Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

The US dollar Keeps Marching North, Lira Hits a Fresh Record Low

The US dollar continued climbing north against the other major currencies, but it is worth mentioning that, among the EM currencies, it hit a fresh record high against the Turkish lira. It seems that expectations over faster hikes by the Fed due to accelerating US inflation kept the dollar supported, but the Lira itself was also on a free fall mode, with the Turkish central bank expected to cut rates further next week, despite inflation in Turkey very close to 20%.

Accelerating US Inflation Pushes USD to a New Record Against TRY

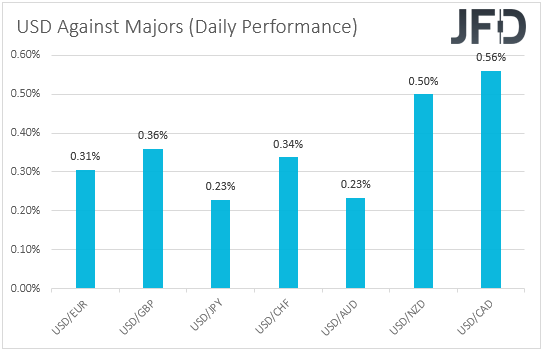

The US dollar continued marching north against all the other major currencies on Thursday and during the Asian session Friday, gaining the most versus CAD, NZD, and GBP in that order.

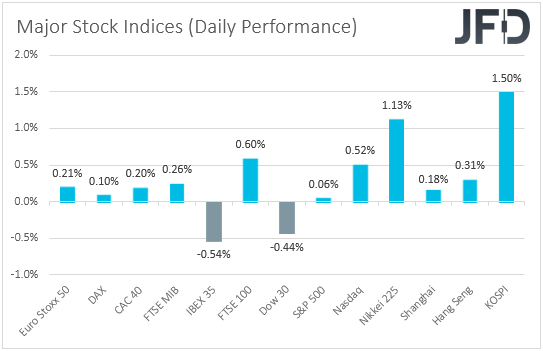

The strengthening of the US dollar and the weakening of the risk-linked currencies suggests that markets may have continued trading in a risk-off manner. However, turning our gaze to the equity world, we see that this was not the case. We see that all but two of the indices under our radar closed in positive territory, with the only exceptions being Spain’s IBEX 35 and Wall Street’s Dow Jones.

The US dollar may have continued being bought due to expectations of faster rate hikes by the Fed after the US CPIs accelerated by more than anticipated, but the effect on equities was limited, as we already warned after all. Remember that, ahead of the release, we highlighted that we were expecting a short-lived correction, and that, due to the resilience of the US economy to the latest bottlenecks, investors may stay willing to add to their risk exposures, despite increasing expectations over faster rate hikes.

The further strength in the US dollar also resulted in a fresh record high in the USD/TRY pair, and we see no signs of the rally abating anytime soon. Yes, the rally in the US inflation has helped the dollar, but the Turkish lira has been in a free fall as well. It lost two-thirds of its value in five years, weighing on the incomes of Turks along with extremely high inflation, while it lost 25% this year mainly due to concerns over the credibility of the Turkish central bank as President Tayyip Erdogan has been pushing for lower interest rates despite inflation running near 20%. Since September, the Turkish central bank has cut its benchmark rate by 300bps, arguing that the inflationary pressures are temporary, and it is expected to deliver another 100bps cut next week.

Now, back to the US and the greenback, another theme that may catch investors’ attention in the next few weeks may be the race on who will be the next Fed Chair, when Jerome Powell’s term ends in early February. At the moment, it seems that President Joe Biden is still weighing whether to keep Powell or pass the torch to Fed Governor Lael Brainard. Powell appears to be the favorite, at least according to an online political wagering, gathering 68% against Brainard’s 31%. Powell has the backing from moderate Democrats as well as Republicans, and a track record of averting a financial crisis and helping the economy to recover from the pandemic recession. However, he also received criticism on letting inflation surging to a 31-year high even as millions of citizens cannot find jobs. In any case, Brainard is considered to be more dovish than Powell on monetary policy, which, combined with the element of surprise, could affect the dollar negatively, if she is chosen. Now, in case Powell stays in charge, the dollar may rise slightly, but not massively. For now, we expect it to continue trending north on expectations that the Fed may eventually need to push the hike button earlier than previously thought.

