Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Equities Gain on Trade Hopes, Pound the Main G10 Winner

Major equity indices traded in the green, as positive headlines surrounding the US-China sequel revived hopes over signing a “phase one” trade deal. In the FX world, the British pound was the main gainer after UK PM Boris Johnson pledged to bring his Brexit deal back to Parliament before Christmas.

Risk Appetite Boosted by US-China Optimism

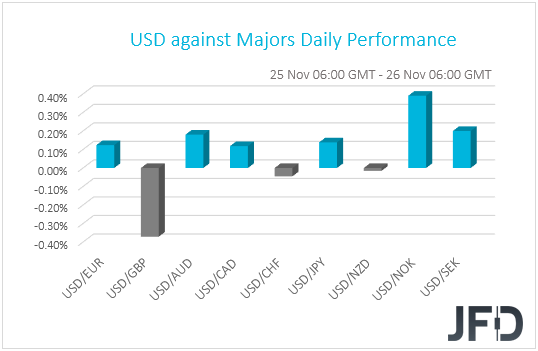

The dollar traded higher or unchanged against all but one of the other G10 currencies on Monday and during the Asian morning Tuesday. It gained the most against NOK, SEK and AUD, while it was found virtually unchanged against CHF and NZD. The greenback underperformed only against the pound.

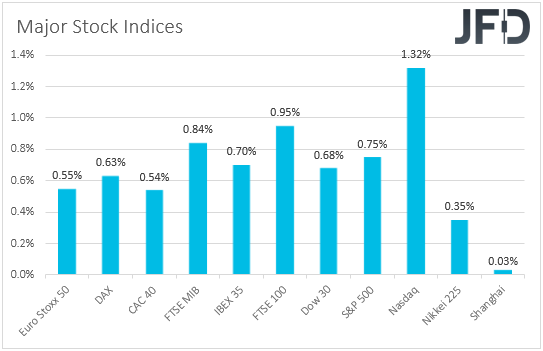

Once again, we cannot derive a clear picture with regards to the broader market sentiment by just looking at the FX performance. That said, the equity world suggests that investors started this week with risk appetite. Major EU and US were a sea of green, with the optimism rolling into the Asian session today.

The driver was for the umpteenth time headlines surrounding the US-China trade sequel. On Sunday, China said that it would strengthen protections with regards to intellectual property rights and that it will enforce violation penalties, which is pleasant news for the US. On top of that, overnight, Chinese Vice Premier Liu He, US Trade Representative Lighthizer and US Treasury Secretary Mnuchin agreed in a telephone call to maintain communication on the remaining unresolved issues.

All these may have revived hopes that a “phase one” deal could be signed soon, even though last week’s reports suggested that this could happen next year. As for our view, trying to figure out where things may be headed next appears to be a hard task. Headlines change from positive to negative within days, or even hours and thus, we will maintain a cautious approach. Barring any downbeat news today, risk appetite could remain supported, but we repeat once again that we remain reluctant to trust a long-lasting uptrend. Before we consider that, we would like to see handshakes and signatures.

