Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Anglo American Stock Is on Shaky Grounds

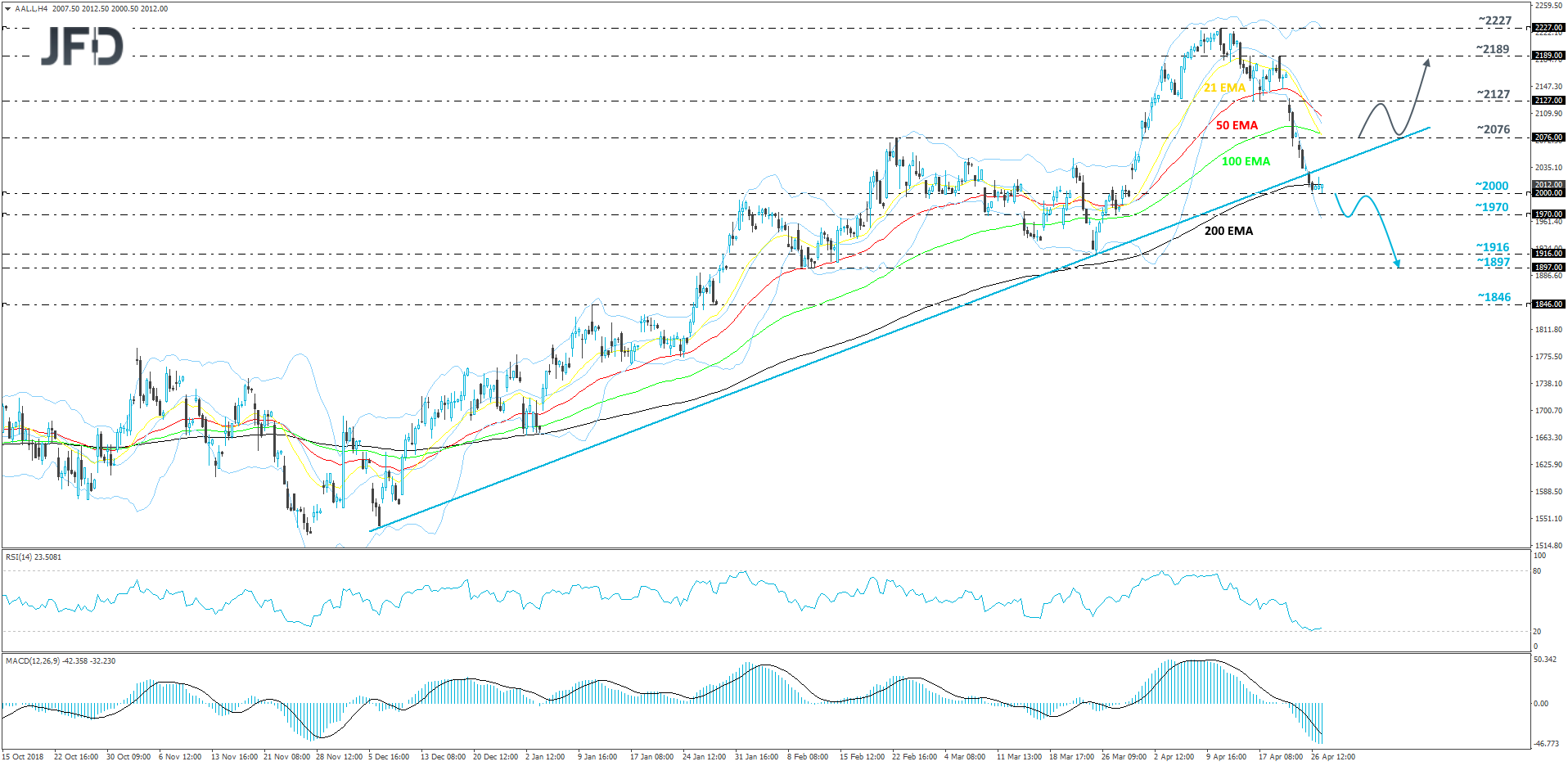

From the beginning of December, the Anglo-American stock (LON: AAL) had a great run, where it kept trading above its medium-term tentative upside support line drawn from the low of December 6th. But on Friday, the upside line got violated and the share price slid closer to the psychological 2000 area. AAL is still trading above that zone, but given that upside trendline has been broken now, the chances of seeing a further move lower have increased, hence why will take a somewhat bearish stand for now.

If the stock does not attract any investor interest at the psychological 2000 level, a break below it could send AAL a bit lower, to test the 1970 support area, which is marked by the low of March 27th. At some point, the share price could rebound back up, but if it continues to trade below the aforementioned upside support line, we will class any move higher as a temporary correction before another leg of selling. This time, if the stock travels further south and the 1970 hurdle fails to hold it, a break below it might open the door to the 1916 obstacle, or even the 1897 level, marked by the lows of March 25th and February 12th respectively.

On the other hand, a break back above the previously-discussed upside support line and a strong push above the 2076 barrier, could increase the stock’s chances to move up again in the near-term. This is when we will examine the possibility for AAL to move towards the 2127 obstacle again, which marks the intraday swing low of April 17th. If the buying doesn’t ease off there, a further push higher could bring the share price to the 2189 mark, which is the high of April 23rd.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

There are risks involved with trading of cash equities. Past performance is not indicative of future results. You should consider whether you can tolerate such losses before trading. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Marcus Klebe

Marcus Klebe

JFD Research

JFD Research