Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

Direct Access To Precious Metals & Currency Markets

Enjoy ultra-competitive spreads, low trading costs, full anonymity, and full transparency when trading FX and precious metals with JFD. In addition, you can benefit from ultra-low latency access to a range of majors, minors, and exotic currency pairs.

Why Trade Forex?

Forex & Precious Metals In Short

Note: The lower margin is available only to “professional” clients and clients of JFD Overseas Ltd.

Pre-Trade Transparency

Take advantage of JFD's pre-trade transparency and see the potential price associated with the planned size of your trading order according to the available depth of market (DoM) for the chosen instrument. The DoM feature and many other useful tools are available in our MetaTrader platforms.

Commissions / Fees

| Instruments | USD | EUR | GBP | CHF |

|---|---|---|---|---|

| Forex * | 2.7 USD | 2.5 EUR | 2.5 GBP | 2.7 CHF |

| Precious Metals - Standard * | 2.7 USD | 2.5 EUR | 2.5 GBP | 2.7 CHF |

* commission per 1 Lot per side

JFD liquidity pool

Aggregation and bridging venues

Rollover & Swaps

If FX or precious metals positions are held during rollover, you could incur swap fees. The swap rate is the interest rate differential between the two currencies of the pair you are trading. It’s calculated based on whether your position is short or long. Please note: The swap rates listed below may be subject to fluctuations due to volatilities and are reviewed and updated on a daily basis.