DJIA – Technical Outlook

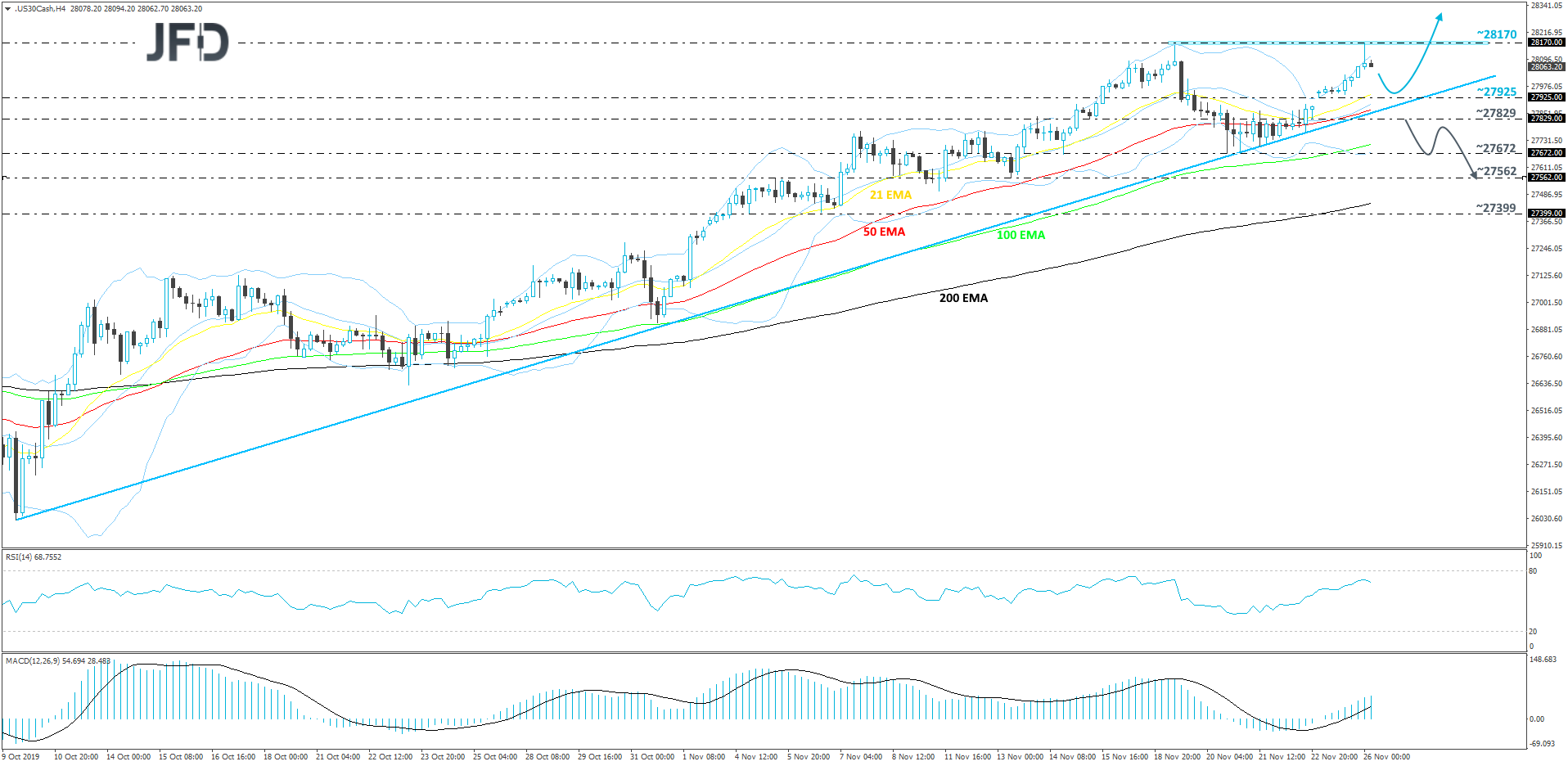

This morning, the Dow Jones Industrial Average cash index managed to hit a new all-time high, reaching the 28170 mark and then retracing back down a bit. Overall, the index is still within an uptrend and continues to trade above a short-term upside support line taken from the low of October 9th. Given that DJIA is quite extended to the upside, there is a possibility to see a bit of correction lower, but if the price remains above the previously-discussed upside line, we may see another round of buying. This is why we will stay somewhat positive, at least over the short-term outlook.

As mentioned above, if the index decides to go for a larger correction, it may end up moving towards the 27925 zone, which is the low of November 24th, or to the aforementioned upside line. If that line provides good support, DJIA may rebound from there and the buyers could drive the price back up to the 28170 barrier, marked by this morning’s high, a break of which could set the stage for a further move north into the uncharted territory.

Alternatively, if the previously-discussed upside line breaks and the rate falls below the 27829 hurdle, which is marked near an inside swing high of November 22nd and near an inside swing low of the same day, this may open the door for some lower levels. We will then target the 27672 obstacle, a break of which might send the index to the 27562 zone, which is the low of November 13th.

GBP Gains as Johnson Promises Brexit Vote by Christmas

Back to the currencies and the G10 world, the British pound was the main gainer, opening with a positive gap and staying under buying interest through the whole day. On Sunday, UK PM Boris Johnson unveiled the Conservatives’ election manifesto, saying that he will bring his Brexit deal back to Parliament before Christmas.

On Friday, sterling hit a 10-day low after preliminary PMI data disappointed, with the surveys saying that the economy is headed for a 0.2% contraction in Q4. At its latest meeting, the BoE maintained the view that some modest tightening, at a gradual pace and to a limited extent may be needed to maintain inflation sustainably at the target, but two members voted in favor of cutting rates. Thus, the disappointing PMIs raised questions on whether the Bank could hike rates, even in case of an orderly Brexit. Investors even assign a 40% chance for a cut to be delivered in March.

Having said all that though, we expect the main driving force behind the pound to continue being news surrounding the political landscape and the upcoming election. Investors may keep paying close attention to incoming polls, which if continue to suggest that the Tories could secure majority in Parliament, may keep the currency supported. That said, we still cannot talk about a major uptrend. Polls were proven wrong in estimating the support for Brexit back in 2016, and thus, if the elections result in another hung parliament, ratifying the deal Johnson agreed with the EU would be very difficult, and thereby the risk of a disorderly exit could reemerge.

