Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Germany Is Still Hanging In There, Eurozone CPIs and US Retail Sales Are In Focus

UK retail sales figures came out as a disappointment. Swedish unemployment suddenly gets a boost and comes out much lower than the forecast. Germany shows good GDP numbers. Today, we will focus on the eurozone’s inflation expectations and the US retail sales numbers.

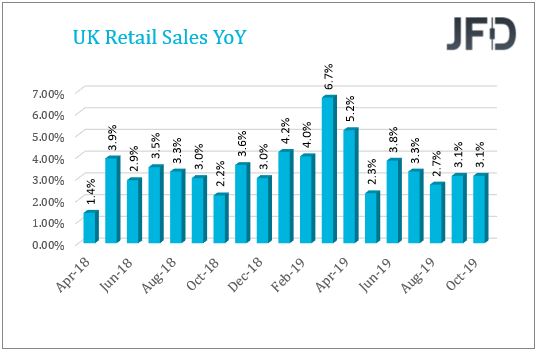

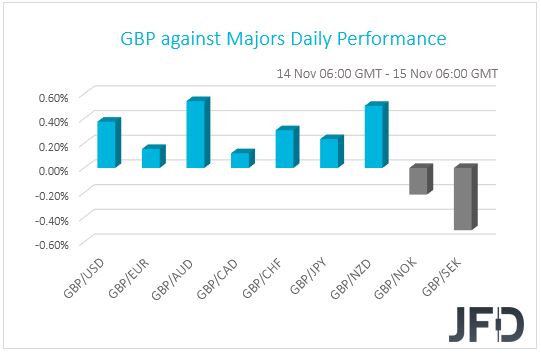

Yesterday, UK retail sales disappointed the market, as the core and the headline figures came out worse than expected. The core MoM and YoY figures were at -0.3% and +2.7%, versus the expected +0.2% and +3.4% respectively. The headline numbers on the same MoM and YoY basis came out at -0.1% and +3.1%, against the forecasted +0.2% and +3.7% respectively. Despite the data coming out below expectations, the pound was seen slightly higher against most of its counterparts, apart from SEK and NOK. Overall, the pound seems to have taken a pause from huge swings and it looks like it is saving itself for a Brexit-related news headline.

The Swedish krona was supported by the country’s unemployment rate, which came out much better than the previous figure before it got adjusted. The reading came out at 6.0%, better by a staggering 1.1%, which is a huge jump in a month's period. This helped SEK to continue strengthening against its major rivals, as it is doing since peaking in the beginning of October.

Germany was in the spotlight yesterday, or to be more precise, its’ better-than-expected GDP figures for Q3. The YoY number was already forecasted to come out at +0.9%, which was better than the previous adjusted -0.1%. It showed up at +1.0%. The QoQ reading did not disappoint as well, when it crawled to +0.1%, when the expectation was only to be -0.1%. The previous adjusted reading was at -0.2%. The main contributor to the positivity was consumption, which rose due to increased household spending. Exports gave a helping hand as well, after they have risen more than twice in September, comparing them to the August numbers. The euro managed not only to halt its slide, but also rise against some of its major counterparts, especially the Australian dollar, which got hammered by the Australian job numbers.

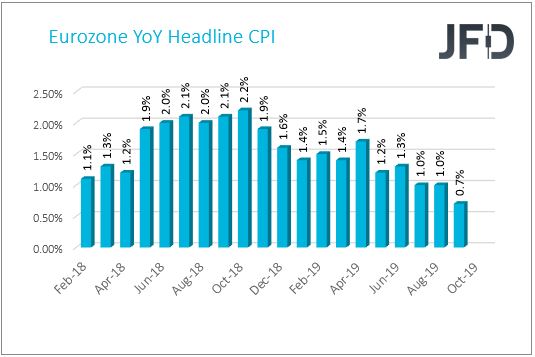

Today, the main data, on which we will keep our focus, will be the eurozone inflation numbers and the US retail sale figures. There is not much excitement around the first data set, as it is expected that the eurozone CPIs have stayed the same, as previous. The core YoY number is forecasted to have remained at +1.1% and the headline one on the same YoY basis is believed to have stayed at +0.7%. According to the ECB, the figures would still satisfy one part of its aim – to maintain inflation below +2.0%, but it wouldn’t satisfy the other part of the target, to have inflation close to +2.0%. If inflation comes out better than expected, this might support the euro, and the common currency could rise against some of its major counterparts again, as it did yesterday. But the bulls should not get their hopes up too quickly, as the move higher might be seen as a temporary recovery of some losses made recently.

An hour before the US opening bell, we will get the US retail sales numbers for the month of October. The expectations suggest improvements in the figures, with the core MoM one forecasted going from -0.1% to +0.4% and the headline going from -0.3% to +0.2%. If so, this could help bring the figures back into positive territory, after a brief decline in September. This could also help boost the greenback slightly against its major counterparts.

