Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Weekly Outlook: Oct 26 – Oct 30: ECB, BoC and BoJ Decide on Monetary Policy

We have three major central banks deciding on monetary policy this week and those are the ECB, the BoC and the BoJ. None of them is expected to alter its policy this week, and thus, investors’ attention will fall on signals with regards to their next steps. The ECB is expected to signal that more stimulus is on the cards at one of the upcoming gatherings, while the BoJ is anticipated to downgrade its economic projections. The BoC is expected to maintain its neutral language, perhaps signaling that it will continue sitting comfortably on the sidelines.

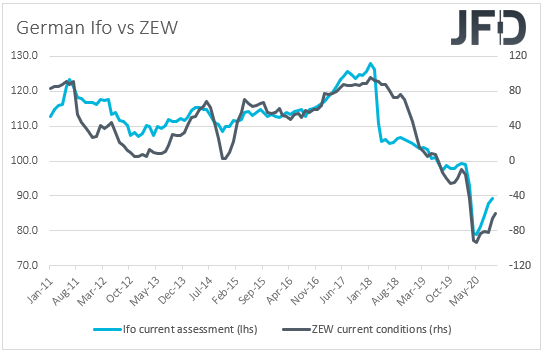

Monday is a relatively light day with the only data worth mentioning being the German Ifo survey for October and the US new home sales for September. With regards to the Ifo survey, the current assessment index is expected to have increased to 89.8 from 89.2, but the expectations one is forecast to have declined to 96.5 from 97.7. This would drive the business climate index down to 93.0 from 93.4. US new home sales are expected to have slowed to +2.8% mom from +4.8%.

Tuesday’s calendar is light as well. During the Asian morning, we have New Zealand’s trade balance for September, while later in the day, we get the US durable goods orders for the same month. Headline orders are expected to have increased at the same pace as in August, which is +0.5% mom, while the core rate is anticipated to have declined to +0.4% mom from +0.6%.

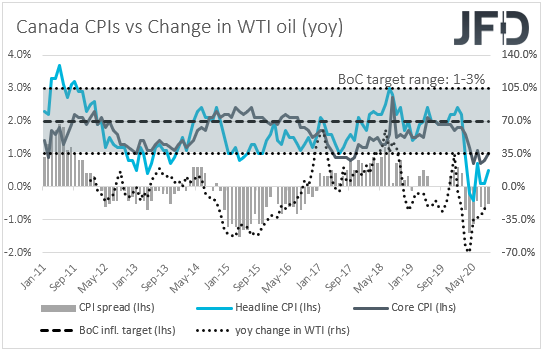

On Wednesday, the main event on the agenda may be the Bank of Canada interest rate decision. At its prior gathering, the BoC kept interest rates unchanged at +0.25%, repeating that they will stay there until the 2% inflation target is sustainably achieved. They also reiterated the view that they will continue with their QE program until the economic recovery is well underway, and that they stand ready to adjust their programs if market conditions change. They said that both the global and Canadian economies are evolving broadly in line with the scenario outlined in July, but added that the bounce-back in activity in the third quarter looks to be faster than anticipated in July.

Since then, employment data for September showed that the unemployment rate declined more than anticipated, with the economy gaining more jobs than initially forecasted. What’s more, headline inflation for the month accelerated to +0.5% yoy from 0.1%, while the core rate rose to +1.0% yoy from 0.8%. Although still below the Bank’s objective of 2%, accelerating inflation, combined with improving labor market, may allow BoC officials to sit comfortably on the sidelines for another gathering and reiterate their neutral language. The Loonie may gain somewhat on the absence of any signals with regards to imminent easing, but, as a commodity-linked currency, we believe its broader path will remain dependent to developments surrounding the broader market sentiment, and especially the US elections next week.

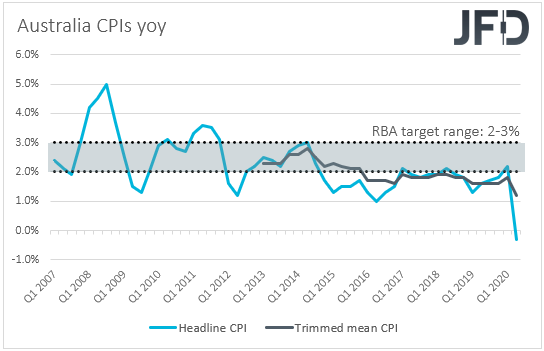

As for Wednesday’s data releases, the most important one seems to be Australia’s CPIs for Q3. Expectations are for the headline CPI rate to have rebounded to +0.7% yoy from -0.3%, and for the trimmed mean one to have ticked down to +1.1% yoy from +1.2%. The weighted mean CPI rate is forecast to have remained unchanged at +1.3% yoy.

