Fraudulent websites posing to have a connection with JFD

Please be aware of fraudulent websites

posing as JFD's affiliates and/or counterparties

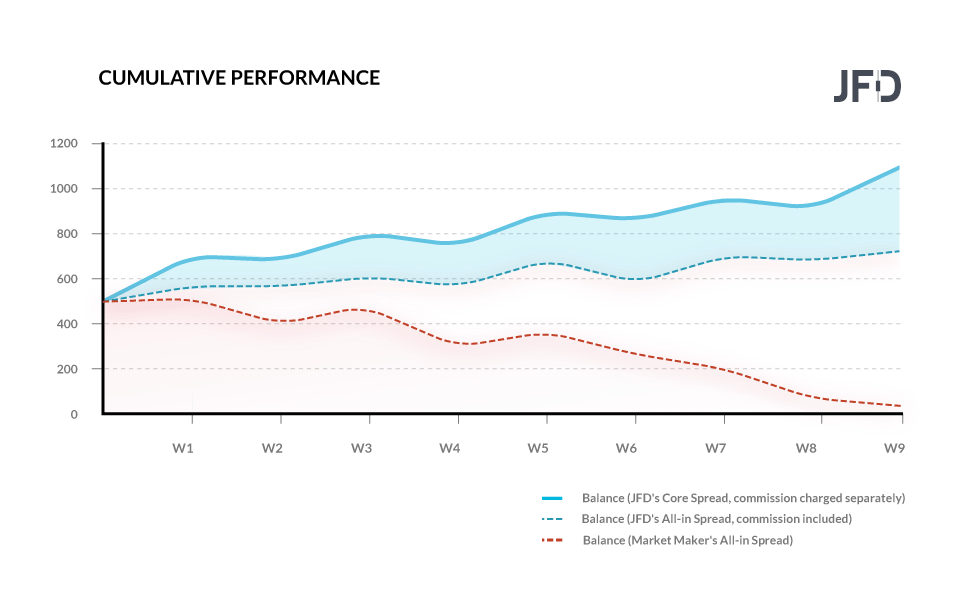

WHY IS YOUR OVERALL PERFORMANCE BETTER WITH CORE SPREADS?

Careful consideration of the total trading costs is important, but how could the different types of spread affect your overall performance?

In our example, we show the cumulative effect of three different spread models on the performance in an intra-day trading style: JFD’s Core Spread (commission charged separately), JFD’s All-In (Marked-Up) Spread (commission included in the spread) and Market Maker’s All-in (Marked-Up) Spread. Taking into consideration the execution quality and the possibilities for reaching Stop Loss and Take Profit levels, JFD's core spread leads to a higher yield from trading while the Marked-Up spread model, applied by the majority of our competition (resulting in higher spikes during market news), may completely destroy an account over a mid-term period (9 weeks on average). Based on extensive research and analysis, we believe that such an example is statistically reliable.

JFD's core interbank spread improves trading efficiency while helping to mitigate the risks from unexpected adverse price movements. Moreover, the demonstrated spread stability in either highly volatile or calm market conditions leads to better predictability, which has a very strong impact on EAs or any other automated trading algorithm. So, choosing JFD’s core spreads model optimises the overall performance, reflected by long-term growth in your account’s balance (illustrated on the chart), and a higher ROI thanks to better execution and a greater level of control over every open position.

Now, that you are aware of the differences between all spread types and the impact each of them may have on your overall performance, it’s time to dig deeper and figure out how these models really work when applied to the MT4 terminal charts.

A COMPARISON: JFD'S CORE SPREADS VS ALL-IN (MARKED-UP) SPREADS COMPARISON

Comparing the total costs of trading at core interbank spreads (commission charged separately) with marked-up spreads (commission included) is important, but ask yourself: is this the whole story?

When market conditions change rapidly or unexpectedly, using pending orders is definitely a good tactic to mitigate risk, prevent dramatic losses or secure reasonable profits. But is it only the trader’s intention and skills that matter? Unfortunately not.