Currency Pair | Long (Points) Per year | Short (Points) Per year |

|---|---|---|

| AUDCAD | 1.29 | -9.54 |

| AUDCHF | 2.59 | -10.70 |

| AUDJPY | 3.95 | -17.13 |

| AUDNZD | 0.34 | -6.86 |

| AUDSGD | 1.09 | -10.47 |

| AUDUSD | -1.93 | -0.68 |

| CADCHF | 1.54 | -7.18 |

| CADJPY | 2.00 | -11.78 |

| CHFJPY | -6.92 | -1.89 |

| EURAUD | -19.90 | 3.59 |

| EURCAD | -5.94 | -1.89 |

| EURCHF | 1.79 | -11.33 |

| EURCZK | -25.60 | 1.96 |

| EURDKK | -12.52 | -30.99 |

| EURGBP | -11.67 | 1.86 |

| EURHKD | -98.22 | 9.33 |

| EURHUF | -94.88 | 17.03 |

| EURJPY | 2.64 | -16.31 |

| EURNOK | -176.61 | 23.06 |

| EURNZD | -14.65 | 1.42 |

| EURPLN | -114.97 | 12.15 |

| EURRUB | -1580.05 | 64.47 |

| EURSEK | -28.41 | -47.24 |

| EURSGD | -0.25 | -3.98 |

| EURTRY | -12147.22 | 1168.87 |

| EURUSD | -13.66 | 1.19 |

| GBPAUD | -2.04 | -7.79 |

| GBPCAD | 3.68 | -21.08 |

| GBPCHF | 5.76 | -23.67 |

| GBPDKK | 1.97 | -14.62 |

| GBPJPY | 8.87 | -38.50 |

| GBPNOK | -43.24 | -55.06 |

| GBPNZD | 1.65 | -17.52 |

| GBPPLN | -43.83 | 4.37 |

| GBPSEK | 26.21 | -216.19 |

| GBPSGD | 2.83 | -25.04 |

| GBPTRY | -13578.69 | 1219.74 |

| GBPUSD | -1.90 | -3.42 |

| NOKSEK | 1.49 | -17.34 |

| NZDCAD | 0.25 | -5.38 |

| NZDCHF | 1.81 | -8.36 |

| NZDJPY | 2.68 | -13.25 |

| NZDSGD | 0.08 | -7.08 |

| NZDUSD | -4.16 | 0.41 |

| SGDJPY | 1.36 | -14.46 |

| TRYJPY | 1.06 | -10.63 |

| USDCAD | 2.76 | -14.52 |

| USDCHF | 4.07 | -17.79 |

| USDCNH | 8.05 | -144.70 |

| USDCZK | -0.04 | -1.52 |

| USDDKK | 14.21 | -100.70 |

| USDHKD | -4.66 | -49.59 |

| USDHUF | -41.73 | 5.57 |

| USDILS | -8.41 | -26.91 |

| USDJPY | 6.66 | -26.81 |

| USDMXN | -545.42 | 101.43 |

| USDNOK | -36.55 | -27.03 |

| USDPLN | -34.34 | 4.43 |

| USDRUB | -599.23 | -597.01 |

| USDSEK | 18.81 | -149.03 |

| USDSGD | 2.00 | -17.12 |

| USDTRY | -10200.62 | 926.72 |

| USDZAR | -332.78 | 53.14 |

| XAGUSD | -2.69 | 0.49 |

| XAUUSD | -84.25 | 8.45 |

| XAGEUR | -1.04 | -0.16 |

| XAUEUR | -47.85 | 2.86 |

| XPTUSD | -38.80 | -61.72 |

| ZARJPY | 0.00 | -0.03 |

| GBPZAR | -400.48 | 68.47 |

| EURMXN | -929.42 | 163.55 |

| EURZAR | -573.45 | 123.85 |

| GBPMXN | -77.74 | 11.68 |

Any Questions?

The security of clients' funds is our highest priority at JFD. All client funds are held in a separate, segregated account with a top-tier credit institution or qualifying money market fund.

We keep detailed records of all transactions made in our clients’ accounts and in the highly unlikely event of JFD's insolvency, those records will be passed to the liquidator who will manage JFD's assets and distribute funds among clients, if applicable.

In addition, eligible clients can apply for compensation via the Investor Compensation Schemes relevant to their regulatory body. For any further information regarding the ICF, please visit: https://www.cysec.gov.cy/en-GB/investor-protection/tae/information/

Please send an email regarding this to support@jfdbrokers.com

The Currency conversion scenarios calculation formulas are:

First roll after the trade is opened:

((Position volume * Open price of the traded symbol / FX Rate ask price at the current end of day) - (Position volume * Open Price of the traded symbol / FX Rate bid price at the moment of position opening))

Example: (52x48.6/1.07981) - (52x48.6/1.07934) = 2340.41-2341.43 = -1.02

Every other roll:

((Position volume * Open price of the traded symbol / FX Rate ask price at the current end of day) - (Position volume * Open price of the traded symbol / FX Rate bid price at the Previous day, end of day))

Example: (52x48.6/1.08446) - (52x48.6/1.07977) = 2330.38 - 2340.50 = -10.12

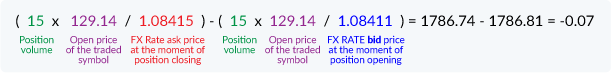

Intraday trades:

((Position volume * Open price / FX Rate ask price at the moment of position closing) - (Position volume * Open price / FX Rate bid price at the moment of position opening))

Example: (15x129.14/1.08415) - (15x129.14/1.08411) = 1786.74 - 1786.81 = -0.07

On Position Close:

((Position volume * Open price / FX Rate ask price at the moment of position closing) - (Position volume * Open price / FX Rate bid price at the Previous day, end of day))

Example: (20x94.02/1.08361) - (20x94.02/1.07986) = 1735.31 - 1741.33 = -6.02

For EUR account base currency to USD Traded Symbol Base Currency, the FX Pair needed for the conversion is EURUSD.

For GBP account base currency to USD Traded Symbol Base Currency, the FX Pair needed for the conversion is GBPUSD.

The Currency conversion scenarios calculation formulas are:

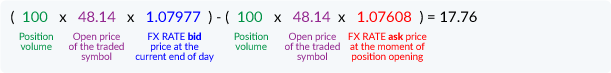

First roll after the trade is opened:

((Position volume * Open price of the traded symbol * FX Rate bid price at the current end of day) - (Position volume * Open price of the traded symbol * FX Rate ask price at the moment of position opening))

Example: (100*48.14*1.07977) - (100*48.14*1.07608) = 17.76

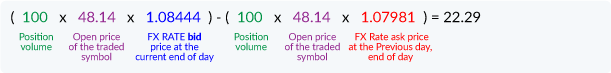

Every other roll:

((Position volume * Open price of the traded symbol * FX Rate bid price at the current end of day) - (Position volume * Open price of the traded symbol * FX Rate ask price at the Previous day, end of day))

Example: (100*48.14*1.08444) - (100*48.14*1.07981) = 22.29

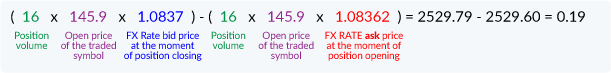

Intraday trades:

((Position volume * Open price * FX Rate bid price at the moment of position closing) - (Position volume * Open price * FX Rate ask price at the moment of position opening))

Example: (16x145.9x1.0837) - (16x145.9x1.08362) = 2529.79 - 2529.60 = 0.19

On Position Close:

((Position volume * Open price * FX Rate bid price at the moment of position closing) - (Position volume * Open price * FX Rate ask price at the Previous day, end of day))

Example: (1x90.01x1.05459) - (1x90.01x1.05412) = 94.92 - 94.88 = 0.04

For USD account base currency to EUR Traded Symbol Base Currency, the FX Pair needed for the conversion is EURUSD.

