Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Sep 14 – Sep 18: Fed, BoJ, and BoE Decisions; NZ GDP and AU Jobs Data

We have three major central banks deciding on monetary policy this week. Those are the Fed, the BoJ and the BoE. All three Banks are expected to refrain from altering their respective policies, and thus, all the attention is likely to fall on clues and hints over their future plans. As for the data, the main releases may be New Zealand’s GDP for Q2 and Australia’s employment report for August.

On Monday, there are no major releases or indicators on the economic agenda. The only noteworthy event is the election in Japan’s governing party on a new leader to succeed Shinzo Abe. The winner is widely expected to be Yoshihide Suga who serves as a chief cabinet secretary in the current administration. On Sunday, Suga said that there is no limit to the amount of bonds the government can issue to support the economy hit by the pandemic, which supports the notion that Abenomics may continue, even without Abe on the lead.

On Tuesday, during the Asian morning, we have China’s fixed asset investment, industrial production, and retail sales, all for August. Fixed asset investment is forecast to have fallen at a slower pace than in July. Specifically, the forecast points to a 0.4% yoy slide after a 1.6% decline. Retail sales are anticipated to have rebounded 0.1% yoy after falling 1.1% in July.

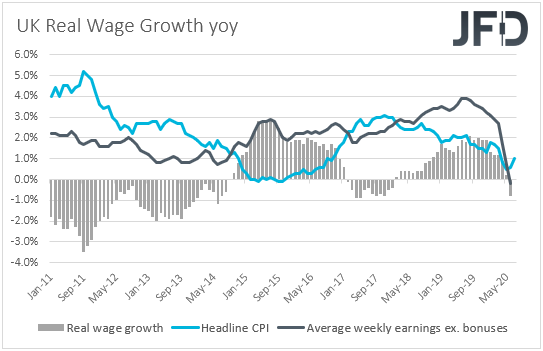

During the early European morning, the UK employment report for July is coming out. The unemployment rate is forecast to have ticked up to 4.0% from 3.9%, while average weekly earnings including bonuses are anticipated to have fallen at a faster pace than in June. Specifically, the yoy earnings rate is expected to have ticked down to -1.3% from -1.2%. The excluding bonuses rate is forecast to have held steady at -0.2% yoy. That said, according to the KPMG and REC UK report on jobs, starting and temp pay fell markedly, but with the rates of decline easing since June. In our view, this shifts the risks of the earnings rates somewhat to the upside.

From Germany, we get the ZEW survey for September. The current conditions index is forecast to have risen to -72.0 from -81.3, while the economic sentiment one is anticipated to have slid to 69.8 from 71.5. Eurozone’s wages and the Labor Costs index, both for Q2, are coming out, but there is no forecast available for neither release.

In the US, the New York Empire state manufacturing index for September and the industrial production for August are coming out. The NY index is forecast to have risen to 5.95 from 3.70, while IP is anticipated to have slowed to +1.0% mom from +3.0%.

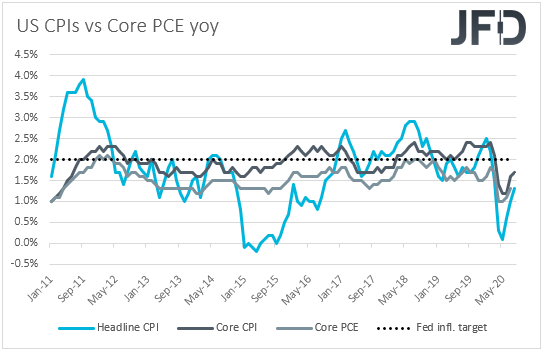

On Wednesday, the main event is likely to by the FOMC monetary policy decision. A few weeks ago, speaking at the Jackson Hole economic symposium, Fed Chief Powell said that the Fed will now target a 2% average inflation and put emphasis on “broad and inclusive” employment, with the shift motivated by underlying changes to the economy, including lower potential growth, persistently lower interest rates and low inflation. Although he added that the Committee is not tying itself to any particular method to define “average” inflation, this means that the Fed is willing to tolerate above 2% inflation for a while before raising interest rates, which implies extra-loose monetary policy for longer. What’s more, in the minutes of the latest FOMC gathering, it was revealed that additional accommodation may be required.