Calculating the total cost of a trade is important but what can truly make or break your strategy is the spread type that the broker uses. Below, we will illustrate the different outcomes from trading at JFD's core interbank spreads (commission charged separately, 100% STP execution) or spreads with a mark-up added by the broker (commission included).

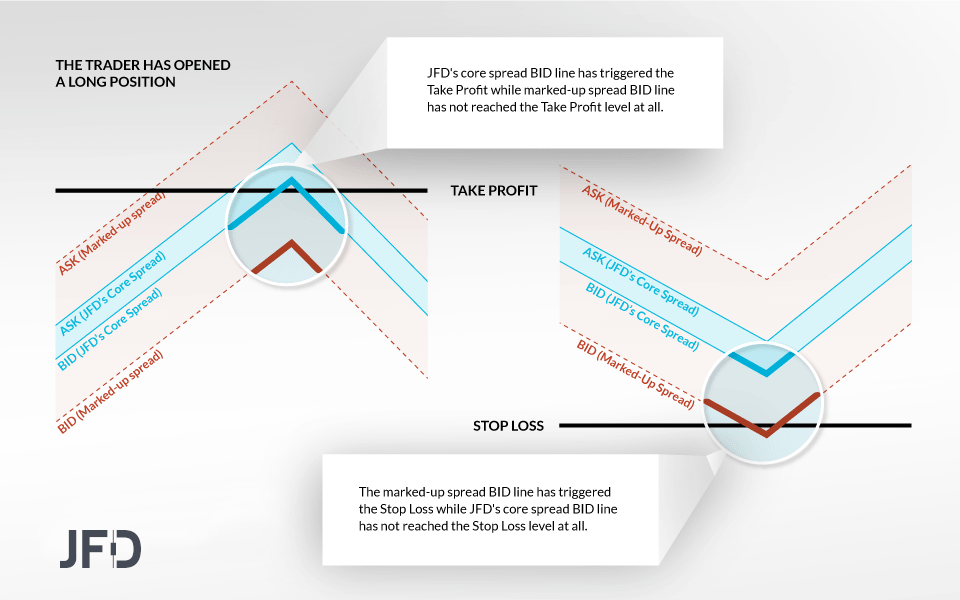

SCENARIO 1

THE CLIENT HAS SET S/L AND T/P LEVELS IN A LONG POSITION (BUY ORDER)

When the price moves in a favourable direction, in many cases what matters the most is whether the Take Profitlevel could be reached or the opportunity to cash in would be missed. When trading at JFD's core interbank spreads, your BID price will reach the Take Profit level faster and more often, being closer to it.

In the opposite case (unexpected adverse price movement), it will take longer for the BID price of JFD's core interbank spreads to reach the Stop Loss level. As a result, you will have more chances to benefit from potential positive shifts in the price direction, unlike trading at all-in (marked-up) spreads - when the BID price could have reached the Stop Loss level faster.