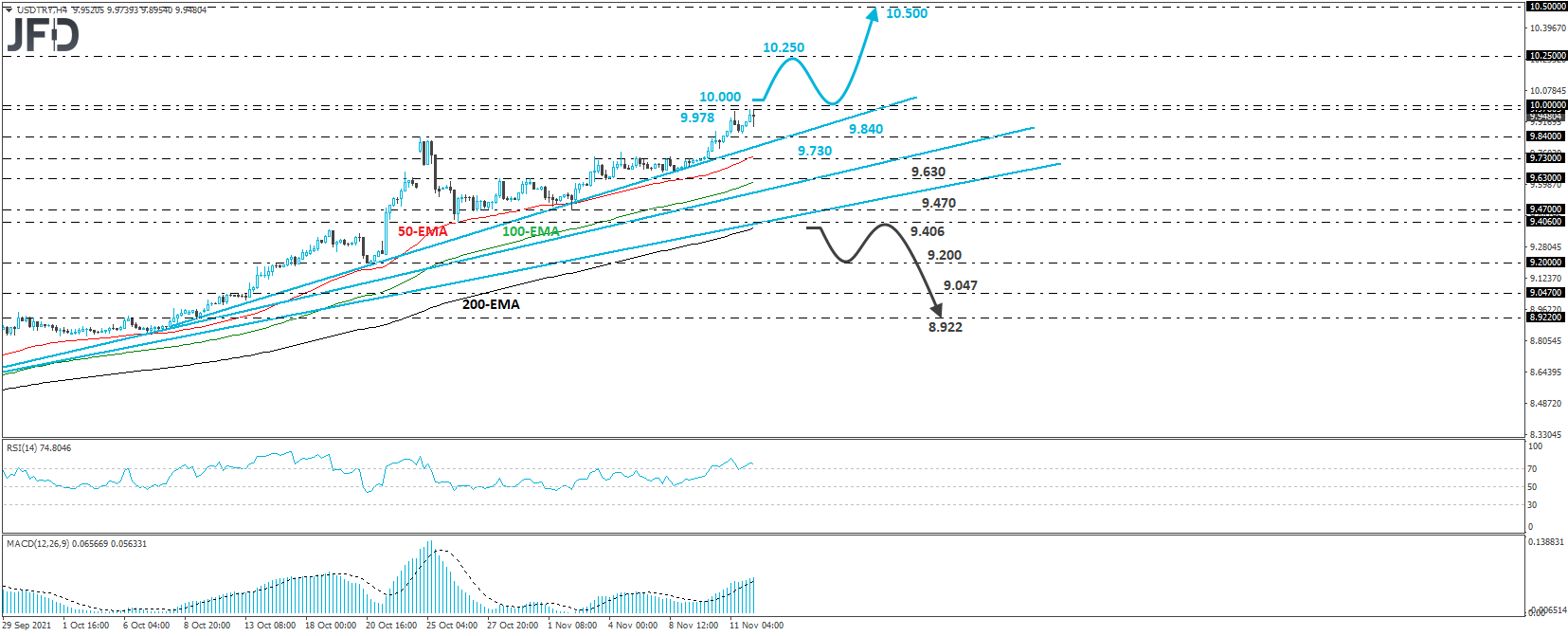

USD/TRY – Technical Outlook

USD/TRY continued its crazy advance yesterday, hitting a fresh record at 9.978, slightly below the round figure of 10.000. Overall, the pair has been in a short-term uptrend mode since September 7th, with the trend accelerating more and more as marked by new shorter-term and steeper upside support lines. So, with all that in mind, we see decent chances for the rate to continue sailing into uncharted waters.

A clear break above the psychological zone could set the stage for extensions towards the next psychological area of 10.500, but we don’t see the case of a straightforward rally. Traders may decide to take a break at around the middle of the road, at around 10.250, thereby allowing a correction lower, perhaps for a test at the 10.000 area as a support this time.

Now in order to start examining a short-term bearish reversal, we would like to see a slide all the way back below 9.406, marked by the low of October 26th. This could confirm the break below the upside support line taken from the low of September 7th, and could encourage declines towards the 9.200 zone, marked by the low of October 20th. If the bears are not willing to stop there, then we could see them diving towards the 9.047 area, marked by the inside swing high of October 12th, or towards the 8.922 zone, defined as a support by the low of October 11th.