Having said all that though, we don’t expect the Fed to act at this gathering. Last Friday, inflation data showed that both the headline and core CPI rates for August came in higher than expected, which combined with the decent NFP gains during the month, may allow officials to stay sidelined and monitor how the economic activity progresses from now onwards. It would be interesting though to see if there are any clues over whether they remain willing to act if things fall out of orbit, and if so, how soon they could pull the easing trigger. Another round of dovish remarks may help equities to rebound as this would mean cheap loans to companies for longer, while at the same time, the US dollar is likely to erase some of its recent gains. The opposite may be true in case the message we get is not as dovish as the one we got from Powell while speaking at the virtual Jackson Hole symposium.

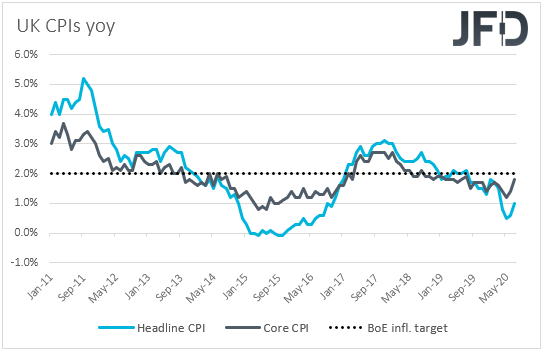

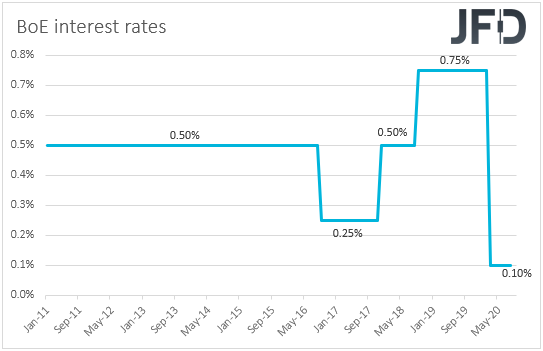

As for Wednesday’s data, during the EU session, we have the UK CPIs for August. Both the headline and core CPI rates are expected to have tumbled to +0.2% yoy and +0.9% yoy from +1.0% and +1.8% respectively. At the latest BoE gathering, policymakers kept monetary policy unchanged, while in the quarterly Monetary Policy Report, it was noted that officials discussed the effectiveness of negative interest rates and noted that they will continue to monitor their appropriateness. What’s more, on September 2nd, Governor Bailey said that negative rates are still a tool in in the Bank’s toolbox, although they are not planning to use it at the moment. Ahead of that gathering, there was some speculation that the Bank may at some point decide to cut rates sub-zero, and a notable slowdown in inflation may revive such speculation.

From the US, besides the FOMC decision, we also have retail sales for August, while from Canada, we get the CPIs for the month. Headline sales are expected to have slowed to +1.0% mom from +1.2%, while the core rate is anticipated to have declined to +0.9% mom from +1.9%. With regards to Canada’s inflation, the headline CPI rate is expected to have risen to +0.4% yoy from +0.1%, while no forecast is available for the core rate.

On Thursday, the central bank torch will be passed to the BoJ and the BoE.

Kicking off with the BoJ, at its previous meeting, it kept its short-term interest rates at -0.1% and the target of its 10-year JGB yield at around 0%, with officials noting that they remain ready to take additional easing steps without hesitation if deemed necessary. That said, we don’t expect any action at this meeting. The Bank is most likely to wait for the position of the Prime Minister to be officially filled, as they would like to know the government’s plans in supporting the economy, so they can more clearly decide what needs to be done in terms of monetary policy. As for the yen, we don’t expect any reaction. Due to its safe-haven status, we expect it to stay mostly linked to developments surrounding the broader investor morale.

