Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Equities Gain on Full COVID-19 Vaccine Approval

The US dollar fell against all the other major currencies yesterday and today in Asia, while equities were a sea of green, due to the US FDA granting full approval to the coronavirus vaccine developed by Pfizer Inc. and BioNTech. That said, market participants may slowly start adopting a more cautious approach ahead of the Jackson Hole Economic Symposium, as they seek clues and hints as to when Fed officials may start withdrawing monetary policy support.

FDA Approves Pfizer-BioNTech Vaccine, Investors Await Jackson Hole Symposium

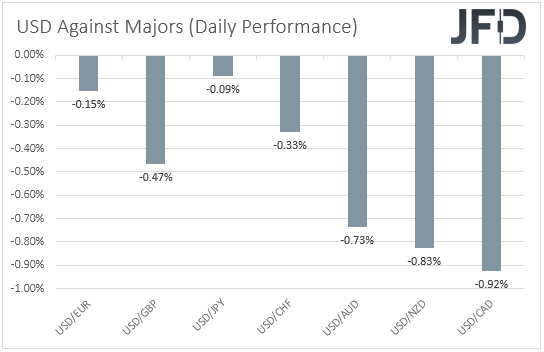

The US dollar traded lower against all the other major currencies on Monday and during the Asian session Tuesday. It fell the most against the commodity-linked CAD, NZD, and AUD in that order, while it slid the least versus JPY and EUR.

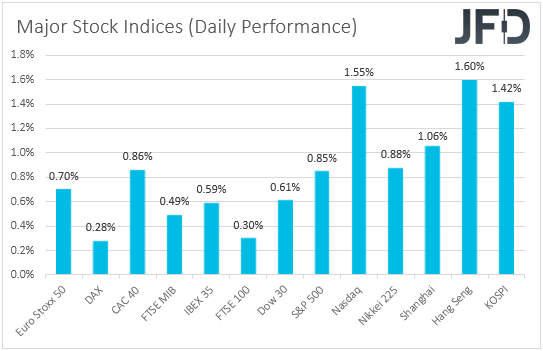

The weakening of the US dollar and the Japanese yen, combined with the strengthening of the risk-linked Aussie, Kiwi, and Loonie, suggests that financial markets traded in a risk-on fashion yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that EU shares traded in positive territory, with appetite improving even further during the US and Asian sessions. Both the S&P 500 and Nasdaq hit fresh record highs.

Initially, EU shares recovered from their biggest weekly loss in nearly six months, helped by mining and oil stocks as commodity prices bounced back, with appetite improving more later in the day and today in Asia as the US Food and Drug Administration (FDA) granted full approval to the coronavirus vaccine developed by Pfizer Inc. and BioNTech. This could cut down hesitancy and accelerate the vaccination process, at least in the US. What’s more, full approval means that the vaccine could get mandatory in some sectors, industries, and firms. The Pentagon has already said that it is preparing to obligate military personnel to get the jab, while New York said that it will require all public-school teachers to take it.

Having said all that though, we don’t expect the same euphoria today, as market participants may slowly start adopting a more cautious approach ahead of the Jackson Hole Economic Symposium, scheduled to begin on Thursday. All the attention is likely to fall on speeches by Fed officials and especially Fed Chief Jerome Powell, who will step up to the rostrum on Friday. At the latest policy gathering, Powell appeared dovish, but the minutes of that meeting revealed that officials largely supported beginning the normalization process later this year. What’s more, in the aftermath of the meeting, most of them expressed a more hawkish view than Powell, which combined with strong employment and inflation data, increased speculation that the Fed could start scaling back its QE purchases in the months to come, perhaps as early as next month.

So, it will be interesting to see whether Powell has changed his mind to support an earlier withdrawal. Up until the end of last week, there was decent speculation that he will provide relatively clear signals over the Fed’s future course of action. However, on Friday, Dallas Fed President Robert Kaplan said he might reconsider his hawkish stance if the virus hurts the economy, while yesterday, data showed that business activity in the US slowed for a third straight month due to the virus spreading. This may have lessened confidence that Powell will provide a clear QE-tapering timeline. Therefore, with the outcome very uncertain, we believe that investors are unlikely to alter much their portfolio balances ahead of the event.

We believe that equities, especially in the EU and the US, may continue trading north, but at a slower pace, while the US dollar may stay on the defensive for a while more. For the greenback to resume its recent uptrend, we believe that fresh signals over early tapering may be needed. This could also hurt equities at the moment, but we don’t expect a trend reversal. As we have noted several times recently, stock indices seemed to have stayed in their upside trajectories, whatever market participants anticipate around the Fed. In the past – before last week - we saw Wall Street hitting records at times when normalization expectations were brought forth, perhaps as investors were rushing to take advantage of low interest rates for as long as possible, but we also saw equities drifting north when such expectations were pushed back. This may have been due to the fact that low interest rates for longer mean low borrowing costs for companies for longer, as well as lower present values for longer.

S&P 500 – Technical Outlook

The S&P 500 cash index inched north yesterday, surpassing its prior record of 4481, to hit a new one slightly higher. Overall, the index continues to drift north above the upside support line drawn from the low of June 21st, and thus, we would consider the outlook to be positive.

We see the case for market participants to challenge the psychological zone of 4500 soon, where they may decide to take a break. This could result in a setback, even back below 4481. However, as long as the price would stay above the aforementioned upside line, we would see decent chances for another rebound. If so, investors may decide to overcome the 4500 this time around, and perhaps set the stage for the next possible psychological zone, at around 4550.

On the downside, we would like to see a clear dip below 4351, before we start examining a near-term trend reversal. S&P would already be below the upside support line, while the dip below 4351 would confirm a forthcoming lower low on the daily chart. The next stop may be at around 4318 or 4288, marked by the lows of July 21st and 8th respectively. If neither level is able to stop the slide, then we could experience extensions towards the low of July 19th, at 4232.

EUR/USD – Technical Outlook

EUR/USD rebounded strongly yesterday, after it hit support near 1.1665 on Friday. However, the recovery was limited near 1.1750, still below the downside resistance line drawn from the high of June 1st. The fact that the rate remains below that line suggests a still-negative near-term outlook. However, given that there is positive divergence between our short-term oscillators and the price action, we prefer to take the sidelines for now.

In order to start examining a downtrend resumption, we would like to see a dip back below 1705, a support marked by the low of August 11th. This could signal that the latest corrective recovery is over and may result in another test near 1.1665. Nonetheless, a break below that level is needed to solidify the view that the bears are in charge, as it will confirm a forthcoming lower low on the daily chart. If we indeed see such a move, the next are to consider as a support may be at around 1.1620, near the low of November 2nd.

In order, to assess whether the outlook has turned bullish, we would like to see a break above 1.1805. The rate would already be above the downside resistance line drawn from the high of June 1st, while the move above 1.1805 would confirm a forthcoming higher high. The bulls could lift the rate to the 1.1830 or 1.1853 levels, marked by the inside swing lows of August 5th and 3rd respectively, where another break could carry larger bullish implications, perhaps paving the way towards the peak of August 4th, at around 1.1900.

As for Today’s Events

The calendar appears relatively light today, with the only releases worth mentioning being Germany’s final GDP for Q2, which is expected to confirm its preliminary estimate, and the US new home sales for July, which are expected to have increased somewhat.

Tonight, during the Asian morning Wednesday, New Zealand’s trade balance for July is coming out, but no forecast is available.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.90% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research