GBP/CAD – Technical Outlook

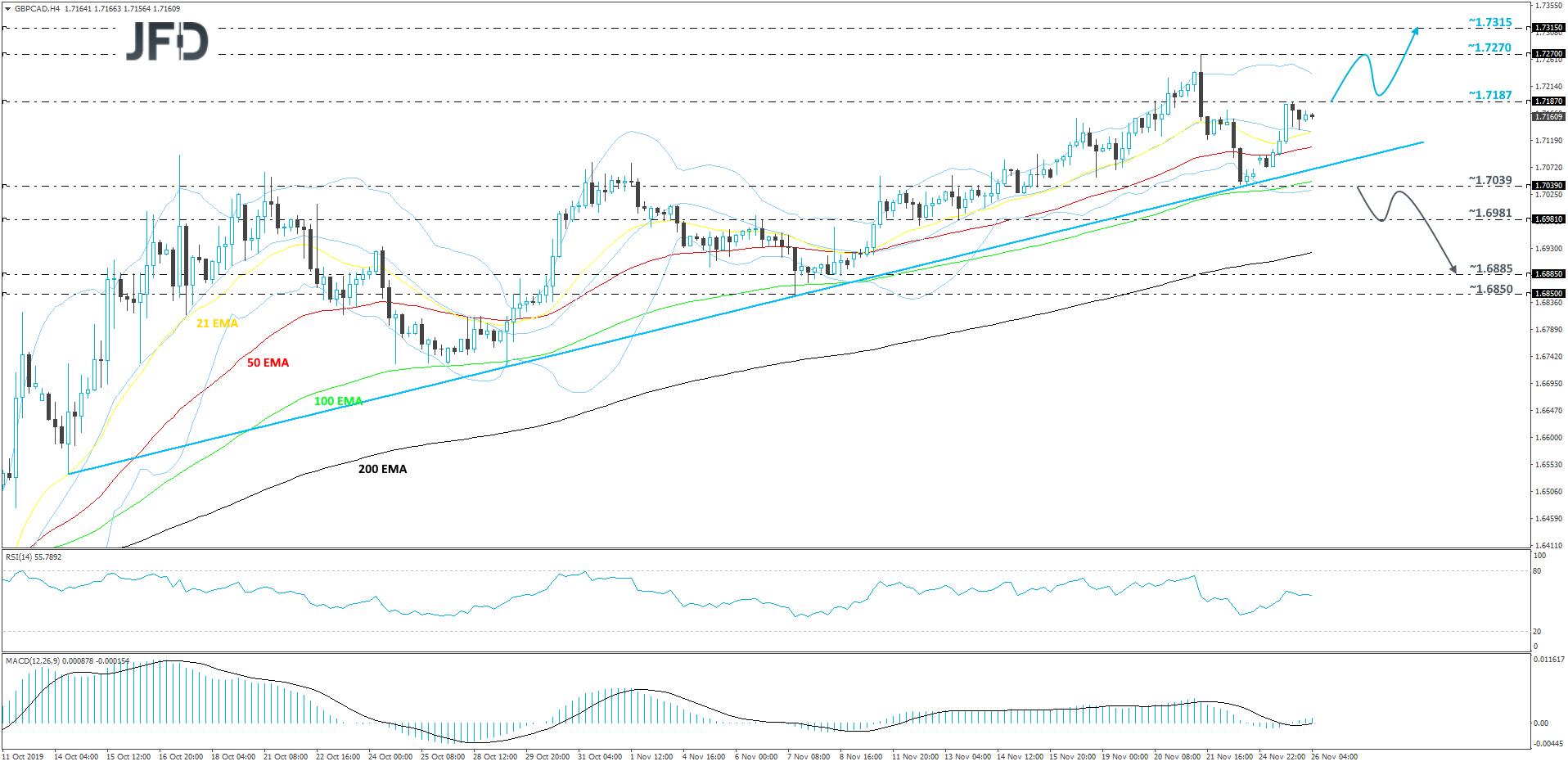

Once again, GBP/CAD rebounded from its short-term upside support line taken from the low of October 14th and made its way back above all of its EMAs. Yesterday, the pair found some resistance near the 1.7187 barrier and moved lower for a small retracement. As long as the rate continues to trade above the aforementioned upside line, we will remain positive, at least in the short run.

A push above yesterday’s high, at 1.7187, could attract more buying interest, which may help GBP/CAD to move to the current high of November, which is at the 1.7270 mark. But this is where the pair could find strong resistance, which may push the rate back down for a bit of retracement. That said, if it continues to balance above the 1.7187 hurdle, the bulls might take charge again, lift GBP/CAD beyond the 1.7270 barrier and target the 1.7315 level, which is marked near the lows of April 17th, 22nd and 23rd.

Alternatively, for us to consider the downside, a break of the previously-mentioned upside line would be needed. In addition to that, a rate-drop below the 1.7039 hurdle, which is the low of November 22nd, could strengthen the bears’ positions and the pair might drift further south. This is when we will target the 1.6981 obstacle, a break of which could set the stage for a move to the 1.6885 level, marked near the low of November 8th.

As for Today’s Events

The calendar is relatively light today. We get the Conference Board consumer confidence index for November, the new home sales for October, and the API (American Petroleum Institute) weekly report on crude oil inventories. The CB index is expected to have risen to 127.0 from 125.9, while new home sales are expected to have rebounded 1.1% mom after falling 0.7% in September. With regards to the API report, as it is always the case, no forecast is available.

As for tonight, during the Asian morning Wednesday, New Zealand’s trade balance is coming out, with the nation’s deficit expected to have widened.

We also have six speakers on the agenda: ECB Vice President De Guindos, ECB Executive Board member Coeure, RBA Governor Low, RBA Assistant Gov. Debelle, and Fed Board Governor Brainard. Tonight, during the Asian morning Wednesday, we will get to hear from RBNZ Governor Orr.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research