Passing the ball to the BoE, this will be one of the smaller meetings, where we get only the decision, the accompanying statement, and the meeting minutes. With that in mind, and also taking into account that Governor Bailey recently noted that they are not planning to adopt negative interest rates at the moment, we do not expect any action at this gathering, even if inflation slows notably as the forecasts suggest. However, we will dig into the statement and the minutes to see whether the chances for such an action have increased since the last time the Bank met.

Something like that is likely to weigh on the already battered pound, which suffered last week from unpleasant developments surrounding the political landscape. Remember that the UK pressed ahead with a draft law that will override key parts of the withdrawal agreement, despite the EU urging them to scrap such plans. In our view, this lessens drastically the chances for any trade accord before the self-imposed October deadline, and increases the probability for a no-deal Brexit at the end of this year. We expect the pound to stay pressured in the foreseeable future, and if risk appetite improves on expectations for more central bank and government stimulus, the British currency is likely to suffer the most against risk- and commodity-linked currencies, like the Aussie and the Kiwi.

As for Thursday’s economic releases, New Zealand’s GDP for Q2 and Australia’s employment report for August are coming out. New Zealand’s GDP is forecast to have shrunk 12.8% qoq, after contracting 1.6% in Q1. This would drive the yoy rate down to -13.3% from -0.2%. At its latest gathering, the RBNZ decided to expand its Large-Scale Asset Purchase (LSAP) program, adding that a package of additional monetary instruments must remain in active preparation, including a negative OCR and purchases of foreign assets. That said, although a 12.8% qoq contraction appears to be a severe one, it is still better than the Bank’s own forecast of -14.3% qoq. Therefore, combined with the fact that the Bank has just expanded its stimulus efforts just at the prior gathering, this is likely to keep officials’ fingers off the easing button when they meet next.

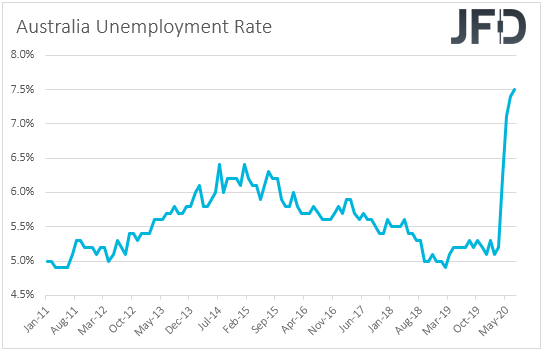

Now moving from New Zealand to Australia, there, the unemployment rate is expected to have increased to 7.7% in August from 7.5%, while the net change in employment is forecast to show that the economy has lost 50k jobs after gaining 114.7k in July. On September 1st, the RBA increased the size of its Term Funding Facility, in order to make it easier for banks to access more funds for longer, with officials repeating that they remain willing to expand their stimulative efforts if deemed necessary. A weak employment report may raise some speculation with regards to that, but our own view is that the RBA is unlikely to rush into acting again, especially at the upcoming gathering. After all, they already expect the unemployment rate to hit 10% by the end of the year, and thus an increase to 7.7% now would not be a surprise.

Finally, on Friday, during the Asian session, we have Japan’s National CPIs for August. No forecast is available for the headline rate, but the core one is forecast to have slid to -0.4% yoy from 0.0%.

During the early EU trading, the UK retail sales for August are due to be released, with both the headline and core figures expected to reveal a slowdown. We get retail sales from Canada as well, but for July, while from the US, we have the preliminary UoM consumer sentiment index for September. Canada’s retails sales are also expected to have slowed notably, after skyrocketing in June, while the UoM index is expected to have increased to 75.0 from 74.1.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research