Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Campbell Soup Company Stock Pops Above Key Resistance

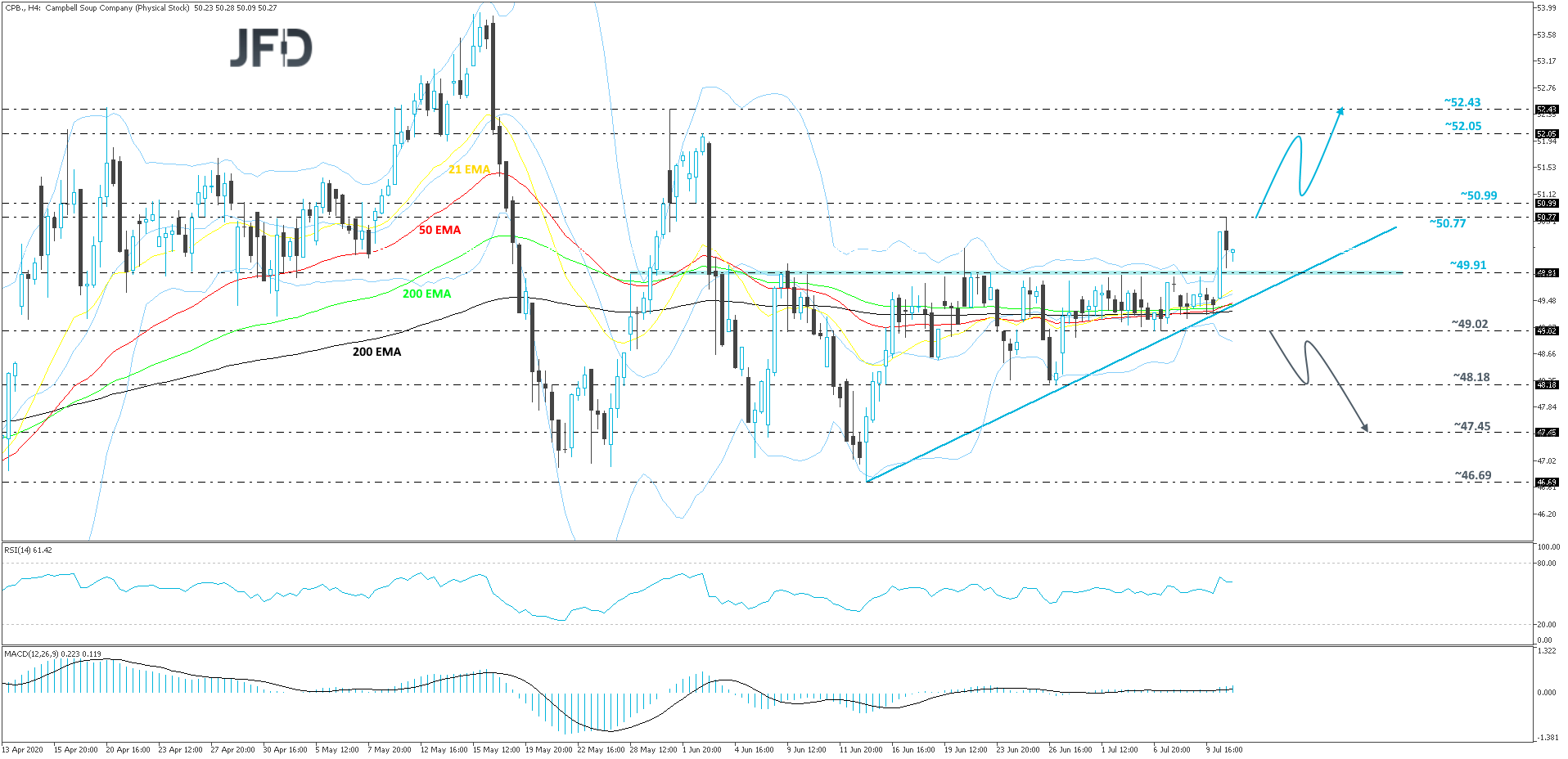

Looking at the technical picture of the Campbell Soup Company stock (NYSE: CPB), on Friday, the share price exploded to the upside, closing in the positive territory for the week. In addition to that, despite declining in the second half of its trading session, CPB managed to close the week above one of its key resistance barriers, at 49.91, which kept the price lower from around the beginning of June. Also, the stock is still balancing above a short-term tentative upside support line drawn from the low of June 15th. As long as that upside line stays intact, we will stay positive, at least in the near term.

As mentioned above, that upside line may continue providing support for CPB. However, to get a bit more comfortable with higher areas, we would like to see the stock rising above the high of last week, at 50.77. That way, the share price could accelerate to the 50.99 obstacle, a break of which might set the stage for a rise to the high of June 2nd, at 52.05, where the stock could get an initial hold-up. Then, if it struggles to overcome that obstacle straight away, CPB might even retrace back down a bit. However, if the share price continues to balance somewhere above the 51-dollar mark, the buyers might take their chances and lift CPB up again. If they manage to overcome the 52.05 hurdle, the next possible resistance area might be near the 52.43 level, which is the highest point of June.

Our oscillators on the 4-hour chart, are somewhat in support of the bullish case, at least for now. The RSI is above 50 but is currently a bit flat. The MACD, on the other hand, is pointing slightly to the upside, while sitting above zero and its trigger line. Both indicators show a slightly rising upside price momentum, which comes in-line with the idea discussed above.

Alternatively, if the share price suddenly breaks the aforementioned upside line and also falls below the 49.02 hurdle, marked by the current lowest point of June, that could temporarily halt new investors from jumping in. The stock might drift to the low of June 26th, a break of which may clear the path to the 47.45 zone, marked by an intraday swing high of June 12th.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research