At its latest gathering, the RBA kept its monetary policy settings unchanged, disappointing those looking for further easing after Deputy Governor Guy Debelle flagged the prospect. Having said that though, a couple of weeks ago RBA Governor Philip Lowe said that more stimulus is possible, with the options including bond buying and a small rate cut. On top of that, the minutes of the latest RBA gathering revealed that officials discussed cutting rates and buying longer-dated debt, which suggests that other members, besides Lowe and Debelle, share the same view. Thus, even if the CPIs improve somewhat, the chances for further action at the next gathering are likely to remain high. According to the ASX 30-day interbank cash rate futures yield curve, there is a 74% probability for interest rates to be cut to zero. Market chatter suggests that rates could be cut to 0.10%, a move that is more than fully priced in.

On Thursday, the central bank torch will be passed to the BoJ and the ECB. During the Asian morning, the BoJ is forecast to hold off from acting, but several reports suggest that officials will proceed with downgrading their economic forecasts. In any case, as it happened during most of the latest BoJ meetings, the yen is unlikely to respond. We believe that the safe-haven currency will stay mostly responsive to developments surrounding the broader investor appetite.

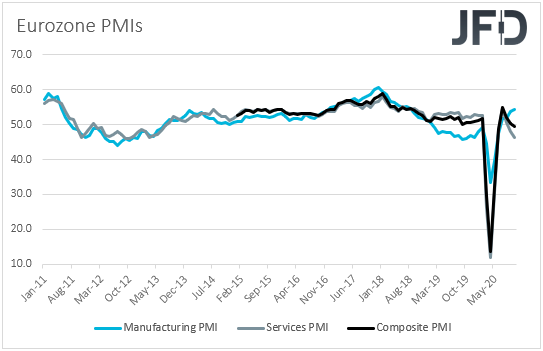

Passing the ball to the ECB, when they last met, officials of this Bank kept monetary policy untouched, reiterating that they stand ready to adjust all their instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.

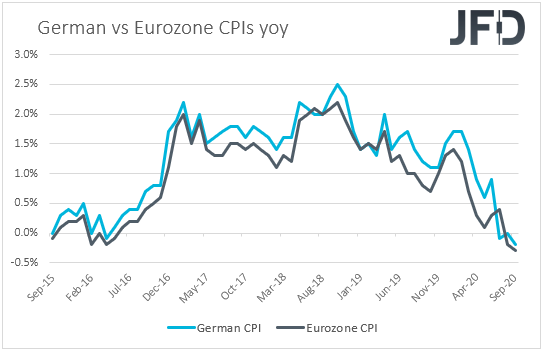

Since then, data showed that the headline CPI rate for September slid further into the negative territory, with the core rate standing at just +0.2% yoy. What’s more, last Friday, the preliminary PMIs for October showed that the services sector slipped deeper into contraction, dragging the composite index below the boom-or-bust 50 zone for the first time since June. Combined with the fact that the coronavirus is spreading at a very fast pace around the bloc, forcing nations to reintroduce restrictive measures, the aforementioned data suggests that further stimulus is necessary by this central bank, and even if we don’t get it at this meeting, we believe that policymakers will provide strong hints that some form of action will be served at one of the upcoming gatherings. Clear signals over more easing soon may prove negative for the euro.

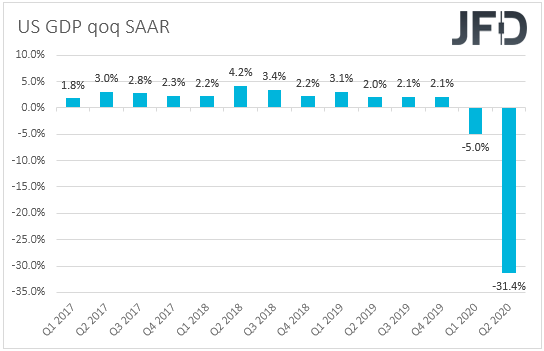

As for Thursday’s economic indicators, the 1st estimate of the US GDP for Q3 is coming out, with the forecast pointing to a 31.9% qoq SAAR rebound following a 31.4% contraction in Q2. That said, the Atlanta GDPNow model suggests a 35.3% rebound and thus, we would consider the risks surrounding the official release as tilted to the upside. Germany’s preliminary inflation data for October is also coming out, with the CPI rate expected to have slid to -0.3% yoy from -0.2%, and the HICP one to have held steady at -0.4%.

On Friday, during the Asian morning, we get the usual end-of-month data dump from Japan. The unemployment rate for September is expected to have ticked up to 3.1% from 3.0%, while the jobs-to-applications ratio is forecast to have remained unchanged at 1.04. Industrial production for the same month is anticipated to have accelerated to +3.2% mom from +1.0%, while no forecast is available for retail sales. The Tokyo CPIs for October are also coming out, but no forecast is available for this data set either.

During the European session, we have Eurozone’s 1st estimate of GDP for Q3 and the bloc’s preliminary CPIs for October. Both the yoy rates of the GDP and the headline CPI are expected to stay unchanged at -15.0% and -0.3%, while no forecast is available for the core CPI rate. The core HICP one is expected to have held steady at +0.4% yoy.

Later in the day, in the US, personal income and spending for September, alongside the core PCE index for the month, are coming out. Personal income is expected to have rebounded 0.5% mom after sliding 2.7% in August, while the spending rate is forecast to have held steady at +1.0% mom. The core PCE index is expected to have ticked up to +1.7% from +1.6%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research