Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Are Investors Betting on William Hill Stock Again?

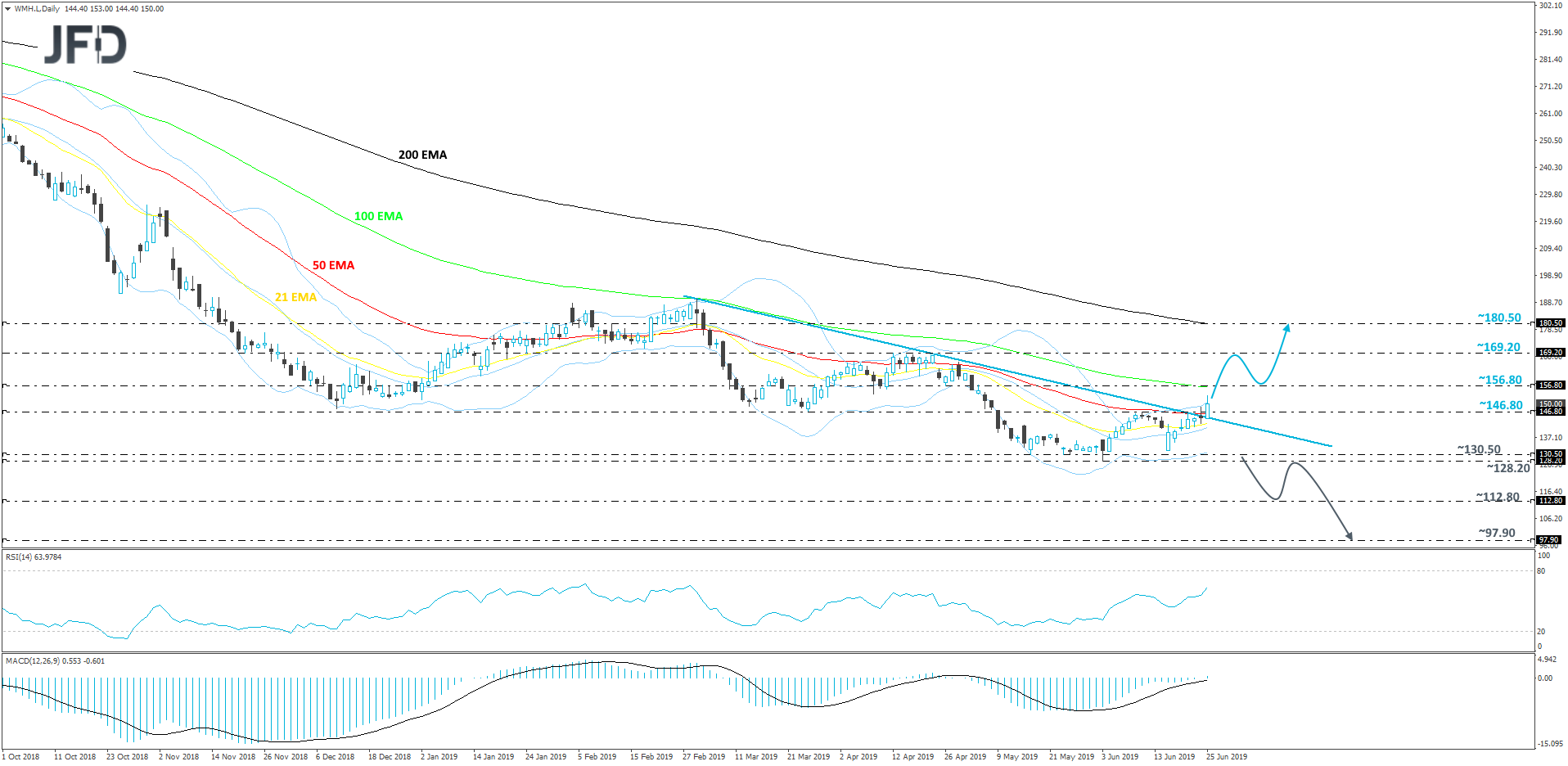

Looking at the technical picture of the William Hill stock (LON: WMH), it seems that it started gaining interest among investors again. Last week, the share price tested its medium-term tentative downside resistance line, drawn from the high of March 1st, but wasn’t able to break above it. Today we are seeing a different image, where the stock managed to climb above that line, which may result in some higher areas being met in the near future. As long as WMH keeps on trading above the previously-mentioned downside line, we remain positive, at least over the short-term outlook.

Given that WMH broke above the 146.80 barrier, marked near the highs of June 11th and 20th, it may continue moving in the upwards direction for a while. The stock could go and test the 156.80 obstacle, a break of which might lead the price to the 169.20 hurdle, which is marked near the highs of April 12th and 17th. We may see WMH slowing down near that hurdle, or even retracing back down a bit. But if the share price stays above the 146.80 zone, WMH might reverse and climb back up again. The move could force the stock to bypass the 169.20 and test the 180.50 level, marked by the high of February 12th and the low of February 22nd. That level also coincides with the 200-day EMA.

Our oscillators shows that the price seems to be gaining positive momentum again, which supports the above-discussed idea. The RSI continues to run above 50 and still points to the upside. The MACD has just re-surfaced above zero and is also now pointing to the upside, not to mention that it sits above its trigger line as well.

Alternatively, if the price reverses and takes a dive back below the aforementioned downside resistance line, we will shift away from the upside idea, especially if the stock falls below the support area between the 128.20 and 130.50 levels. That break would confirm a forthcoming lower low and could send WMH to the 112.80 zone, marked by the low of December 2nd, 2008. If that area is not able to withstand downside pressure, a break of it could lead share price to the 97.90 hurdle, which marks the lowest point of 2008.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

JFD Research

JFD Research

Marcus Klebe

Marcus Klebe