zone, marked by the low of April 13th, that could spook the buyers from the arena for a bit. Silver may then drift to the lowest point of March, at 23.76. where a temporary hold-up could occur. That said, if the sellers are still feeling active, they might easily overcome that obstacle, this way confirming a forthcoming lower low and clearing the path towards the 22.66 level, marked by an inside swing high of November 30th, 2020.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research