For GBP account base currency to EUR Traded Symbol Base Currency, the FX Pair needed for the conversion is EURGBP.

For CHF account base currency to USD Traded Symbol Base Currency, the FX Pair needed for the conversion is USDCHF.

For CHF account base currency to EUR Traded Symbol Base Currency, the FX Pair needed for the conversion is EURCHF.

| Explanation on First Roll | FX_CON_position ID_EOD FX rate at the current roll_FX rate at the moment of position opening |

| Explanation on Roll Transition | FX_CON_position ID_EOD FX rate at the current roll_EOD FX rate from the previous roll date |

| Explanation on Position Close | FX_CON_position ID_FX rate at the moment of the position closing_EOD FX rate from the last roll |

| Explanation on Position Intraday Close | FX_CON_position ID_FX rate at the moment of the position closing_FX rate at the moment of position opening |

| Example | FX_CON_15625485_1.09547_1.08458 |

Note: Other identity documents may be accepted or required, depending on your country of birth / home country. Our Customer Support will contact you if needed.

Alternatively, please send an email to support@jfdbrokers.com, and our friendly Customer Support Team will be happy to help accordingly.

You can pay funds by bank remittance (SEPA or non-SEPA) or by using JFD’s online payment solution providers - Nuvei, Payabl, Skrill, Neteller and SOFORT. Please note that we attach great importance to security. For that reason, we only accept payments from a bank account kept in the client's name. If you use bank remittance, this account must have been entered as reference account in the Online Account Opening Form.

Your JFD account can be opened in one of the following four currencies: (EUR, USD, GBP, CHF). However, you can make a deposit in any of the currencies offered by our payment providers to us. Please note that the currency in which you are making a deposit may be converted to the equivalent amount in the currency of your JFD account (EUR, USD, GBP, CHF).

Our online payment system supports the following currencies:

It's quite simple to withdraw your funds using a bank wire transfer. Just login to My JFD and fill in the form in the Withdrawal section.

In order to protect all parties against the possibility of perpetration of any financial crime and comply with AML Directive DI144-2007-08 of 2012 of Cyprus Securities Exchange Commission and related EU regulations, JFD will only process withdrawals/refunds back to the source of the original deposit.

Please be informed that in the event that funds have been deposited by both an online payment solution and by bank wire, the funds deposited via the online solution will be processed first back to the original online source up to the total amount deposited through this method and then any remaining funds will be returned by bank wire transfer.

2. JFD's online payment solution

Please note that in order to withdraw funds using JFD’s online payment solution providers, Nuvei, Payabl., Skrill or SOFORT, please log in to MyJFD and make your selection in the Withdrawal section.

Credit Standard: Payback on amount which equals or is less than the deposits made online. You will be charged 2.00 EUR/GBP/USD/CHF per transfer and the procedure takes around 2-3 days.

Credit Extra: Payback on amount which is higher than the deposits made online. You will be charged 2.00 units per transfer and the procedure takes around 3 - 10 days.

Please note that this will not apply if your country does not support the CFT program. Click here to find out if your card and country is supported. In this case, the extra amount will be transferred via bank transfer.

You will be charged 2.00 EUR/1.70 GBP/2.00 USD/1.95 CHF per transfer.

You will be charged 1% of the withdrawal amount, to a maximum of 10 EUR / 11USD / 8 GBP / 11 CHF. Please note: there is no extra charge if a client wants to withdraw more than he has deposited.

Click here to see the different payment methods using Skrill.

You will be charged 2% of the withdrawal amount, to a maximum of 30 USD. Please note: there is no extra charge if you want to withdraw more than the deposited amount.

Withdrawals will be processed as ordinary bank withdrawal requests.

Please note that this information is only an indication and depends first and foremost on the banks involved in the transaction.

Each client who has a live trading account with JFD can use our online payment solutions for safe and quick depositing of funds. To get started, login to My JFD,click on the Deposit section and make your selection. You will be redirected to the payment provider. For Skrill/Neteller, enter your credentials or register if you haven’t already done so (please use the same email address as your JFD account).

For SOFORT, select your country and with the help of the bank's sort code, choose the bank that will carry out the transfer. You will enter the login section of our secure payment form, where you can log in with your own online banking login details. The information will be sent to your bank in an encrypted form. You will be asked for a confirmation code. Each confirmation code can be used only once and for your security cannot be entered a second time. You will then receive a summary of your SOFORT transfer.

