Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Can The Red Electrica Stock Overcome The February High?

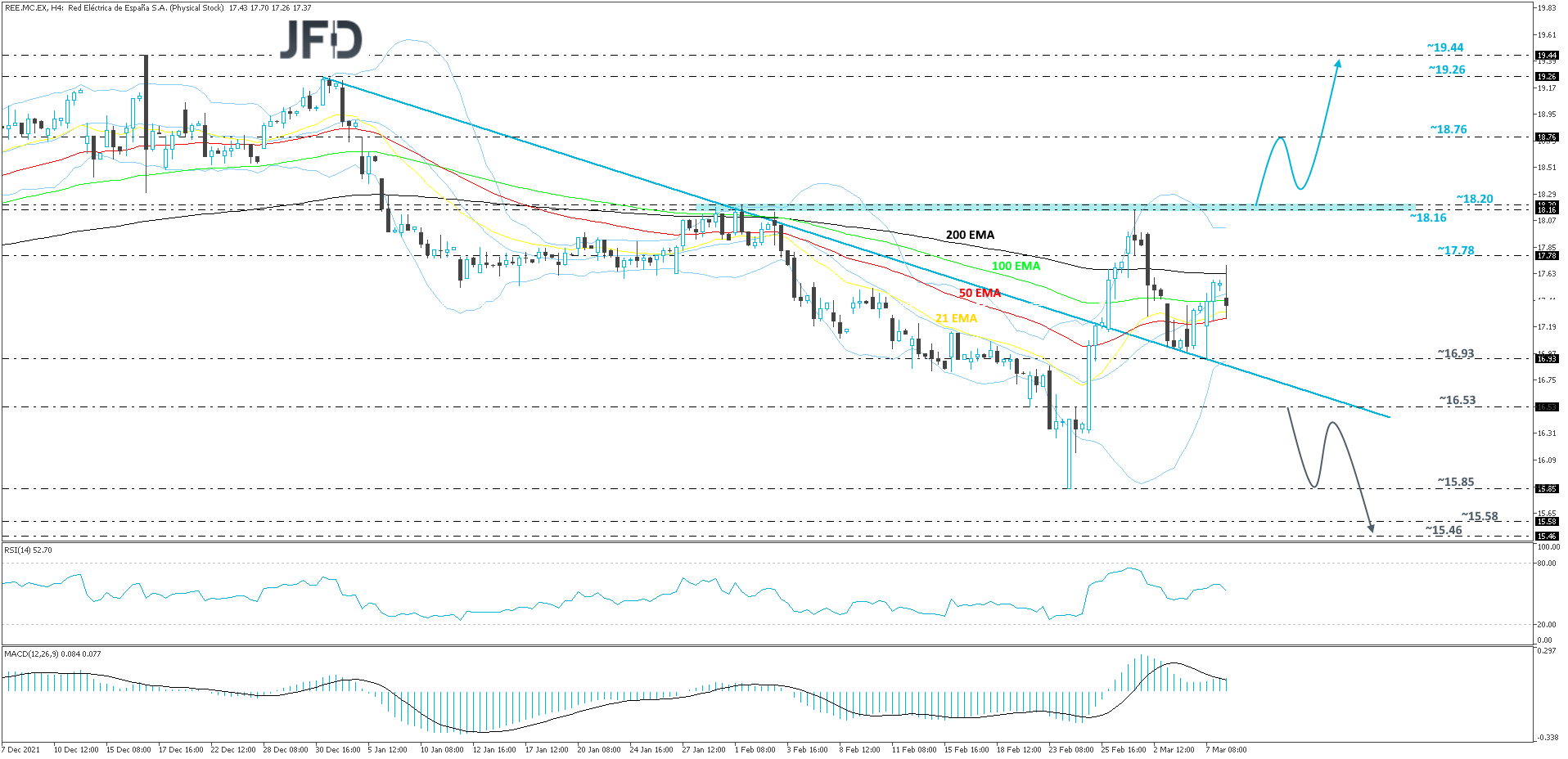

The technical picture of the Red Electrica Corporation SA (BME: REE) on our 4-hour chart shows that, after finding resistance near the area between the 18.16 and 18.20 levels, marked by the current highest point of March and the highest point of February respectively, the share price went lower. However, this might have been seen just as a corrective move lower, as the stock continues to trade above a short-term downside resistance line, drawn from the high of January 3rd. That said, in order to aim for higher areas, we would still prefer to wait for a break above the 18.20 barrier first. Hence our cautiously bullish approach for now.

If, eventually, that jump happens and the stock moves above the 18.20 barrier, this will confirm a forthcoming higher high. More buyers could join in and drag REE to the 18.76 obstacle, marked by the high of January 5th. If the buying doesn’t stop there, the next potential target might be at 19.26, which is the current highest point of this year.

The RSI is currently pointing lower but remains above 50. The MACD is flat but sits above zero and slightly above the trigger line. The two oscillators show positive price momentum, however we would like to see a push above the 18.20 barrier first, before examining higher areas.

Alternatively, if the stock drops below the previously discussed downside line, this may spook some new buyers from entering, especially if REE also moves below the 16.53 hurdle, marked by the inside swing high of February 24th. The share price may fall to the 15.85 hurdle, which is the lowest point of February, where a temporary hold-up could occur. If that hurdle doesn’t break the fall, the next possible aim might be at 15.58, or at the 15.46 level, marked by the lowest point of June 2021.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research