Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Equities Surge on Russia-Ukraine Talks, ECB Decision and US CPIs in Focus

European stock indices rallied yesterday, with Wall Street and Asia following suit, albeit not as strong, perhaps due to headlines that Russia and Ukraine expressed to talk over a diplomatic solution. As for today, investors may pay extra attention to the ECB decision and the US CPIs for February, as both events could well reshape market expectations on the ECB’s and Fed’s future plans. Tomorrow, during the early European session, the UK releases its monthly GDP for January.

Risk Appetite Improves on Russia’s and Ukraine’s Willingness for Diplomacy

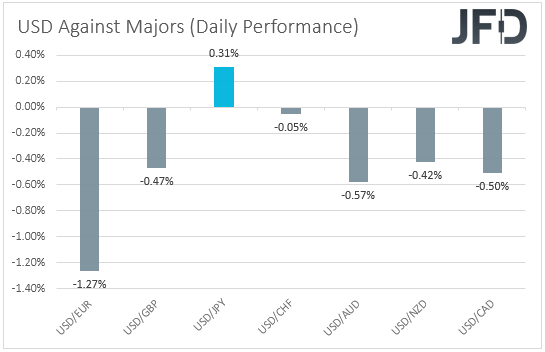

The US dollar pulled back against most of the other major currencies on Wednesday and during the Asian session Thursday. It gained only against JPY, while it was found virtually unchanged against CHF. The main gainer was EUR.

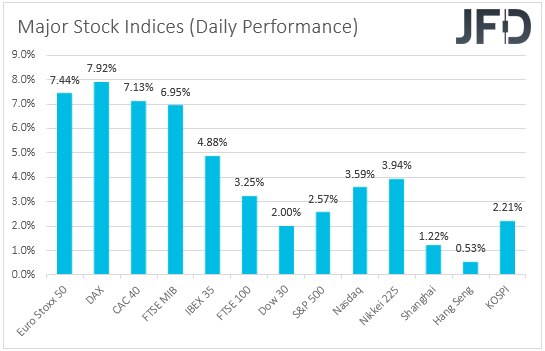

The retreat in the US dollar and the relative weakness in the other safe-haven currencies, yen and franc, suggests that risk appetite may have improved yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that all global indices under our radar traded in the green, with the EU ones winning the most, averaging 6.26% of gains. Appetite was still strong, but not that strong, during the US session, and somewhat weaker during the Asian session today.

What may have encouraged investors to push the buy button may be news that Russia and Ukraine expressed willingness to talk over a diplomatic solution. That said, the reason why Wall Street and Asian markets saw less gains than their European counterparts may have been headlines of Ukraine accusing Russia for bombing a children’s hospital in the city of Mariupol. This may have raised fears that the road towards finding common ground may not be an easy one.

With that in mind, we also believe that any resolution will not happen overnight. The war continues, and thus, we will maintain the view that the path of least resistance for equities, as well as the euro, is still to the downside, despite the very strong recovery yesterday. We will still class it as a corrective phase. We prefer to wait for headlines pointing to concrete evidence that both sides are indeed working towards a diplomatic solution.

Oil prices were also affected by the headlines over negotiations between the two nations, but that was not the only case. Another reason for the sharp and strong retreat in oil prices may have been reports that the United Arab Emirates and Iraq said they would support increasing oil production in order to offset some disruptions caused by the sanctions on Russia’s energy market.