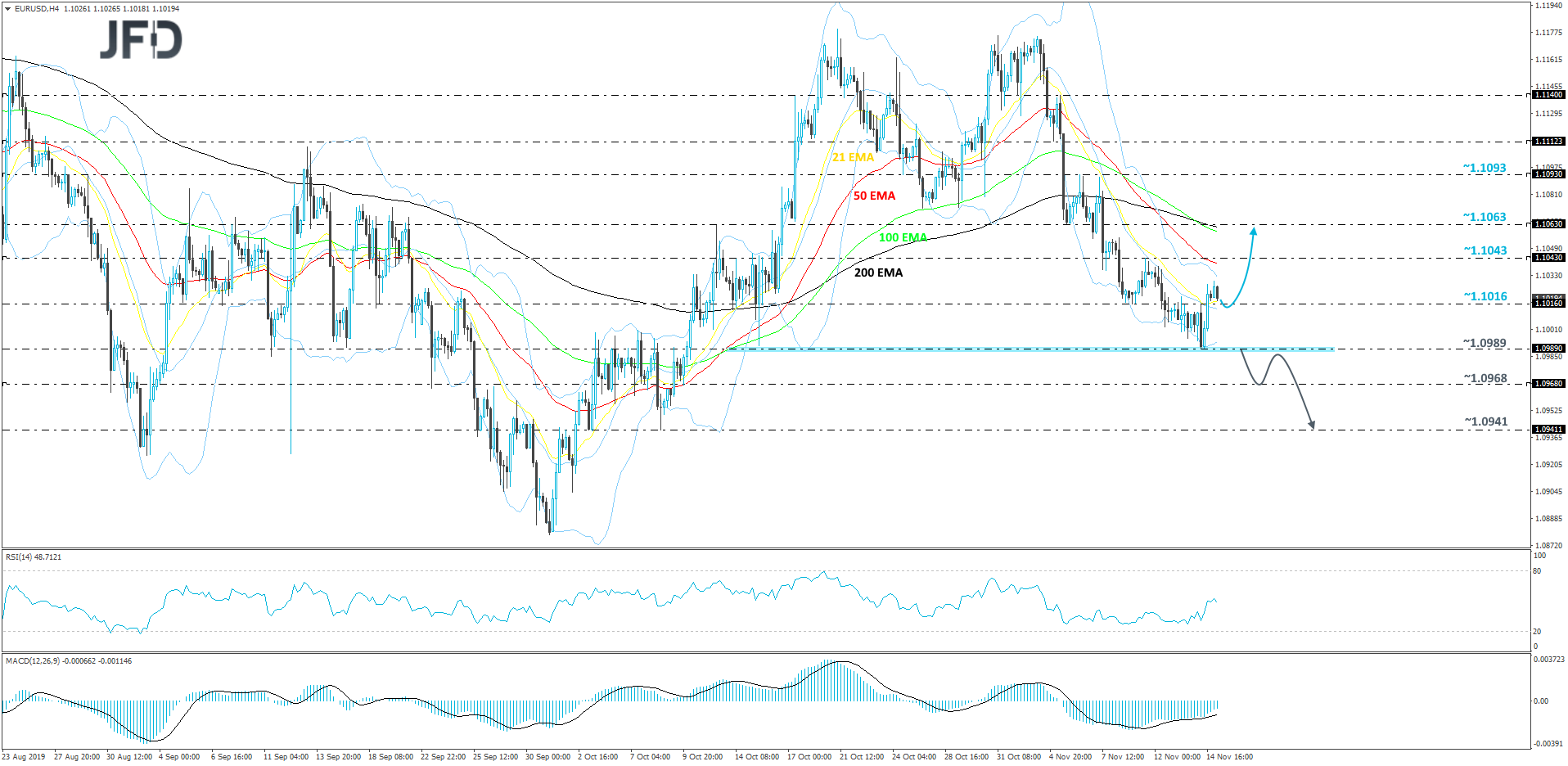

EUR/USD – Technical Outlook

EUR/USD found perfect support, yesterday, near the 1.0989 hurdle, from which it rebounded and moved back above its 21 EMA on the 4-hour chart. At the same time, the rate was also placed above the 1.1016 resistance zone, which now could play the role of a support area. If that 1.0989 level does act as a good support, the pair could make its way a bit higher, in order to recover some of the losses made during the past couple of weeks. From the very short-term perspective, there is a chance for EUR/USD to move a bit higher, as it is quite overstretched to the downside on the shorter timeframes.

As mentioned above, if the rate slides a bit lower, but fails to stay below the 1.1016 hurdle, this could result in the bulls re-entering the field and potentially driving the pair to the 1.1043 obstacle, which is the high of this week. Initially, EUR/USD might stall around there, but if the buying is still strong, a break of that obstacle would place the pair in the positive territory for the week and could send the rate to the 200 EMA, or the 1.1063 level, marked by the high of October 11th and the low of November 5th.

Alternatively, for us to consider the downside, a break of the 1.0989 hurdle, which is the current low of this week, is required. This way, the pair would confirm a forthcoming lower low and the rate may slide to the 1.0968 zone, a break of which might set the stage for a test of the 1.0941 level, marked by the lows of October 3rd and 8th.

GBP/CHF – Technical Outlook

Together with some other GBP pairs, GBP/CHF is also stuck inside a tight range, roughly between the 1.2675 and 1.2820 levels. This range has been ongoing from around mid-October. Overall, the pair remains above its medium-term tentative upside support line taken from the low of August 13th, so the rate still has a good potential to move higher in the future. That said, until we get a clear break through one of the sides of the range, GBP/CHF has an equal chance of moving either way, at least in the short run.

If the rate slides and breaks through the lower bound of the range, at 1.2675, this could attract more sellers into the game and the pair may end up testing the 1.2615 support zone, which marks the low of October 16th. If that area is still no match for the sellers, its break might set the stage for further drift south, towards the 1.2464 level, marked by the low of October 14th.

Alternatively, if the pair break through the upper side of the aforementioned range, at 1.2820, this would confirm a forthcoming higher high and more buyers could be joining into the action. This is when we will target the 1.2893 obstacle, a break of which could help the pair to test the 1.2936 zone as well, marked by the high of May 21st. If the rate gets a hold-up around there, there is also a possibility it may correct back down a bit. That said, if GBP/CHF remains above the upper bound of that range, the bulls could take charge again and push the pair beyond the 1.2936 barrier and aim for the 1.3010 level, marked by the low of May 13th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

78% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

.JPG)

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research