Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Is Société Générale Stock Preparing For An Uprise?

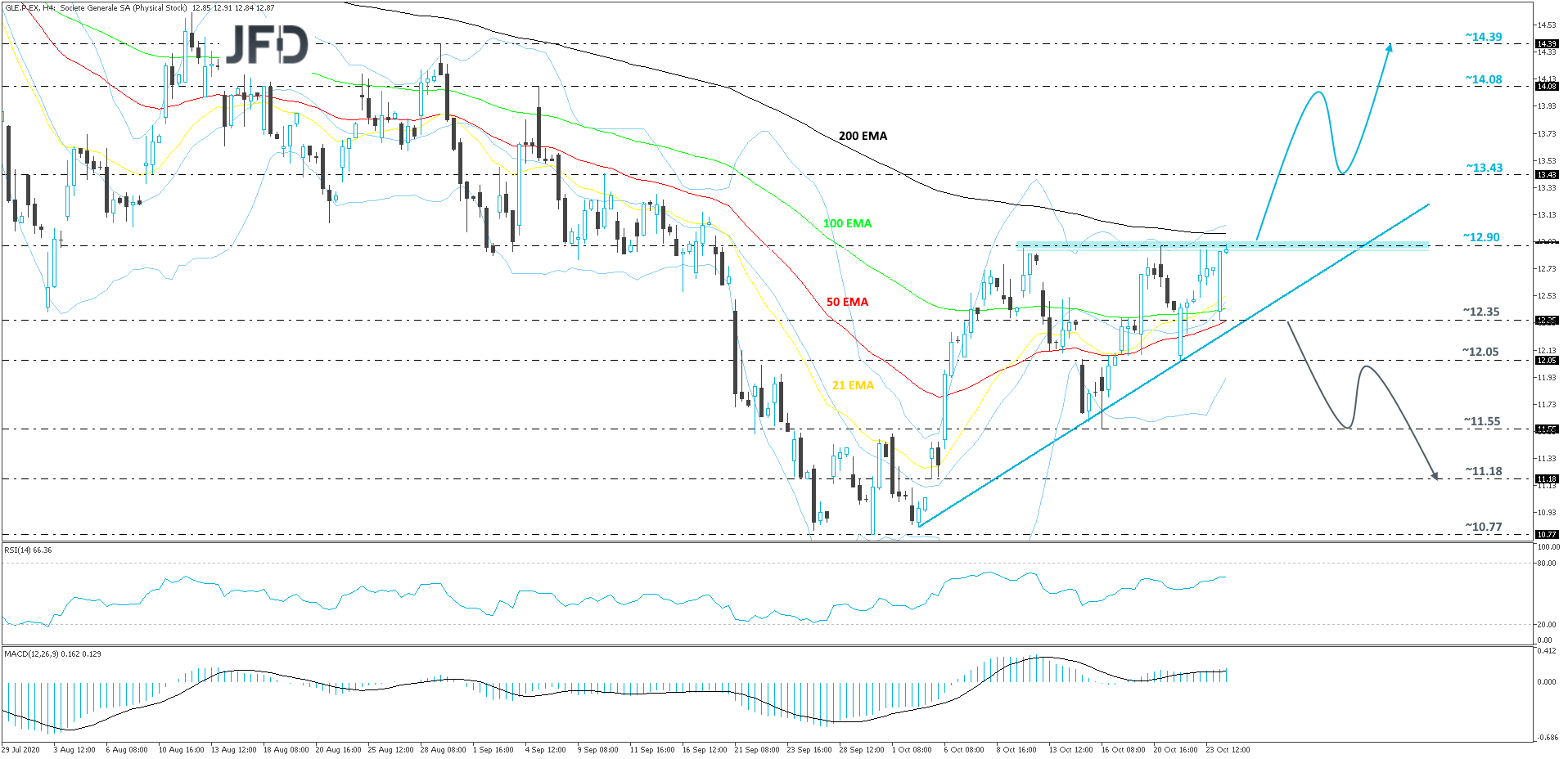

Looking at the technical picture of Société Générale stock (EPA: GLE) on our 4-hour chart, we can see that, after reversing to the upside in the end of September, the share price continues to run above a short-term upside support line drawn from the low of October 2nd. Today, we are seeing the stock knocking on the door of one of its key resistance areas, at 12.90, marked near the highs of October 12th and 21st. Although GLE is showing willingness to move further north, to be on the safe side, we would prefer to wait for a break and a daily close above that 12.90 barrier first. For now, we will take a cautiously-bullish approach.

A daily close above the 12.90 barrier might attract more buyers into the game, as such a move would confirm a forthcoming higher high, potentially clearing the way for further advances. At the same time GLE may rise above the 200 EMA and end up traveling to the 13.43 obstacle, or even the 14.08 zone, marked by the highs of September 10th and 7th respectively. The stock might stall near the latter price, or even correct a bit lower. That said, if GLE continues to balance above the aforementioned upside line, we will stay positive with the near-term outlook. Another uprise may bring the stock to the 14.08 area again, a break of which could open the way to the 14.39 level, marked by the high of August 31st.

The RSI is currently flat but remains above zero. The MACD is pointing fractionally to the upside, while sitting above zero and its trigger line. The two oscillators are indicating positive price momentum, suggesting that more upside might be in the works. However, the flatness of the RSI also suggests to wait for at least a push above the 12.90 barrier first.

If stock suddenly moves to the downside, breaks the aforementioned upside line and then slides below the 12.35 hurdle, marked by today’s current low, that might spook some new buyers from entering any time soon. The share price could drift to the 12.05 obstacle, a break of which may send the stock to the 11.55 zone, marked by the low of October 16th. If there are still no takers of GLE at that price area, a further decline could send the stock to the 11.18 level, marked by the low of October 5th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research