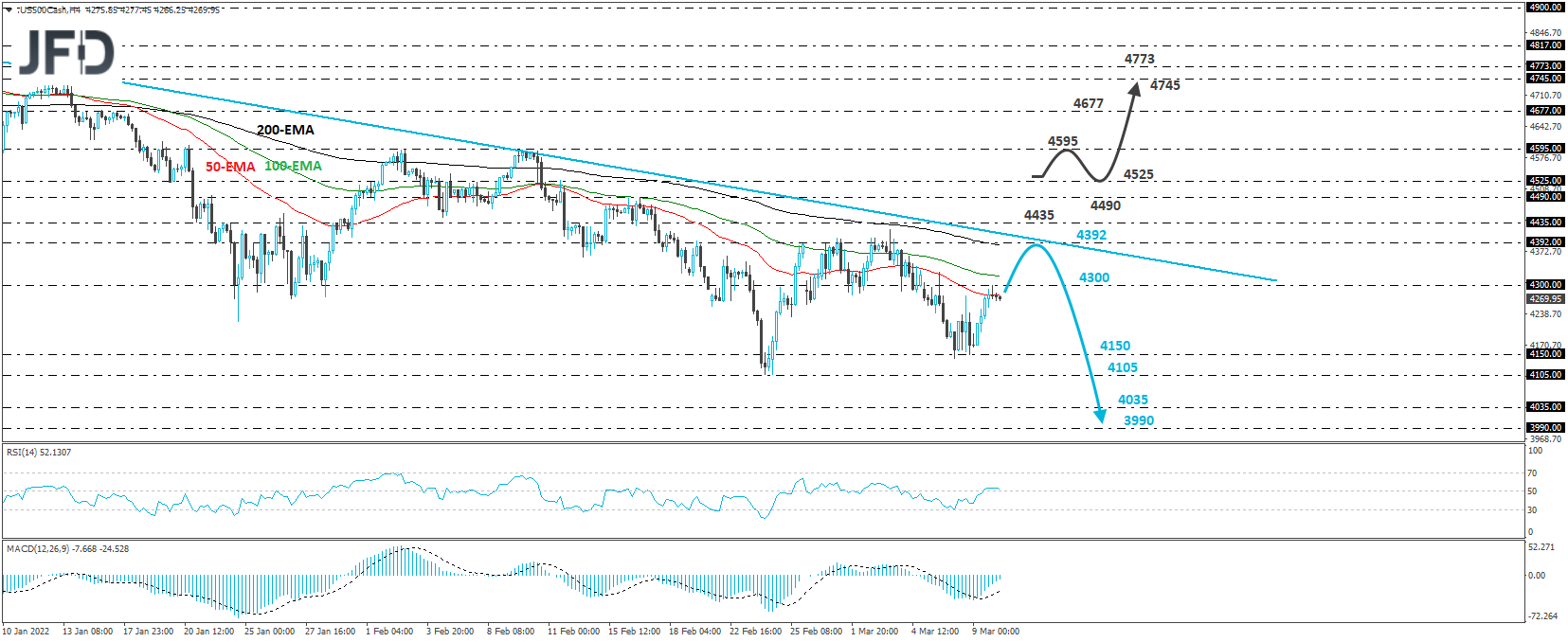

S&P 500 – Technical Outlook

The S&P 500 cash index traded higher yesterday, after it hit support at 4150 on Tuesday. However, the recovery was paused near the 4300 zone, still below the downside resistance line drawn from the high of January 4th. In our view, this keeps the door open for another round of selling.

If the bears take charge again very soon, we could see them aiming for another test near the 4150 zone, or even the 4105 one, marked by the low of February 24th. Another break, below 4105, could signal the continuation of the prevailing short-term downtrend, and may see scope for declines towards the 4035 territory, marked by the low of May 13th, or the 3990 zone, marked by the inside swing high of March 18th.

In order to start examining the bullish case again, we would like to see a strong recovery above 4435. This may confirm the break above the aforementioned downside line and may pave the way towards the 4490 or 4525 zones, marked by the highs of February 16th and 11th respectively. Another break, above 4525 could carry extensions towards the 4595 zone, marked by the highs of February 2nd and 9th.

ECB and US CPIs to Reshape Market Expectations on ECB and Fed Plans

As for today, there are two important economic events on the agenda and those are the ECB monetary policy decision and the US CPIs for February.

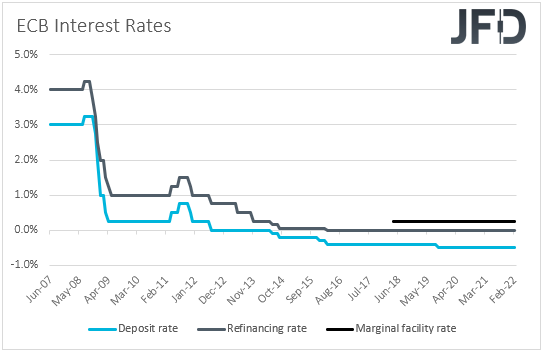

Kicking off with the ECB, at its last gathering, this Bank kept policy untouched, but at the press conference following the decision, President Lagarde said that inflation remained elevated for longer than previously thought and that the economy was hurt less than anticipated by the pandemic. She also added that the March and June meetings would be essential for evaluating their guidance, which perhaps meant that they could, after all, decide to lift rates this year.