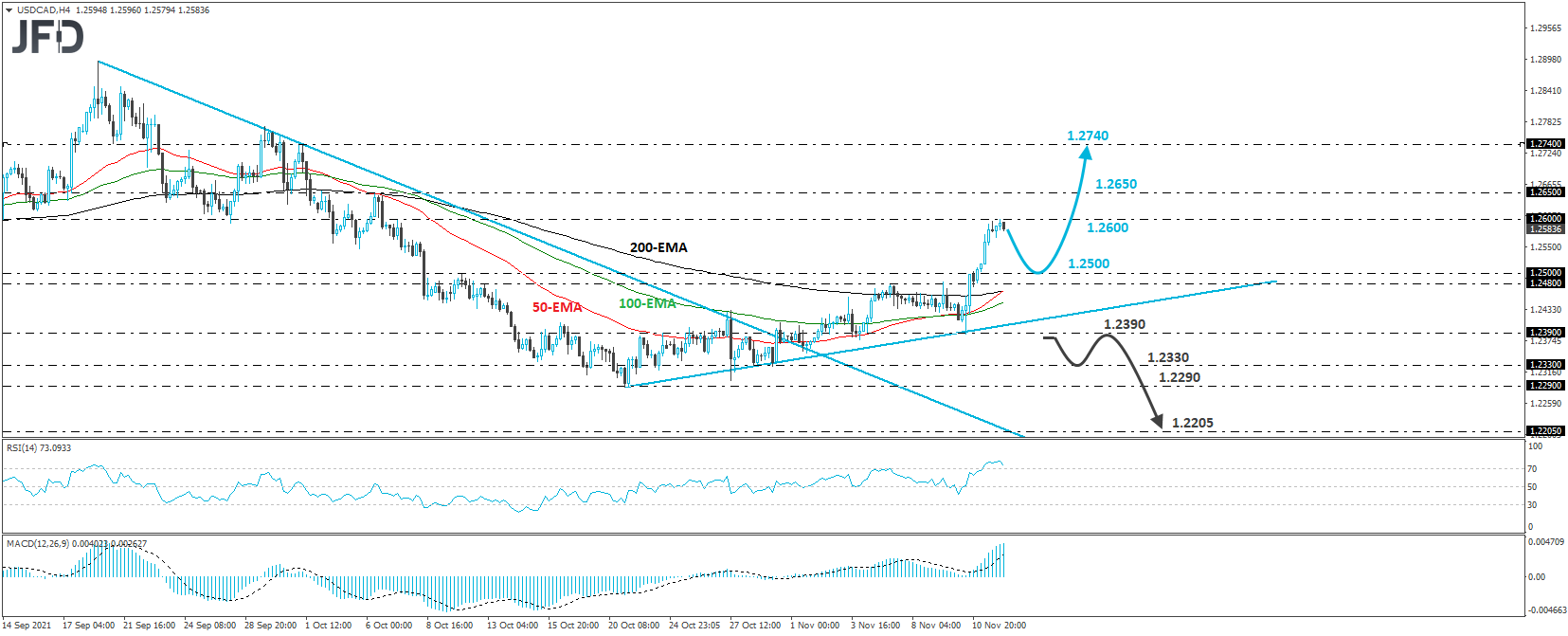

USD/CAD – Technical Outlook

USD/CAD traded sharply higher the last couple of days, after it hit support at 1.2390, near the upside support line drawn from the low of October 21st. What’s more, it emerged above the 1.2500 zone, thereby confirming a forthcoming higher high on the 4-horu chart. In our view, all these technical signs paint a positive near-term picture.

At the time of writing, the pair is resisting near the 1.2600 zone, marked by the high of October 7th, from where we see a decent chance for a setback. However, the bulls may jump back into the action from near the 1.2500 area and push for another test at 1.2600, or even a break higher. This could result in advances towards the 1.2650 barrier, marked by the high of October 6th, the break of which could extend the gains towards the high of October 1st, at 1.2740.

We will start examining the bearish case only upon a dip below 1.2390. This could signal the break below the upside line taken from the low of October 21st and may initially allow declines towards the 1.2330 or 1.2290 territories, marked by the lows of October 29th and 21st respectively. Now, if neither area is able to stop the decline, then we could see extensions towards the 1.2205 territory, defined as a support by the low of June 9th.

As for Today’s Events

The calendar is light today as well, with the only releases worth mentioning being the US JOLTs Job Openings for September and the preliminary UoM consumer sentiment index for November. The job openings are expected to have declined somewhat, while the Michigan index is forecast to have inched up to 72.4 from 71.7.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68.02% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research