Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Brent Crude Oil Trades in a Rally Mode

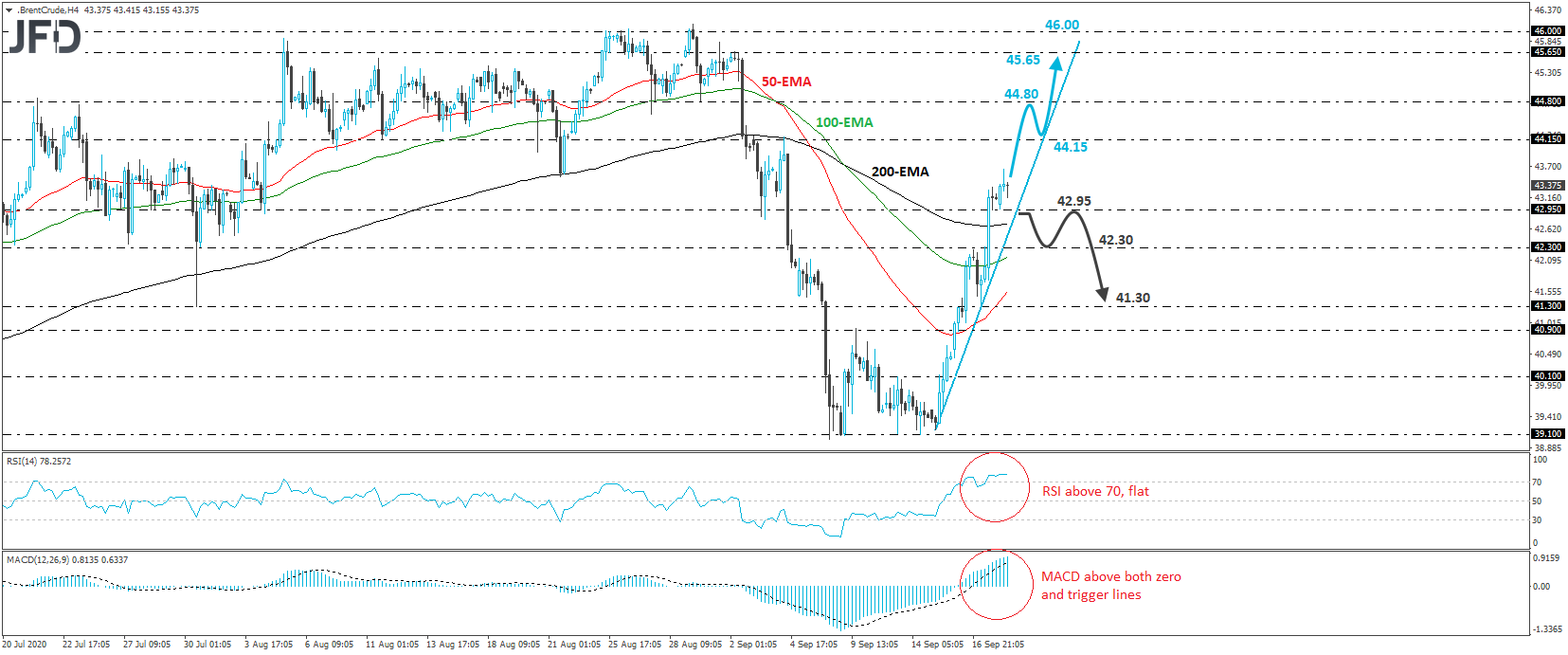

Brent oil has been in a rally mode since Tuesday, when it hit support fractionally above the key area of 39.10. Yesterday, the liquid surged above the 42.95 zone after Hurricane Sally cut US production and after the OPEC+ group agreed to take action against members not complying with their latest deal. Overall, we can mark an steep upside support line from the Tuesday’s low, above which the price continues to trade, thereby keeping the short-term outlook positive.

If the bulls are willing to stay in the driver’s seat, we may see them targeting the 44.15 resistance soon, marked by the high of September 4th. If they don’t stop there, the rally could extend towards the 44.80 area, defined as a resistance by the inside swing low of August 31st. If that zone is also violated, the next stop may be the peak of September 2nd, at 45.65.

Looking at our short-term oscillators, we see that the RSI lies above 70, but points east, while the MACD, although above both its zero and trigger lines, shows signs of slowing down as well. Both indicators detect strong upside speed, but their flattening suggests that a pullback may be on the cards soon, perhaps after the bulls challenge the 44.15 or the 44.80 zones.

In order to abandon the bullish case, we would like to see a drop back below 42.95. Such a move would also take the black liquid back below the aforementioned steep upside line and may initially trigger declines towards the 42.30 barrier, defined as a support by Wednesday’s inside swing high. Another break, below 42.30, could carry larger bearish implications, perhaps setting the stage for yesterday’s low, at around 41.30.

Anotación: Artículo traducido del original en inglés

Aviso de Riesgos:

El contenido que producimos no constituye asesoramiento de inversión o recomendación de inversión (no debe considerarse como tal) y de ninguna manera constituye una invitación para adquirir ningún instrumento o producto financiero. El Grupo de Compañías de JFD, sus afiliados, agentes, directores, funcionarios o empleados no son responsables de ningún daño que pueda ser causado por comentarios o declaraciones individuales de analistas de JFD y no asume ninguna responsabilidad con respecto a la integridad y corrección del contenido presentado. . El inversor es el único responsable del riesgo de sus decisiones de inversión. En consecuencia, debe buscar, si lo considera apropiado, asesoramiento profesional independiente relevante sobre la inversión considerada. Los análisis y comentarios presentados no incluyen ninguna consideración de sus objetivos personales de inversión, circunstancias financieras o necesidades. El contenido no se ha preparado de acuerdo con los requisitos legales para los análisis financieros y, por lo tanto, el lector debe verlo como información de marketing. JFD prohíbe la duplicación o publicación sin aprobación explícita.

Los CFD son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 84,25% de las cuentas de inversores minoristas pierden dinero cuando negocian CFD con la Compañía. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse correr el alto riesgo de perder su dinero. Lea la Divulgación completa de riesgos.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research