Since then, inflation accelerated further, but we also witnessed the crisis in Ukraine, which may well undermine economic growth in Europe. Also, let’s not forget that Lagarde pushed against expectations over a summer rate increase, even before Russia’s invasion in Ukraine. Thus, we expect the Bank to highlight the risks arising from the war, and signal that it will take a more patient approach on interest rates than previously thought. That said, they will still need to fight inflation pressures, and they may decide to do so by ending their asset purchases earlier. In any case, a dovish take on interest rates could bring the euro under renewed selling interest.

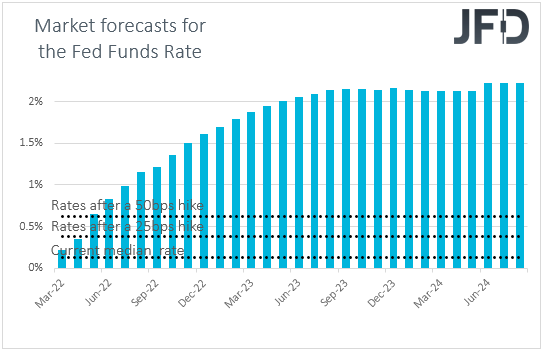

Now, passing the ball to the US CPIs, expectations are for the headline rate to have risen further, to +7.9% yoy from +7.5%, but the core one is anticipated to have ticked down to +5.9% yoy from 6.0%. In our view, this suggests that the main contributor to the spike in headline inflation may be the surging energy prices.

Last week, when testifying before Congress, Fed Chair Jerome Powell said that he may support a quarter-point hike at the upcoming gathering, disappointing those expecting a 50bps rise. However, he also added that he is ready to use larger or more frequent rate hikes if inflation doesn’t slow. Despite underlying inflation expected to have slowed somewhat, both rates are still well above the Fed’s objective of 2%, and with energy prices keep surging in early March the headline rate could drift higher this month as well. Thus, if the forecasts are met, we see decent chances for market participants to bring forward their hike expectations, something which could support the US dollar, and perhaps halt the recovery in equities.