For Nuvei, we accept credit cards (VISA debit/credit, Maestro, and MasterCard).

For Payabl., we accept credit cards (VISA debit/credit and MasterCard).

For Skrill, please click here to view our different payment methods.

For SOFORT, click to see which countries are available for instant online banking transfers.

For Nuvei (Visa, Maestro or Master Card), the maximum deposit is 10,000 units per day. You cannot make more than 5 deposits per hour and more than 8 deposits per day.

For Payabl. (Visa, Maestro or Master Card), the maximum deposit is 50 000 EUR per month per card or email. You cannot make more than 100 transactions per month per card or registered email.

For customers who are verified by Skrill, they can deposit unlimited amounts from their Skrill balance as well as by credit/debit card via the Skrill gateway. Non-verified customers are subject to a deposit limit of approximately 2,500 EUR per annum (depending on the country).

For SOFORT, the maximum deposit is 50,000.00 EUR per day or 15,000.00 GBP per day -TBC

Verified Neteller customers can deposit up to 10,000.00 EUR per transaction if no lower limits apply to their accounts. Non-verified Neteller customers have a deposit limit in the range of 1,800.00-3,000.00 EUR per annum that varies depending on their risk profile and country.

Nuvei is Level 1 certified by the Payment Card Industry Data Security Standards (PCI DSS). PCI security standards are operational requirements set by the Payment Card Industry Data Security Standards Council in order to protect card holder data. These standards govern all merchants and organisations that store, process, or transmit this data.

Payabl. is a Regulated Payments Institution specializing in Acquiring, Issuing and Mobile Payments with a license granted by the Central Bank of Cyprus, that provides online merchants with reliable and effective acquiring solutions with PCI-DSS Level 1 certified gateway.

Skrill was the first licensed e-money issuer in the UK and is authorised by the Financial Conduct Authority (FCA). The information which is transmitted is encrypted to the highest standards of the Payment Card Industry Data Security Standards (PCI-DSS Level 1), so your data is unreadable even if someone tries to intercept it.

NETELLER is one of the most trusted online payment systems in the world and is authorized by the Financial Conduct Authority (FCA).The information which is transmitted is encrypted to the highest standards of the Payment Card Industry Data Security Standards (PCI-DSS Level 1), so your data is unreadable even if someone tries to intercept it.

SOFORT is one of the safest payment methods online. The entry of your online banking details and confirmation code occurs entirely in the secure payment form of SOFORT GmbH, where the merchant has no access. Sensitive information (like confidential login details and confirmation codes) is not stored. SOFORT GmbH possesses the TÜV seal “Approved Data Protection” and SOFORT has the certificate “Approved Payment System” awarded by TÜV Saarland.

MT5+ permits you to use a wide range of order types and features, for example:

In addition, you can allow automated trading systems, otherwise known as Expert Advisors (EAs – see below for explanation) to trade via the platform.

Click here for our MT5+ Desktop User Guide.

Click here to see the differences between the two terminals on our platform comparison page. You can also view our tutorial videos to find out the main differences between the tools on MT5+ and MT4+.

MT5+ also offers three closing options:

Note: The platform does not need to be open in order for pending orders or closing options to work. These order details are stored on the trade server and are not dependent on the MT5+ platform.

MT4+ permits you to use a wide range of order types and features, for example:

In addition, you can allow automated trading systems, otherwise known as Expert Advisors (EAs – see below for explanation) to trade via the platform.

Note: EAs are automated trading systems that were developed by third parties. JFD does not assume any liability whatsoever for losses caused by employing these EAs.

Note: EAs are automated trading systems developed by third parties. JFD does not assume any liability whatsoever for losses caused by using these EAs.

MT4+ also offers three closing options:

Note: The platform does not need to be open in order for pending orders or closing options to work. These order details are stored on the trade server and are not dependent on the MT4+ platform.

commission is visible at Depot window -> Positionen Tab -> Column Kommission and Swaps

commission per side / per deal could be checked at Depot window -> Ausgefuhrte Auftrage

commission for round turn (opening and closing) could be checked at Depot window -> Geschlossene Positionen

If you want widgets to remain connected but only in one direction (i.e. to send data, but not to receive any), select Widget from the action menu, then choose Connect with Set (mit Set verbinden) , followed by Receive Data (Daten empfangen) . Note: Some widgets (such as charts) can receive data from others, but cannot send data.

When this is done, StereoTrader will be automatically applied to each new chart you open.