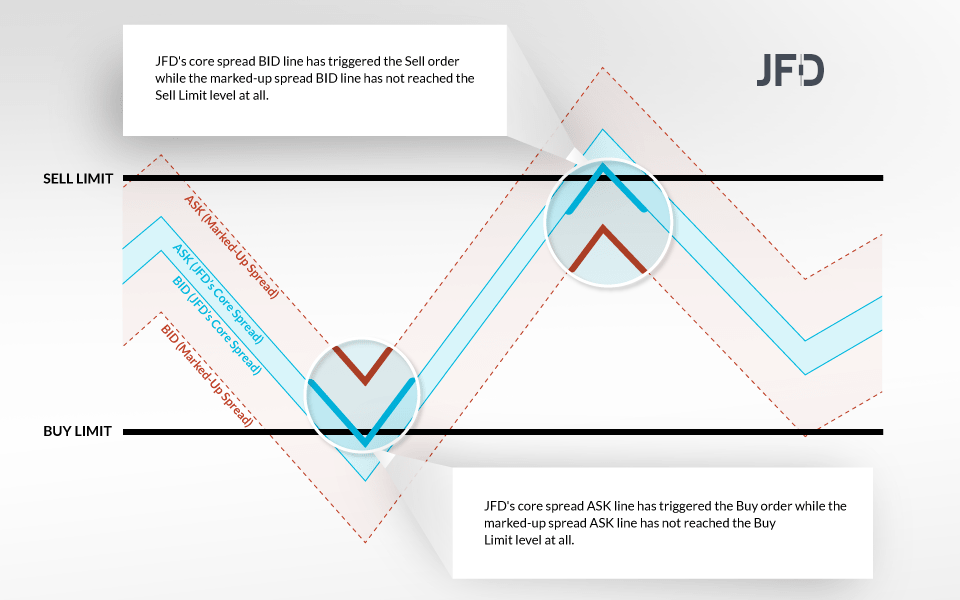

SCENARIO 2

THE CLIENT HAS SET SELL LIMIT AND BUY LIMIT ORDERS

Related to the BID/ASK line, Sell/Buy Limit orders are triggered faster when trading at JFD's core interbank spreads. In this way, you are able to benefit from well-predicted price movements.

Vice versa, when you trade at all-in (marked-up) spreads, the BID/ASK line may not trigger the limit order at all, preventing you from realising your planned strategy. As a result, there will be a negative impact on your overall performance due to missed opportunities.

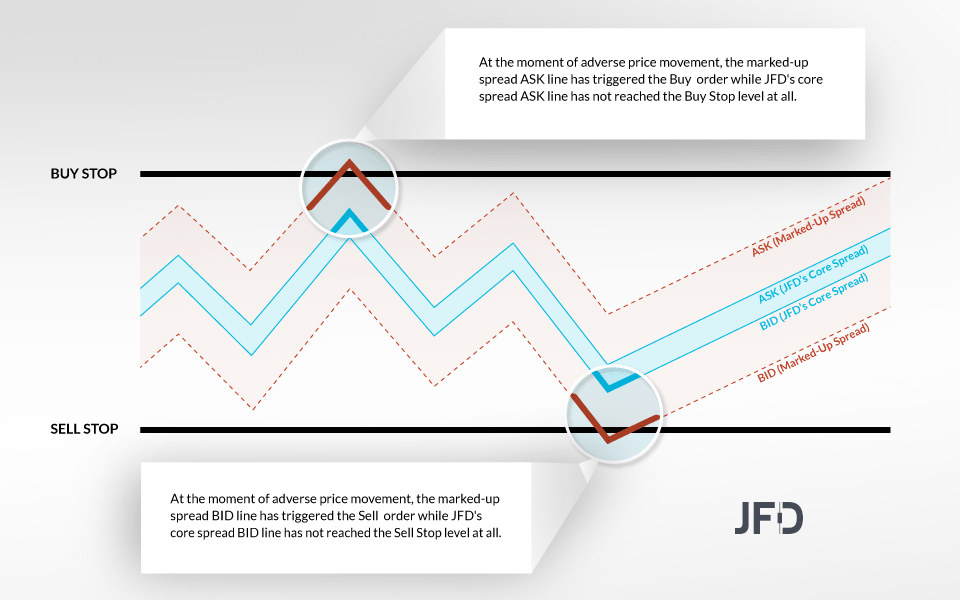

SCENARIO 3

THE CLIENT HAS SET SELL STOP AND BUY STOP ORDERS

JFD's core interbank spread BID/ASK price triggers the Stop order later than the respective all-in (marked-up) spread BID/ASK price does. Thus, you are less exposed to the risk of unexpected negative market movements. Therefore, when you trade at JFD's core interbank spreads, your overall performance is positively influenced.

When trading with JFD, you will constantly benefit from true interbank spreads (no manipulation, zero mark-up) taken from a deep liquidity pool and facilitated by high-end IT infrastructure! All this on a 100% STP 'Fill or Fill' execution basis (no requotes!).