EUR/USD – Technical Outlook

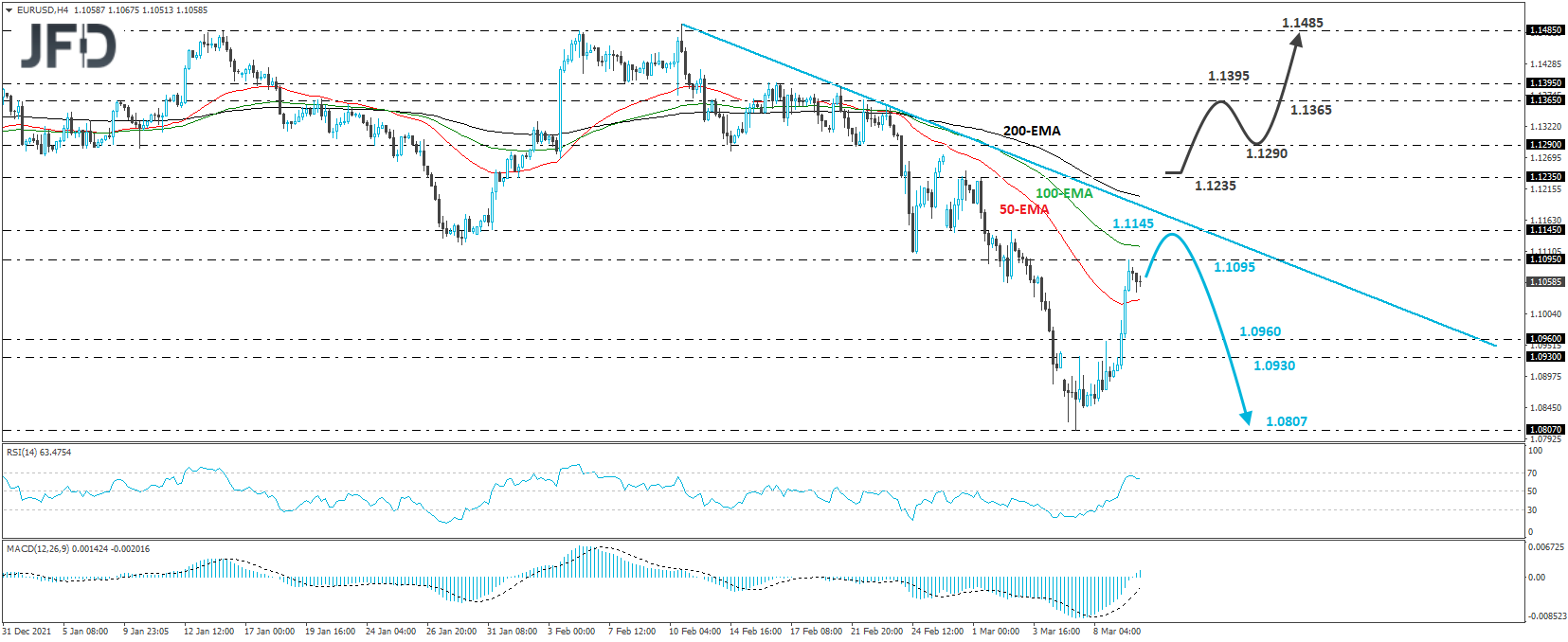

EUR/USD rebounded strongly, overcoming the 1.0960 zone, but hitting resistance at 1.1095, still below the downside resistance line taken from the high of February 10th. In our view, this still keeps the short-term downtrend intact.

Even if the recovery continues for a while more, the bears could still take charge from near the 1.1145 zone, marked by the high of March 2nd, and perhaps push the action back down to the 1.0960 barrier, marked by yesterday’s inside-swing high, or to the 1.0930 territory, defined by the peak of Tuesday. If the bears do not stop there, then we may see them pushing towards Tuesday’s low.

On the upside, we would like to see a strong break above 1.1235 before we start assessing the likelihood of a bullish reversal. This could confirm the break above the aforementioned downside line and may initially target the 1.1290 barrier, marked by the lows of February 14th and 22nd. Another break, above that level, could extend the advance towards the 1.1395 barrier, marked by the peak of February 16th, the break of which could set the stage for the 1.1485 zone, which acted as a ceiling between January 13th and February 10th.

UK Monthly GDP, IP and MP, on Tomorrow’s Early Agenda

Tomorrow, during the early European session, we get the monthly UK GDP for January, alongside the industrial and manufacturing production rates for the month. No forecast is available for the GDP, while both the IP and MP rates are expected to have held steady at +0.3% mom and +0.2% mom respectively.

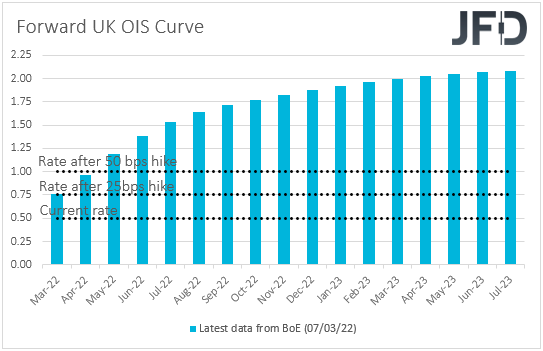

At the latest BoE gathering, officials voted 5-4 for a hike by 25bps, with the 4 dissenters calling for a 50bps increase. Since then, we’ve been highlighting that only one member needed to be convinced for that to happen at the upcoming gathering, and the accelerating CPIs for January, indeed, added to speculation on that front. However, this was the case around a week before Russia invaded Ukraine, with the events unfolding since then, marketwise, raising concerns over the global economic performance, and especially in Europe, something evident by the tumbles in the euro and the pound.

Thus, with all that in mind, we don’t believe that the BoE will now stay willing to hike by 50bps at its upcoming gathering, even if Friday’s data come in better than expected. Actually, we now question officials’ willingness to even hike by 25bps. In any case, according to the UK OIS (Overnight Index Swaps) forward curve, market participants believe that a quarter-point hike could still be delivered.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.82% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research