Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

CaixaBank Stock Shows Slight Weakness

The Spanish CaixaBank SA (BME: CABK) recently came under fire, after announcing their plans to cut its workforce by 6452 jobs. However, the original proposal was for a total of 8291 role. This comes a few months after CaixaBank’s merger with Bankia SA. But interestingly enough, most of the job cuts will be one CaixaBank’s side. The Spanish labor unions are in talks with the bank and according to them, they managed to agree, so that it would be a voluntary leave for the bank worker. But the main issue here is that such job cuts always send a signal that the industry is not at its best times right now and other banks might follow suit.

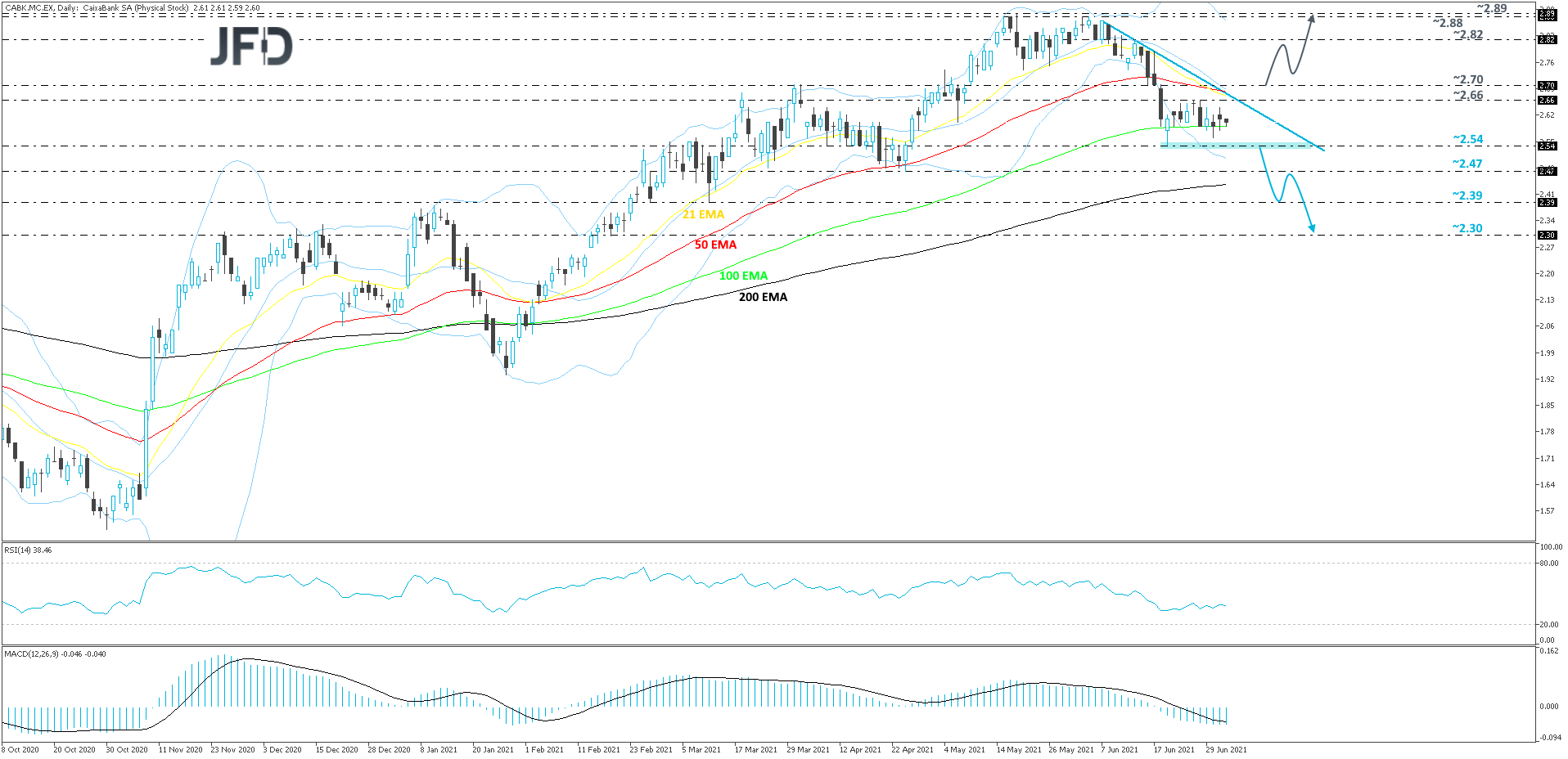

Looking at the technical picture of CABK on our daily chart, we can see that after the reversal lower in the beginning of June, the share price is now trading below a short-term downside resistance line taken from the high of June 7th. The stock is now approaching one of its key support areas, at 2.54, marked by the lowest point of June. In order to examine further declines, a break of that support area would be needed.

If, eventually, the share price falls below the 2.54 hurdle, this will confirm a forthcoming lower low, possibly opening the door for a move to the 2.47 obstacle, or to the 2.39 zone, marked by the lowest point of March. Near that zone CABK might get halted temporarily, but if there are still no new buyers around that price, the stock may continue its journey south, potentially targeting the 2.30 level. That level marks the low of February 18th.

The RSI and the MACD are currently pointing slightly lower. Also, the RSI remains below 50 and the MACD continues to run below zero and its trigger line. The two oscillators show increasing downside speed of the price, which comes in line with the scenario discussed above.

Alternatively, if the stock breaks the aforementioned downside resistance line and then climbs above the 2.70 barrier, marked by the lows of May 10th and June 16th, that could clear up the path towards higher areas. That’s when we will target the 2.82 obstacle, a break of which may send CABK to the next potential resistance area between the 2.88 and 2.89 levels, marked by the highest point of June and May respectively.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research